What is the cost of Medicare Part B in 2017?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $134.00 in 2017.

How much will health insurance premiums be for 2017?

The monthly premiums that include income-related adjustments for 2017 will be $187.50, $267.90, $348.30, or $428.60, depending on the extent to which an individual beneficiary's modified adjusted gross income exceeds $85,000 (or $170,000 for a married couple).

What is the standard Medicare Part B premium for 2018?

The standard Medicare Part B premium for medical insurance in 2018 is $134.00. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

What percentage of Medicare Part B premiums are affected by income?

These income-related monthly premium rates affect roughly five percent of people with Medicare. The total Medicare Part B premiums for high income beneficiaries for 2017 are shown in the following table:

How much would a patient pay for a standard Medicare Part B premium in 2017?

$134The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount. This is because the Part B premium increased more than the cost-of-living increase for 2017 Social Security benefits.

How much does Medicare Part B normally cost?

$170.10 each monthCosts for Part B (Medical Insurance) $170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

How much is Medicare Part B monthly?

2022If your yearly income in 2020 (for what you pay in 2022) wasYou pay each month (in 2022)File individual tax returnFile joint tax return$91,000 or less$182,000 or less$170.10above $91,000 up to $114,000above $182,000 up to $228,000$238.10above $114,000 up to $142,000above $228,000 up to $284,000$340.203 more rows

Why am I getting charged more for Medicare B?

If You Have a Higher Income If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the “income-related monthly adjustment amount.” Here's how it works: Part B helps pay for your doctors' services and outpatient care.

What is the cost of Medicare Part B for 2021?

$148.50 forMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

Does Medicare Part B cost change every year?

Each year the Medicare Part B premium amount changes to reflect inflation and the economic status of the U.S. The standard Medicare Part B premium in 2022 is $170.10 per month and can be as high as $578.30 a month for high-earning beneficiaries.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Do I have to pay for Medicare Part B?

Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Is the cost of Medicare Part B going up in 2022?

If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022. That's a 14.5% increase, and is one of the steepest increases in Medicare's history.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What Medicare Part B Covers

In a nutshell, Medicare Part B, or "medical insurance," is the part of Medicare that covers most medical services and supplies other than hospital...

What Medicare Part B Costs in 2017

The short answer is that the standard Medicare Part B premium is $134 per month. However, that's not what most beneficiaries actually pay. There ar...

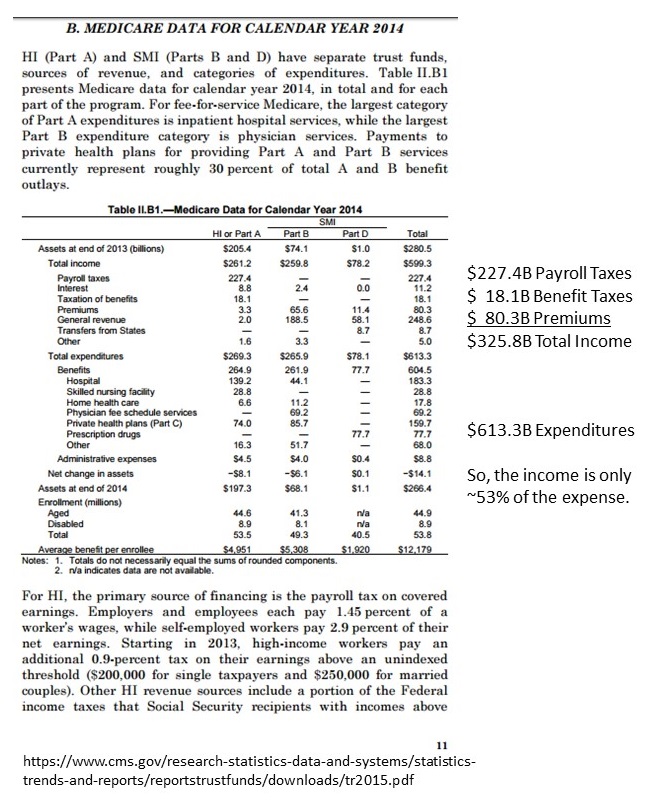

Is Medicare in Financial Trouble?

You may have seen headlines about Medicare's financial troubles, so let's set the record straight. First of all, those headlines are referring to t...

How much does Medicare Part B cost?

The short answer is that the standard Medicare Part B premium is $134 per month. However, that's not what most beneficiaries actually pay. There are essentially three categories of beneficiaries, each with different premiums. About 70% of Medicare beneficiaries pay their premiums directly through their Social Security benefits.

What is Medicare Part B?

Medicare Part B is also known as "medical insurance," and it covers most medical services and supplies other than hospital stays. Here's a more detailed explanation of what Medicare Part B covers and what it will cost in 2017. Image source: Getty Images.

What are the preventative services covered by Medicare Part B?

Preventative services covered by Medicare Part B include services like lab tests; screenings for conditions such as diabetes, heart disease, and cancer; and services intended to prevent diseases (such as your annual flu shot).

When will Medicare be privatized?

This change may come in the form of a tax increase, benefit reductions, or privatization. If Republican leaders get their way, Medicare will be privatized by 2024 (which would definitely affect Part B).

When will the hospital insurance fund run out?

After that, however, deficits are projected, and the Hospital Insurance trust fund is expected to run out in 2028. So it's fair to assume that something will need to change in the coming years.

Does Medicare cover ambulances?

Medicare Part B also covers ambulance services, but only if other transportation could endanger your health. For instance, if you're having a heart attack , Medicare Part B would cover ambulance transportation. Preventative services covered by Medicare Part B include services like lab tests; screenings for conditions such as diabetes, heart disease, ...

Is Medicare Part A funded by premiums?

First of all, those headlines are referring to the part of Medicare that's funded by tax revenue -- Part A, or hospital insurance -- not Part B, which is funded mostly by premiums. Also, Medicare Part A is in decent financial shape -- for now.

How much is Medicare Part B?

Starting January 1, most people with Medicare will see a small increase in their Part B premium, from $104.90 to an average of $109.00 per month. But about 30 percent of people covered by Medicare will see a minimum Part B premium ...

What is the hold harmless provision in Medicare?

This difference in premium amounts is due to a federal law which is commonly called the “hold harmless” provision. This provision prevents about 70 percent of beneficiaries from seeing major increases in Medicare Part B premiums when Social Security cost of living adjustments (COLAs) are nonexistent or very small.

Can you see a Part B premium increase?

Those who are held harmless will not see their Part B premium increase by an amount that is greater than the dollar amount of their COLA increase. Because the COLA is a percentage of a person’s Social Security benefits, the exact dollar amount of the increase, and the premium, will vary.

What is Medicare Part B?

Medical care that is not inpatient is usually covered under Medicare Part B. Medicare Part B covers 80 percent of medically necessary physician or outpatient charges, including charges from a physician for care received in a hospital. The Part B deductible generally applies.

What services are covered by Medicare Part B?

Currently, services covered under Medicare Part B (the 20 percent coinsurance charge and deductible generally apply) include: Physician and surgeon fees. Outpatient services. Immunosuppressive drugs. Blood service, after you pay for the first three pints of blood in any calendar year. Clinical laboratory services.

What is Medicare preventive care?

The preventive services Medicare fully covers include: An annual wellness exam to develop or update a personalized prevention plan. Annual mammograms for individuals age 40 or older, and a baseline mammogram for individuals between ages 35 and 39. Pap test and pelvic exams. Pneumococcal and flu vaccines.

What is the Medicare Part D coverage number?

You can get further information about coverage under Medicare Part B by calling the Social Security Administration at (800) 772-1213 or by visiting www.ssa.gov (the Social Security Administration website) or www.medicare.gov.

How to contact Medicare.org?

If you have questions or need help finding quality coverage at a price you can afford, call one of our licensed sales agents at (888) 815-3313 — TTY 711.

Does Medicare cover home health?

Certain medically-necessary home health services. Physical and occupational therapy. Ambulance service. Medicare also fully covers the cost of most preventive services (beneficiaries will pay nothing out-of-pocket) if a health-care provider accepts assignment. Some services are limited to one per year.

Can you get a hold harmless from Medicare?

Due to a provision in the Social Security Act, you are “held harmless” from Part B premium increases when no Social Security COLA is payable. Unfortunately, this is not the case for the approximately 30% of Medicare beneficiaries who are not subject to this “hold harmless” provision.

How much does Medicare Part B cost?

Most recipients pay an average of $109 a month for coverage, but certain beneficiaries pay the standard premium of $134 a month. If you meet one of the following conditions, then you’ll pay the standard amount ($134) or more:

Why did Medicare premiums go up in 2016?

The Centers for Medicare & Medicaid Services (CMS) cited several reasons for the price hike, including paying off mounting debt from past years and ensuring funding for future coverage. But another important factor was that 2016 saw no cost-of-living adjustment (COLA) for Social Security benefits. For 70 percent of Medicare beneficiaries, this meant that premium rates would stay the same in 2016. The remaining 30 percent — about 15.6 million enrollees — faced higher monthly premiums. And everyone who signs up for Medicare in 2016, regardless of enrollment status or income, will pay a higher annual deductible.

What is Part D insurance?

Part D covers prescription drug costs, and it was introduced in 2003 to help seniors afford medication. It’s a popular provision. How much you pay for Part D varies based on the type of coverage you choose, but there are standards in place to limit your out-of-pocket spending. Once again, higher-income enrollees will pay an income-based surcharge on top of their monthly premiums:

What is Medicare Advantage?

Medicare Advantage offers a bevy of benefits to seniors who are looking for more comprehensive coverage. These plans must include at least the same benefits offered through Parts A and B, and many (but not all) plans cover prescription drugs. Because these plans are sold through private insurers instead of directly through the federal government, Medicare Advantage has different costs that vary by plan. As with any insurance plan, costs rise each year. If you want to learn more about this type of coverage, then check out our guide to Medicare Advantage.

Do you have to pay for Medicare Part A?

Most people don’t have to pay for Part A, or the hospitalization portion of Medicare. They paid for it with payroll deductions all their working lives. That’s the good news. These people will need to pay the deductible before Medicare pays their part. That doesn’t mean people need to scrape and scrounge to pay it before they go to the hospital. Instead, they will be billed for the amount incurred by the hospitalization, and when the deductible is paid, Medicare will kick in and begin paying its share.

Does Medicare Part A cover hospital care?

Under traditional Medicare, Part A covers hospital care. This portion alone counts as minimum essential coverage under the Affordable Care Act. Most recipients do not pay a premium for Part A coverage because this portion is funded through work-based taxes that you pay throughout your working life. If you’ve accumulated 40 quarter credits (and most people do), then you can enroll in Part A for free. Otherwise, the costs are as follows:

Is Medigap the same as Medicare?

In all but three states, Medigap plans are the same. They are organized into plans A through N. These plans are offered by private insurance companies and are not part of Medicare. They offer the same things Medicare does and then some.

What percentage of Medicare beneficiaries will see a slight increase in their Part B premiums?

Since that adjustment is 0.3 percent in 2017, about 70 percent of Medicare beneficiaries will see only a slight increase in their Part B premiums. The higher premium amount will apply to new enrollees in the program, and certain beneficiaries will continue to pay higher premiums based on their modified adjusted gross income.

What is Medicare Part D?

Beneficiaries in Medicare Part D prescription drug coverage plans pay premiums that vary from plan to plan. Beginning in 2011, the Affordable Care Act required Part D beneficiaries whose modified adjusted gross income exceeds the same income thresholds that apply to Part B premiums to also pay a monthly adjustment amount. ...

Who is responsible for monthly adjustment?

The Social Security Administration (SSA) is responsible for all income-related monthly adjustment amount determinations. To make the determinations, SSA uses the most recent tax return information available from the Internal Revenue Service. For 2017, that will usually be the beneficiary's 2015 tax return information.

Can Medicare Part B premiums be increased?

However, most Medicare beneficiaries will not pay this amount. By law, Part B premiums for current enrollees cannot increase by more than the amount of the cost-of-living adjustment for social security (railroad retirement tier I) benefits.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.