751 Social Security and Medicare Withholding Rates

- Social Security and Medicare Withholding Rates. The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total.

- Additional Medicare Tax Withholding Rate. Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status.

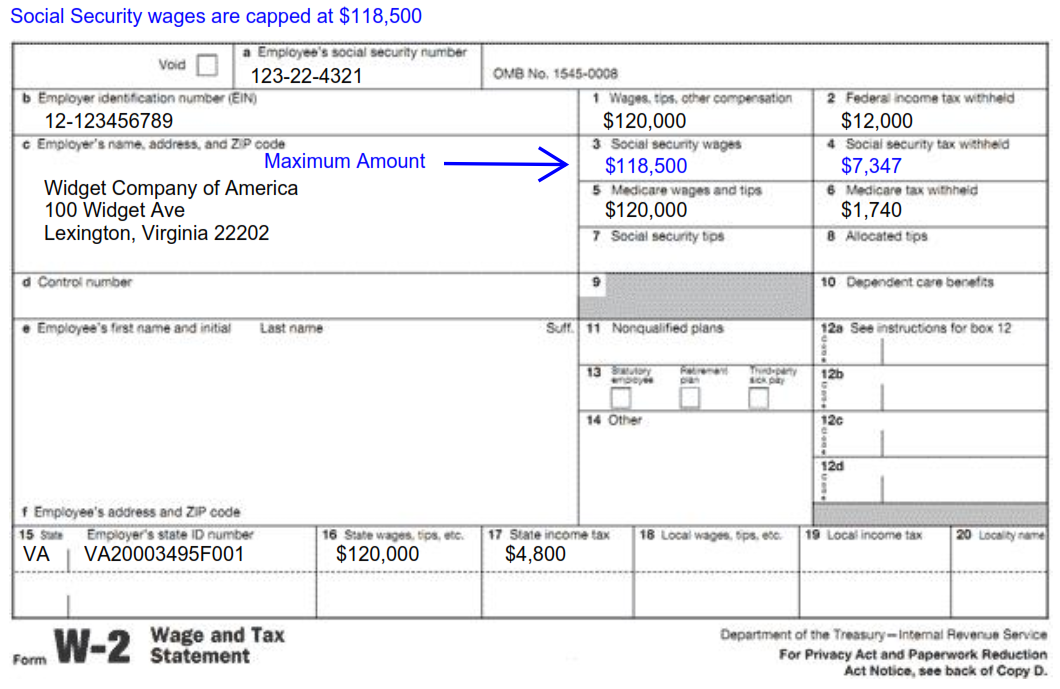

- Wage Base Limits. ...

What is the Social Security tax rate and Medicare tax rate?

I have a question about the Social Security tax rate and the Medicare tax rate? What is the percentage withheld for each? The employee tax rate for Social Security is 6.2% — and the employer tax rate for Social Security is also 6.2%.

Can I deduct Social Security and Medicare taxes?

Social Security and Medicare taxes of most wage earners are figured by their employers. Also you can deduct the employer-equivalent portion of your SE tax in figuring your adjusted gross income. Wage earners cannot deduct Social Security and Medicare taxes.

What is the FICA tax on social security and Medicare?

The Social Security and Medicare taxes that are withheld from your paychecks are collectively referred to as the Federal Insurance Contributions Act tax, or "FICA tax." You pay half of these taxes, and your employer pays half: 7.65% of your salary or wages each for a total of 15.3%. 1

What is Social Security tax and how does it work?

Social Security tax, like Medicare tax, is designed to help support the millions of retired Americans. This tax pays for federal disability and retirement benefits. Both employers and employees must pay Social Security Tax.

Who pays SS and Medicare taxes?

Employees, employers, and self-employed persons pay social security and Medicare taxes. When referring to employees, these taxes are commonly called FICA taxes (Federal Insurance Contributions Act).

What is the SS tax?

Social Security taxes fund the retirement, disability, and survivorship benefits that millions of Americans receive each year from the Social Security Administration. In 2021, the Social Security tax rate is 12.4%, divided evenly between employers and employees, on a maximum wage base of $142,800.

Is SS and Medicare included in federal tax?

FICA is not included in federal income taxes. While both these taxes use the gross wages of the employee as the starting point, they are two separate components that are calculated independently. The Medicare and Social Security taxes rarely affect your federal income tax or refunds.

Why is Medicare taken out of my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee's paycheck or paid as a self-employment tax. 1.

How much Medicare tax do I pay?

1.45%Medicare tax: 1.45%. Sometimes referred to as the “hospital insurance tax,” this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000.

Does everyone pay Medicare tax?

Who pays the Medicare tax? Generally, all employees who work in the U.S. must pay the Medicare tax, regardless of the citizenship or residency status of the employee or employer.

Can I opt out of Medicare tax?

The problem is that you can't opt out of Medicare Part A and continue to receive Social Security retirement benefits. In fact, if you are already receiving Social Security retirement benefits, you'll have to pay back all the benefits you've received so far in order to opt out of Medicare Part A coverage.

Who is exempt from Medicare tax?

The Code grants an exemption from Social Security and Medicare taxes to nonimmigrant scholars, teachers, researchers, and trainees (including medical interns), physicians, au pairs, summer camp workers, and other non-students temporarily present in the United States in J-1, Q-1 or Q-2 status.

Do I get Medicare tax back?

You are entitled to a refund of the excess amount if you overpay your FICA taxes. You might overpay if: You aren't subject to these taxes, but they were withheld from your pay.

Does everyone pay Social Security tax?

Some of your earnings might be exempt from this tax The Social Security tax, also known as Old Age, Survivors, and Disability Insurance (OASDI), applies to all income earned from labor. Paying it is pretty much unavoidable if you work. All employees and self-employed taxpayers pay the Social Security tax.

Why do I pay so much in taxes and get so little back?

Answer: The most likely reason for the smaller refund, despite the higher salary is that you are now in a higher tax bracket. And you likely didn't adjust your withholdings for the applicable tax year.