What is the current tax rate for Medicare?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers.

How to calculate additional Medicare tax properly?

- Normal medicare tax rate for individual is 1.45 % of gross wages or salary

- Normal medicare tax rate for self employed person is 2.9 % of Gross income.

- If wage or self employment income is more than the threshold amount , only then you are liable for additional medicare tax .

What is the additional Medicare tax?

What Is the Additional Medicare Tax?

- The Additional Medicare Tax has been in effect since 2013.

- Taxpayers who make over $200,000 as individuals or $250,000 for married couples are subject to an additional 0.9 percent tax on Medicare.

- The Additional Medicare Tax goes toward funding features of the Affordable Care Act.

Why is there a cap on the FICA tax?

Key Takeaways

- Social Security and Medicare payroll withholding are collected as the Federal Insurance Contributions Act (FICA) tax.

- Income tax caps limit do not apply to Medicare taxes, but Social Security taxes have a wage-based limit.

- The cap limits how much high earners need to pay in Social Security taxes each year.

How do you calculate your Medicare tax?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay.

How much is Medicare tax per year?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What was the additional Medicare tax 2016?

This added tax raises the wage earner's portion on compensation above the threshold amounts to 2.35 percent; the employer-paid portion of the Medicare tax on these amounts remains at 1.45 percent....2016 Payroll Tax Unchanged; Tax Brackets Nudge Up.FICA Rate (Social Security + Medicare withholding)20152016Employer7.65%7.65%Self-Employed15.30%15.30%2 more rows•Oct 15, 2015

When did the Medicare tax rate change?

Since 2013, you'll pay a 3.8% Medicare tax rate on your net investment income when the total amount exceeds the income thresholds. The tax, known as the Net Investment Income tax, will go into the government's General Fund and not into Medicare. Most people only pay the 2.9% flat tax rate.

How does the 3.8 Medicare tax work?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

How much is Social Security and Medicare tax?

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

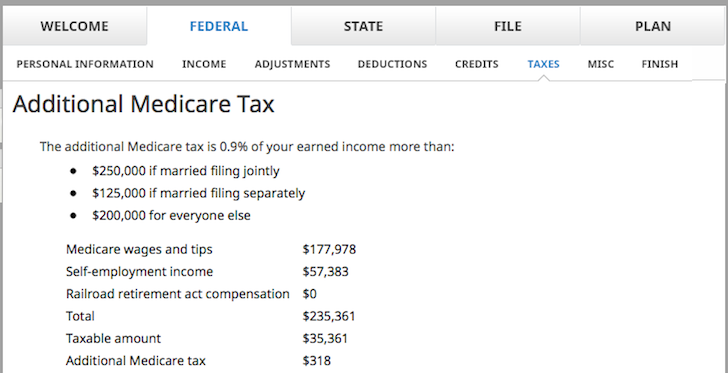

What is the additional Medicare tax for 2019?

A 0.9% Additional Medicare Tax applies to Medicare wages, self-employment income, and railroad retirement (RRTA) compensation that exceed the following threshold amounts based on filing status: $250,000 for married filing jointly; $125,000 for married filing separately; and. $200,000 for all other taxpayers.

Did Medicare tax go up?

(Maximum Social Security tax withheld from wages is $9,114 in 2022). For Medicare, the rate remains unchanged at 1.45% for both employers and employees.

What is the additional Medicare tax rate for 2022?

2022 updates 2.35% Medicare tax (regular 1.45% Medicare tax plus 0.9% additional Medicare tax) on all wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return).

Why did Medicare premiums go up?

The Centers for Medicare and Medicaid Services (CMS) announced the premium and other Medicare cost increases on November 12, 2021. The steep hike is attributed to increasing health care costs and uncertainty over Medicare's outlay for an expensive new drug that was recently approved to treat Alzheimer's disease.

At what income level does Medicare tax increase?

The regulation has been in place since 2013. Everyone who earns income pays some of that income back into Medicare. The standard Medicare tax is 1.45 percent, or 2.9 percent if you're self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

What is the Medicare rate for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020.

What type of tax is Medicare?

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and peopl...

What is the tax rate for Social Security and Medicare?

The FICA tax includes the Social Security tax rate at 6.2% and the Medicare tax at 1.45% for a total of 7.65% deducted from your paycheck.

What does it mean if you see a Medicare deduction on your paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital In...

What happens if your employer did not withhold Social Security and Medicare taxes?

Employers that do not adhere to tax laws by withholding FICA taxes for Social Security and Medicare could be subject to criminal and civil sanction...

How do self-employed people pay Medicare tax?

If you are a self-employed person, Medicare tax is not withheld from your paycheck. You would typically file estimated taxes quarterly and use the...

What is a Medicare benefit tax statement?

This evidence of coverage statement confirms that you have enrolled in Medicare Part A and have health insurance that meets the Affordable Care Act...

When is the W-2 due for 2016?

The due date for filing 2016 Form W-2 with the Social Security Administration is now January 31st. This also applies to certain Form 1099-MISC reporting for non-employee compensation such as payments to independent contractors.

What is EFTPS in tax?

Electronic Federal Tax Payment System (EFTPS) Employers must pay their Federal Tax Liabilities through the Electronic Federal Tax Payment System unless they pay less than $2,500 in quarterly payroll tax liabilities and pay their liability when filing their employment tax returns (Forms 941 and 944).

What is the Social Security tax for 2017?

As of 2017, the employee share of Social Security and Medicare taxes is 7.65%. If you make over $200,000, remember to account for the Additional Medicare Tax. It may seem like a lot of trouble now, but all this tax withholding is designed to give you a safety net when you reach retirement.

What is Medicare tax?

Medicare tax is a payroll tax that funds the Medicare Hospital Insurance program. Employers and employees each pay Medicare tax at a rate of 1.45% with... Menu burger. Close thin.

What is the Medicare surtax rate?

It is not split between the employer and the employee. If your income means you’re subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000.

When did Medicare HI start?

Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks. Since 1966 the Medicare HI tax rate has risen, though it’s still below the Social Security tax rate.

Is NIIT the same as Medicare?

According to the IRS, a taxpayer may be subject to both the Additional Medicare Tax and the NIIT, but not necessarily on the same types of income .

Is there a limit on Medicare taxes?

Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes. Medicare Taxes and the Affordable Care Act. The Affordable Care Act (ACA) added an extra Medicare tax for high earners.

What does Medicare tax mean?

Medicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice.

How does it work?

Medicare tax is a two-part tax where you pay a portion as a deduction from your paycheck, and part is paid by your employer. The deduction happens automatically as a part of the payroll process.

What is the Medicare tax used for?

The Medicare tax pays for Medicare Part A, providing health insurance for those age 65 and older as well as people with disabilities or those who have certain medical issues. Medicare Part A, also known as hospital insurance, covers health care costs such as inpatient hospital stays, skilled nursing care, hospice and some home health services.

What's the current Medicare tax rate?

In 2021, the Medicare tax rate is 1.45%. This is the amount you'll see come out of your paycheck, and it's matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

Frequently asked questions

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and people with disabilities.

What is Medicare contribution tax?

A Medicare contribution tax of 3.8% now additionally applies to "unearned income"—that which is received from investments, such as interest or dividends, rather than from wages or salaries paid in compensation for labor or self-employment income. This tax is called the Net Investment Income Tax (NIIT). 7 .

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

What is the Medicare tax rate for 2020?

Updated December 07, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn. But there are two other Medicare taxes ...

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

How much is Social Security taxed in 2021?

Social Security has an annual wage limit, so you pay the tax only on income above a certain amount: $137,700 annually as of 2020 and $142,800 in 2021. 5 . Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, ...

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Can an employer withhold AMT?

Any shortfall to withholding must be paid by the taxpayer at tax time. Employers can be subject to penalties and interest for not withholding the AMT, even if the oversight was due to understandable circumstances.

How much is Medicare taxed?

In comparison with the Social Security tax, Medicare is taxed at a much lower rate of 1.45%. Unlike Social Security, however, there is no wage cap -- every dollar of earned income is subject to Medicare taxes.

What is the payroll tax rate for Medicare?

However, this amount is only assessed on the first $127,200 of wage income. Beyond this amount, the payroll tax rate is just 2.9% -- the employer and employee portions of the Medicare tax.

How much do you have to pay in taxes on a W-2?

For example, if you earn $50,000 from a W-2 employer and have payroll taxes withheld, and also earn $100,000 in self-employment income, you'll only need to pay Social Security tax on the first $77,200 of that amount, since when combined with the $50,000 of employment earnings, it reaches the $127,200 maximum.

What is payroll tax?

As a broad definition, a payroll tax is a tax withheld by an employer and paid on behalf of its employees, based on the wages or salary of the employee. They differ from income taxes in that everyone pays a flat payroll tax rate, as opposed to income taxes, which are progressive, or increasing rates, based on earnings.

What is FICA tax?

Also known as FICA taxes in the United States, the employer withholds a percentage of wages, which is calculated differently for the Social Security and Medicare portions of the tax.

What is the payroll tax rate for Social Security?

The Social Security part of the payroll tax is assessed at a rate of 6.2% each for the employer and employee, for a combined rate of 12.4%. Social Security tax is only assessed on earned income up to a certain maximum each year. For 2017, the Social Security taxable maximum is $127,200, and no tax is assessed on income above this amount.

What is the Medicare tax rate for $22,800?

For your other $22,800 of income, only the 1.45% Medicare tax rate would apply, which translates to another $330.60. Combined, this results in a payroll tax of $11,805.60 each for you and your employer.

What is the Medicare tax rate?

The standard Medicare tax is 1.45 percent, or 2.9 percent if you’re self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

How much Medicare do self employed people pay in 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

How much tax do you pay on income above the threshold?

For example, if you’re a single tax filer with an employment income of $250,000, you’d pay the standard 1.45 percent on $200,000 of your income, and then 2.35 percent on the remaining $50,000.

Does RRTA count toward income tax?

Incomes from wages, self-employment, and other compensation, including Railroad Retirement (RRTA) compensation, all count toward the income the IRS measures. If you’re subject to this tax, your employer can withhold it from your paychecks, or you can make estimated payments to the IRS throughout the year.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.