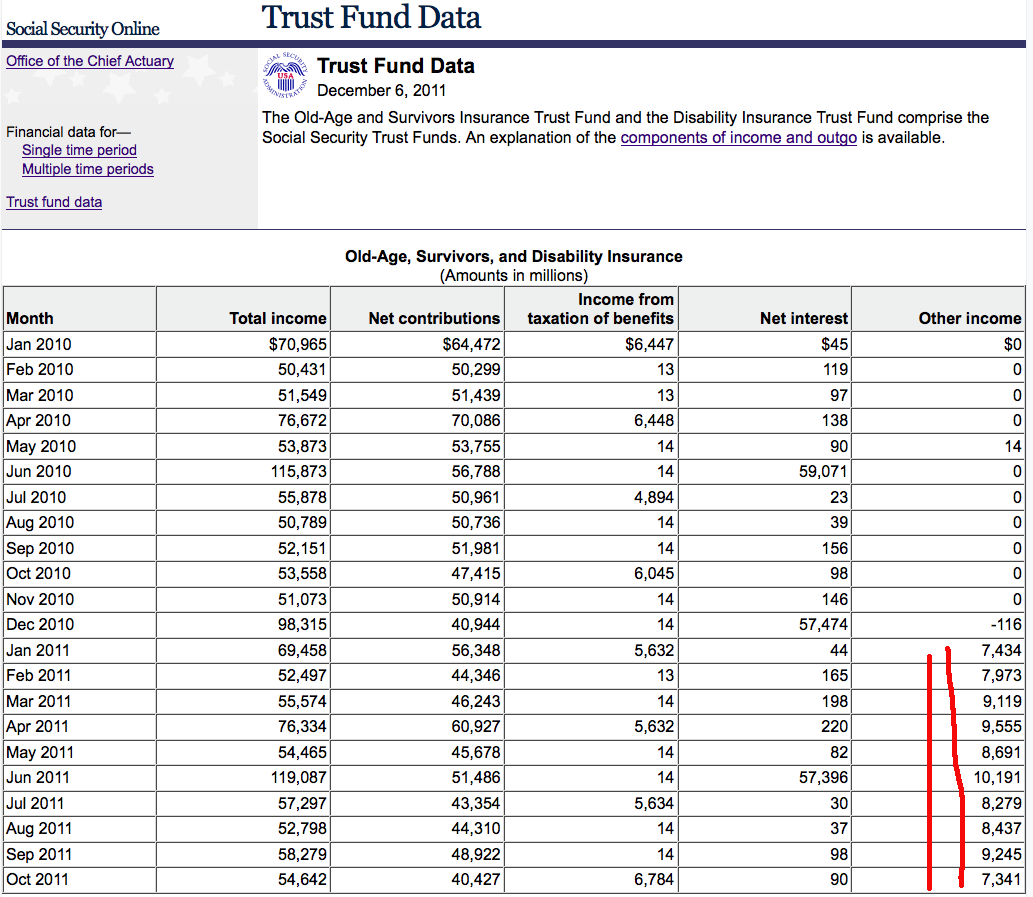

2015 Social Security and Medicare Tax Withholding Rates and Limits

| Tax | 2014 Limit | 2015 Limit |

| Social Security Gross | $117,000.00 | $118,500.00 |

| Social Security Liability | $7,254.00 | $7,347.00 |

| Medicare Gross | No Limit | No Limit |

| Medicare Liability | No Limit | No Limit |

What was the Medicare tax rate in 2015?

1.45 percentThe FICA Tax Rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2015 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).Nov 27, 2014

What is Medicare and Social Security withholding?

If you work for an employer, you and your employer each pay a 6.2% Social Security tax on up to $147,000 of your earnings. Each must also pay a 1.45% Medicare tax on all earnings. If you're self-employed, you pay the combined employee and employer amount.

Why do I pay Social Security and Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.Mar 3, 2022

Why is Social Security taken out of paycheck?

The Social Security and Medicare programs are in place to help with your income and insurance needs once you reach retirement age. If you're on your employer's insurance plan, this deduction may come out of your paycheck to cover your medical, dental and life insurance premiums.Oct 31, 2016

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

How many people will pay Social Security taxes in 2015?

Of the estimated 168 million workers who will pay Social Security taxes in 2015, about 10 million will pay higher taxes because of the increase in the taxable maximum, the SSA said. Social Security and Medicare payroll withholding are collected together as the Federal Insurance Contributions Act (FICA) tax.

What is the tax rate for Medicare and Social Security?

Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount. The Medicare portion is 1.45% on all earnings.

How much is Medicare tax?

For most Americans, the Medicare portion of the FICA tax remains at 2.9 percent, of which half ( 1.45 percent) is paid by employees and half by employers. Unlike Social Security, there is no limit on the amount of earnings (which includes salary and bonus income) subject to the Medicare portion of the tax. This results, for most American wage ...

What is the FICA tax rate?

This results, for most American wage earners, in a total FICA tax of 15.3 percent (Social Security plus Medicare), half of which is paid by employees and half by employers. Again, self-employed individuals are responsible for the entire FICA tax rate of 15.3 percent (12.4 percent Social Security plus 2.9 percent Medicare).

What is the additional Medicare tax?

The Additional Medicare Tax raises the wage earner’s portion on compensation above the threshold amounts to 2.35 percent ; the employer-paid portion of the Medicare tax on these amounts remains at 1.45 percent. The IRS has posted responses to frequently asked questions regarding the Additional Medicare Tax.

Will Social Security increase in 2016?

On Oct. 15, 2015, the Social Security Administration announced that there will be no increase in monthly Social Security benefit payments in 2016, and that the amount of wages subject to Social Security taxes will also remain unchanged at $118,500 in 2016. See the SHRM Online article Social Security Payroll Tax Threshold Unchanged for 2016.

Is Medicare a payroll tax?

The IRS has posted responses to frequently asked questions regarding the Additional Medicare Tax. Net Investment Income Tax. Although it is not a payroll tax, HR professionals also should be aware of the net investment income tax (NIIT) that high earners must pay when they file their income tax returns.

When is Medicare tax withheld?

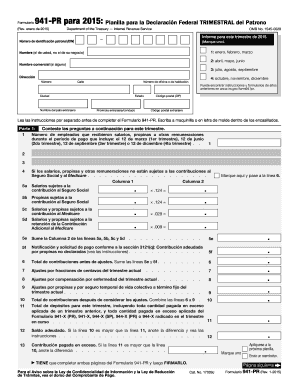

Beginning January 1, 2013, employers are responsible for withholding the 0.9% Additional Medicare Tax on an employee's wages and compensation that exceeds a threshold amount based on the employee's filing status. You are required to begin withholding Additional Medicare Tax in the pay period in which it pays wages and compensation in excess of the threshold amount to an employee. There is no employer match for the Additional Medicare Tax.

What is the wage base limit for Social Security?

See requirements for depositing. The social security wage base limit is $137,700 for 2020 and $142,800 for 2021. The employee tax rate for social security is 6.2% for both years.

What is self employment tax?

Self-Employment Tax. Self-Employment Tax (SE tax) is a social security and Medicare tax primarily for individuals who work for themselves. It is similar to the social security and Medicare taxes withheld from the pay of most employees.

Do you pay federal unemployment tax?

You pay FUTA tax only from your own funds. Employees do not pay this tax or have it withheld from their pay.

Must You Pay Social Security and Medicare Tax?

Nonresident aliens who are F-1, J-1, M-1 or Q-1 visa holders are not subject to social security and Medicare taxes (FICA) on services are performed to carry out the purpose for which they are admitted to the United States [IRC sec. 3121 (b) (19)].

How to Obtain a Refund

If FICA has been withheld from your wages by mistake (look in box 4 of your W-2), you should first ask the employer who withheld the tax for a refund. If the employer does not grant a refund, a refund can be claimed from the IRS on IRS Form 843. Follow the instructions for claiming a refund in Chapter 8 of IRS Publication 519.

Totalization Agreements

If you are in the United States only temporarily for work or study and are not exempt from social security under one of the above provisions, your US social security contributions may provide benefits in your home country under a “totalization agreement” that the US has negotiated with several other countries.

When did Medicare withholding change?

Note: The Patient Protection and Affordable Care Act signed into law March 23, 2010, created the “additional Medicare Tax” that changed Medicare withholding computations effective January 1, 2013. All wages, self-employment income, and other compensation that are subject to regular Medicare Tax and are paid in excess of ...

What is the maximum Social Security tax for 2016?

The Social Security Tax Rate remains at 6.2 percent. The resulting maximum Social Security Tax for 2016 is $7,347.00. There is no limit on the amount of earnings subject to Medicare (Hospital Insurance) Tax.

What is the FICA tax rate for 2016?

The FICA Tax Rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2016 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

Is Medicare taxed on self employment?

All wages, self-employment income, and other compensation that are subject to regular Medicare Tax and are paid in excess of the applicable threshold are subject to the additional Medicare Tax.

Motley Fool Returns

Understanding how these taxes work helps you budget for how much you’ll have withheld for all types of taxes. If you have multiple jobs, you can claim the Social Security over payment on Form 1040. If you owe any taxes, the IRS will use part of your refund to pay them off.

Things to Consider About Retirement

If you’re in college, for example, you’re exempt from paying FICA taxes on the wages you earn from an on-campus job. Exemptions apply to some nonresident aliens as well, including foreign government employees and teachers.

What OASDI Tax Is and Why You Should Care

However, if you do take advantage of the exemption, you will be ineligible to receive any of the benefits offered by Social Security. If you’ve ever looked at the details on your paycheck stub, you’ve probably run into the alphabet soup of deductions and withholdings that reduce the amount of money you get to take home on payday.

Social Security and Medicare (FICA) Tax Deductions

Certain religious groups (like the Amish) may apply for an exemption from FICA taxes by filing IRS Form 4029. But by not paying these payroll taxes, you waive your right to take advantage of Medicare and Social Security benefits.