What is a Qualified Medicare Beneficiary (QMB)?

- General Information. A Qualified Medicare Beneficiary (QMB) is a Medicare beneficiary who, because of low income and limited financial resources, qualifies to have certain medical expenses covered at no additional ...

- Eligibility. ...

- To Apply. ...

- For More Information. ...

Does Someone on Medicaid automatically qualify for Medicare?

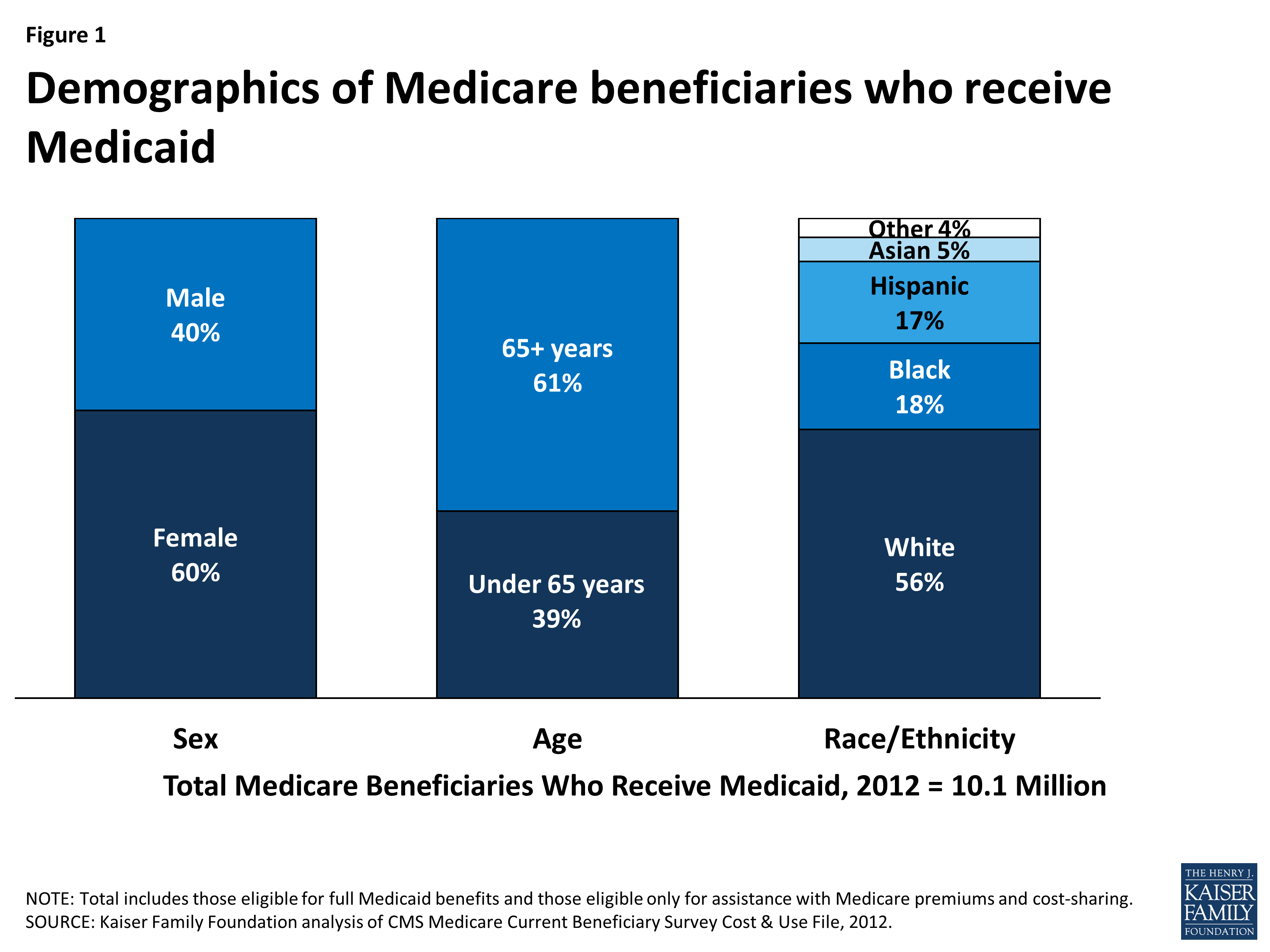

Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. To be considered dually eligible, persons must be enrolled in Medicare Part A (hospital insurance), and / or Medicare Part B (medical insurance).

Does a Medicaid beneficiary have to pay back th?

You may find yourself no longer eligible for Medicaid and even have to pay back Medicaid for health care services rendered. It's important to understand how Medicaid works and your responsibilities as a Medicaid recipient.

What is slmb or a specified low income Medicare beneficiary?

The Specified Low-income Medicare Beneficiary (SLMB) program is a type of Medicare Savings Program designed to help qualified beneficiaries – many of whom also have Medicaid – pay their Medicare Part B premiums.

Can a Medicare or Medicaid beneficary join a HMO?

In most cases, prescription drugs are covered in HMO Plans. Ask the plan. If you want Medicare drug coverage (Part D), you must join an HMO Plan that offers prescription drug coverage. Do I need to choose a primary care doctor in Health Maintenance Organization (HMO) Plans? In most cases, yes, you need to choose a primary care doctor in HMO Plans.

Is QMB the same as Medicare?

The Qualified Medicare Beneficiary (QMB) Program is one of the four Medicare Savings Programs that allows you to get help from your state to pay your Medicare premiums. This Program helps pay for Part A premiums, Part B premiums, and deductibles, coinsurance, and copayments.

What does Medicare QMB mean?

Qualified Medicare BeneficiaryThe Qualified Medicare Beneficiary (QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries.

What is QMB Medicaid in Georgia?

The Qualified Medicare Beneficiary (QMB) program was designed to fill the gaps in Medicare coverage by eliminating out-of-pocket expenses for Medicare covered services. The QMB program helps low–income Medicare beneficiaries by paying Medicare premiums, deductibles and coinsurance.

What is QMB Medicaid in Texas?

The Qualified Medicare Beneficiary (QMB) Program pays Medicare premiums, deductibles and coinsurance for a person who meets the requirements of this section. To be eligible for QMB coverage, a person must: be entitled to benefits under Medicare Part A; and. meet income and resources requirements.

What are the benefits of QMB?

The Qualified Medicare Beneficiary (QMB) Program is one of the four Medicare Savings Programs that allows you to get help from your state to pay your Medicare premiums. This Program helps pay for Part A premiums, Part B premiums, and deductibles, coinsurance, and copayments.

Does Social Security count as income for QMB?

An individual making $1,000 per month from Social Security is under the income limit. However, if that individual has $10,000 in savings, they are over the QMB asset limit of $8,400.

What is the income limit for QMB in Georgia?

$1,064 a monthQualified Medicare Beneficiary (QMB): The income limit is $1,064 a month if single or $1,437 a month if married.

What is the maximum income to qualify for Medicaid in GA?

Georgia Medicaid is currently only available to non-disabled, non-pregnant adults if they are caring for a minor child and have a household income that doesn't exceed 36% of the poverty level (for a household of two in 2022, this amounts to about $550 in monthly income).

Does Georgia have QMB Plus?

Full Benefit Dual Eligibles -- QMBs who also meet the financial criteria for full Medicaid coverage. Full Benefit Dual Eligibles are entitled to QMB Medical Benefits, plus all benefits available under the Georgia State Plan for fully eligible Medicaid recipients.

Who qualifies for QMB in Texas?

To qualify for the QMB program, you need to have limited financial resources. This means that when you add up all of your resources as an individual, those should value no more than $8,400, in 2022. As a couple, your maximum countable resources should be $12,600.

How do you qualify for QMB in Texas?

To be eligible for QMB coverage, a person must: be entitled to benefits under Medicare Part A; and....Q-2000, Qualified Medicare Beneficiaries – MC-QMBare 65;have a disability (as determined by SSA); or.have chronic renal disease.

What is the maximum monthly income to qualify for Medicaid in Texas?

In Texas, as of 2020, if you need long-term care the maximum income for Medicaid assistance is $2,349 per individual. This income cap includes any source of income including pensions, social security, or disability benefits (although certain Veterans Affairs (VA) benefits are treated differently).

What are the benefits of QMB?

Benefits of the QMB program include: 1 Medicare Part A & B premiums paid back in your Social Security Check 2 Medicare Part D premium reduced or covered through the Low Income Subsidy (LIS) / Extra Help program 3 Medication costs reduced to $0 – $10 for most medications through the LIS / Extra Help program 4 No Donut Hole / Coverage Gap 5 Medicare deductibles paid by Medicaid 6 Medicare coinsurance and copays within prescribed limits paid

Where can I find the SSI limits?

The limits are updated quarterly and can be found on the SSI-Related Programs Financial Eligibility Standards Chart.

Does Medicare pay for hospital visits?

No copays for doctors, hospital visits, or medical procedures for Medicare approved expenses.

Can a trust pay a beneficiary?

With either example, AGED as the Trustee may use the money in the trust to pay bills and expenses for the individual (known as the beneficiary), as long as the expenses are for the sole benefit of the beneficiary, and are not paid for by government benefits. Examples of bills paid from the trust include, but are not limited to, mortgage, rent, facility bills, utilities, repairs, auto insurance, auto payment, etc. However, the trust cannot pay the beneficiary directly, as this could disqualify them from the QMB program.

Does Medicaid count overage?

Setting up a Pooled Trust allows you to place your over income and/or over asset (or both) into the trust, making this overage no longer “countable” for Medicaid purposes. This means that while Medicaid acknowledges your total income and/or assets, they deduct the income and/or assets placed into the trust from the total, so that it no longer counts against you.

How does Medicaid QMB work?

In addition to covering Medicare premiums for eligible QMB recipients, one of the benefits of the QMB program is having protection from improper billing. Improper billing refers to when health care providers inappropriately bill a beneficiary for deductibles, copayments or coinsurance.

What are other Medicare and Medicaid assistance programs?

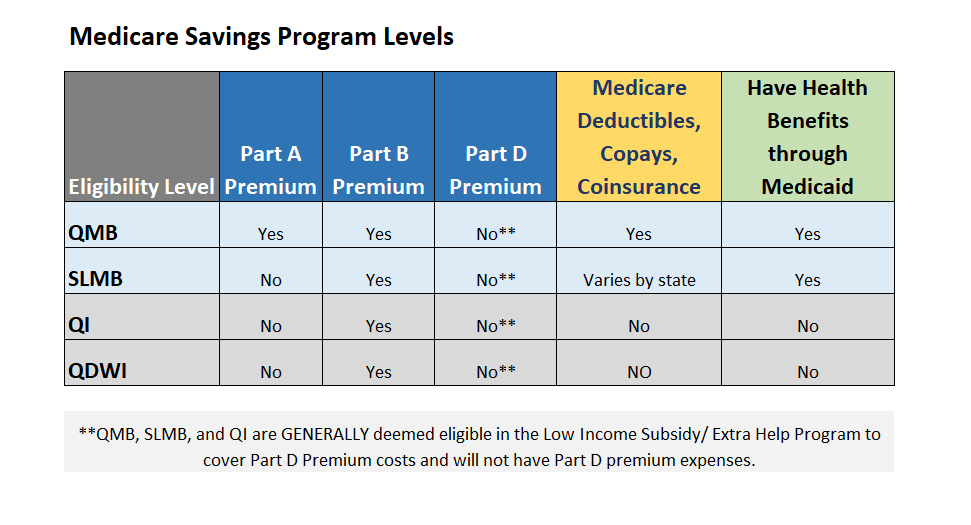

QMB is not the only program available to dual-eligible beneficiaries. Others include:

What is QMB insurance?

The QMB program helps pay for the full cost of Medicare Part A and Part B premiums along with complete coverage of deductibles, copayments and coinsurance. QMB offers the most comprehensive coverage of the programs available to dual-eligible beneficiaries.

What does QMB mean in Medicare?

QMB stands for “Qualified Medicare Beneficiary” and is a cost assistance program designed to help individuals who are eligible for both Medicare and Medicaid, a circumstance that is known as “dual eligibility.”

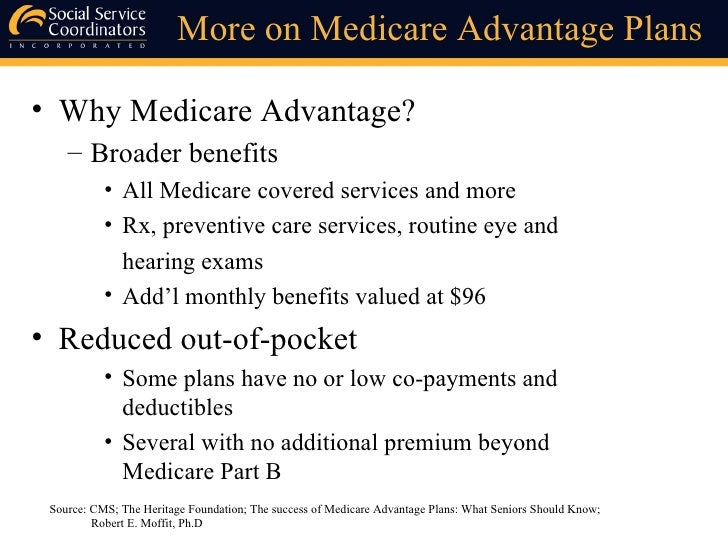

What is a dual eligible special needs plan?

This is a particular type of Medicare Advantage plan with a benefits package that is tailored to the needs of those with the limited income and resources common among Medicaid recipients.

How to apply for QMB?

To apply for the QMB program, contact your state Medicaid program . Please not that if your income or financial resources are close to the totals listed above, you should still apply, as you may potentially be eligible.

Do you have to be on Medicare to qualify for QMB?

You must be eligible for both Medicare and Medicaid to be eligible for QMB benefits. While Medicare’s eligibility requirements are federally mandated, each state may set its own qualifying restrictions for Medicaid.

What is qualified Medicare Beneficiary?

The Qualified Medicare Beneficiary program works to help cover Medicare Part A and Part B premiums, as well as the costs of coinsurance, copayments, and deductibles. All of these costs can add up quickly, especially if you require a variety of different medical services. This program is able to provide full payment of both ...

What is the difference between Medicare and Medicaid?

Original Medicare is available to individuals 65 years of age or older and individuals with certain disabilities. Medicaid insurance caters to individuals with low income and provides an affordable, government-funded healthcare option for this demographic. The QMB program has specific income requirements that must be met, ...

What does QMB mean for medicaid?

What Does Medicaid QMB Cover? Medicaid QMB, which stands for Qualified Medicare Beneficiary , is a program designed specifically for individuals that qualify for both Medicare and Medicaid coverage and that are financially unstable.

What is the income limit for QMB?

In 2019, the monthly income limits for individuals is $1,060 and the monthly income limit for a married couple is $1,430. There is also a limit on resources, which is set at $7,730 for individuals and $11,600 for married couples. Additionally, you must also be at or below the annual federal poverty level. The amounts of the QMB requirements and the poverty line generally coincide, but it is good to be aware of both.

Is Medigap covered by QMB?

It is important to note that if you are currently using a Medigap plan, the premiums associated with it are not covered by the QMB program. In addition, you should also be aware that states can impose laws specific to Medicaid, Medicare, and QMB programs.

Can you be billed for Medicare Part A and Part B?

This means that you should not be billed for any approved care you receive under Medicare Part A or Part B that is received at a Medicare-approved facility by an approved provider. There should be no major exceptions to this other than the restrictions on care that Original Medicare puts in place.

Do you have to accept Medicare and QMB?

They must accept Medicare and QMB payment for their services and recognize this payment as being the full amount of the cost of service . Improper billing protections prevent individuals using the QMB program from being responsible for any cost-sharing expenses, no matter their origin.

What is a qualified Medicare beneficiary?

The Qualified Medicare Beneficiary program is a type of Medicare Savings Program (MSP). The QMB program allows beneficiaries to receive financial help from their state of residence with the costs of Medicare premiums and more. A Qualified Medicare Beneficiary gets government help to cover health care costs like deductibles, premiums, and copays.

What is Medicare qualified?

A Qualified Medicare Beneficiary gets government help to cover health care costs like deductibles, premiums, and copays. Recipients must meet all criteria to qualify for the program assistance.

What is a QMB premium?

The Part A monthly premium (if applicable) The Part B monthly premium and annual deductible. Coinsurance and deductibles for health care services through Parts A and B. If you’re in a QMB program, you’re also automatically eligible for the Extra Help program, which helps pay for prescription drugs.

What is QMB in Medicare?

Qualified Medicare Beneficiary (QMB) Program. If you’re a Medicare beneficiary, you know that health care costs can quickly add up. These costs are especially noticeable when you’re on a fixed income. If your monthly income and total assets are under the limit, you might be eligible for a Qualified Medicare Beneficiary program, or QMB.

What is the QMB in North Carolina?

In North Carolina QMB is called MQB. If you live in Nebraska, Federal QMB is replaced with full Medicaid.

Why do you need a QMB with Advantage?

Pairing an Advantage Special Needs Plan with your QMB is a great way to protect yourself from unexpected health costs. It also provides extra benefits at an affordable price.

How much money do you need to qualify for QMB?

To be eligible for a QMB program, you must qualify for Part A. Your monthly income must be at or below $1,084 as an individual and $1,457 as a married couple. Your resources (money in checking and/or savings accounts, stocks, and bonds) must not total more than $7,860 as an individual or $11,800 as a married couple.

What is QMB in Medicare?

The QMB program is a state program that helps covers the cost of Medicare premiums, deductibles and coinsurance that Medicare beneficiaries usually pay. You may be eligible for the QMB program if you are entitled to Medicare Part A coverage, and have limited income and resources. If you are eligible, your state’s Medicaid program may pay for your Medicare Part B premium, Part A and Part B deductibles, and coinsurance.

How to contact Medicare.org?

Call us at (888) 815-3313 — TTY 711 to speak with a licensed sales agent.

What is QMB insurance?

The QMB program covers the cost of Medicare premiums, deductibles and coinsurance that Medicare beneficiaries usually pay. It means that your state covers these Medicare costs for you, and you have to pay only for anything that Medicare normally does not cover.

Why do I have to apply for QI each year?

The QI program must be applied for each year because assistance is provided from a limited pool of funds on a first-come, first-served basis. Individuals who received the benefit in the last month of the previous year will be given priority.

Does QMB supplement Medicare?

QMB does not supplement your Medicare coverage but instead ensures that you will not be precluded from coverage because you cannot afford to pay the costs associated with Medicare. Keep in mind that some states require you to pay a small co-payment when you see a doctor.

Do you have to be entitled to Medicare Part A?

You must be entitled to Medicare Part A.

Does Medicaid pay for Medicare Part B?

If you are eligible, your state’s Medicaid program may pay for your Medicare Part B premium, Part A and Part B deductibles, and coinsurance .

What other Medicare Savings Programs are there?

SLMB is just one of the available Medicare Savings Programs. Others include:

Who sells dual eligible special needs plans?

Dual-eligible Special Needs Plans and other Medicare Advantage plans are sold by private insurance companies. For help comparing plans, you can look at plans online or call to speak with a licensed insurance agent for information about eligibility and enrollment.

How do you qualify for SLMB?

Each state Medicaid program has its own rules concerning qualification.

What is SLMB in Medicare?

The Specified Low-income Medicare Beneficiary (SLMB) program is a type of Medicare Savings Program designed to help qualified beneficiaries – many of whom also have Medicaid – pay their Medicare Part B premiums.

Is there Medicaid assistance for Medicare Advantage beneficiaries?

Individuals who qualify for both Medicare and Medicaid are considered “dual eligible” and may qualify for a certain type of Medicare Advantage plan called a Special Needs Plan. And one particular type of Special Needs Plan is a Dual Eligible Special Needs Plan (D-SNP).