What does SDI stand for on your paycheck stub?

Jul 10, 2017 · The California State Disability Insurance (SDI) program provides short-term disability insurance and paid family leave wage replacement benefits to eligible workers. The wages are determined as follows: Gross Pay (including tips and taxable fringe benefits including employer contributions to HSA plans).

What does SDI on my check deductions stand for?

Apr 02, 2020 · Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer. The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax.

How much does SDI staffing pay?

Jul 27, 2017 · SDI stands for State Disability Insurance and is paid out to workers who have hurt themselves away from the job site and cannot work for a period of time. Distinction The major distinction between SDI and worker's compensation is that SDI is payable when a worker hurts himself or is diagnosed with an illness not related to his job site or office.

How often does SDI pay?

taxes. The payroll taxes taken from your paycheck include Social Security and Medicare taxes, also called FICA (Federal Insurance Contributions Act) taxes. The Social Security tax provides retirement and disability benefits for employees and their dependents. The Medicare tax provides medical benefits to people age 65 or

Can I opt out of CA SDI?

Can an employee opt out of the Disability Insurance or Paid Family Leave program? No. The State Disability Insurance (SDI) program and contributions are mandatory under the California Unemployment Insurance Code.Feb 18, 2022

Is SDI a Medicare tax?

Taxes Paid by an Employer An employer may pay an employee's share of Social Security/Medicare (taxes imposed under the Federal Insurance Contributions Act [FICA]), State Disability Insurance* (SDI), and/or federal and state income taxes without deduction from the employee's salary.

Who pays SDI tax?

employee payrollThe only state that has a tax specifically called an SDI tax is California, but several other states have temporary disability insurance (TDI) that functions similarly. An SDI tax is paid through employee payroll as opposed to workers' compensation insurance, which is paid for by employers.

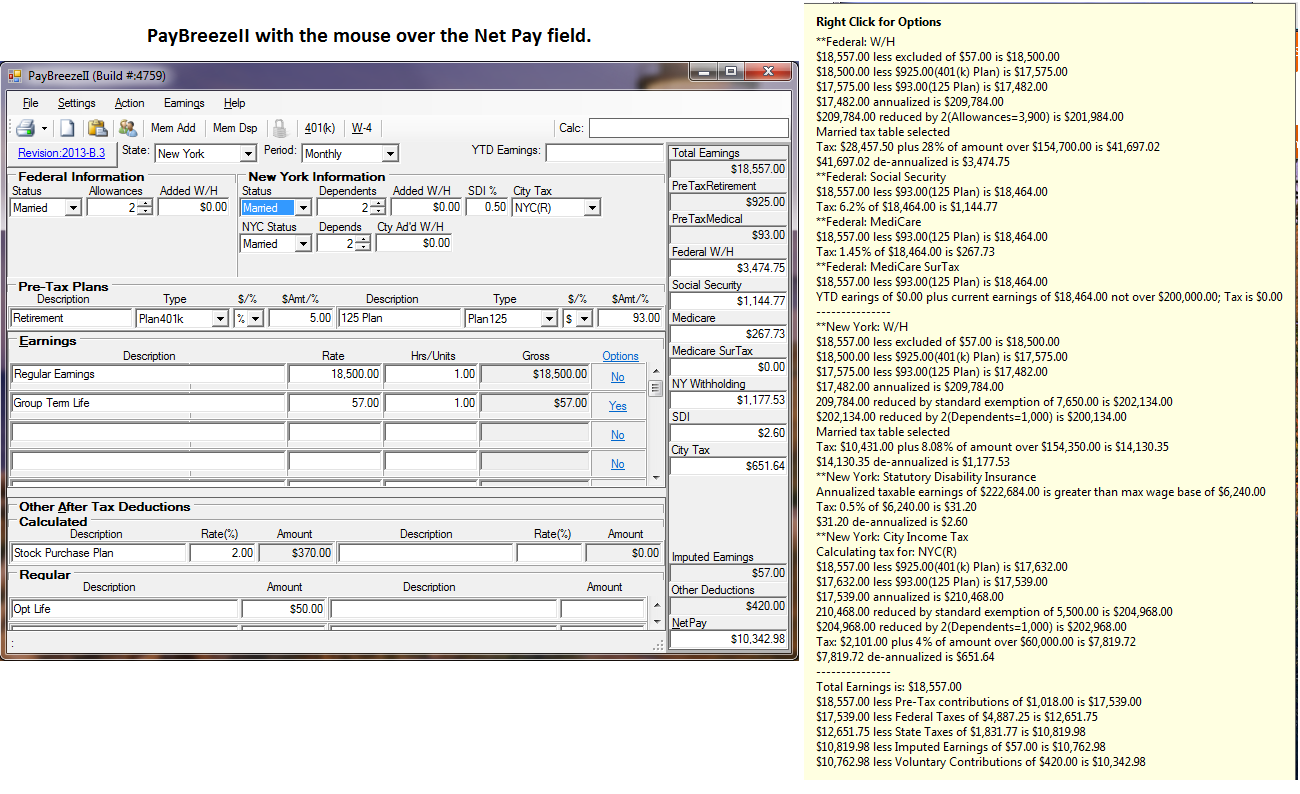

What is SDI deduction on my paycheck?

SDI is an acronym for “state disability insurance.” Some states call it TDI for “temporary disability insurance.” Not every state has this tax, but those that do require payroll deductions that help fund short-term (generally a maximum of six months) disability benefits for workers who become disabled.May 30, 2019

Is SDI the same as Medicare?

Disabled people who are approved for Social Security disability insurance (SSDI) benefits will receive Medicare, and those who are approved for Supplemental Security Income (SSI) will receive Medicaid. However, SSDI recipients aren't eligible to receive Medicare benefits until two years after their date of entitlement.

What Are SDI benefits?

SDI stands for “State Disability Insurance.” SDI is a cash benefit that provides partial income replacement for up to twelve months when you become unable to do your usual work due to mental or physical injuries, illnesses, and other health conditions.

Who qualifies for SDI?

Be unable to do your regular or customary work for at least eight days. Have lost wages because of your disability. Be employed or actively looking for work at the time your disability begins. Have earned at least $300 from which State Disability Insurance (SDI) deductions were withheld during your base period.Jan 28, 2022

Does SDI count as income?

State Disability Insurance (SDI) This could occur if a person was receiving UI benefits and then became disabled. When SDI benefits are received as a substitute for UI benefits, the SDI is taxable by the federal government but is not taxable by the State of California.

Is SDI a tax?

California has four state payroll taxes: Unemployment Insurance (UI) and Employment Training Tax (ETT) are employer contributions. State Disability Insurance (SDI) and Personal Income Tax (PIT) are withheld from employees' wages.Feb 14, 2022

Which states have SDI?

Six jurisdictions (California, Hawaii, New Jersey, New York, Puerto Rico and Rhode Island) operate state disability insurance (SDI) programs.Dec 22, 2021

What is SDI on W-2?

SDI = State Disability Insurance (premium) Yes, put it in your W-2 data entry, as it's deductible on your Federal return if you itemize.May 31, 2019

What is the CA SDI rate for 2020?

1.00 percentThe State Disability Insurance (SDI) withholding rate for 2020 is 1.00 percent. The taxable wage limit is $122,909 for each employee per calendar year. The maximum to withhold for each employee is $1,229.09.Feb 14, 2022

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is the tax rate for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income. Your employer also pays a matching Medicare tax based on your paycheck. There are two ways that you may see the Medicare payroll deduction applied to your paycheck.

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

What is SDI withholding?

Some states require an SDI withholding. SDI stands for State Disability Insurance and is paid out to workers who have hurt themselves away from the job site and cannot work for a period of time.

Who is Scott Damon?

Scott Damon is a Web content specialist who has written for a multitude of websites dating back to 2007. Damon covers a variety of topics including personal finance, small business, sports, food and travel, among many others.

What SDI Does

Funded with deductions from workers' wages, the SDI programs provide temporary benefit payments to an employee who cannot work due to a non-work-related illness, injury or condition. A work-related disability would be administered under a state's Worker's Compensation program.

States with SDI Programs

While all 50 states have State Disability Insurance programs, not all states have State Disability Insurance. Five states plus one territory require a State Disability Insurance Tax. They are New York, New Jersey, Rhode Island, California, Hawaii and Puerto Rico.

Withholding Rates

The amount withheld from your paycheck for SDI will depend on where you live. Each state sets its own withholding rate. The Taxable Base Wage, an amount after which SDI is no longer applied, also differs by state (see Resources).

What is withholding on a paycheck?

Withholding refers to the money that your employer is required to take out of your paycheck on your behalf. This includes federal and state income tax payments, Social Security, Unemployment Insurance, and Worker’s Comp.

What taxes are deducted from paycheck?

In a payroll period, the taxes deducted from a paycheck typically include Social Security and Medicare taxes , otherwise known as FICA (Federal Insurance Contributions Act). The following taxes and deductions are what you can expect to see on your paycheck, explained in detail below.

What is the Fair Standards Labor Act?

The Fair Standards Labor Act (FSLA) requires employers to keep records of how many hours an employee ...

How much does a worker contribute to Medicare?

Every worker contributes 1.45% of their gross income to Medicare and every employer pays an additional 1.45% on behalf of each employee.

What is pre-tax deduction?

It also shows pre-tax deductions for different employee benefits that you may receive, such as health insurance and retirement contributions. Deductions shows any additional deductions that might be taken out of your paycheck after tax, like group life or disability insurance.

What deductions are on pay stubs?

Common pay stub deductions include federal and state income tax, as well as Social Security. These federal and state withholdings account for much of the difference between your gross income and net income. There may be other deductions as well, depending on the programs that you sign up for with your employer.

What is federal withholding tax?

This is known as your withholding tax — a partial payment of your annual income taxes that gets sent directly to the government. These payments are managed by the IRS.

What is FICA tax?

FICA Tax. FICA is an acronym for Federal Insurance Contributions Act. This act was introduced in 1930 to cover Social Security. Both you and your employer will pay into this tax. Now, the tax is divided into Medicare and Social Security tax which is why you will probably see these two items on your paystub rather than just FICA.

What happens if you don't pay Social Security taxes?

If an employee makes more than the set $132,900, Social Security tax should not be withheld from their pay for any earning made above this amount. If you do not follow Social Security, Medicare, or FICA instruction carefully, you may end up either not deducting enough or too much.

What is the Medicare tax rate for 2019?

In 2019, the tax rate for employees was 1.45% for Medicare and 6.2% for Social Security. High-income employees are charged an additional 0.9% Medicare surtax. Employers have the responsibility of withholding FICA taxes from their employees’ wages.

Do self employed pay Social Security taxes?

Both employers and employees must pay Social Security Tax. As with Medicare tax, self-employed individuals will have to pay both the employee and employer portion of Social Security Tax. The rate for Social Security tax in 2019 was 6.2% of an employee’s gross wages below $132,900. The employer must match the amount paid by the employee.

Do employers have to pay FICA taxes?

In addition, employers must also pay their own employer FICA taxes and report both these and their employees’ portions to the IRS. FICA taxes are the most important tax to stay on top of and get correct. Not withhold or paying the correct amount of FICA taxes will result in serious consequences for the employer.

Do self employed people pay Medicare taxes?

If you are self-employed, you will pay self-employment tax, which is the equivalent of both employee and employer portions of the Medicare Tax. In 2019, the rate of Medicare tax was 1.45% of an employee’s gross earnings. The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional ...