Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

What is a Medicare Plan D?

Medicare Plan D is a Medicare Supplement plan, also known as a Medigap plan. Plan D is one of the 10 standardized Medicare Supplement plans available in most states: A, B, C, D, F, G, K, L, M, and N. The names “Medicare Plan D”, “Medicare Supplement Plan D”, and “Medigap Plan D all mean the same thing.

How do I compare Medicare Part D plans?

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com. 2 How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month.

How do I choose a stand-alone Medicare Part D prescription drug plan?

This article focuses on choosing a stand-alone Medicare Part D prescription drug plan. The two main things to consider when choosing the best Medicare Part D prescription drug plan for you are costs and benefits.

Is Medicare Plan D replacing Plan C?

But starting 2020, Medicare Plan D replaced Plan C as one of the guaranteed issue plans for new enrollees. If coverage for the Part B deductible isn’t a priority, you can buy Medigap Supplement Plan D now or whenever you become eligible for Medicare.

What is the difference between basic and enhanced Part D plans?

Enhanced plans charge higher monthly premiums than basic plans but typically offer a wider range of benefits. For instance, these plans may not have a deductible, may provide extra coverage during the donut hole, and may have a broader formulary. Some of these plans may also cover excluded drugs.

What are the two types of Medicare Part D plan?

Are you thinking about Medicare Part D coverage for your prescription drugs? As you may know, there are two main ways to get this coverage: Stand-alone Medicare Part D Prescription Drug Plan. Medicare Advantage Prescription Drug plan.

Which Medicare Part D plan is best?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is a standalone Part D plan?

STANDALONE PART D PLAN A standalone plan provides coverage just for your prescription drugs. You would enroll in this type of plan if: You use Original Medicare for your health care needs and want prescription drug coverage. You have a Medicare Supplement plan.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

How do I select Part D plan?

Your 5-Point Checklist for Choosing a Medicare Part D PlanLow or $0 Copays. Some Medicare Part D plans offer $0 copays for certain drugs on their formularies (drug list). ... Medication Home Delivery. Trips to the pharmacy can be time consuming and may require advance planning. ... Drug Pricing Tool. ... Prescription Refill Reminders.

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What is the cost of Medicare Part D for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

Can you change Medicare Part D plans anytime?

You can sign up for a Medicare Part D plan or switch from one Part D plan to another during each year's open enrollment period. You also can sign up for a Medicare Advantage plan or switch to a different Medicare Advantage plan — with or without drug coverage — during that time.

Can you buy Medicare Part D by itself?

You have two ways to get coverage: Buy a stand-alone Part D prescription drug plan, or sign up for a Medicare Advantage plan that combines medical and drug coverage. Private insurance companies that Medicare regulates offer both types of plans.

What plan types can you get a stand-alone Part D plan with?

The plan can be a “stand-alone” Part D drug plan — one that offers only drug coverage and is the type that can be used by people enrolled in the original Medicare program. Or it can be a Medicare Advantage plan (such as an HMO or PPO) that offers Part D drug coverage as well as medical coverage in its benefits package.

How much does Medicare Part D cost in 2021?

If your filing status and yearly income in 2019 was:File individual tax returnFile joint tax returnYou pay each month (in 2021)above $170,000 and less than $500,000above $340,000 and less than $750,000$71.30 + your plan premium$500,000 or above$750,000 and above$77.90 + your plan premium4 more rows

What Is The Coverage Gap (“Donut Hole”), and When Does It Start?

For those who are new to the coverage gap, or “donut hole,” learning about the different Medicare Part D coverage phases is a good place to start....

What Costs Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Once you’ve entered the coverage gap (“donut hole”), it’s important to understand which out-of-pocket costs count towards helping you reach the cat...

What Costs Don’T Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Not all out-of-pocket costs count towards reaching catastrophic coverage. The following costs don’t count towards getting you out of the coverage g...

How Do I Avoid The Medicare Part D Coverage Gap (“Donut Hole”)?

Now that you know about the coverage gap (“donut hole”), here is some good news: 1. Many Medicare beneficiaries won’t have to pay the increased pri...

What If I Have Questions About The Coverage Gap (“Donut Hole”)?

If you have questions about how the coverage gap works and how to avoid it, I can help. A licensed insurance agent such as myself can help you comp...

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is formulary exception?

A formulary exception is a drug plan's decision to cover a drug that's not on its drug list or to waive a coverage rule. A tiering exception is a drug plan's decision to charge a lower amount for a drug that's on its non-preferred drug tier.

What happens if you don't use a drug on Medicare?

If you use a drug that isn’t on your plan’s drug list, you’ll have to pay full price instead of a copayment or coinsurance, unless you qualify for a formulary exception. All Medicare drug plans have negotiated to get lower prices for the drugs on their drug lists, so using those drugs will generally save you money.

How many prescription drugs are covered by Medicare?

Plans include both brand-name prescription drugs and generic drug coverage. The formulary includes at least 2 drugs in the most commonly prescribed categories and classes. This helps make sure that people with different medical conditions can get the prescription drugs they need. All Medicare drug plans generally must cover at least 2 drugs per ...

What does Medicare Part D cover?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary.

Why does Medicare change its drug list?

Your plan may change its drug list during the year because drug therapies change, new drugs are released, or new medical information becomes available.

How many drugs does Medicare cover?

All Medicare drug plans generally must cover at least 2 drugs per drug category, but plans can choose which drugs covered by Part D they will offer. The formulary might not include your specific drug. However, in most cases, a similar drug should be available.

What is tiering exception?

A tiering exception is a drug plan's decision to charge a lower amount for a drug that's on its non-preferred drug tier. You or your prescriber must request an exception, and your doctor or other prescriber must provide a supporting statement explaining the medical reason for the exception. .

What is the maximum deductible for Medicare Part D in 2021?

In 2021, the maximum deductible is $445. Some Medicare Part D plans don’t charge a deductible. A copayment is a dollar amount you pay every time you fill a prescription drug. A coinsurance is a percentage you pay when you fill a prescription. Copayment and coinsurance amounts vary according to the pricing tier the medication is on.

What is Medicare Part D?

Medicare Part D is prescription drug coverage offered by private insurance companies. You can get Medicare Part D coverage through a stand-alone plan that works together with Original Medicare (Part A and Part B) or through a Medicare Advantage prescription drug plan. Find affordable Medicare plans in your area.

What to consider when choosing a Medicare Part D plan?

The two main things to consider when choosing the best Medicare Part D prescription drug plan for you are costs and benefits .

What is deductible for 2021?

A deductible is the amount you pay for your prescription drugs before your plan begins to pay.

What is the star rating on Medicare Part D?

The star rating is an indicator of the plan’s quality and performance. Factors that go into the star rating include:

How to know if antineoplastics are covered by Medicare?

To know if your prescription drug is covered by your plan, ask for the plan’s formulary. A formulary is a list of covered prescription medications. If you have a plan that doesn’t cover ...

What is a five star plan?

The plan’s management of chronic conditions. The plan’s provision of screening tests and vaccines. If you a see five-star plan with a higher premium than a 3-star plan, you may consider if the increased monthly cost is worth it for coverage that is rated highly.

What is the deductible phase of Medicare?

Deductible phase: For most stand-alone Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans, you’ll pay 100% for medication costs until you reach the yearly deductible amount (if your plan has one). After you reach the deductible, the Medicare plan begins to cover its share of prescription drug costs. The deductible amount may vary by plan, and some plans may not have a deductible. If your Medicare plan doesn’t have a deductible, then you’ll start your coverage in the initial coverage phase (see below).

How to avoid coverage gap?

Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap. Here are some tips for how you can lower the amount you spend on medications: Many expensive prescription drugs have a generic or lower-cost alternative. Switching to lower-cost drugs may help you avoid entering the coverage gap.

What is the coverage gap in Medicare?

Typically, each new coverage phase begins once your spending has reached a certain amount. The coverage gap is one of the coverage phases under Medicare Part D.

What is the Medicare Part D coverage gap?

The Medicare Part D Coverage Gap (“Donut Hole ”) Made Simple. Summary: When it comes to Medicare prescription drug coverage, you might have questions surrounding the Medicare Part D coverage gap, also known as the “donut hole.”. The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug Plans or Medicare Advantage ...

Why won't Medicare pay the $4,020 coverage gap?

Now that you know about the coverage gap (“donut hole”), here is some good news: Many Medicare beneficiaries won’t have to pay the increased prices during the coverage gap because their prescription drug costs won’t reach the initial coverage limit of $4,020 in 2020.

How much is the coverage gap for 2020?

While in the coverage gap, you’ll typically pay up to 25% of the plan’s cost for both covered brand-name drugs and generic drugs in 2020. You’re out of the coverage gap once your yearly out-of-pocket drug costs reach $ 6,350 in 2020. Once you have spent this amount, you’ve entered the catastrophic coverage phase.

What is the cost of prescription drugs in 2020?

Remember, if your prescription drug spending reaches $6,350 in 2020, you’ll have catastrophic coverage for the rest of the year. The following costs count towards your out-of-pocket spending and getting you out of the coverage gap: The 70% manufacturer discount for brand-name drugs while you’re in the coverage gap.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

How to find out if Medicare covers prescription drugs?

One way to learn about your Medicare prescription drug coverage options is to speak with a licensed insurance agent . You can compare Medicare Advantage plan costs in your area and find a plan that covers the prescription drugs you need.

Why do we detail Part D costs?

We also detail Part D plan costs so that you can better understand your Medicare prescription drug coverage options.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

What is copayment insurance?

Copayments and coinsurance are the amounts that you must pay once your plan’s coverage does begin.

How much out of pocket is considered catastrophic?

Once you reach $6,550 in out-of-pocket spending, you are out of the donut hole and enter “ catastrophic coverage ,” where you typically only pay a small copayment or coinsurance payment for the rest of the year.

How it works

After Medicare pays its approved amount for services, Medigap plans help cover what would otherwise be your out-of-pocket costs: copayments, coinsurance and some deductibles. These plans are available only to individuals enrolled in Medicare Part A and Part B — not to Medicare Advantage members.

How much does Medigap Plan D cost?

Medigap Plan D is regulated by the government but sold by private insurers. Prices vary according to factors including age, location and tobacco use. In a representative California ZIP code (92589) in 2022, monthly premiums for a 65-year-old nonsmoker range from $124 to $230.

Compare alternative plans

About the author: Alex Rosenberg is a NerdWallet writer focusing on Medicare and information technology. He has written about health, tech, and public policy for over 10 years. Read more

What is a Medigap Plan D?

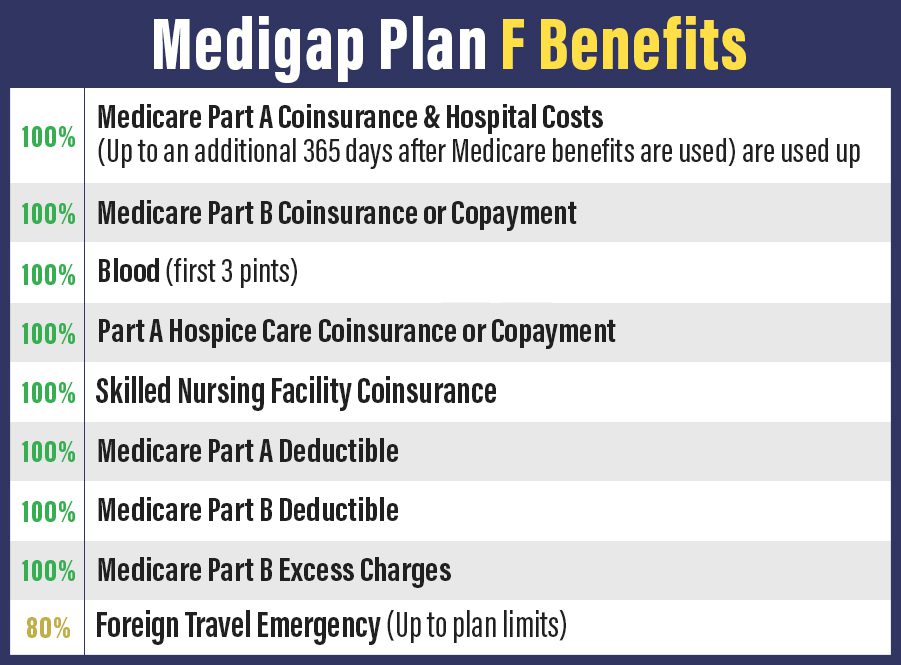

Medigap Plan D is a mid-range benefits plan similar to Plan N . Plan D provides more benefits than basic Plan A and Plan B, but it does not cover the Medicare Part B deductible and Part B excess charges, which are covered by Plan F.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What is Medicare Supplement Plan D?

Medigap Plan D is one of the standardized Medicare Supplement Insurance options available in most states. (Massachusetts, Minnesota, and Wisconsin have different options). Medicare Supplement Plan D helps cover a number of costs your Original Medicare (Part A and Part B) coverage doesn't pay for.

How much is Medicare Part A deductible in 2021?

Medicare Part A comes with a deductible, which is $1,484 per benefit period in 2021. You could potentially have to meet this deductible multiple times in a single year, which can add up quickly.

How much is coinsurance for skilled nursing?

Medical care provided at skilled nursing care facilities is covered by Medicare Part A, but it requires coinsurance costs of $85.50 per day in 2021 after day 20 of your stay.

What is Medicare Part A?

Medicare Part A Coinsurance. Medicare Part A is known as hospital insurance and it includes cost-sharing measures like coinsurance. Inpatient hospital stays covered by Medicare Part A require coinsurance fees if they exceed 60 days.

How much does Medicare pay for coinsurance?

Medicare Part B typically pays for 80% of the Medicare-approved amount for covered services, leaving a 20% coinsurance in most cases, after you meet the Part B deductible.

What is a Part D plan?

The plan can be a “stand-alone” Part D drug plan — one that offers only drug coverage and is the type that can be used by people enrolled in ...

Is Medicare Advantage a PPO?

Or it can be a Medicare Advantage plan (such as an HMO or PPO) that offers Part D drug coverage as well as medical coverage in its benefits package. Within these two broad categories are many individual plans, each of which has different costs and benefits. Each plan has its own formulary — the list of drugs it covers — and sets ...

How long does it take for a medicare prescription to be filled?

As an additional safeguard, your Medicare prescription drug insurer must generally offer enrollees a 90-day filling of their current medications when the plan benefits change from one year to the next – under certain circumstances. Because there are conditions attached to this policy, known as a “ transition fill ,” you should be sure to know your insurer’s rules – while ensuring the plan follows through on its obligations to support you as Medicare beneficiary.

What is Medicare Part D?

Medicare Part D is the private sector’s first foray into a part of the Medicare program where all benefits are delivered by the private sector. To make Part D coverage palatable to budget analysts in Washington – who need to sign off before lawmakers can create something like a prescription drug benefit – the law’s authors created a “ donut hole ” (also known as the coverage gap), and you had to pay your drug costs yourself while you were in the donut hole.

What is the most important thing to do as a Medicare beneficiary?

From my experience dealing with frustrated Medicare enrollees, I can tell you that selecting the right prescription drug plan is one of the most important. If you make the right choices, they can save you huge sums of of money and headache, while ensuring you have access to the medications you need.

How to contact Medicare Advantage?

Call 1-844-309-3504. 2. Check your Medicare Advantage plan. If you have a Medicare Advantage plan, you usually have to receive your drug benefits through the plan rather than a separate Part D insurer. If you are one of the growing number of Medicare beneficiaries who receive their hospital and physicians benefits ( Medicare Part A and Part B) ...

Why do we need a Part D?

These are people who enrolled in Part D because prescription drugs have historically been one of the expenses that were most concerning to beneficiaries. (Nearly $1 of every $5 Medicare dollars goes toward outpatient prescription drug costs, mostly via Part D coverage.)

How many rules of the road are there for Medicare Part D?

When tackling Medicare Part D, here are seven rules of the road.

How to select a Medicare Part D plan?

Unless you’re really comfortable using a computer and other Internet tools, the best way to select a Part D plan is to contact the government’s 1-800-MEDICARE call center and ask the customer service agent to spend some time and walk you through the process of using Medicare.gov’s online Plan Finder to select a new plan.