How much is Medicare Part B annual deductible?

Nov 10, 2015 · CMS also announced that the annual deductible for all Part B beneficiaries will be $166.00 in 2016. Premiums for Medicare Advantage and Medicare Prescription Drug plans already finalized are unaffected by this announcement. To get more information about state-by-state savings, visit the CMS website at.

What is the current deductible for Medicare Part B?

Nov 11, 2015 · On November 10, 2015, the Centers for Medicare & Medicaid Services (CMS) announced the 2016 Medicare Part B monthly premium and annual deductible amounts of $121.80 and $166, respectively.

Does Medicaid pay the Part B deductible?

Apr 20, 2016 · The Part B annual deductible is $166. People with incomes up to 135 percent of the federal poverty level, ($1,357 in monthly income for an individual and $1823 for a couple) are eligible for help paying their premiums through Medicaid or a Medicare Savings Program. For more information, including asset limits, visit Medicare Interactive.

What is the monthly premium for Medicare Part B?

The Medicare Part B 2016 deductible will be $166, or $17 more than 2015. Medigap Protection Against Deductibles, Co-pays, and Coinsurance Medicare supplement plans go a long way toward helping eliminate Medicare out-of-pocket costs that often go up from one year to the next.

What is the annual Medicare Part B deductible?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What was Medicare Part B premium in 2015?

What was the Medicare Part B premium in 2017?

What is the annual deductible for Medicare Part B for 2018?

How much did Medicare go up in 2016?

| How Much You'll Pay for Medicare Part B in 2016 | ||

|---|---|---|

| Single Filer Income | Joint Filer Income | 2016 Monthly Premium |

| Up to $85,000 | Up to $170,000 | $121.80 or $104.90* |

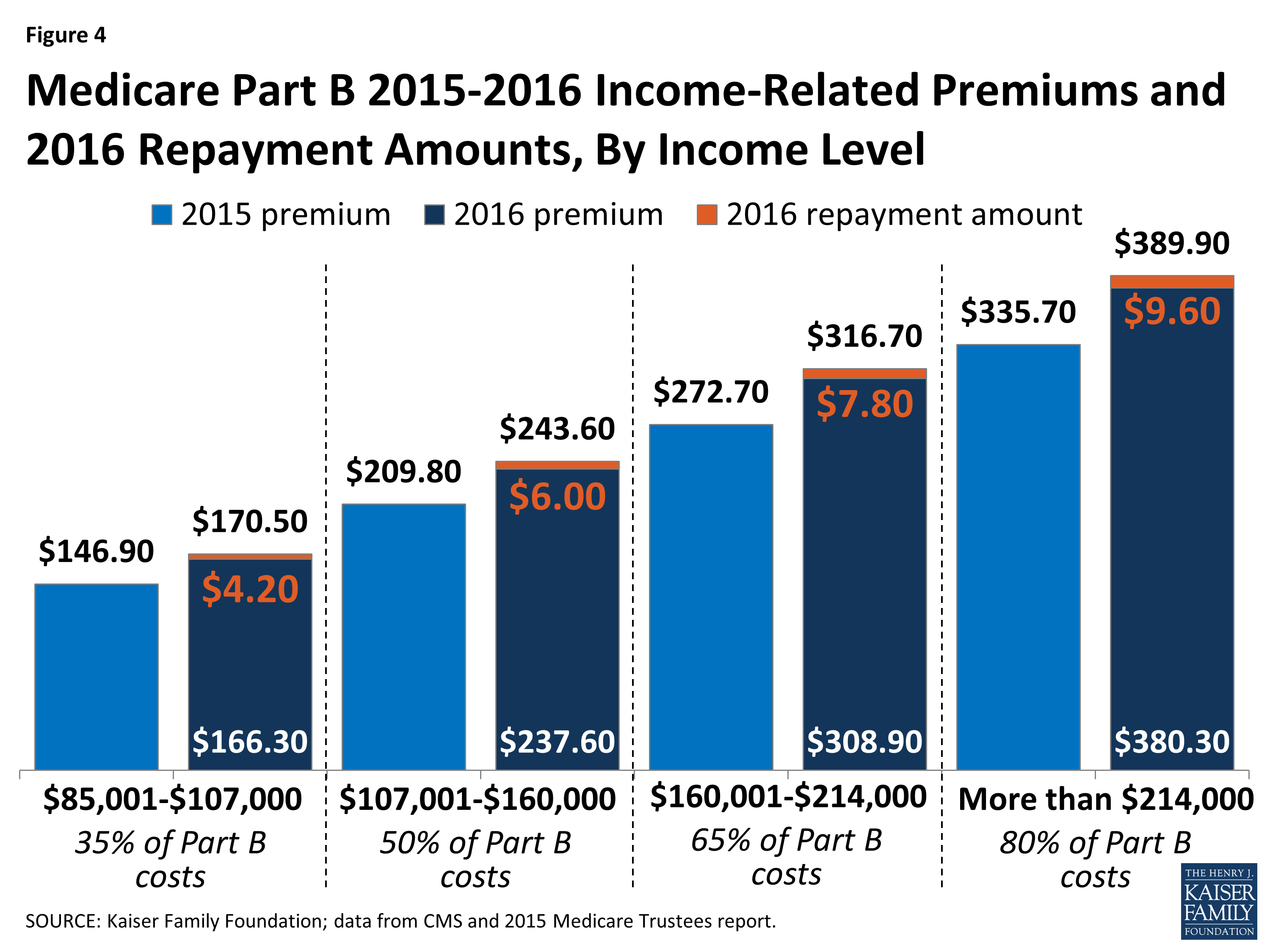

| $85,001 - $107,000 | $170,001 - $214,000 | $170.50 |

| $107,001 - $160,000 | $214,001 - $320,000 | $243.60 |

What was the Medicare deductible in 2014?

What is the Part B deductible for 2019?

The annual deductible for all Medicare Part B beneficiaries is $185 in 2019, an increase of $2 from the annual deductible $183 in 2018.Oct 12, 2018

What is the Medicare Part B deductible for 2020?

What were Medicare premiums in 2018?

How does Medicare Part B reimbursement work?

Will Medicare Part B premium go up in 2022?

What income is used to determine Medicare premiums 2021?

How much was Medicare Part B in 2016?

The Medicare Part B premium in 2016 is technically $121.80 for people whose yearly income is $85,000 or below. But, Social Security benefits did not go up this year. As a result most people who get Social Security benefits will continue to pay the same Part B premium amount as they paid in 2015, typically $105.

What was Medicare Part B premium in 2016?

So, what’s the Medicare premium in 2016? The Medicare Part B premium in 2016 is technically $121.80 for people whose yearly income is $85,000 or below. But, Social Security benefits did not go up this year.

Is Medicare Part B the same as Medicare Part B?

Written by Diane Archer. Until recently, the Medicare Part B premium (medical insurance) was the same for everyone regardless of income, geography or health status, a quarter of the cost of Part B services.

Who wrote Medicare Part B?

by Diane Archer. Bill Smith. Written by Diane Archer . Until recently, the Medicare Part B premium (medical insurance) was the same for everyone regardless of income, geography or health status, a quarter of the cost of Part B services.

What is the Medicare premium for 2016?

The standard 2016 Medicare Part B premium will remain at $104.90 per month , the same rate as in 2015. Higher Part B premium rates for people with higher incomes will also remain at 2015 levels.

When did Medicare Part B and A changes take effect?

The Medicare administration has announced Medicare Part A and Part B rates for 2016, with changes taking effect Jan. 1, 2016.

What is Medicare Supplement Plan F?

An excellent, budget-friendly solution is Medicare Supplement Plan F, which covers all Medicare-approved costs not covered by Medicare Part A and Medicare Part B. With fixed premiums that can easily fit into your budget, Plan F covers all Medicare Part A and Part B deductibles along with “excess charges” you would otherwise have to pay out of pocket. Excess charges are the difference between what Medicare pays and what your medical provider charges—and they can add up fast without the protection Plan F provides! To learn more about how Medicare supplement plans can save you money, request a free Medigap quote from one of our licensed Medicare supplement insurance representatives or call MedicareMall toll-free at (877) 413-1556.

How much did Medicare pay in 2016?

In 2016, you pay: $0 for the first 20 days of each benefit period. $161 per day for days 21-100 of each benefit period. All costs for each day after day 100 of the benefit period. If you don’t qualify for premium-free Medicare Part A, you can enroll in Part A for $226 per month if you’ve worked and paid Social Security taxes for 30 to 39 quarters, ...

Do you get a Medicare bill if you have a Part B?

You get a bill for the Part B premium. If your premium is automatically deducted from your Social Security benefits, you wouldn’t get a bill. You quality for both Medicare and Medicaid benefits, and Medicaid pays for your premiums. This is called being “dual-eligible.”. Your income exceeds a certain dollar amount.

Do you have to pay for Medicare Part A?

Most people don’t have to pay a premium for Medicare Part A. They do, however, have to factor in the following Medicare Part A costs for inpatient hospital stays for each benefit period. Medicare considers a benefit period to start the day that a hospital or skilled nursing facility (SNF) admits you as an inpatient.

How long is a benefit period for Medicare?

Medicare considers a benefit period to start the day that a hospital or skilled nursing facility (SNF) admits you as an inpatient. The end of the benefit period occurs when you haven’t received any inpatient hospital care (or skilled care in an SNF) for 60 consecutive days. Deductible: $1,288.

How many reserve days are Medicare Part A?

Note that every Medicare Part A beneficiary is entitled to 60 “lifetime reserve days” as a hospital inpatient. You begin using these reserve days after you spend 90 days as a hospital inpatient within one benefit period. You will pay all costs for days beyond lifetime reserve days.

Is Medicare dual eligible?

You quality for both Medicare and Medicaid benefits, and Medicaid pays for your premiums. This is called being “dual-eligible.”. Your income exceeds a certain dollar amount. Your premium could be higher than the amount listed above, as there are different premiums for different income levels.

What is Medicare Supplement Plan?

Costs for Medicare Supplement (Medigap) Those who need help paying for such health-care costs as deductibles, premiums, and other Original Medicare expenses may want to purchase a Medicare Supplement plan, also known as Medigap plan.

Medicare Part B Deductible – What It Is

Medicare Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Some people automatically get Medicare Part B (Medical Insurance), and some people need to sign up for Part B

Find Best Medicare Insurance Plan Coverage

There are countless companies looking to sell you Medicare coverage. Only one resource exclusively lets you find local Medicare insurance agents.

What Does Part B Cover?

Medically necessary services: This includes services or supplies that are needed to diagnose or treat your medical condition. And, they meet accepted standards of medical practice.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

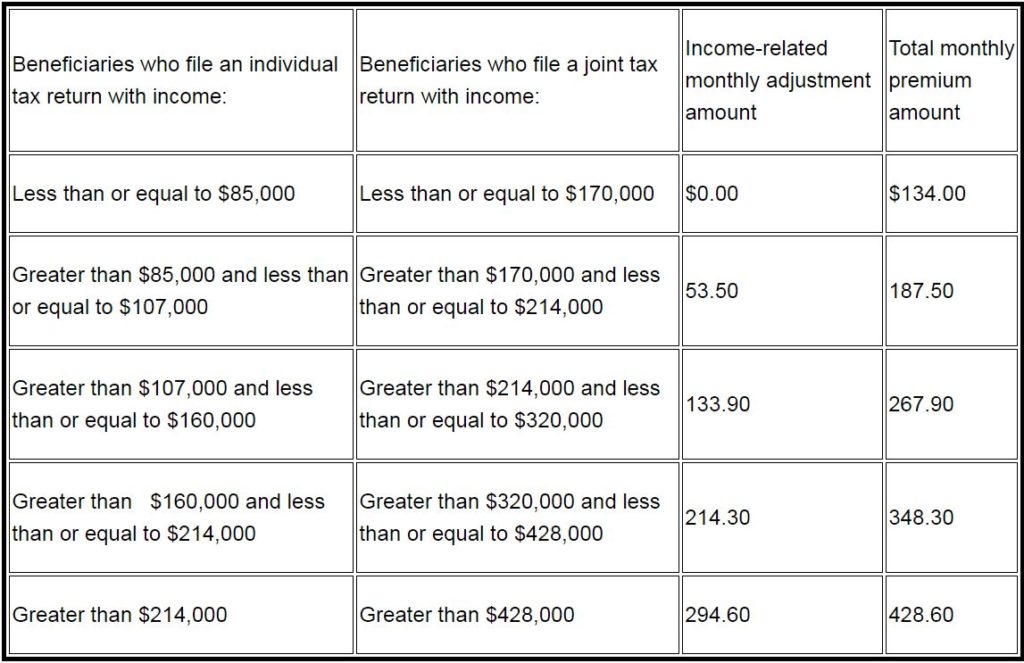

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much will Medicare pay in 2021?

In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much is the Part B premium for 2021?

2021. The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How much does Medicare Part B cover?

After the enrollee pays the deductible, Medicare Part B generally covers 80% of the Medicare-approved amount for covered services, and the enrollee pays the other 20%.

How much is the Part B tax deductible?

The Part B deductible increased again for 2017, to $183, and remained unchanged for 2018. For 2019, it increased slightly, to $185. And for 2020, it increased by another $13, to $198. The $5 increase in 2021 pushed it over $200 for the first time, with the 2021 Part B deductible reaching $203.

Will Medicare Part B increase in 2021?

Q: Did the Medicare Part B deductible increase for 2021? A: Yes. The Part B deductible increased by $5 for 2021, to $203. (Note that the monthly premium for Part B also increased for most enrollees for 2020, to $148.50/month.

How much is Medicare Part B deductible for 2021?

These enrollees have to pay the full Part B deductible if and when they need services that are covered under Medicare Part B. For 2021, that deductible is $203. After the enrollee pays the deductible, Medicare Part B generally covers 80% of the Medicare-approved amount for covered services, and the enrollee pays the other 20%.

What is the Medicare deductible for 2021?

For 2021, that deductible is $203. After the enrollee pays the deductible, Medicare Part B generally covers 80% of the Medicare-approved amount for covered services, and the enrollee pays the other 20%.

Do you have to pay Part B deductible?

Enrollees who have Medicaid or retiree health benefits from an employer generally don’t have to pay the Part B deductible, as the other coverage picks up the tab. Some Medicare Advantage plans have no deductibles and low copays (Medicare Advantage enrollees pay the Part B premium plus the Medicare Advantage premium, ...

Is Part B deductible indexed annually?

Part B deductible by year. These amounts are indexed annually, after being set by the Medicare Modernization Act in 2005: Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006.