What it means to pay primary/secondary

- The insurance that pays first (primary payer) pays up to the limits of its coverage.

- The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover.

- The secondary payer (which may be Medicare) may not pay all the remaining costs.

Full Answer

How does Medicare work as a secondary payer?

Oct 07, 2021 · What is Medicare Secondary Insurance Medicare Supplement plans are secondary insurance for individuals who have Part A and Part B. Because Medicare doesn’t cover everything, these policies are available to fill in the gaps. This helps reduce costs. Most states offer 12 different plan options, with varying levels of coverage.

Can you have private insurance and Medicare?

What it means to pay primary/secondary The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the remaining costs.

When Medicare is primary and secondary?

Oct 25, 2021 · Medicare secondary insurance is also offered by private insurance companies, and supplements your primary Medicare Part A and Part B coverage. In other respects, the two insurance types are very different. Best Medigap Coverage Information: Aetna Aetna Need to enter personal information to get pricing Coverage documents are lengthy

Is Medicare primary or secondary?

Medicare Secondary Payer (MSP) is a term used when Medicare is not responsible for paying first on a healthcare claim. The decision as to who is responsible for paying first on a claim and who pays second is known in the insurance industry as “coordination of benefits.”

What is Medicare Secondary Payer?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare. When Medicare began in 1966, it was the primary payer for all claims except for those covered by Workers' Compensation, ...

When did Medicare start?

When Medicare began in 1966 , it was the primary payer for all claims except for those covered by Workers' Compensation, Federal Black Lung benefits, and Veteran’s Administration (VA) benefits.

What is conditional payment?

A conditional payment is a payment Medicare makes for services another payer may be responsible for.

Why is Medicare conditional?

Medicare makes this conditional payment so that the beneficiary won’t have to use his own money to pay the bill. The payment is “conditional” because it must be repaid to Medicare when a settlement, judgment, award or other payment is made. Federal law takes precedence over state laws and private contracts.

How long does ESRD last on Medicare?

Individual has ESRD, is covered by a GHP and is in the first 30 months of eligibility or entitlement to Medicare. GHP pays Primary, Medicare pays secondary during 30-month coordination period for ESRD.

What are the responsibilities of an employer under MSP?

As an employer, you must: Ensure that your plans identify those individuals to whom the MSP requirement applies; Ensure that your plans provide for proper primary payments whereby law Medicare is the secondary payer; and.

What is the purpose of MSP?

The MSP provisions have protected Medicare Trust Funds by ensuring that Medicare does not pay for items and services that certain health insurance or coverage is primarily responsible for paying. The MSP provisions apply to situations when Medicare is not the beneficiary’s primary health insurance coverage.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

How To Shop & Compare Medicare Supplement Plans

Researching the plan thats right for you is key to getting the coverage you need. Each plan offers specific benefits depending on your state, which benefits you desire, and the costs.

Is Supplemental Insurance Worth It

It depends. Most seniors do supplement Medicare in some way. Those that dont have access to group health coverage will often invest in a Medigap policy to supplement Original Medicare or Medicare Advantage plan in lieu of Original Medicare. The right choice between these two really hinges on what you need.

Compare Medicare Supplement Insurance Plans

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here’s how we make money.

Best Medicare Supplement Companies

Unlike health insurance, where policies differ among providers, Medicare supplement plans are standardized so that the benefits for each plan letter are the same for each company. This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna.

What Do Medicare Supplement Plans Not Cover

Most Medicare Supplement plans have limits and exclusions to what they cover. For example, Plans C, D, F, G, and N cover 80% of medically necessary emergency care outside the U.S., but each of those four plans has other areas that they dont cover. Medicare.gov offers a detailed explanation of benefits for each plan.

Find A Secondary Health Insurance Quote With First Quote Health

If youre still wondering if a secondary health insurance plan is for you, its best to talk to a health insurance professional. Health insurance agents and brokers are a great tool and resource when it comes to shopping for a plan, or even just getting answers to your health insurance questions.

Aarp By United Healthcare

AARP is a special interest group that has served seniors since 1958. The company was founded with the goal of keeping aging Americans informed, empowered, and independent. Through various programs and services, it works to make the world more accessible and enjoyable for seniors across the country.

What is the highest level of Medicare supplement?

These are standardized plans in most states. The highest level of coverage is the Plan F Medicare Supplement. It pays 100% of the co-pays and deductibles for Medicare covered treatments.

How much is Plan F insurance?

A Plan F with one company may be as much as $500 per year cheaper with a different company and the coverage is exactly the same. It's best to use an insurance broker who sells for many companies rather than sign up directly through one specific company.

Is Plan G the same as Plan F?

The others to consider are Plan G which is the same as Plan F except you pay your Medicare Part B deductible which is less than $150 per year currently. You will often save $200 to $300 annually on your premiums choosing a plan G supplement over a Plan F.

Does Medicare Part D cover prescriptions?

Medicare and your supplement do not cover prescription medicines so most people buy a Medicare Part D plan for those.

What is secondary health insurance?

Secondary health insurance is coverage you can buy separately from a medical plan. It helps cover you for care and services that your primary medical plan may not. This secondary insurance could be a vision plan, dental plan, or an accidental injury plan, to name a few. These are also called voluntary or supplemental insurance plans.

What insurance covers a stroke?

Hospital care insurance can vary in terms, but often covers you for certain serious illnesses or conditions, such as stroke or heart attack. These plans may give you a cash payment to apply to costs. Cancer Insurance: Some secondary insurance plans can help cover treatment costs related to certain types of cancer.

What is a supplement plan?

Supplemental health plans like vision , dental , and cancer insurance can provide coverage for care and services not typically covered under your medical plan. Supplemental plans often have a deductible, copay, and coinsurance. When you meet the deductible then your plan starts sharing part of the costs with you.

What happens when you meet your deductible?

When you meet the deductible then your plan starts sharing part of the costs with you. When you see a provider you may have to pay a small fee, or copay, at the time of the visit. Lump sum insurance plans pay you a cash amount, should you suffer a covered illness or injury.

What is accidental injury insurance?

An accidental injury plan is a type of secondary insurance that may give you a cash payout, or lump sum. You can use this money to help pay medical bills or household expenses.

What is short term disability?

Disability: Short- and long-term disability plans are a type of secondary insurance coverage. It gives you benefits if you become injured or ill and can't work for any length of time. Life Insurance: A type of secondary insurance that pays out a lump sum to a beneficiary in the event of your death.

What does a vision plan cover?

A vision plan can provide coverage for routine eye exams and prescription glasses or contacts , depending on the plan. Dental: A dental plan can cover you for preventive care such as routine teeth cleanings and some X-rays. It may also help cover you for certain kinds of specialized dental care.

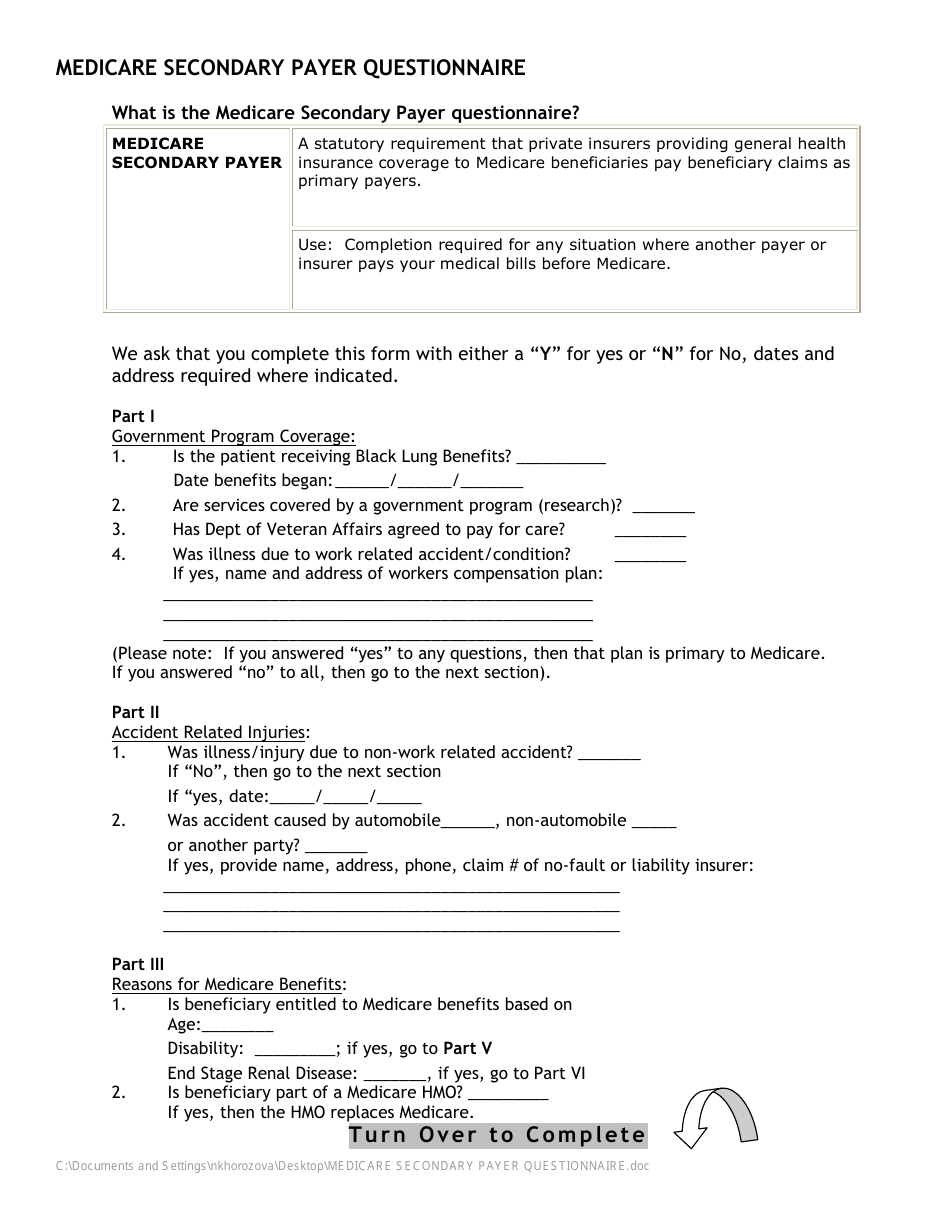

What is Medicare Secondary Payer questionnaire?

Medicare Secondary Payer Questionnaire. (Short Form) The information contained in this form is used by Medicare to determine if there is other insurance that should pay claims primary to Medicare.

What is the purpose of Medicare Secondary Payer questionnaire?

CMS developed an MSP questionnaire for providers to use as a guide to help identify other payers that may be primary to Medicare. This questionnaire is a model of the type of questions you should ask to help identify MSP situations.

What is the purpose of the Medicare questionnaire?

What is it? The Medicare Current Beneficiary Survey (MCBS) is a survey of people with Medicare. We use it to learn more about things like how people get their health care, the rising cost of health care, and how satisfied people are with their care.

What does Medicare Secondary Payer mean?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility – that is, when another entity has the responsibility for paying before Medicare. … Medicare is also the primary payer in certain instances, provided several conditions are met.

How does Medicare process secondary claims?

When Medicare is the secondary payer, submit the claim first to the primary insurer. … If, after processing the claim, the primary insurer does not pay in full for the services, submit a claim via paper or electronically, to Medicare for consideration of secondary benefits.

Does Medicare automatically send claims to secondary insurance?

Medicare will send the secondary claims automatically if the secondary insurance information is on the claim. … Medicare crosses over most claims automatically and you can see this on the remittance.

Does Medicare pay copays as secondary insurance?

Medicare will normally act as a primary payer and cover most of your costs once you’re enrolled in benefits. Your other health insurance plan will then act as a secondary payer and cover any remaining costs, such as coinsurance or copayments.