What is eligible for SNAP benefits?

Medicare SNPs are a type of Medicare Advantage Plan (like an HMO or PPO). Medicare SNPs limit membership to people with specific diseases or characteristics. Medicare SNPs tailor their benefits, provider choices, and drug formularies to best meet the specific needs of the groups they serve. Find out who can join a Medicare SNP.

Will I get extra SNAP benefits?

The amount of the shelter deduction is capped at (or limited to) $597 unless one person in the household is elderly or disabled. The limit is higher in Alaska, Hawaii, and Guam. For a household with an elderly or disabled member all shelter costs …

What is the Medicaid SNAP program?

Program (SNAP) Facts What is SNAP? The Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, helps low-income people buy nutritious food. Although SNAP is a federal program, state agencies run the program through local offices. You may be eligible to receive SNAP benefits if you meet certain income and resource requirements.

How do I qualify for SNAP benefits?

Oct 19, 2021 · By Caroline Gabryel. A study published in Annals of Internal Medicine led by UNC School of Medicine’s Seth A. Berkowitz, MD, MPH, shows that participation in the Supplemental Nutrition Assistance Program (SNAP) by older adults dually enrolled in Medicare and Medicaid is associated with fewer hospital visits and lower healthcare costs.

What is SNP in healthcare?

A SNP may be any type of MA CCP, including either a local or regional preferred provider organization (i.e., LPPO or RPPO) plan, a health maintenance organization (HMO) plan, or an HMO Point-of-Service (HMO-POS) ...

Why do SNPs need to provide Part D coverage?

All SNPs must provide Part D prescription drug coverage because special needs individuals must have access to prescription drugs to manage and control their special health care needs. SNPs should assume that, if no modification is contained in guidance, existing Part C and D rules apply.

What is a special needs plan?

A special needs plan (SNP) is a Medicare Advantage (MA) coordinated care plan (CCP) specifically designed to provide targeted care and limit enrollment to special needs individuals. A special needs individual could be any one of the following: An institutionalized individual, A dual eligible, or. An individual with a severe or disabling chronic ...

When did the SNP program end?

Most recently, section 206 of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) extended the SNP program through December 31, 2018.

Do SNPs have to submit bids?

SNPs must prepare and submit bids like other MA plans, and are paid in the same manner as other MA plans based on the plan’s enrollment and risk adjustment payment methodology. All SNPs must abide by current CMS guidance on cost sharing requirements.

Do SNPs have to follow Medicare?

SNPs are expected to follow existing MA program rules, including MA regulations at 42 CFR 422, as modified by guidance, with regard to Medicare- covered services and Prescription Drug Benefit program rules. All SNPs must provide Part D prescription drug coverage because special needs individuals must have access to prescription drugs to manage and control their special health care needs. SNPs should assume that, if no modification is contained in guidance, existing Part C and D rules apply.

Did CMS accept SNP applications in 2008?

Accordingly, CMS did not accept SNP applications in 2008 for contract year (CY) 2009. The Medicare Improvements for Patients and Providers Act of 2008 (MIPPA) lifted the Medicare, Medicaid, and SCHIP Extension Act of 2007 moratorium on approving new SNPs.

When will the SNAP program be extended?

Biden on March 11, 2021, extends increases to the Supplemental Nutrition Assistance Program (SNAP) maximum allotments from July 1, 2021, through Sept. 30, 2021.

How much can you deduct from your SNAP?

The following deductions are allowed for SNAP: A 20-percent deduction from earned income. A standard deduction of $167 for household sizes of 1 to 3 people and $181 for a household size of 4 (higher for some larger households and for households in Alaska, Hawaii, and Guam).

What is the net income test?

However, a household with an elderly or disabled person only has to meet the net income test. Net income means gross income minus allowable deductions. Gross income means a household's total, non-excluded income, before any deductions have been made.

What is dependent care deduction?

A dependent care deduction when needed for work, training, or education. Medical expenses for elderly or disabled members that are more than $35 for the month if they are not paid by insurance or someone else. The excess medical expenses deduction is described below. In some states, legally owed child support payments.

What are the rules for SNAP?

Home. Supplemental Nutrition Assistance Program (SNAP) To get SNAP benefits, you must apply in the state in which you currently live and you must meet certain requirements, including resource and income limits. Most SNAP eligibility rules apply to all households, ...

How to contact a state agency for snap?

You can contact your state agency by visiting your local SNAP office, visiting your state agency’s website, or calling your state’s toll-free SNAP Information hotline.

How much is shelter deduction?

Some states allow a set amount for utility costs instead of actual costs. The amount of the shelter deduction is capped at (or limited to) $586 unless one person in the household is elderly or disabled. The limit is higher in Alaska, Hawaii, and Guam.

How much can you deduct from your SNAP?

The following deductions are allowed for SNAP: A 20-percent deduction from earned income. A standard deduction of $167 for household sizes of 1 to 3 people and $181 for a household size of 4 (higher for some larger households and for households in Alaska, Hawaii, and Guam).

What are the requirements to qualify for Snap?

citizens and certain lawfully present non-citizens. Generally, to qualify for SNAP, non-citizens must meet one of the following criteria: Have lived in the United States for at least 5 years. Be receiving disability-related assistance or benefits.

What is the difference between net and gross income?

Gross income means a household's total, non-excluded income, before any deductions have been made. Net income means gross income minus allowable deductions.

How to calculate SNAP allotment?

Because SNAP households are expected to spend about 30 percent of their own resources on food, your allotment is calculated by multiplying your household’s net monthly income by 0.3, and subtracting the result from the maximum monthly allotment for your household size.

How to contact a state agency for snap?

You can contact your state agency by visiting your local SNAP office, visiting your state agency’s website, or calling your state’s toll-free SNAP Information hotline.

What is dependent care deduction?

A dependent care deduction when needed for work, training, or education. Medical expenses for elderly or disabled members that are more than $35 for the month if they are not paid by insurance or someone else. This is described on the elderly and disabled page. In some states, legally owed child support payments.

How long does it take to get unemployment benefits?

During the 30 days, you will need to complete an eligibility interview and give proof (verification) of the information you provided. The interview is typically completed over the telephone or in-person. If you are found eligible, you will receive benefits based on the date you submitted your application.

What methodology do I-SNPs use?

In states and territories without a specific tool, I-SNPs must use the same LOC determination methodology used in the respective state or territory in which the I-SNP is authorized to enroll eligible individuals.

What does an I-SNP need to document?

If an I-SNP enrollee changes residence, the I-SNP must document that it is prepared to implement a CMS-approved MOC at the enrollee’s new residence, or in another I-SNP contracted LTC setting that provides an institutional level of care.

What is the net income for Snap?

If your household only consists of one person, then the gross monthly income to be eligible for SNAP is $1,287 (net $990). For two people, gross is $1,726 (net $1,335). The numbers increase from there. Find out if you are eligible for any deductions.

What do you look for in a snap application?

When applying for SNAP, they look at the income, resources, and size of the household. For this situation, a household is defined by people that live together and purchase and prepare food together. When looking at income and resources, it is the total of all members of the household, not just the head of household.

What is the federal food and nutrition service?

The federal food and nutrition service works with a wide range of other organizations including state agencies, nutrition educators, and neighborhood organizations to provide SNAP recipients with nutrition assistance and information.

What is an EBT card?

Being Approved for Food Stamp Benefits. When you are found eligible for SNAP benefits, you will receive an Electronic Benefit Transfer (EBT) card. Your benefits are automatically loaded onto the card each month. The card will work like a debit card with funds deducted from the account with each purchase.

How is the allotment calculated?

For that reason, benefit amounts, called allotments, are figured by taking the net income of the household and multiplying it by 0.3. That number is then subtracted from the maximum allotment allowed based on the size of the household.

What is the federal food stamp program?

SNAP is the largest domestic program available to nutritional assistance, and it is available for low-income individuals and families that meet the eligibility requirements. The federal food and nutrition service works with a wide range of other organizations including state agencies, nutrition educators, and neighborhood organizations to provide SNAP recipients with nutrition assistance and information.

What is the purpose of the Supplemental Nutrition Assistance Program?

The Supplemental Nutrition Assistance Program (SNAP) is a federally funded program to provide food assistance to low-income individuals and families. SNAP is funded by the federal government and administered through the states. Many states also work with other local agencies to provide ongoing nutritional education and training to SNAP recipients.

What is a special needs plan?

A Special Needs Plan (SNP) is a type of Medicare Advantage plan that combines all the benefits of Original Medicare (Parts A and B) with prescription drug coverage (Part D), but is only available to those beneficiaries who have an additional qualifying condition. For example, those who: 1 Have a specific chronic health condition 2 Are eligible for both Medicare and Medicaid 3 Are a resident of a long-term care facility

What are the requirements for SNP?

To be eligible for an SNP, you must have Medicare Parts A and B and meet the specific conditions of the SNP. Depending on the specific plan, benefits may also include coverage for routine dental, vision and hearing care; nonemergency transportation to and from medical care; fitness programs; an over-the-counter medication allowance and more.

What Is A Special Needs Plan?

- A special needs plan (SNP) is a Medicare Advantage (MA) coordinated care plan (CCP) specifically designed to provide targeted care and limit enrollment to special needs individuals. A special needs individual could be any one of the following: 1. An institutionalized individual, 2. A dual eligible, or 3. An individual with a severe or disabling chr...

Statutory and Regulatory History

- The Medicare Modernization Act of 2003 (MMA) established an MA CCP specifically designed to provide targeted care to individuals with special needs. In the MMA, Congress identified “special needs individuals” as: 1) institutionalized individuals; 2) dual eligibles; and/or 3) individuals with severe or disabling chronic conditions, as specified by CMS. MA CCPs established to provide se…

Requirements and Payment Procedures

- SNPs are expected to follow existing MA program rules, including MA regulations at 42 CFR 422, as modified by guidance, with regard to Medicare-covered services and Prescription Drug Benefit program rules. All SNPs must provide Part D prescription drug coverage because special needs individuals must have access to prescription drugs to manage and control their special health c…

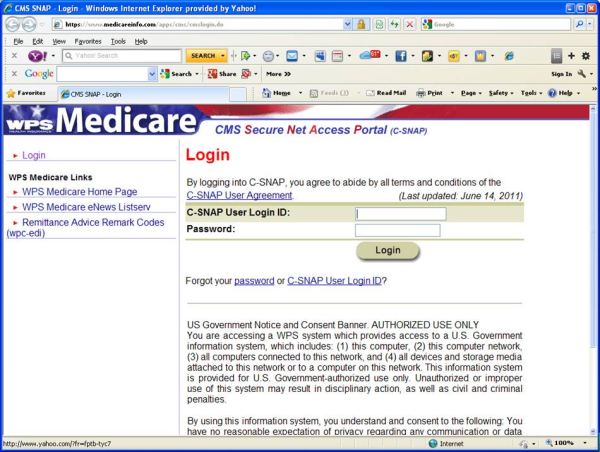

Site Overview

- Specific information about each of the three SNP types (C-SNPs, D-SNPs, and I-SNPs), as well as information on the SNP Application and the SNP Model of Care, can be found by clicking the appropriate links on the left-hand side of this page. In addition, there is a link below to the online Medicare Managed Care Manual, which contains Chapter 16b – CMS's current sub-regulatory gu…