How much does Medicare Part B costs?

and Part B which covers doctor’s visits and other medical services, and costs $170.10 per month for most enrollees in 2021. Everyone is eligible for Medicare at age 65, even if your full Social ...

What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

How much does Part B insurance cost?

Part B costs: What you pay 2021: Premium $170.10 each month (or higher depending on your income). The amount can change each year. You’ll pay the premium each month, even if you don’t get any Part B-covered services.

Does Medicare Part B cost money?

• Part B Medicare Part B has a monthly premium. The amount you pay depends on your yearly income. Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year.

What was the cost of Medicare Part B in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What was the cost of Medicare Part B in 2018?

$134 per monthAnswer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

What was the cost of Medicare Part B in 2019?

$135.50Part B. On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

What was the cost of Medicare Part B in 2015?

$104.90 per monthMost beneficiaries pay $104.90 per month for Medicare Part B.

What was the Medicare deductible for 2017?

$183 inCMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016). Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement.

What is the cost of Medicare Part B for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Is Medicare Part B worth the cost?

You need Part B before you can enroll in Medigap or a Medicare Advantage plan. Lastly, Part B is not free unless you qualify for a Medicare Savings program due to low income. Though you must pay a premium for Part B, it provides a very significant 80% of all your outpatient expenses.

What are the annual premiums for Part B coverage in 2019 and 2020?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019.

What is the standard monthly premium for Medicare Part B?

$170.10Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What was the Medicare Part B premium for 2014?

CMS said the standard Medicare Part B monthly premium will be $104.90 in 2014, the same as it was in 2013. The premium has either been less than projected or remained the same, for the past three years. The Medicare Part B deductible will also remain unchanged at $147.

What is the cost of Medicare Part B for 2020?

$144.60 forMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

What were Medicare premiums in 2015?

As a result of the Bipartisan Budget Act of 2015, the Part B monthly premium will be increasing for 30 percent of Part B enrollees from $104.90 in 2015 to $121.80 in 2016—a 16 percent increase, but far less than the increase initially projected by the Medicare actuaries (Figure 1).

What Medicare Part B Covers

In a nutshell, Medicare Part B, or "medical insurance," is the part of Medicare that covers most medical services and supplies other than hospital...

What Medicare Part B Costs in 2017

The short answer is that the standard Medicare Part B premium is $134 per month. However, that's not what most beneficiaries actually pay. There ar...

Is Medicare in Financial Trouble?

You may have seen headlines about Medicare's financial troubles, so let's set the record straight. First of all, those headlines are referring to t...

How much does Medicare Part B cost?

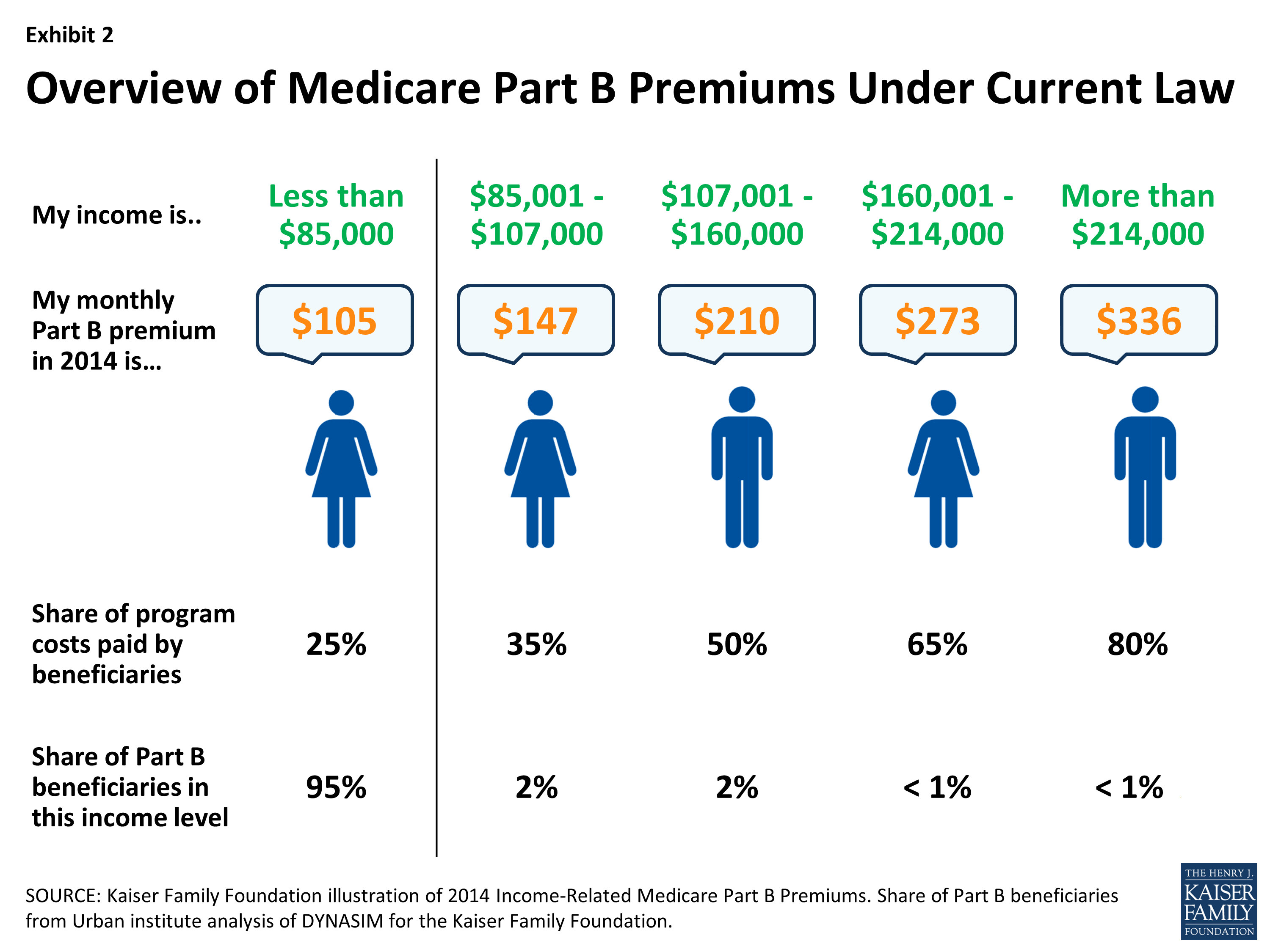

The short answer is that the standard Medicare Part B premium is $134 per month. However, that's not what most beneficiaries actually pay. There are essentially three categories of beneficiaries, each with different premiums. About 70% of Medicare beneficiaries pay their premiums directly through their Social Security benefits.

What is Medicare Part B?

Medicare Part B is also known as "medical insurance," and it covers most medical services and supplies other than hospital stays. Here's a more detailed explanation of what Medicare Part B covers and what it will cost in 2017. Image source: Getty Images.

What are the preventative services covered by Medicare Part B?

Preventative services covered by Medicare Part B include services like lab tests; screenings for conditions such as diabetes, heart disease, and cancer; and services intended to prevent diseases (such as your annual flu shot).

When will Medicare be privatized?

This change may come in the form of a tax increase, benefit reductions, or privatization. If Republican leaders get their way, Medicare will be privatized by 2024 (which would definitely affect Part B).

When will the hospital insurance fund run out?

After that, however, deficits are projected, and the Hospital Insurance trust fund is expected to run out in 2028. So it's fair to assume that something will need to change in the coming years.

Does Medicare cover ambulances?

Medicare Part B also covers ambulance services, but only if other transportation could endanger your health. For instance, if you're having a heart attack , Medicare Part B would cover ambulance transportation. Preventative services covered by Medicare Part B include services like lab tests; screenings for conditions such as diabetes, heart disease, ...

Is Medicare Part A funded by premiums?

First of all, those headlines are referring to the part of Medicare that's funded by tax revenue -- Part A, or hospital insurance -- not Part B, which is funded mostly by premiums. Also, Medicare Part A is in decent financial shape -- for now.

How much is Medicare Part B?

Starting January 1, most people with Medicare will see a small increase in their Part B premium, from $104.90 to an average of $109.00 per month. But about 30 percent of people covered by Medicare will see a minimum Part B premium ...

Can you see a Part B premium increase?

Those who are held harmless will not see their Part B premium increase by an amount that is greater than the dollar amount of their COLA increase. Because the COLA is a percentage of a person’s Social Security benefits, the exact dollar amount of the increase, and the premium, will vary.

How much does Medicare Part B cost?

Most recipients pay an average of $109 a month for coverage, but certain beneficiaries pay the standard premium of $134 a month. If you meet one of the following conditions, then you’ll pay the standard amount ($134) or more:

Why did Medicare premiums go up in 2016?

The Centers for Medicare & Medicaid Services (CMS) cited several reasons for the price hike, including paying off mounting debt from past years and ensuring funding for future coverage. But another important factor was that 2016 saw no cost-of-living adjustment (COLA) for Social Security benefits. For 70 percent of Medicare beneficiaries, this meant that premium rates would stay the same in 2016. The remaining 30 percent — about 15.6 million enrollees — faced higher monthly premiums. And everyone who signs up for Medicare in 2016, regardless of enrollment status or income, will pay a higher annual deductible.

What is Part D insurance?

Part D covers prescription drug costs, and it was introduced in 2003 to help seniors afford medication. It’s a popular provision. How much you pay for Part D varies based on the type of coverage you choose, but there are standards in place to limit your out-of-pocket spending. Once again, higher-income enrollees will pay an income-based surcharge on top of their monthly premiums:

What is Medicare Advantage?

Medicare Advantage offers a bevy of benefits to seniors who are looking for more comprehensive coverage. These plans must include at least the same benefits offered through Parts A and B, and many (but not all) plans cover prescription drugs. Because these plans are sold through private insurers instead of directly through the federal government, Medicare Advantage has different costs that vary by plan. As with any insurance plan, costs rise each year. If you want to learn more about this type of coverage, then check out our guide to Medicare Advantage.

Is Medigap the same as Medicare?

In all but three states, Medigap plans are the same. They are organized into plans A through N. These plans are offered by private insurance companies and are not part of Medicare. They offer the same things Medicare does and then some.

How much does Part B pay in 2017?

If you're enrolled in Part B but are not receiving Social Security payments, or the premiums are not deducted from them, you'll pay $134 a month in 2017. If you enroll in Part B for the first time in 2017 — regardless of whether you're receiving Social Security payments — you will pay $134 a month.

How much more will COLA pay for Part B?

In 2017, because the COLA will raise benefits by a measly 0.3 percent, they will pay an average of $4.10 more for Part B, depending on the dollar increase in their Social Security checks.

Can you pay more in Part B than you receive from Cola?

Under the law, people with Medicare who draw Social Security benefits cannot pay more in Part B premium increases than they receive from the COLA. So in 2016, these people — about 70 percent of beneficiaries — were "held harmless" from any premium increase and paid the same as they had in 2015. In 2017, because the COLA will raise benefits by ...

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

What is Medicare Part B 2021?

Medicare Part B costs in 2021. Medicare Part B (medical insurance) is also part of Original Medicare. Part B carries a monthly premium and an annual deductible. Costs shown below are for 2021. Medicare Part B premium. The amount you pay for your Part B premium may vary based on your situation.

What is the 20% coinsurance for Medicare Part B?

Besides the premium and deductible, there are other Medicare Part B costs you should know about: for example, many Medicare services and supplies require a 20% coinsurance payment or a copayment after you’ve reached your annual deductible .

What is Medicare Advantage?

Medicare Part A continues to pay for hospice benefits when you have a Medicare Advantage plan. Some Medicare Advantage plans include prescription drug coverage and may include other benefits as well. Premiums and deductibles for Medicare Advantage plans may vary, depending on which plan you choose and the extent of your health coverage.

How to calculate late enrollment penalty for Medicare?

You can calculate the late-enrollment penalty by multiplying the number of full months you went without Part D or creditable coverage by 1% of the national base beneficiary premium , which is $33.06 in 2021. Then, round the total to the nearest $0.10, and add it to your Medicare prescription drug plan’s monthly premium.

How much does Medicare pay after deductible?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services. If your income is over a certain amount, your Medicare Part B monthly premium may be higher. The government looks to your reported income from two years ago to see if you have to pay a higher amount.

How much will Medicare pay for prescription drugs in 2021?

For the year 2021, once you and your plan have spent a combined $4,130 on covered prescription drugs, you’ll reach the coverage gap (sometimes also referred to as the “donut hole”).

How many Medigap plans are there?

Medigap is private insurance, and premiums may vary depending on the area you live in and which plan you choose. There are 10 standardized Medigap insurance plans in most states, and while plans of the same name have the same basic coverage, the coverage varies among standardized plans of different names.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

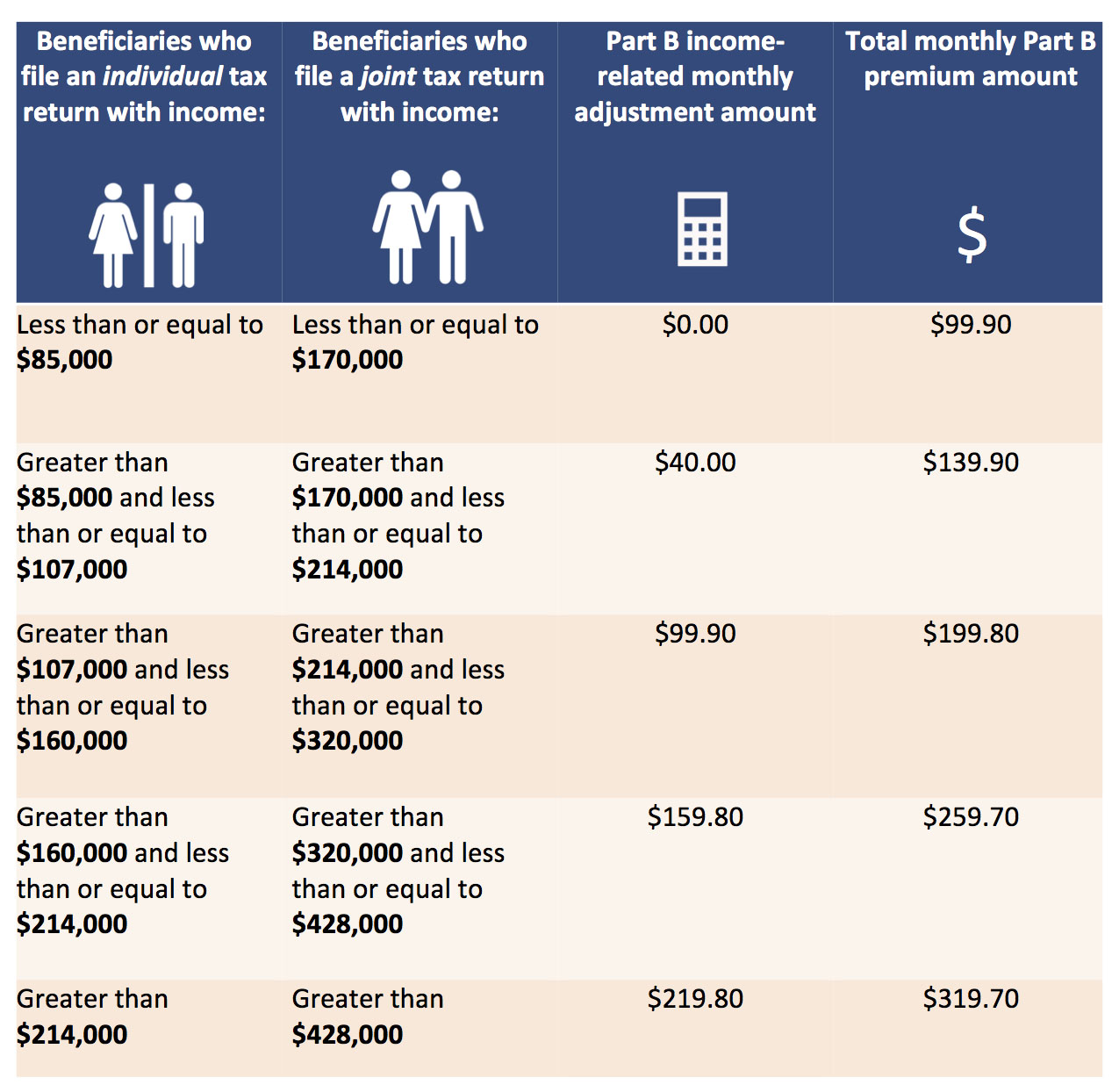

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.