2017 Federal Payroll Tax Rate Changes

| 2017 Current Year | 2016 Prior Year | |

| FICA / OASDI Employee rate Maximum liabi ... | 6.2% $7,886.40 6.2% $7,886.40 $127,200.0 ... | 6.2% $7,347.00 6.2% $7,347.00 $118,500.0 ... |

| Medicare Employee and Employer rate Maxi ... | 1.45% No limit No limit 0.9% | 1.45% No limit No limit 0.9% |

| FUTA Employer rate Wage limit | 0.6% $7,000 | 0.6% $7,000 |

| Social Security Benefits Earned income m ... | $16,920.00 No limit | $15,720 No limit |

What is the current tax rate for Medicare?

2017. The maximum amount of wages subject to the social security tax (6.2 percent) for 2017 is $127,200. There is no limit on the amount of wages subject to the Medicare tax (1.45 percent).

How to calculate additional Medicare tax properly?

Nov 10, 2016 · For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80. Because of the “hold harmless” provision covering the other 70 percent of beneficiaries, premiums for the remaining 30 percent must cover most of the increase in …

What is the additional Medicare tax?

5 rows · Dec 13, 2016 · The wage base increases to $127,200 for Social Security and remains UNLIMITED for Medicare. ...

Why is there a cap on the FICA tax?

Dec 07, 2016 · The maximum Social Security tax in 2017 The current Social Security tax rate is 6.2% for both employers and employees, and the 2017 maximum earnings amount subject to Social Security tax is...

What is the tax base for Social Security and Medicare?

What was the Social Security tax rate in 2017?

What is the Social Security income limit for 2017?

How much in total are you responsible for both Social Security tax and Medicare tax as an employer with an employee?

What was the Social Security tax rate in 1980?

| Year | FICA | Self-Employment |

|---|---|---|

| 1980 | 6.13% on first $25,900 | 8.1% on first $25,900 |

| 1979 | 6.13% on first $22,900 | 8.1% on first $22,900 |

| 1978 | 6.05% on first $17,700 | 8.1% on first $17,700 |

| 1977 | 5.85% on first $16,500 | 7.9% on first $16,500 |

When was the last time Social Security tax was raised?

What is the Social Security tax limit for 2021?

How are Social Security benefits taxed in 2021?

What is the income limit before Social Security is taxed?

Which type of tax is taken out of each paycheck and includes Medicare and Social Security taxes quizlet?

What taxes are taken out of Social Security?

How can I avoid paying taxes on Social Security?

- Move income-generating assets into an IRA. ...

- Reduce business income. ...

- Minimize withdrawals from your retirement plans. ...

- Donate your required minimum distribution. ...

- Make sure you're taking your maximum capital loss.

What is the Medicare premium for 2017?

For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80. Because of the “hold harmless” provision covering the other 70 percent of beneficiaries, premiums for the remaining 30 percent must cover most ...

How much is Medicare Part A deductible?

The Medicare Part A inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,316 per benefit period in 2017, an increase of $28 from $1,288 in 2016. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the COLA for Social Security?

Because of the low Social Security COLA, a statutory “hold harmless” provision designed to protect seniors, will largely prevent Part B premiums from increasing for about 70 percent ...

What is the tax code for a spouse who is married and lived with their spouse?

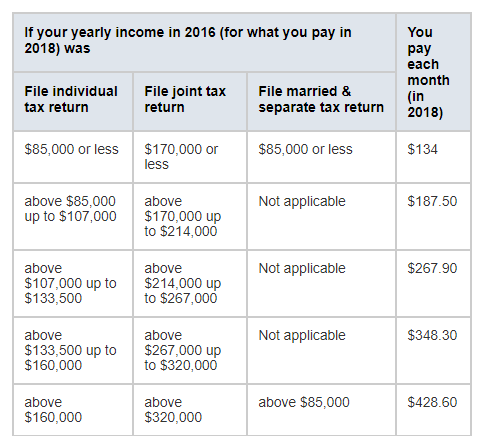

428.60. Premiums for beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouse at any time during the year, but file a separate tax return from their spouse:

What is the maximum pretax contribution for 2017?

The maximum employee pretax contribution remains unchanged at $18,000 in 2017. The “catch-up” contribution limit remains at $6,000 in 2017 for individuals who are age 50 or older.

When are W-2s due for 2016?

The due date for filing 2016 Form W-2 with the Social Security Administration is now January 31st. This also applies to certain Form 1099-MISC reporting for non-employee compensation such as payments to independent contractors. Prior deadlines were end of February for paper filing and end of March for electronic.

What is EFTPS in tax?

Electronic Federal Tax Payment System (EFTPS) Employers must pay their Federal Tax Liabilities through the Electronic Federal Tax Payment System unless they pay less than $2,500 in quarterly payroll tax liabilities and pay their liability when filing their employment tax returns (Forms 941 and 944).

What is the maximum Social Security tax for 2017?

The current Social Security tax rate is 6.2% for both employers and employees, and the 2017 maximum earnings amount subject to Social Security tax is $127,200. This translates to a maximum Social Security tax of $7,886.40 for an individual.

Will Social Security go up in the future?

It could go much higher in the future. As a final thought, it's important to note that the maximum Social Security tax could be much higher in the future as Congress tries to fix the program's financial troubles. According to the latest projections, Social Security is expected to run out of cash reserves by 2034, ...

Can you increase your taxable earnings if you don't have a cola?

However, the law states that the taxable earnings cap cannot increase in years when there is no COLA. Since Social Security beneficiaries did not receive a COLA in 2016, the maximum taxable earnings was stuck at $118,500 for two years.

Does the taxable earnings cap increase in years when there is no COLA?

However, the law states that the taxable earnings cap cannot increase in years when there is no COLA. Since Social Security beneficiaries did not receive a COLA in 2016, the maximum taxable earnings was stuck at $118,500 for two years.

How much is the average Social Security payment for 2017?

The SSA estimates that the average monthly Social Security benefits payable in January 2017 for all retired workers will be $1,360, up only $5 from the 2016 average payment of $1,355. While the 2017 benefit increase is small, SSI recipients had no cost-of-living adjustment in 2016 due to low inflation.

What is the tax rate for Medicare and Social Security?

Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable-maximum amount. The Medicare portion is 1.45% on all earnings.

How much did Social Security increase in 2017?

Monthly Social Security and Supplemental Security Income (SSI) benefits for more than 65 million Americans will increase just 0.3 percent in 2017, the SSA also announced.

What is the maximum Social Security benefit for 2017?

The maximum Social Security benefit for workers retiring at full retirement age in 2017 will be $2,687 per month, up from $2,639 per month in 2016. The SSA estimates that the average monthly Social Security benefits payable in January 2017 for all retired workers will be $1,360, up only $5 from the 2016 average payment of $1,355.

Will Social Security increase Medicare?

For many SSI recipients, their Social Security increase is likely to be offset by higher Medicare premiums, which could be even steeper for those covered by Medicare Part B if they have delayed taking Social Security because they are still working, for instance. Increases in Retirement Earnings Limit.

What is the maximum income for 2017?

The earnings limit for these individuals in 2017 will be $44,880 per year ($3,740 per month), up from $41,880 per year ($3,490 per month) in 2016. There is no limit on earnings beginning the month an individual attains full retirement age. 2017 Income Tax Brackets.

Is FICA tax set by law?

Social Security and Medicare payroll taxes are collected together as the Federal Insurance Contributions Act (FICA) tax. FICA tax rates are statutorily set and therefore require new tax legislation to be changed.

What is the wage base limit for Social Security in 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the Medicare tax rate?

The employee tax rate for Medicare is 1.45% — and the employer tax rate is also 1.45%. So, the total Medicare tax rate percentage is 2.9%. Only the employee portion of Medicare taxes is withheld from your paycheck. There’s no wage-based limit for Medicare tax. All covered wages are subject to Medicare tax. If you receive wages over $200,000 ...

How much Medicare tax is withheld from paycheck?

There’s no wage-based limit for Medicare tax. All covered wages are subject to Medicare tax. If you receive wages over $200,000 a year, your employer must withhold a .9% additional Medicare tax. This will apply to the wages over $200,000.

How much Medicare tax do you pay if you are married?

If you receive wages over $200,000 a year, your employer must withhold a .9% additional Medicare tax. This will apply to the wages over $200,000. This is on top of the 1.45% employer tax rate. If you’re married, you might not have enough Medicare taxes withheld.

What is the Social Security tax rate for 2020?

The employee tax rate for Social Security is 6.2% — and the employer tax rate for Social Security is also 6.2%. So, the total Social Security tax rate percentage is 12.4%. Only the employee portion of Social Security tax is withheld from your paycheck. The 2020 wage-base limit is $118,500.

What is the maximum amount of Social Security taxes to be withheld from paycheck?

Only the employee portion of Social Security tax is withheld from your paycheck. The 2020 wage-base limit is $118,500. If you earn more than that with one employer, you should only have Social Security taxes withheld up to that amount. If you have more than one employer and you earn more than that amount, you’ll receive an adjustment ...

What is the income limit for married filing separately?

This also applies to married filing separately if your income is over $125,000. If this is the case, cover the additional Medicare taxes needed by: Adjusting your withholding. Making estimated payments.

What is the wage base limit for 2020?

The 2020 wage-base limit is $118,500. If you earn more than that with one employer, you should only have Social Security taxes withheld up to that amount. If you have more than one employer and you earn more than that amount, you’ll receive an adjustment of any overpaid Social Security taxes on your return. The employee tax rate for Medicare is ...

Can you deduct Social Security and Medicare taxes?

Also, you can deduct the employer-equivalent portion of your SE tax in figuring your adjusted gross income. Wage earners cannot deduct Social Security and Medicare taxes.

Is self employment tax included in Medicare?

Self-Employment Tax (Social Security and Medicare Taxes) It should be noted that anytime self-employment tax is mentioned, it only refers to Social Security and Medicare taxes and does not include any other taxes that self-employed individuals may be required to file. The list of items below should not be construed as all-inclusive.

What is self employment tax?

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. You figure self-employment tax (SE tax) yourself using Schedule SE (Form 1040 or 1040-SR).

What is the tax rate for self employment?

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance). For 2020, the first $137,700 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, ...

What is the Social Security tax rate for 2020?

The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance). For 2020, the first $137,700 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, Social Security tax, ...

How much is Medicare tax for 2021?

The amount increased to $142,800 for 2021. (For SE tax rates for a prior year, refer to the Schedule SE for that year). All your combined wages, tips, and net earnings in the current year are subject to any combination of the 2.9% Medicare part of Self-Employment tax, Social Security tax, or railroad retirement (tier 1) tax.

Does the 1040 affect self employment?

This deduction only affects your income tax. It does not affect either your net earnings from self-employment or your self-employment tax. If you file a Form 1040 or 1040-SR Schedule C, you may be eligible to claim the Earned Income Tax Credit (EITC).