What is Medicare primary insurance and how does it work?

As we mentioned above, Medicare Primary insurance simply means that Medicare pays first and any other insurance pays secondary. Medicare pays first or second depending on what types of other health coverage you have. Some people have no other coverage so Medicare becomes primary by default.

Which health insurance plans are considered primary?

Medicare and a private health plan -- Medicare would be considered primary if the employer has 100 or fewer employees. A private insurer is primary if the employer has more than 100 employees.

What is a primary insurance payer?

A private insurer is primary if the employer has 20 or more employees. The primary insurance payer is the insurance company responsible for paying the claim first. When you receive health care services, the primary payer pays your medical bills up to the coverage limits. The secondary payer then reviews the remaining bill and picks up its portion.

What is the difference between primary and secondary insurance?

Primary policies are usually relevant to property, liability, or health coverage. The first policy to pay the financial loss is the primary insurance. Secondary or excess insurance pays for the amount that remains when the primary policy's coverage has been exhausted. For instance, some people in the US have health insurance besides Medicare.

Who is primary payer with Medicare?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

Who is the primary insurance holder?

A person who fills out and signs a request for insurance coverage is usually referred to as the primary insured or applicant. This person is generally the intended policyowner and is listed as applicant on the premium due page after a policy is issued.

How can you tell if Medicare is primary or secondary?

Medicare is always primary if it's your only form of coverage. When you introduce another form of coverage into the picture, there's predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

Is my insurance primary or secondary?

Primary insurance: the insurance that pays first is your “primary” insurance, and this plan will pay up to coverage limits. You may owe cost sharing. Secondary insurance: once your primary insurance has paid its share, the remaining bill goes to your “secondary” insurance, if you have more than one health plan.

Is my mom the policyholder?

In most types of insurance, your immediate family who live in your household are also automatically covered. This includes children, your spouse, parents, grandparents and siblings who live with you.

What does it mean to be primary insured?

Primary insurance is health insurance that pays first on a claim for medical and hospital care. In most cases, Medicare is your primary insurer.

How do I know if my insurance is primary?

Primary insurance is a health insurance plan that covers a person as an employee, subscriber, or member. Primary insurance is billed first when you receive health care. For example, health insurance you receive through your employer is typically your primary insurance.

Can you have Medicare and another insurance at the same time?

It is possible to have both private insurance and Medicare at the same time. When you have both, a process called “coordination of benefits” determines which insurance provider pays first. This provider is called the primary payer.

How do you make Medicare primary?

Making Medicare Primary. If you're in a situation where you have Medicare and some other health coverage, you can make Medicare primary by dropping the other coverage. Short of this, though, there's no action you can take to change Medicare from secondary to primary payer.

What is an insurance holder?

In the insurance world, a policyholder — which you may also see written as “policy holder” (with a space) — is the person who owns the insurance policy. As a policyholder, you are the one who purchased the policy and can make adjustments to it. Policyholders are also responsible for making sure their premiums get paid.

What is Medicare Secondary Payer?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare.

What determines primary and secondary health insurance?

The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" to pay. The insurance that pays first is called the primary payer. The primary payer pays up to the limits of its coverage. The insurance that pays second is called the secondary payer.

What Is Medicare Primary Insurance?

Medicare Primary insurance simply means that Medicare pays first. Whether Medicare pays first or second depends on what types of other health cover...

Medicare Expects You to Know Who Is Primary

You see, Patricia didn’t realize that since her employer has less than 20 employees, Medicare would be her primary coverage. By failing to enroll i...

to Enroll Or Not to Enroll?

Not everyone needs to enroll in Medicare right when they turn 65. Many people continue to work past age 65 and have access to employer coverage thr...

When Medicare Is Secondary

Secondary insurance pays after your primary insurance. It serves to pick up costs that the primary coverage didn’t cover. For example, if your prim...

Feeling Unsure About When Is Medicare Primary?

Figuring all this out is enough to give anyone a headache – we know! Fortunately Boomer Benefits has helped tens of thousands of Medicare beneficia...

How do you determine which health insurance is primary?

Determining which health plan is primary is straightforward: “If you are covered under an employer-based plan, that is primary,” Mordo says. If you...

Should I consider secondary health insurance coverage?

Some people think in terms of “primary insurance vs. secondary insurance.” But the two types of insurance can complement one another. For example,...

How do deductibles work with two insurances?

If you carry two health insurance plans and have deductibles with each plan, you’re responsible for paying both of them when you make a claim. In o...

Can you be covered by two health insurance plans?

Yes, you can be covered by two health insurance plans. In some cases, each member of a couple might have health insurance through their employer. C...

Does secondary insurance cover the primary deductible?

Typically not. If you have a deductible on one or both plans, you will need to pay those deductibles before your insurance reimburses you for care....

What does it mean when Medicare is primary?

When Medicare is Primary. Primary insurance means that it pays first for any healthcare services you receive. In most cases, the secondary insurance won’t pay unless the primary insurance has first paid its share. There are a number of situations when Medicare is primary.

What is secondary insurance?

Secondary insurance pays after your primary insurance. It serves to pick up costs that the primary coverage didn’t cover. For example, if your primary insurance has a $1000 deductible, but your secondary insurance has a $500 deductible, your secondary would kick in to pay $500 of that $1000 bill.

What is the term for a former employer providing health insurance for you after you are no longer working?

You Have Retiree Coverage or COBRA. Sometimes a former employer provides group health insurance coverage for you AFTER you are no longer working. This is called retiree coverage. Medicare is primary and your providers must submit claims to Medicare first. Your retiree coverage through your employer will pay secondary.

What is tricare for life?

You Have Tricare-for-Life. Tricare-for-Life (TFL) is for military retirees and their spouses who are also eligible for Medicare. In this scenario, Medicare is the primary insurance for any care you receive at non-military providers, so you need to enroll in both Part A and B.

Does Medicare expect you to know who is primary?

Medicare Expects YOU to Know Who is Primary. In our example above, Patricia didn’t realize that since her employer has less than 20 employees, Medicare would be her primary coverage. By failing to enroll in Medicare, she was now responsible for paying for the cost of that MRI.

Is Medicare primary or secondary?

Then of course there is employer coverage. If you have active employer coverage, whether Medicare is primary or secondary also depends on the size of the insurance company.

Is Medicare a secondary insurance?

Medicare is secondary to your group health insurance if the company has 20 or more employees. If the group insurance is affordable, you may choose to delay your enrollment in Part B. ALWAYS speak with a licensed insurance agent who specializes in Medicare before making this decision.

What is primary insurance?

Primary insurance is a policy that pays for coverage first, even when the policyholder has other policies that cover the same risk. Those other policies will only be tapped when the primary policy has reached its financial limit. Advertisement.

Does Medicare pay for excess?

When they bill for a medical expense that is insurance-dependent, the non-Medicare insurance is charged first. Medicare pays only for the excess amount. Advertisement.

What is the difference between Medicare and Medicaid?

Eligible for Medicare. Medicare. Medicaid ( payer of last resort) 1 Liability insurance only pays on liability-related medical claims. 2 VA benefits and Medicare do not work together. Medicare does not pay for any care provided at a VA facility, and VA benefits typically do not work outside VA facilities.

Is Medicare a secondary insurance?

When you have Medicare and another type of insurance, Medicare is either your primary or secondary insurer. Use the table below to learn how Medicare coordinates with other insurances. Go Back. Type of Insurance. Conditions.

What is primary insurance?

Primary insurance. The primary insurance payer is the insurance company responsible for paying the claim first. When you receive health care services, the primary payer pays your medical bills up to the coverage limits. The secondary payer then reviews the remaining bill and picks up its portion.

What is the most common example of carrying two health insurance plans?

The most common example of carrying two health insurance plans is Medicare recipients, who also have a supplemental health insurance policy, says David Mordo, former national legislative chair and current regional vice president for the National Association of Health Underwriters.

What happens when you have two health insurances?

When you have two forms of health insurance coverage, your primary insurance pays the first portion of the claim up to your coverage limits. Your secondary insurance may pick up some or all of the remaining costs.

What are some examples of two insurance plans?

Other examples of when you might have two insurance plans include: An injured worker who qualifies for worker's compensation but also has his or her own insurance coverage. A military veteran who is covered by both Veterans Administration benefits and his or her own health plan. An active member of the military who is covered both by military ...

What is the process of coordinating health insurance?

That way, both health plans pay their fair share without paying more than 100% of the medical costs. This process is called coordination of benefits.

Is secondary insurance responsible for cost sharing?

However, you still might be responsible for some cost-sharing. For example, it’s a mistake to think your secondary insurance will kick in and cover the deductible attached to your primary insurance. Instead, you likely will be responsible for covering the deductible. You also may be responsible for copay and coinsurance fees.

Can a married couple have two health insurance plans?

It’s also possible that a married couple could have two health insurance plans, even if each spouse is covered through a health insurance plan at their workplace. “They’re both covered under their own policies with their companies, but one of the spouses decides to (also) jump on their spouse’s plan,” Mordo says.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

How much do you owe a doctor if your primary insurance pays $300?

So, let’s say you have a bill for $500 from a visit. If your primary insurer pays $300 and your secondary insurer pays $150, you will owe $50. When you visit the doctor and register as a new patient, you’ll most likely be given a form to fill out about your insurer (s).

What to watch out for if you have secondary insurance?

8 Things to Watch Out for if You Have Secondary Insurance. 1. You’ll have to pay two premiums. 2. You may have two deductibles. 3. You’ll have two different health insurance companies to juggle. 4. You may have two different types of plans (HMO and PPO for example) and it can get confusing.

What happens if you have both parents insure a child?

In the instance where parents both insure a child, the birthday rule applies, and whichever parent has the earlier birthday holds the primary plan. If the parents are divorced, the parent with custody would carry the primary insurance and the other parent the secondary one. If they have joint custody, the birthday rule applies again.

How old do you have to be to add a second child to your health insurance?

This is a big benefit to families with more than one child under the age of 26. The second adult child gets added to a parent’s health plan free of charge. For private health plans, ask your provider for how much it would cost to add an adult child onto the plan.

Is it better to have 2 health insurance plans?

Advantages to Having 2 Health Insurance Plans. It costs little to be added to a parent’s or spouse’s employer health plan since some employer health plans offer family coverage at a flat rate. And if they are already offering insurance to another family member, adding you may come at no cost at all.

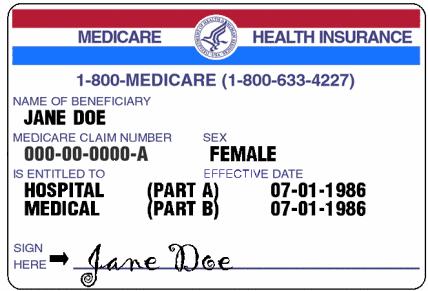

What is a health insurance beneficiary?

Health insurance beneficiaries are the insured parties that use the insurance policy to get health services. The policyholder is usually the insured person in family and individual coverage, the individual policyholder or group policyholder is always the owner. Comparison shopping is the ideal method for making side-by-side assessments ...

Who is the source for determining covered beneficiaries under an insurance policy?

Policyholder is the source for determining covered beneficiaries under an insurance policy. su_box] The policyholder is the legal owner of an insurance policy. The policyholder may or may not be the beneficiary, but he or she has the power to determine the beneficiaries. The policyholder is usually the signatory on the insurance contract with ...

What is the difference between a policyholder and a beneficiary?

There is an important distinction between policyholder and beneficiary. The beneficiary is the person with authority to use the policy for its benefits. This person is the insured person under the policy. The policyholder is the owner of the policy . He or she is the party to the contract with the insurance provider.

What does "policyholder" mean?

What does “policyholder” mean for health insurance? 1 Policyholder is the legal word that points to the owner of a health insurance policy 2 Policyholder is the person that can name beneficiaries and coverage of a spouse, significant other, or other legal dependents 3 Policyholder describes the owner of insurance policies whether sponsored by employers, purchased for families, or individuals 4 Employer plans use a group policyholder, and the invited individuals get options for participation from the group policyholder 5 Policyholder is the source for determining covered beneficiaries under an insurance policy

What is a group policyholder certificate?

The group policyholder assigns benefits to the employees or members by a certificate of insurance. The certificate is proof and authority to get health benefits from the insurer. Typically, group members have an ID card that proves they are eligible for coverage.

What is health insurance?

The health insurance policy is a contract that contains agreements to provide insurance coverage for health and medical care for a price, usually a monthly premium. The insurance provider agrees to pay for medically necessary treatment and services that fall under the terms of the contract. The Affordable Care Act changed the essential content ...

What is a group policyholder?

Group policyholders are often companies or organizations that sponsor or promote health coverage for a class of individuals and their dependents. A familiar example is an employer-sponsored coverage plan for its employees.

Who is responsible for pursuing recovery from a liability insurer?

The CRC is responsible for pursuing recovery directly from a liability insurer (including a self-insured entity), no-fault insurer or workers’ compensation entity. For more information on the processes used by the CRC to recover conditional payments, see the Insurer NGHP Recovery page.

What is BCRC in Medicare?

The Benefits Coordination & Recovery Center (BCRC) consolidates the activities that support the collection, management, and reporting of other insurance coverage for Medicare beneficiaries. The BCRC takes actions to identify the health benefits available to a Medicare beneficiary and coordinates the payment process to prevent mistaken payment ...