Supplemental insurance is extra or additional insurance that you can purchase to help you pay for services and out-of-pocket expenses that your regular insurance does not cover. Some supplemental insurance plans will pay for out-of-pocket medical expenses, such as deductibles, copayments, and coinsurance.

Full Answer

What is the best supplemental insurance to have with Medicare?

- You must have Medicare Part A and Part B.

- A Medigap policy is different from a Medicare Advantage Plan. ...

- You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. ...

- A Medigap policy only covers one person. ...

How do I Choose Medicare supplemental insurance?

- Your State Insurance Department – They should have records of complaints against insurance companies. ...

- SHIP (State Health Assistance Program) – The SHIP for your state should have some type of Medigap comparison shopping guide, which may list rates and ratings. ...

- Independent insurance agents

- Ratings web sites – JD Power , NCQA, and U.S. ...

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

Is Medicare supplemental insurance worth buying?

To help answer it for yourself, it would be wise to compare Medicare Supplement plans to the other two options available to you: Doing nothing, and sticking with Original Medicare, and; Medicare Advantage plans; If you can afford the monthly premiums, Medicare Supplement plans may very well be worth the price. This is because it can limit, or eliminate, your out-of-pocket medical costs.

What is the purpose of Medicare supplemental insurance?

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

What is the difference between Medicare and a supplemental plan?

When you buy a Medicare Supplement insurance plan, you are still enrolled in Original Medicare, Part A and Part B. Medicare pays for your health-care bills primarily, while the Medigap plan simply covers certain cost-sharing expenses required by Medicare, such as copayments or deductibles.

What is the difference between Medicare Advantage and supplemental?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Can I switch from Medicare Advantage to Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What is Medicare Supplement Insurance?

Key Takeaways. Medicare Supplement Insurance, or Medigap, is a type of health insurance policy sold by private insurance companies to complement Medicare policies. It covers common gaps in Medicare’s standard insurance plans. Insured individuals pay monthly premiums for Medigap policies directly to the insurance provider.

What is Medicare Part C?

Medicare Part C is also known as a Medicare Advantage plan. As with Medigap plans, Medicare Advantage (MA) plans come from private providers. These plans include and replace Medicare Parts A, B, and usually Part D coverage, but not hospice care. 5 6 Medicare Advantage plans generally include:

How much will Medicare premiums be in 2021?

Monthly premiums are updated annually and range from $259 to $471 in 2021, depending on an individual's quarterly coverage eligibility. 8 Medigap plans will assist with covering these out-of-pocket expenses. Even though premiums may be free for most Medicare enrollees, they must cover certain out-of-pocket expenses.

How long is the Medigap open enrollment period?

The Medigap Open Enrollment Period (OEP) is six months from the first day of an individual's 65th birthday month. These plans may also have open enrollment for six months after signing up for Part B coverage. 3 . Insured individuals pay monthly premiums for private Medigap policies directly to the insurance provider.

Does Medicare Supplement cover gaps?

Medicare Supplement Insurance covers common gaps in Medicare’s standard insurance plans. People who apply for Medigap coverage must take part in Medicare Parts A and B. Medigap plans supplement, but do not replace, primary Medicare coverage. 1 There are 10 Medigap plans, from Plan A to Plan N. 2 .

Does Medigap pay monthly premiums?

Insured individuals pay monthly premiums for Medigap policies directly to the insurance provider . Medigap coverage is different from Medicare Part C, which is also known as a Medicare Advantage plan.

Does Medigap pay directly to the hospital?

The private insurer then remits the difference directly to the healthcare provider. Some plans submit payments to hospitals based upon the Medicare Part A claim information, but this is less common.

What is Medicare Supplement Insurance Plan?

What Is a Medicare Supplement Insurance Plan? A Medicare Supplement Insurance plan (also called Medigap) can help cover some of the out-of-pocket costs that Original Medicare doesn't, such as copays and deductibles. Each type of plan offers a different combination of basic health insurance benefits. Use the following guide to compare Medicare ...

Which is the most popular Medicare Supplement?

Medigap Plan F Is the Most Popular. Medicare Supplement Insurance Plan F is the most popular Medigap plan, largely because it offers the most comprehensive range of basic benefits. Plan F is the only Medigap plan that covers all nine of the basic Medigap benefits, including the Medicare Part B deductible and Part B excess charges.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When is the best time to buy Medicare Supplement?

The best time to buy a Medicare Supplement Insurance plan is during your Medigap open enrollment period. During your open enrollment period, insurance companies cannot consider any pre-existing conditions when deciding whether or not to offer you a policy. They also cannot charge you more for a Medigap plan based on pre-existing conditions.

Does Medicare Supplement Insurance require coinsurance?

Medicare Supplement Insurance Plans. Medicare Part A and Part B both require deductibles and coinsurance or copays. Medigap plans help beneficiaries fill in these cost "gaps" that can add up to potentially large dollar amounts. The chart below lists the basic benefits offered by each type of Medigap plan. Click here to view enlarged chart.

What is Medicare Supplement Insurance?

Medicare Supplement insurance is meant to limit unpleasant surprises from healthcare costs. Your health at age 65 may be no indicator of what’s to come just a few years later. You could get sick and face medical bills that devastate years of planning and preparation. Combine this with the fixed income that so many seniors find themselves on, ...

How much does Medicare Supplement cover?

Choosing Medicare Supplement insurance can help. It can cover up to 100% of out-of-pocket costs, depending on the plan. One out of every three Original Medicare beneficiaries — over 13 million seniors — have chosen to do so. 1.

How long is the open enrollment period for Medicare?

The Medigap Open Enrollment Period covers six months. It starts the month you are 65 or older and are enrolled in Medicare Part B. In this period, no insurer offering supplemental insurance in your state can deny you coverage or raise the premium because of medical conditions.

How many separate insurance plans are there?

Premiums for the same policy can vary between insurance companies. But, only the quoted price and the reputation of the insurer will vary. There are ten separate plans, labeled A through N. Two plans, C and F, are no longer offered to newly eligible beneficiaries.

What is Part B deductible?

After that, you pay daily coinsurance amounts, depending on the length of your stay. Part B also has an annual deductible. Once you reach it, Part B covers 80% of eligible doctor-related, testing and medical-equipment expenses. You are responsible for the balance (or coinsurance).

Does Medicare Supplement cover all costs?

Original Medicare does not cover all costs. Medicare Supplement insurance, or Medigap, can cover what Medicare does not. Private insurance companies – vetted by the federal government – offer it to help manage out-of-pocket expenses. These policies do not add coverage.

Can you renew a Medigap policy?

You can renew your Medigap policy as long as you pay the premium. The insurer cannot use your health problems to cancel your policy or raise your premium.

Who regulates Medicare Supplement Insurance?

Medicare Supplement Insurance plans are tightly regulated by the Centers for Medicare and Medicaid Services (CMS), a government agency. CMS determines what each letter plan will cover, and it requires each insurance company to offer the plan as is, without modifications.

How long does a Supplement 1 plan cover?

The Supplement 1 plan covers 120 days of mental health hospitalization and the state-mandated benefits, plus the deductibles for Medicare Part A and Part B, co-insurances for services at a skilled nursing facility under Part A, and emergency medical costs when traveling outside of the U.S.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

How much is Medicare Part B deductible?

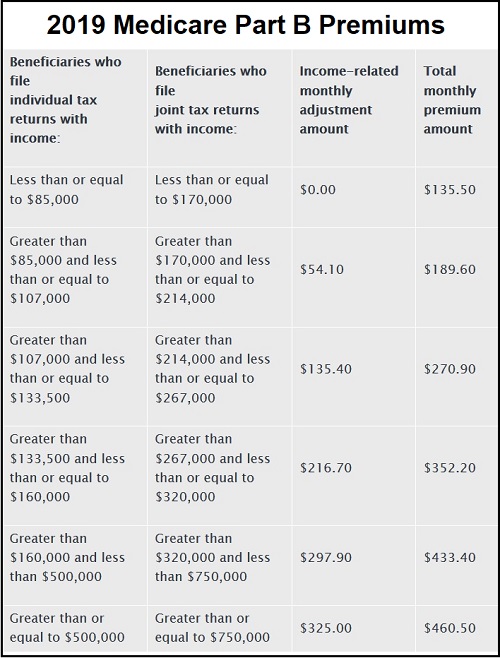

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

What is Medicare Supplement?

Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance. For many people, Medicare Supplement, also known as Medigap, insurance helps them economically by paying some of the out-of-pocket costs associated with Original Medicare.

How many people does Medicare Supplement cover?

Keep in mind that, just like Medicare, Medicare Supplement plans are individual insurance policies. They only cover one person per plan. If you want coverage for your spouse, you must purchase a separate plan.

What percentage of Medicare supplement is paid?

After this is paid, your supplement policy pays your portion of the remaining cost. This is generally 20 percent. Some policies pay your deductibles The deductible is a set amount which you must pay before Medicare begins covering your health care costs.

How long does Medicare cover travel?

Each plan varies in what it covers, but all plans pay for Medicare Part A (hospital insurance) coinsurances for up to 365 days beyond the coverage that Medicare offers. Some of the plans cover a percentage of the cost for emergency health care while traveling abroad.

How old do you have to be to qualify for medicare?

To be eligible for Medicare, you must be at least 65 years old, a citizen of the United States or permanent legal resident for at least five consecutive years. Also, you, or your spouse, must have worked and paid federal taxes for at least ten years (or 40 quarters).

Does Medicare cover long term care?

Most plans do not cover long-term care, vision, dental, hearing care, or private nursing care. All Medicare Supplement insurance coverage comes with a monthly premium which you pay directly to your provider. How much you pay depends on which plan you have.

Does Medicare Supplement pay for coinsurance?

Most supplement plans pay for Medicare copayments, coinsurance, and deductibles. But the coverage may vary according to the plan you choose. Medicare Supplement plans work together with Original Medicare. First, Medicare pays for a percentage, usually 80 percent, of the Medicare-approved cost of your health care service.

What is supplemental insurance?

Supplemental insurance is any policy that you have in addition to your main health insurance coverage.

Cost of supplemental insurance

Supplemental policies are less expensive than regular insurance because they provide supplemental coverage, not comprehensive coverage.

Why should you buy supplemental plans?

Supplemental policies serve a dual purpose of limiting how much you pay for health care while also helping to protect your finances.

Types of supplemental insurance

Below are descriptions of some of the most popular supplemental plans and what to consider when shopping for coverage.

Frequently asked questions

Supplemental insurance is an add-on to your regular insurance that provides an extra level of coverage, helping you to meet out-of-pocket costs and other expenses not covered by your regular insurance.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (also called Medigap) and Medicare Advantage plans (Medicare Part C) are two very different private Medicare options that you may consider. This guide highlights the differences between Medicare Supplement Insurance and Medicare Advantage so you can better understand these two private Medicare coverage options.

How many Medicare Supplement plans will be available in 2021?

Medicare Supplement Insurance. Availability. 3,550 different plans available nationwide in 2021 1. 10 standardized plans available in most states, though all 10 may not be available to you in every state. Eligibility. Available to beneficiaries enrolled in Original Medicare who live in the plan’s service area.

How does a Medigap plan work?

Here are a few examples of how a Medigap plan can work: You schedule a doctor’s appointment with a doctor for services that are covered by Medicare Part B. The doctor accepts Medicare “assignment” — this means she accepts Medicare’s reimbursement rate for all covered services as payment in full.

What are the benefits of Medicare Part A and B?

Can offer additional benefits, such as dental, vision, hearing and prescription drug coverage, among other benefits.

How much is Medicare Part A deductible in 2021?

The Medicare Part A deductible is $1,484 per benefit period in 2021. The Medicare Part A deductible is not annual — you could potentially need to meet this deductible more than once in a given year. Medicare Part B deductible. The Medicare Part B deductible is $203 per year in 2021.

What is Medicare Advantage?

Medicare Advantage plans are a type of private Medicare insurance that offers all of the same benefits as Original Medicare. Most Medicare Advantage also offer benefits that are not covered by Original Medicare. Benefits and plan availability can vary from plan to plan.

What is the average Medicare premium for 2021?

The average monthly premium for a Medicare Advantage plan in 2021 is $33.57. 3. You’ll also still pay your Medicare Part B premium in addition to your Medicare Advantage plan premium. The average monthly premium for a Medicare Supplement Insurance plan in 2019 was $125.93. 4.