How does income affect monthly Medicare premiums?

Oct 12, 2018 · The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, an increase of $1.50 from $134 in 2018.

How do you calculate Medicare premium?

If you paid Medicare taxes for only 30-39 quarters, your 2019 Part A premium will be $240 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. How it changed from 2018. The 2019 Part A premiums increased a …

How does Medicare determine your income?

Oct 24, 2018 · The 2019 standard monthly Medicare Part B premium , which covers physician services and other medical and outpatient care, will increase from $134.00 to $135.50, up $1.50 a month for people with incomes of $85,000 or less. But, many people with Medicare have been paying less than the standard premium.

How much is the Medicare Part a premium?

Oct 12, 2018 · The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, a slight increase from $134 in 2018.

How Much Is Medicare a month in 2019?

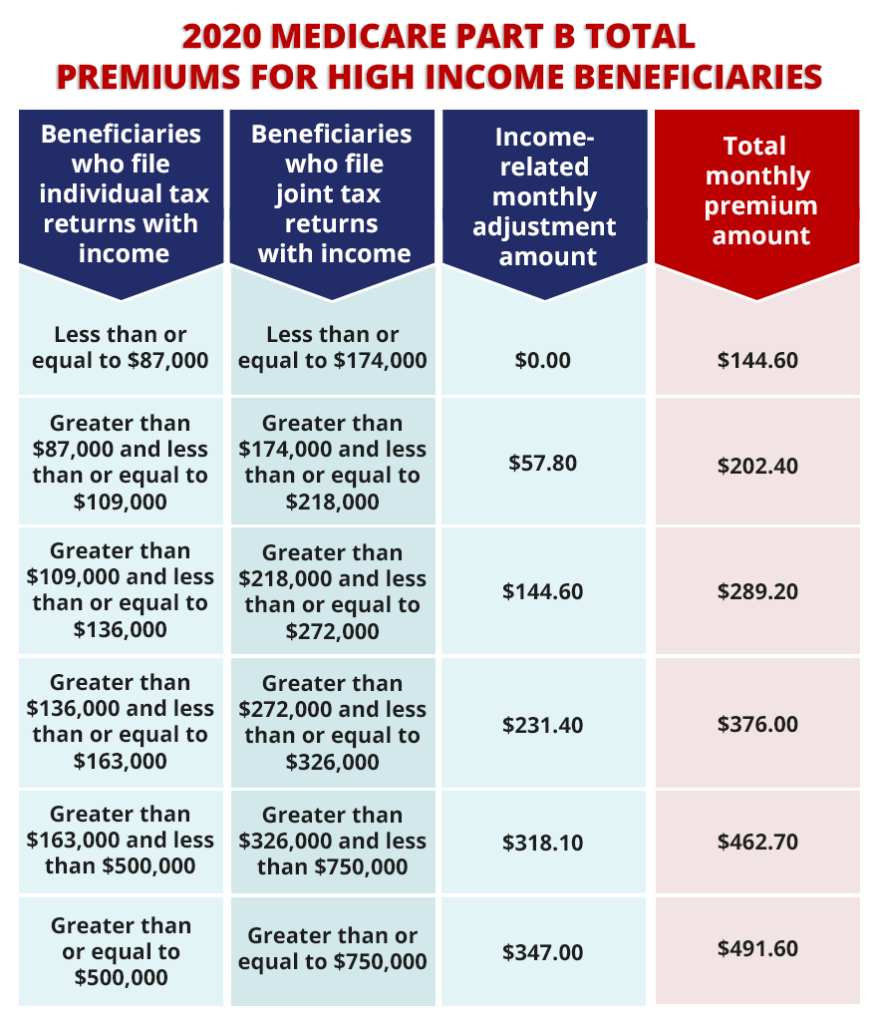

$135.50The standard monthly premium will be $144.60 for 2020, which is $9.10 more than the $135.50 in 2019. The annual deductible for Part B will rise to $198, up $13 from $185 this year. About 7% of beneficiaries will pay extra from income-related adjustment amounts.Nov 11, 2019

What was the cost of Medicare Part B in 2019?

$135.50Part B. On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

What is the Part B premium for Medicare for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the Medicare premium for seniors?

Those who are enrolled in Medicare but aren't yet collecting Social Security have to pay those premiums directly. Those who are receiving Social Security, meanwhile, have their Part B premiums deducted from their benefits. This year, the standard monthly Medicare Part B premium costs seniors $148.50 a month.Nov 17, 2021

What is the Part D premium for 2020?

Part D prescription drug coverage helps millions of Original Medicare beneficiaries pay for their medication costs. Those benefits, however, come at a price. Nationwide, the average monthly Part D premium in 2020 is $30. If you find a plan that's cheaper, it might be tempting to snag it and call it a day.

What is the Irmaa for 2019?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2019More than $160,000 but less than $500,000 More than $500,000$433.40 $460.50Married filing jointlyMore than $170,000 but less than or equal to $214,000$189.60More than $214,000 but less than or equal to $267,000$270.909 more rows•Dec 6, 2021

Did Medicare premiums go up for 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

What is the minimum premium for Medicare Part B?

$170.10The standard Part B premium amount is $170.10 (or higher depending on your income). In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is Medicare Part B 2020 premium?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What month is Medicare deducted from Social Security?

Hi RCK. The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.Mar 5, 2021

How much is deducted from Social Security for Medicare?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

How much is Medicare premium per month?

If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. How it changed from 2018. The 2019 Part A premiums increased a little over 3 percent from 2018.

What is the Medicare Part B premium?

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium.

What is Medicare Part A?

2019 Medicare Part A premium. Medicare Part A (hospital insurance) helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

Is Medicare Part B optional?

Medicare Part B is optional. You will likely be automatically enrolled in Part B (with the option to drop it) if you are automatically enrolled in Medicare Part A.

How much is Medicare Part C?

Plan premiums will vary by provider, plan and location. The Centers for Medicare and Medicaid Services (CMS) reports that the average Medicare Advantage plan premium in 2019 will be $28.00 per month.

What is the COLA for 2019?

The COLA in 2019 is 2.8 percent. An additional income bracket was added in 2019. In 2020, the IRMAA will be indexed to inflation for the first time since 2010. It’s expected that the income thresholds that determine when someone pays a Medicare IRMAA will rise slightly in 2020.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) provides coverage for some of the out-of-pocket costs that Medicare Part A and Part B don't cover. This can include costs such as Medicare deductibles, copayments, coinsurance and more. Medigap plans are sold by private insurance companies so there is no standard premium.

How much will Medicare pay in 2019?

An estimated 2 million Medicare beneficiaries (about 3.5 percent) will pay less than the full Part B standard monthly premium amount in 2019 due to the statutory hold harmless provision, which limits certain beneficiaries’ increase in their Part B premium to be no greater than the increase in their Social Security benefits.

How much will Medicare premiums decrease in 2019?

On average, Medicare Advantage premiums will decline while plan choices and new benefits increase. On average, Medicare Advantage premiums in 2019 are estimated to decrease by six percent to $28, from an average of $29.81 in 2018.

When does Medicare open enrollment end?

Ahead of Medicare Open Enrollment – which begins on October 15, 2018 and ends December 7, 2018 – CMS is making improvements the Medicare.gov website to help beneficiaries compare options and decide if Original Medicare or Medicare Advantage is right for them.

What is the Medicare Part B premium?

The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, a slight increase from $134 in 2018.

How much is Medicare Part A deductible?

The Medicare Part A inpatient deductible that beneficiaries will pay when admitted to the hospital is $1,364 in 2019, an increase of $24 from $1,340 in 2018.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

What is CMS eMedicare?

As announced earlier this month, CMS launched the eMedicare Initiative that aims to modernize the way beneficiaries get information about Medicare and create new ways to help them make the best decisions for themselves and their families.

How much is Medicare Part B 2019?

I won't keep you in suspense. The standard Medicare Part B monthly premium for 2019 will be $135.50, a modest increase of just $1.50 per month over 2018's standard premium. In addition, the annual Medicare Part B deductible will increase, but by just $2, to $185.

What is Medicare Part B?

Medicare Part B is the medical insurance component of the Medicare program. It pays for costs like doctor's office visits, medical equipment, and outpatient procedures.

Is Medicare Part B rising?

The Centers for Medicare and Medicaid Services just announced the 2019 Medicare Part B premiums. You might not be surprised to learn that premiums are rising, but you might be pleasantly surprised to learn that they aren't rising by very much.

Is Medicare Part A premium free?

Meanwhile, Medicare Part A, which mainly covers hospital stays, remains premium-free for most American seniors, although the Part A deductible is rising from $1,340 in 2018 to $1,364 in 2019.

Where is Matt from Motley Fool?

Matt is a Certified Financial Planner based in South Carolina who has been writing for The Motley Fool since 2012. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price.

What is Medicare Part B Premium?

Medicare Part B is your Medical insurance under original Medicare and carries with is a standard monthly premium. Part B covers doctors’ visits, surgeries, durable medical equipment, and the like. In 2018 the standard Medicare part B premium for new and recent enrollees is 134.00 monthly. CMS just announced this will rise by 1.1% to 135.50 monthly.

Medicare Part A Hospital Deductible

CMS has also announced an increase to the Medicare Part A hospital deductible. Unlike the Medical deductible that is annual, the hospital deductible could be assessed each time you’re admitted to the hospital. In 2018, this deductible is $1,340.00 dollars and, CMS has increased this deductible to: $1,364.00 dollars for 2019.

Medicare Advantage Premiums

Medicare Advantage premiums are slated to decrease slightly in 2019 on average nationally. Medicare Advantage plans replace the original Medicare program and are offered by private insurance carriers who contract with CMS/ Medicare to offer your Medicare benefits.

New Regional MAPD Plans

Many MAPD carriers have rolled out new, more richly designed MAPD plans in certain areas in Texas and across the country. For instance, seniors living in Harris county Texas and several other regions across the Lone Star State will be able to enroll into an MAPD PPO plan that’s 0 monthly plan premiums.

Learn More About 2019 Medicare Premiums and Deductibles

Our brokers can enter your medications into the Medicare site to quickly determine which part D or MAPD plan is right for you based on the Medications and doctors you currently participate with.

2019 Increase in Medicare Premiums

After staying the same last year, Medicare’s Part B premium will increase slightly in 2019. The premium will increase $1.50 from $134 a month to $135.50.

2019 Increase in Social Security Benefits

The Social Security Administration has announced a 2.8 percent increase in benefits in 2019, the largest increase in the last eight years! The change will put an additional $468 annually in the pocket of the average retired beneficiary.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

Who is Thomas Brock?

Thomas Brock is a well-rounded financial professional, with over 20 years of experience in investments, corporate finance, and accounting. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar.

Who is Dana Anspach?

Linkedin. Follow Twitter. Dana Anspach is a Certified Financial Planner and an expert on investing and retirement planning. She is the founder and CEO of Sensible Money, a fee-only financial planning and investment firm.