Medicare supplement plans comparison

| Standard Plan F | High-deductible Plan F | Standard Plan G | High-deductible Plan G | |

| Part B deductible | Yes | Yes | No | No |

| Part B excess charge | Yes | Yes | Yes | Yes |

| Foreign travel exchange (up to plan limi ... | 80% | 80% | 80% | 80% |

| Deductible | N/A | $2,340 | N/A | $2,340 |

How much is plan F Medicare?

In terms of popularity, Plan F is the most popular, with approximately 55 percent of all Medigap plans currently active being Plan F. Plan C is in second place but there is a huge gap as Plan C only accounts for about 9 percent of all Medigap plans.

Who is eligible for Medicare Plan F?

People who became eligible for Medicare before 2020: You can still enroll in Plan F, even if you've never had this particular plan before. John is 73, and he has end-stage renal disease (ESRD). He’s choosing Plan F because he needs regular kidney dialysis, as well as physical therapy for an old shoulder injury.

How much does a Medicare supplement insurance plan cost?

Medicare Supplement Insurance Cost Factors

- Plan Coverage. One big factor in the cost of a Medicare Supplement Insurance plan is the level of coverage provided.

- Carrier. Medicare Supplement Insurance is sold by private insurance companies that set their own plan prices.

- Location. ...

- Enrollment Time. ...

- Pricing Structure. ...

- Discounts. ...

- Gender. ...

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

What is the advantage of Medicare Plan F?

Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.

Who qualifies for Medicare Plan F?

Who Can Enroll in Plan F? Any Medicare beneficiary who was Medicare-eligible prior to January 1, 2020, can enroll in Plan F. If you are within the first six months of having enrolled in Medicare Part B, you are able to enroll in Plan F under the guarantee issue period.

What is the average cost of Medicare Plan F?

How much does it cost for Medigap Plan F? The average premium for Medicare Supplement Insurance Plan F in 2022 is $172.75 per month, or $2,073 per year.

Does Medicare Plan F cover deductible?

Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Is Medicare Part G better than Part F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

Is Medicare Plan F being discontinued?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.

What is the difference between plan C and plan F?

Plan F covers everything Plan C does, and also covers Medicare Part B excess charges. These two plans are some of the most comprehensive Medicare Supplement Insurance plans you can purchase, which makes them a very attractive option.

Does Medicare Plan F cover vision?

Plan F is one of the most comprehensive Medicare supplement plans you can purchase, but it doesn't cover everything. This plan will not cover the following: Things that Medicare doesn't normally cover, like acupuncture, vision exams and dental work, are not included in Plan F coverage.

Is there a Medicare plan that covers everything?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

What does Medigap plan F pay For?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but unless you were eligible for Medicare by Dec.

What is the difference between Plan F and Plan F high deductible?

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium. As a reminder, your...

Does Plan F cover dental?

Original Medicare doesn’t cover routine dental care, like cleanings or extractions, and there are no supplement plans that fill the gap. If you wan...

Is there an alternative to Plan F?

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers,...

How many Medicare Supplement Plans are there?

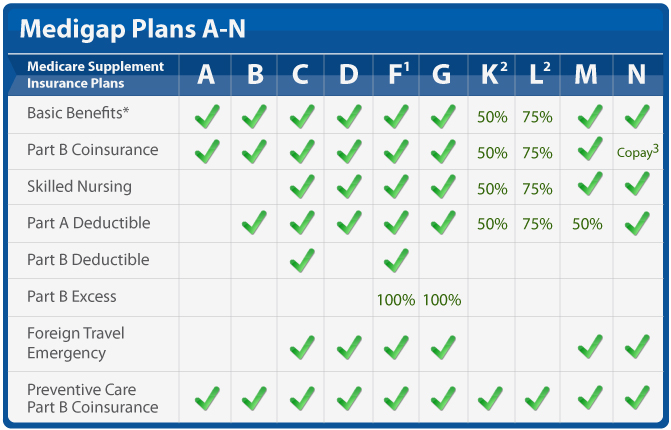

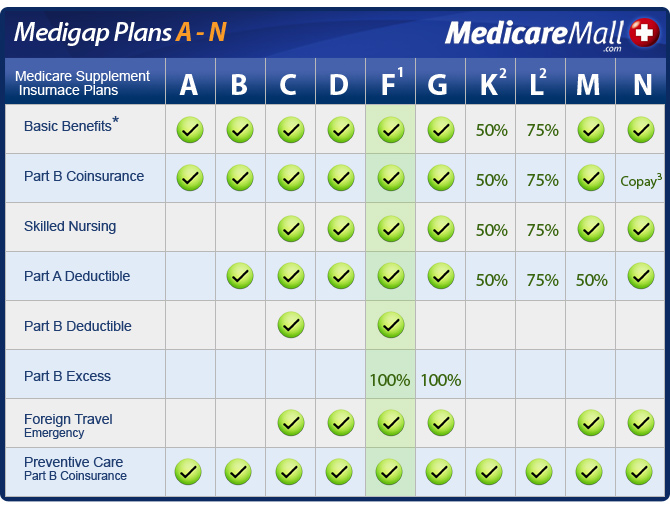

There are 10 different Medicare supplement plans. You’ll see them designated as letters: A through D, F, G, and K through N. Each of these different plans is standardized, meaning the same set of basic benefits needs to be offered.

What is a plan F?

Plan F is a very comprehensive plan, helping cover expenses that original Medicare doesn’t. This includes your deductibles, coinsurance, and copays when receiving medical care. It even covers a portion of your medical expenses during foreign travel.

What is the deductible for Plan F?

High-deductible plan F. Plan F also has a high deductible option. While monthly premiums for this option may be lower, you must pay a deductible before Plan F begins paying for benefits. For 2021, this deductible is set at $2,370.

What are the disadvantages of Medigap Plan F?

Disadvantages of Medigap Plan F. On the downside of this plan option, its large amount of coverage can be costly and have high monthly premiums. Also, if you’re newly eligible for Medicare as of January 1, 2020, or later, you will not be eligible to buy this plan, as it is being phased out for new enrollees.

Does Medicare Supplement cover healthcare?

Medicare supplement insurance can help pay for healthcare costs that original Medicare doesn’t cover. About 25 percent. Trusted Source. of people who have original Medicare are also enrolled in a Medicare supplement plan. Private companies sell Medicare supplement plans. There are 10 different Medicare supplement plans.

Is Medicare Supplement Plan F a part of Medicare?

You may have also heard of something called Medicare Supplement Plan F. Medicare Plan F isn’t a “part” of Medicare. It’s actually one of several Medicare supplement insurance ( Medigap) plans.

Is Medigap part of Medicare?

It’s actually one of several Medicare supplement insurance ( Medigap) plans. Medigap comprises several plans you can buy to help pay for things that original Medicare (parts A and B ) doesn’t. Keep reading to find out more about plan F, what it includes, and if it may be a good fit for you.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

What is Medicare Supplement Plan F?

In addition, Plan F provides coverage for skilled nursing facility care, Medicare Part A and B deductibles, and international travel medical emergency help.

How much is the deductible for Plan F?

International travel medical emergency help. Plan F also has a high-deductible option. If you choose this option, you have to pay a deductible of [$2,240] for [2018] before the plan pays anything. This amount can go up each year.

What is Medicare Part B excess?

Medicare Part B excess charges (this is the difference between what a doctor or provider charges and the amount Medicare will pay up to Medicare's limiting amount) Skilled nursing facility care. Medicare Part A deductible for hospitalization. Medicare Part B deductible for medical and hospital outpatient expenses.

Does Medicare Supplement cover 100% of Part B?

One of only two Medicare Supplement plans that cover 100% of Medicare Part B excess charges . This plan may help protect you from additional out-of-pocket expenses if you need treatment that exceeds what Medicare will approve.

Is Medicare Supplement insurance endorsed by the government?

Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Coverage may be limited to Medicare-eligible expenses. Benefits vary by insurance plan and the premium will vary with the amount of benefits selected.

Does Medicare Supplement Plan F cover out-of-pocket expenses?

Because the plan also covers costs in excess of Medicare-approved amounts, you may have no out-of-pocket costs for hospital and doctor's office care with this plan. Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. ...

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Why is Medicare Plan F so popular?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover.

What is the most comprehensive Medicare plan?

If you became eligible for Medicare on or after January 1, 2020, you’ll find that Plan G is the most comprehensive Medigap plan available to you. (In recent years, Plan G has been the second most popular Medicare Supplement plan, and you can read more on that below.) A Medigap plan, or Medicare Supplement, pays after Medicare to help cover your ...

What is the best Medigap plan for 2021?

The best Medigap plans in 2021 are still Plan F and Plan G. While Plan F has long been the most popular, Plan G is gaining steam since Plan F is no longer available to new enrollees. Get a quote for both and see which ones offer you the best annual savings.

What happens if you don't have a Supplement?

You would also pay 20% of expensive procedures like surgery because Part B only pays 80%.

Is Medicare Supplement Plan F the #1 seller?

This post has been updated for 2021. Medicare Supplement Plan F has also been the #1 seller with Baby Boomers for many years. According to a report from America’s Health Insurance professionals in 2016, about 57% of all Medigap policies in force were a premium Medicare Plan F policy.

Does Medicare Plan F cover outpatient deductible?

Plan F fully covers both your Part A hospital deductible and your Part B outpatient deductible. It covers all of the 20% that Medicare Part B normally leaves for you to pay. Medicare Plan F covers all Part B excess charges. You will never pay the standard 15% excess charges that doctors under Medicare are allowed to charge for Part B services.

What Is Medicare Supplement Insurance?

Medicare supplement plans are private health insurance plans that supplement Original Medicare.

What Is Medicare Supplement Plan F?

First, the bad news, Plan F has been phased out for new enrollees as of 2020. This is due to new legislation that no longer allows Medicare Supplement Insurance plans to cover your Part B deductible ($203 in 2021).

Frequently Asked Questions

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance (including Part B deductibles), which means you pay nothing out of pocket throughout the year.

Conclusion

We hope you found this overview helpful! If you have a question we did not cover, however, don’t hesitate to leave a comment or send us an email at [email protected]. We’ll be sure to get back to you within 24 hours.

What is Medicare Supplement Insurance Plan?

What Is a Medicare Supplement Insurance Plan? A Medicare Supplement Insurance plan (also called Medigap) can help cover some of the out-of-pocket costs that Original Medicare doesn't, such as copays and deductibles. Each type of plan offers a different combination of basic health insurance benefits. Use the following guide to compare Medicare ...

Which is the most popular Medicare Supplement?

Medigap Plan F Is the Most Popular. Medicare Supplement Insurance Plan F is the most popular Medigap plan, largely because it offers the most comprehensive range of basic benefits. Plan F is the only Medigap plan that covers all nine of the basic Medigap benefits, including the Medicare Part B deductible and Part B excess charges.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When is the best time to buy Medicare Supplement?

The best time to buy a Medicare Supplement Insurance plan is during your Medigap open enrollment period. During your open enrollment period, insurance companies cannot consider any pre-existing conditions when deciding whether or not to offer you a policy. They also cannot charge you more for a Medigap plan based on pre-existing conditions.

Does Medicare Supplement Insurance require coinsurance?

Medicare Supplement Insurance Plans. Medicare Part A and Part B both require deductibles and coinsurance or copays. Medigap plans help beneficiaries fill in these cost "gaps" that can add up to potentially large dollar amounts. The chart below lists the basic benefits offered by each type of Medigap plan. Click here to view enlarged chart.