Recurring Medicare Part B Reimbursement is for those who want to be automatically reimbursed monthly for their premiums deducted from their social security benefit check. Submit one specialized reimbursement form to setup automatic reimbursement for the rest of the year. There will be no need to file a reimbursement request again for Medicare Part B until the following year.

How do I set up recurring reimbursement for Medicare Part B?

Guide to Recurring Medicare Part B Reimbursement Requests This form is for those who want to be automatically reimbursed monthly for their premiums deducted from their Social Security benefit check. Submit one Medicare Part B Reimbursement Request Form to set up recurring reimbursement for the rest of the year.

What is Medicare Part B reimbursement?

The remaining 20 percent that can be billed to the patient is known as the Medicare coinsurance. One of the keys to understanding Medicare Part B reimbursement is “ assignment ,” which can be confusing for those not familiar with medical insurance terminology.

Will Medicare reimburse retired workers for Medicare Part B?

Some retired workers—particularly public employees—whose pension systems provide private health insurance may be reimbursed for their Part B premiums if they opt to enroll in Medicare upon reaching eligibility.

How much does Medicare Part B Giveback cost per month?

For example, if you typically pay $170.10 per month, but your MA plan's giveback benefit is $50, you don't get $50 back each month. Instead, you'd only pay $120.10 per month (the standard Part B premium minus your $50 giveback benefit).

How does Medicare Part B reimbursement work?

The Medicare Part B Reimbursement program reimburses the cost of eligible retirees' Medicare Part B premiums using funds from the retiree's Sick Leave Bank. The Medicare Part B reimbursement payments are not taxable to the retiree.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Can you get reimbursed for Medicare Part B?

If you are a new Medicare Part B enrollee in 2021, you will be reimbursed the standard monthly premium of $148.50 and do not need to provide additional documentation.

What is recurring premium reimbursement?

The Recurring Premium Reimbursement Claim Form lets you request reimbursement of your health care premiums on a recurring basis. Your premiums must be a fixed monthly amount for a set period of time.

How does the Medicare Give Back program work?

The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C (Medicare Advantage) plans. If you enroll in a Medicare Advantage plan with this benefit, the plan carrier will pay some or all of your Part B monthly premium.

What is the Medicare Part B premium for 2021?

$148.50Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Who gets Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

How do I get Part B reimbursement?

benefit: You must submit an annual benefit verification letter each year from the Social Security Administration which indicates the amount deducted from your monthly Social Security check for Medicare Part B premiums. You must submit this benefit verification letter every year to be reimbursed.

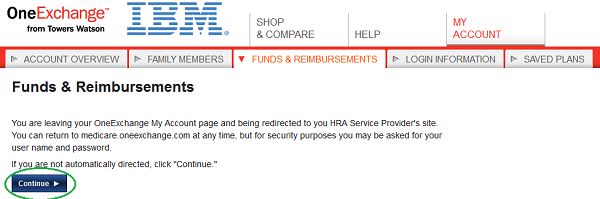

How long does it take to get reimbursed from Via Benefits?

within 14 daysOnce your reimbursement request is approved, you will receive reimbursement within 14 days for your eligible prescription drug out-of-pocket expenses.

How are via Benefits paid?

often a prescription drug coverage plan—through Via Benefits, you pay a monthly premium for each plan to each insurance company. If you use your coverage to go to the doctor or get a prescription, you may have to pay deductibles or copays to the doctor or pharmacy.

What can I use my via Benefits for?

Via Benefits provides access to a Medicare marketplace that includes a wide variety of Medicare Advantage, Medicare Supplement (Medigap), and Medicare Part D Prescription Drug plans from the nation's leading health insurers.

How much does Medicare cost?

Medicare Part premiums are currently set at $99.90 for most seniors with Medicare. That’s not expensive for what it covers, but it adds up to nearly $1,200 per year. Considering the medical coverage they’re getting, most people don’t mind shelling out that $1,200. But there are some lucky people who don’t have to.

Can you get full reimbursement for Part B?

If you pay more than the standard Part B premium, you may be eligible for full reimbursement. Some pension plans may offer reimbursement only up to the standard premium amount.

Do Medicare Part B patients get reimbursed?

Correction. They do pay their Medicare Part B premiums—but then they get reimbursed for what they paid .

How is Medicare Part B reimbursement conducted?

Reimbursement for Medicare Part B is conducted through a series of codes that number in the thousands and are updated quarterly. It is, then, important for long term care facility owners and administrators to understand how Medicare Part B works and what can be billed through it. For an overview of the process by which Medicare Part B is used in nursing homes, watch this interview between Jason Long, CEO of Experience Care, and Sue Friesth, Experience Care’s financial product manager:

What is Medicare Part B?

Medicare Part B, like the other three branches of Medicare, is billed through a system of thousands of codes in the Healthcare Common Procedure Coding System (HCPCS), more specifically HCPCS Level II. These are medical codes used for claims related to items and services like devices, supplies, medications, and transportation.

How much is Medicare Part B 2021?

The people receiving care will first have to elect Medicare Part B coverage, which requires them to pay a premium. For 2021, this amount is $148.50 for those making $88,000 or less. There is also a deductible, which is $203 for 2021, that must be paid, either by the patient/resident or a co-insurer. The deductible can be paid to any provider of Medicare Part B services. In other words, prior to entering a facility, a senior may have already met his or her deductible elsewhere and will, thus, not have to pay it at the facility. Once that deductible is met, one will be covered by Medicare.

How much does Medicare charge for therapy?

In other words, the entire fee schedule amount, the gross price, for therapy services must be documented. For instance, your facility may charge $75 for therapy evaluation, regardless of whether it is charged to Medicare or a private payer. Medicare Part B, meanwhile, might have $69 as its fee schedule amount for that service, meaning, you cannot charge more than that. What you should not do is charge 80% of the $69, or, $55.20, because that will result in only receiving 80% of what you charge, or, $44.16. Instead, you bill the entire $69 or $75 and then end up receiving $55.20 in reimbursement.

How to apply for Medicare if you are not enrolled in Medicare?

Those who are not enrolled in Medicare Part A must first do so. They can apply online here. Those unsure whether or not they have Part A can look on their red, white, and blue Medicare card, which will show “Hospital (Part A)” on the lower-left corner. Alternatively, they can call their local Social Security office or call Social Security at 1-800-772-1213.

Does Medicare reimburse for 80% of coinsurance?

It is important that long term care providers do not write off the coinsurance amount, as this will lead to Medicare treating the amount reported as the total amount, meaning, Medicare will only reimburse the facility for 80% of the 80% being reported. Medicare will then expect another payer to account for the remaining 20%, when, in reality, that 20% has not been reported.

Is a nursing home covered by Medicare Part B?

L ong term care facilities are often reimbursed for the therapy services they provide through Medicare Part B. After 100 days in a nursing home, a resident will no longer be covered by Medicare Part A for certain services. It is at that point that Medicare Part B is utilized for physical therapy, occupational therapy, and speech-language pathology.

What happens if you don't pay Medicare Part B?

If you don't pay your monthly Medicare Part B premiums through Social Security, the giveback benefit would be credited to your monthly statement. Instead of paying the full $148.50, you'd only pay the amount with the giveback benefit deducted.

What does it mean to be dually eligible for Medicare?

If you're dually eligible, it means you have both Medicare and Medicaid.

What is the Medicare premium for 2021?

In 2021, the standard Medicare Part B monthly premium is $148.50. Beneficiaries also have a $203 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

How to find Part B buy down?

If you enroll in a plan that offers a giveback benefit, you'll find a section in the plan's summary of benefits or evidence of coverage (EOC) that outlines the Part B premium buy-down. Here, you'll see how much of a reduction you'll get. You can also call us toll-free at 1-855-537-2378 and one of our knowledgeable, licensed agents will answer your questions and explain your options.

Can you enroll in Medicare Advantage if you have Medicaid?

This means anyone with Medicaid or other forms of assistance that pay the Part B premium cannot enroll in one of these Medicare Advantage plans.

Does Medicare give back Medicare?

The Medicare giveback benefit, or Part B premium reduction plan, is becoming more available and popular among beneficiaries. Medicaid also offers programs that pay your Part B premium if you meet certain qualifications, and some retiree health plans may offer reimbursement benefits.

Do retirees get Medicare Part B?

However, for most plans you must be a retired employee or already enrolled in the health plan and be enrolled in Medicare Part B.

Can you report recurring services on a bill?

Hospitals have the option of reporting those recurring services on a single bill. They can do that, but they are not required to. If you put everything on a single claim, then when conditional packaging is ...

Is radiation therapy considered repetitive?

There is no requirement for chemotherapy and radiation therapy as types of services that would need to be billed or defined as repetitive services. Occupational therapy and physical therapy, for instance, are listed as repetitive services.

Billed Amount vs. Approved Amount

- The billed amount, or professional fee, is simply the amount for a service or item that appears on a provider’s bill. If no insurance was involved, that is the amount a patient would be charged. Medicare takes into account, for example, that the same office visit probably costs more in New …

Assignment

- One of the keys to understanding Medicare Part B reimbursement is “assignment,” which can be confusing for those not familiar with medical insurance terminology. Medicare’s definition of an assignment is “an agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any mor…

What If The Doctor Or Supplier Does Not Accept assignment?

- This does not mean you cannot seek treatment from them. It also doesn’t mean the service or item will be denied by Medicare. These are both common misconceptions. However, there are some distinct disadvantages to using non-participating providers: 1. You may have to pay the entire charge for the service or item at the time of service. 2. You will usually end up paying mor…

How Are Medicare Part B Claims paid?

- All Medicare Part B claims are processed by contracted insurance providers divided by region of the country. The current term for these providers is “Medicare administrative contractors” (MACS). Providers file your Part B claim to one of the MACS and it is from them that you will receive a notice of how the claim was processed. The statement you will receive is called a Medicare Sum…

Medicare Supplemental Insurance

- While not strictly a part of Medicare, “Medigap” plans are worth a brief mention. They are sold by private insurers in every state, and their main function is to pick up the 20 percent Medicare coinsurance. More extensive information on them is available on the Medicare website at this tab.

Filing An Appeal

- An appeal is an action you can take if you disagree with the way your claim was processed. If you believe a service or item was denied in error, or you disagree with the amount of payment, you have the right to appeal. You may also appeal if Medicare stops paying for an item or service that you are currently receiving and believe you still need. If you decide toappeal Medicare’s decision…