The Medicare program covers railroad workers just like workers under social security. Railroad retirement payroll taxes include a Medicare hospital insurance tax just like social security payroll taxes.

Full Answer

What does railroad Medicare cover?

Medicare offers coverage to railroad employees just as it does for people who have Social Security. The payroll taxes of railroad employees include railroad retirement and Medicare hospital insurance taxes. If you have concerns or questions about your Railroad Retirement benefits and Medicare, you can find out more from your local RRB field office.

What is the phone number for railroad Medicare?

Jan 14, 2022 · The Medicare program covers railroad workers just like workers under social security. Railroad retirement payroll taxes include a Medicare hospital insurance tax just like social security payroll taxes.

Does railroad Medicare require authorization?

The Medicare program covers railroad workers just like workers under social security. Railroad retirement payroll taxes include a Medicare hospital insurance tax just like social security payroll taxes. Though you’re paying into the Medicare program during your working years, and will probably rely on its

What is Railroad Retirement Medicare?

Insurance provided by the Railroad Retirement Board, instead of a Social Security Medicare card showing their toll-free phone number. Your card also displays your Medicare Claim Number with the ... Palmetto GBA Railroad Medicare Beneficiary Contact Center (1-800-833-4455), and Customer Service staff can do the search with you on the telephone ...

What is the difference between railroad Medicare and regular Medicare?

A: The only difference is that retired railroad beneficiaries have their Part B benefits administered by the Palmetto GBA Railroad Retirement Board Specialty Medicare Administrative Contractor (RRB SMAC) regardless of where they live. Members should be certain to advise providers of this when they receive treatment.

Is railroad Medicare an Advantage plan?

Yes, Railroad Medicare beneficiaries can choose to enroll in Medicare Advantage plans.Mar 28, 2022

Is railroad Medicare primary or secondary?

Railroad Providers - Medicare Secondary Payer (MSP)

How do you get contracted with railroad Medicare?

Getting Started With Railroad Medicare BillingStep 1: Ensure your enrollment information is correct with your local Part B Medicare Administrative Contractor (MAC) ... Step 2: Request a Railroad Medicare PTAN. ... Step 3: Receive your Railroad Medicare PTAN. ... Step 4: File Electronically. ... Step 5: Go Green — Electronic Remits.Sep 30, 2020

Is railroad Medicare Part B?

RRB will collect your Medicare premiums. If you receive Railroad Retirement benefits or railroad disability annuity checks, your Medicare Part B premium should be automatically deducted from your check each month. If you do not qualify for premium-free Part A, it will also be deducted from your check.

Does railroad Medicare require prior authorization?

Do I need to obtain prior authorization or precertification before I provide a Part B service to a Railroad Medicare patient? With the one exception listed below, prior authorization or precertification is not required for any Part B services billed to Palmetto GBA Railroad Medicare at this time.Mar 25, 2022

What does a railroad Medicare number look like?

Medicare Numbers have 11 characters and contain numbers and uppercase letters only. They do not contain the letters S, L, O, I, B or Z. Characters one, four, seven, 10 and 11 will always be a number. The second, fifth, eighth and ninth characters will always be a letter.Jul 15, 2019

Can I collect social security and railroad retirement?

-When a railroad employee dies or retires after completing less than 10 years of railroad service, his railroad retirement credits are transferred to the social security system and are treated as regular social security credits.

Is railroad retirement considered social security?

If you do not meet the minimum qualifications for a Railroad pension, your railroad industry earnings will count toward your Social Security credits. Worked in the railroad industry for less than 10 years and you have less than five years of railroad earnings after 1995.

How do I verify Railroad Medicare eligibility?

Contact Railroad MedicareProvider Contact Center: 888-355-9165.IVR: 877-288-7600.TTY: 877-715-6397.

Does Railroad Medicare have a provider portal?

Palmetto GBA Railroad Medicare is pleased to offer eServices, our free Internet-based, provider self-service portal. The application provides information access over the Web for the following online services: Eligibility. Medicare Beneficiary Identifier (MBI) Lookup.

What is Palmetto GBA Railroad Medicare?

About Railroad Medicare Palmetto GBA is the Railroad Specialty Medicare Administrative Contractor (RRB SMAC) and processes Part B claims for Railroad Retirement beneficiaries nationwide.

What is Medicare Part A?

Hospital Insurance ( Medicare Part A ), which helps pay for inpatient care in hospitals and skilled nursing facilities (following a hospital stay), some home health care services, and hospice care.

What is the enrollment period for Medicare?

Special Enrollment Period for People Covered Under a Group Health Plan#N#If you are age 65 or older and covered under a group health plan, either from your own or your spouse’s current employment, you have a special enrollment period in which to sign up for Medicare Part B. This means that you may delay enrolling in Medicare Part B without having to wait for a general enrollment period and paying the 10 percent premium surcharge for late enrollment. The special enrollment period rules allow you to: 1 enroll in Medicare Part B anytime while you are covered under the group health plan based on current employment; or 2 enroll in Medicare Part B during the 8-month period that begins the month after your group health coverage ends or employment ends, whichever comes first.

What age do you have to be to have a group health plan?

Group health plans for employers with 20 or more employees are required by law to offer workers and their spouses who are age 65 or older the same health benefits that are provided to younger employees.

Does Medicare cover railroad workers?

The Medicare program covers railroad workers just like workers under social security. Railroad retirement payroll taxes include a Medicare hospital insurance tax just like social security payroll taxes. Though you’re paying into the Medicare program during your working years, and will probably rely on its services in the future, ...

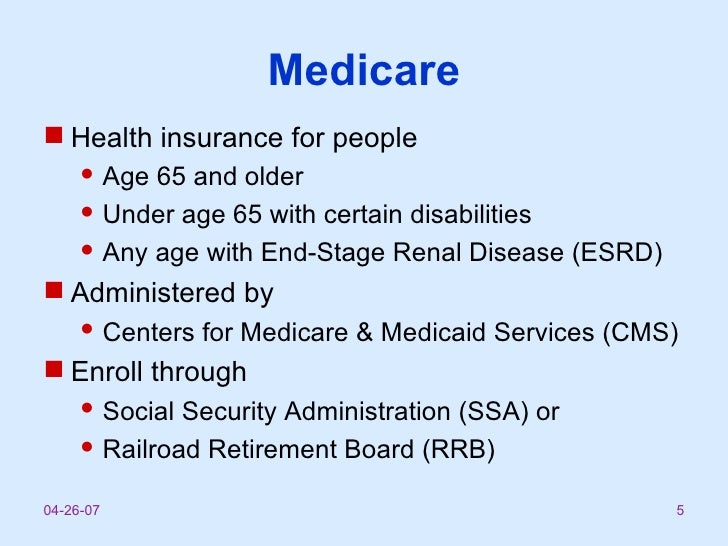

What age does Medicare cover?

Medicare is our country’s health insurance program for people age 65 or older, certain people with disabilities who are under age 65, and people of any age who have permanent kidney failure.

When does the enrollment period start for a 401(k)?

If you are eligible at age 65, your initial enrollment period begins 3 months before the month of your 65th birthday; includes the month you turn age 65; and ends 3 months after the month of your 65th birthday.

Is Medicare Part D the same as Medicaid?

Prescription Drug Coverage ( Medicare Part D ), as described in more detail under Prescription Drug Coverage. A Word about Medicaid. You may think that Medicaid and Medicare are two different names for the same program. Actually, they are two different programs.

When can I disenroll from Medicare Advantage?

A: You can generally disenroll from a Medicare Advantage plan only during the Medicare open enrollment period of October 15-December 7, the Medicare Advantage Plan disenrollment period of January 1-February 14, or when you qualify for a Special Enrollment Period (SEP). For more information on SEPs, go to www.Medicare.gov.

Does Medicare pay for hearing aids?

A: No, Medicare does not pay for hearing aids or hearing exams, when the purpose of the exam is to determine whether you need hearing aids or for fitting hearing aids.

Do I need to sign up for Medicare Part B?

A: As an active employee covered under the active employee H&W Plan, you do not need to sign up for Medicare Part B. You should, however, sign up for Medicare Part A (for which there is no cost) to avoid any future Medicare enrollment problems. It is strongly recommended that you contact the Railroad Retirement Board three (3) months before you turn age 65 to start the Medicare enrollment process.

Does Medicare cover injectable cancer drugs?

A: Only in limited instances will Medicare Part B provide for prescription drug coverage, such as for certain injectable cancer drugs or immunosuppressive drugs. All other Medicare benefits for prescription drugs require enrollment in a Part D Prescription Drug Program.

Does Medicare cover dental implants?

A: In most cases, Medicare does not cover dental services, specifically, services related to the care, treatment, filling, removal, or replacement of teeth, or structures directly supporting teeth. This would include check-ups, cleanings, and dental devices (such as dentures, dental plates, dental implants, or bridges) as well as extractions or other procedures performed to prepare the mouth for dentures (including reconstruction of the ridge) or titanium implants.

Can Medicare cards be similar?

A: This can easily happen as the two Medicare cards are very similar. The doctor’s office should pay close attention to the specific details printed on your Railroad Medicare card.

When do you become eligible for Medicare?

Typically, you’ll become eligible when you turn 65 or reach your 25th month of receiving disability benefits. The main difference is that the RRB classifies disability differently than the SSA does, so check with a representative ...

What is the RRB in 2020?

Licensed Insurance Agent and Medicare Expert Writer. June 15, 2020. Before the Social Security Administration (SSA) was formed, the Railroad Retirement Board (RRB) developed retirement, disability, and unemployment benefits for railroad workers who were hit hard by the Great Depression. Today, the RRB offers railroad workers a similar safety net.

Does Medicare cover Canada?

Generally, Medicare doesn’t cover health care costs in foreign countries, but RRB beneficiaries can use Medicare Part A for covered hospital expenses incurred in Canada . However, you may not receive coverage for Part B medical expenses, such as doctor visits, lab work, and preventative care.

Is Railroad Retirement Board the same as Social Security?

Railroad Retirement Board benefits are a lot like Social Security benefits. Your Medica re benefits are generally the same as well, except for a few perks. For example, you may be able to obtain coverage under Part A in Canada, and you may be able to cover dependent parents based on your work record instead of theirs.

Is Medicare deductible from Social Security?

Generally, your Medicare costs through the RRB will be the same as those paid by people who qualify for Medicare via Social Security. Just like workers outside the railroad industry, you’ll see Medicare deductions from your paycheck during your working years. These are the same for all workers: 1.45% of your income in 2020. 1

RRB Specialty MAC Providers

Effective immediately, the Railroad Medicare COVID-19 hotline can be reached at 888-882-7931 between the hours of 8:30 a.m. to 7 p.m. ET. Representatives can assist with provisional enrollment and information about accelerated payment requests. Learn More

Railroad Medicare COVID-19 Hotline

Effective immediately, the Railroad Medicare COVID-19 hotline can be reached at 888-882-7931 between the hours of 8:30 a.m. to 7 p.m. ET. Representatives can assist with provisional enrollment and information about accelerated payment requests. Learn More

How long does Cobra cover dependents?

Coverage will terminate for dependents but can be extended for up to 36 months through COBRA. Call 1-800-842-5252 for current COBRA rates.

When does dependent coverage end?

If the employee becomes eligible for Medicare prior to 65, the dependent coverage continues until the employee is eligible for Medicare due to age. If the dependent becomes eligible for Medicare prior to the employee’s age 65, the dependent’s GA-46000 coverage ends.

How to contact Cobra?

Call 1-800-842-5252 for current COBRA rates. Coverage for Dental and Vision terminates when employee retires, but can be extended under COBRA for 18 months. Call 1-800-842-5252 for current COBRA rates.