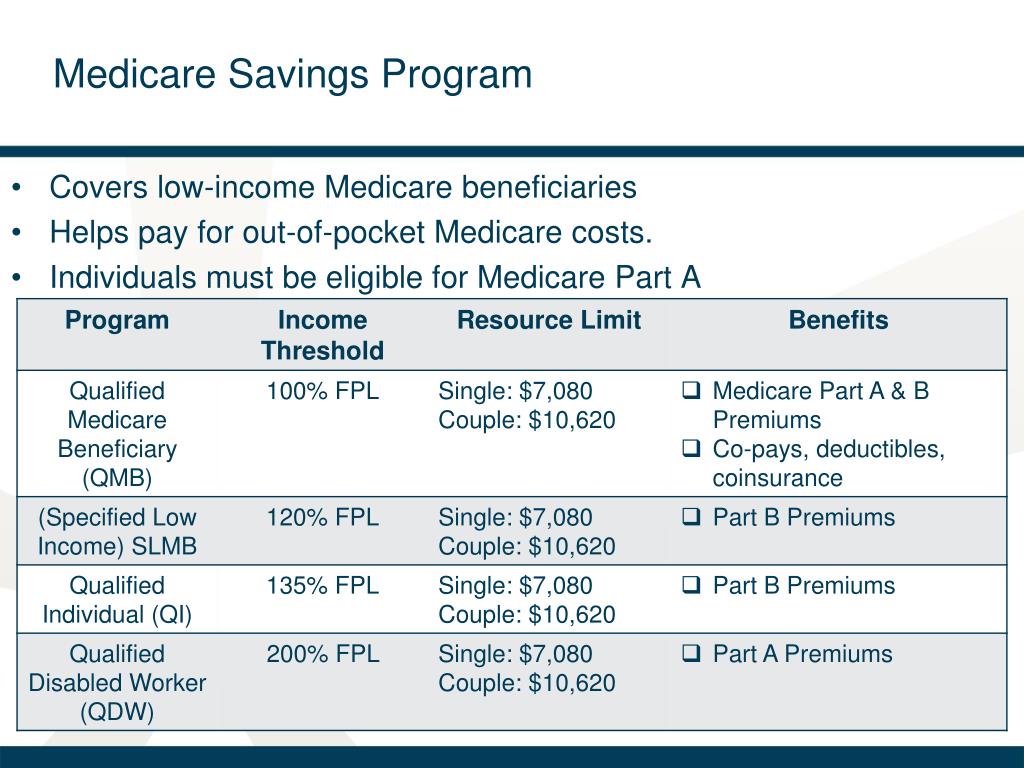

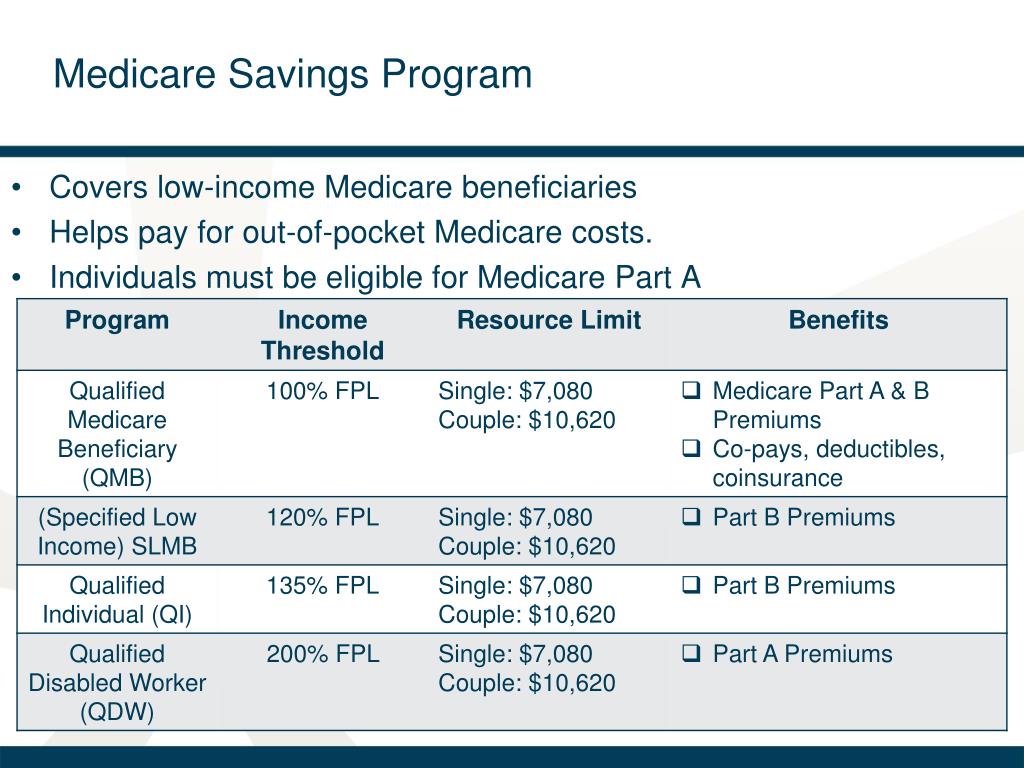

- Medicare Savings Program (MSP) is a Medicaid-administered program that can assist people with limited income in paying for their Medicare premiums.

- Qualified Medicare Beneficiary. ...

- Specified Low-income Medicare Beneficiary (SLMB): Pays the Medicare Part B premium.

- Qualifying Individual (QI) Program: Pays the Medicare Part B premium. ...

What state has best Medicaid program?

This site contains information for:

- Individuals - People looking to apply for benefits, learn more about Medicaid programs, or find help

- Providers - Health care providers who are enrolled with Medicaid or would like to enroll and need more information about billing, Medicaid programs, and help resources

- Reports - People looking for reports about Medicaid programs

What are the four Medicare savings programs?

- Most MSPs pay Medicare Part B premiums and some help with additional Part A and B costs

- MSPs don’t cover costs from Medicare Part C plans (Medicare Advantage)

- Medicare beneficiaries who qualify for an MSP also receive Medicare Extra Help to help pay for prescription drugs

What is the income limit for Medicare savings program?

You may qualify for the QMB program if your monthly income is less than $1,084 and your total assets are less than $7,860. The maximum is less than $1,457 per month for married couples and less than $11,800 total. A QMB plan does not require you to pay any premiums, deductibles, copayments, or coinsurance.

Is there currently a Medicare savings plan?

There are four types of Medicare Savings Programs. Three of them are available only if you have Medicare and are at least 65 years old: The Qualified Medicare Beneficiary (QMB) Program helps pay for Medicare Part A premiums and Medicare Part B premiums, deductibles, coinsurance, and copays.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Is QMB the same as Medicare?

What Is The QMB Program? The QMB Program is a Medicare Savings Program (MSP) for people who have Medicare, but need help affording certain Medicare costs. QMB typically covers Medicare Part A and Part B premiums as well as deductibles, coinsurance, and copayments.

What is the income limit for MSP?

Medicare Savings Program (MSP)Income Requirements for MSP ProgramsFamily SizeQMB 100% FPLQI-1 135% FPL1$1,133$1,5302$1,526$2,0613$1,920$2,5928 more rows

What is the difference between the Medicare and Medicaid programs?

The difference between Medicaid and Medicare is that Medicaid is managed by states and is based on income. Medicare is managed by the federal government and is mainly based on age. But there are special circumstances, like certain disabilities, that may allow younger people to get Medicare.

What does QMB mean on Medicare?

Qualified Medicare BeneficiarySPOTLIGHT & RELEASES. The Qualified Medicare Beneficiary (QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries.

Can you have Medicare and Medicaid?

Medicare-Medicaid Plans Medicare is working with some states and health plans to offer demonstration plans for certain people who have both Medicare and Medicaid and make it easier for them to get the services they need. They're called Medicare-Medicaid Plans.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What is the income limit for extra help in 2021?

To qualify for Extra Help, your annual income must be limited to $20,385 for an individual or $27,465 for a married couple living together.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

What is the highest income to qualify for Medicaid?

Federal Poverty Level thresholds to qualify for Medicaid The Federal Poverty Level is determined by the size of a family for the lower 48 states and the District of Columbia. For example, in 2022 it is $13,590 for a single adult person, $27,750 for a family of four and $46,630 for a family of eight.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

How do I qualify for dual Medicare and Medicaid?

Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. To be considered dually eligible, persons must be enrolled in Medicare Part A (hospital insurance), and / or Medicare Part B (medical insurance).

What is Medicare Savings Program?

A Medicare Savings Program (MSP) is designed to cover all or part of Medicare out-of-pocket expenses that encumber Medicare recipients who live within limited financial means.

What is a Medicare summary notice?

You will also receive a Medicare Summary Notice (MSN), which is proof of being in the program and shows the healthcare provider you should not be billed for services, deductibles, coinsurance or copayments. An exception is outpatient prescriptions.

Is Medicare cost prohibitive?

The cost of Medicare benefits in the form of premiums, coinsurance, copayments and deductibles can raise concerns about affordability, especially when you are on a limited income. For Medicare recipients under a certain income and asset level, Medicare benefits can be cost prohibitive.

What is the MSP program?

Medicare Savings Program (MSP) The Medicare Savings Program (MSP) is a Medicaid-administered program that can assist people with limited income in paying for their Medicare premiums. Depending on your income, the MSP may also pay for other cost-sharing expenses.

What is a QMB on Social Security?

If qualified, you will no longer have this premium amount deducted from your Social Security benefit. Qualified Medicare Beneficiary ( QMB): Pays for Medicare Part A premium for people who do not have enough work history to get premium free Part A. QMB also pays the Part B premium, deductibles and coinsurances.

On this page

The Medicare Savings Program (MSP) can provide assistance with premium costs, copayments, deductibles, and coinsurance for individuals who are entitled to Medicare and meet program requirements.

Information about how to qualify

To find out if you qualify for a Medicare Savings Program (MSP), view the income chart in this brochure.

What is Medicare Savings Program?

A Medicare Savings Program (MSP) can help pay deductibles, coinsurance, and other expenses that aren’t ordinarily covered by Medicare. We’re here to help you understand the different types of MSPs. Below, we explain who is eligible for these programs and how to get the assistance you need to pay for your Medicare.

How many types of MSPs are there?

There are four kinds of MSPs. Each type of MSP is tailored to different needs and circumstances. Qualified Medicare Beneficiary (QMB) Programs pay most of your out-of-pocket costs. These costs include deductibles, copays, coinsurance, and Part B premiums. A QMB will also pay the premium for Part A if you haven’t worked 40 quarters.

Does Medicare savers have a penalty?

Also, those that qualify for a Medicare Savings Program may not be subject to a Part D or Part B penalty. Although, this depends on your level of extra help and the state you reside in. Call the number above today to get rate quotes for your area.

What is the Medicare Savings Program (MSP)?

MSP helps Medicare recipients pay for all or part of their Medicare premiums.

Who is eligible for the Medicare Savings Program (MSP)?

Medicare recipients who meet income and resources requirements may be eligible for MSP. For additional information, see Apple Health eligibility manual - WAC 182-517-0100 Federal Medicare savings programs.

What are the Medicare Savings Program (MSP) Federal Poverty Levels (FPLs)?

In order to be income eligible for MSP coverage, an individual's MSP household must have net income that is less than or equal to the following FPL percentages.

How does ACES determine eligibility for the Medicare Savings Program (MSP)?

ACES performs the existing SSI-Related income calculation to determine if a client meets MSP eligibility requirements. If the client isn't eligible for MSP using the SSI-Related calculation, a second calculation is performed (if appropriate) to include additional household members. This is called Alternate Methodology calculation.

How does the system determine household size requirements when using the Alternate Methodology calculation?

When the Alternate Methodology calculation is performed to include additional household members, the Medicare Savings Program (MSP) Assistance Unit (AU) must contain at least one dependent child who meets all of the following criteria:

How does the system display what Medicare Savings Program (MSP) income method was used to determine eligibility?

All MSP AUs have a system generated Income Qualification code, which is based on the rules to determine MSP eligibility.

Medicare Savings Program Florida Eligibility

Your eligibility for each program will depend on your income and available resources. Here are the resources that count toward your limits.

QMB Program in Florida

This is a program that pays health premiums for people with limited income resources. It covers Part A and B premiums, out-of-pocket deductible expenses, co-insurance, and co-payment.

SLMB Medicaid in Florida

SLMB is a government-funded program that helps low-income citizens pay for Part B premiums.

QI (Qualified Individual Program)

This program helps state residents reduce payments for Part B premiums. When Clients apply for QI benefits, they receive them on a first-come-first-service basis. Those who received benefits in the previous year also come first.

QDWI (Qualified Disabled and Working Individuals)

It helps the working class living with disabilities and under 65 years old to pay their Part A premiums.

Florida Extra Help Program (Low Income Subsidy)

This program is a federally-funded program that reduces the cost of out-of-pocket prescription drugs. It is also known as a low-income subsidiary LIS. Extra help has two categories, full extra help, and partial help. Full extra help covers Individuals with monthly incomes equal to or less than $1,469 for singles and $1,980 for couples.