What is the monthly premium for Medicare Part B?

Nov 08, 2019 · The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs.

Is Medicare Part B premiums tax-deductible?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will …

Does Medicare charge a deductible?

In 2022, you pay $233 for your Part B deductible [glossary]. After you meet your deductible for the year, you typically pay 20% of the Medicare-Approved Amount for these: Most doctor services (including most doctor services while you're a hospital inpatient) Outpatient therapy; Durable Medical Equipment (Dme) [Glossary]

How much does Medicare Part B cost?

2020 – $198; 2022 – $233; Medicare Part B Deductible – What It Is. Medicare Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Some people automatically get Medicare Part B (Medical Insurance), and some people need to sign up for Part B. Most people pay the standard Part B premium amount.

What is the 2021 deductible for Medicare for A and B?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is my Medicare Part B deductible?

The Medicare Part B deductible is $233. Once met, you pay 20 percent of the Medicare-approved amount for most doctor services, outpatient therapy and durable medical equipment.

What is the yearly Part B deductible?

Part B Annual Deductible: Before Medicare starts covering the costs of care, people with Medicare pay an amount called a deductible. In 2022, the Part B deductible is $233.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

How do I find out my deductible?

A deductible can be either a specific dollar amount or a percentage of the total amount of insurance on a policy. The amount is established by the terms of your coverage and can be found on the declarations (or front) page of standard homeowners and auto insurance policies.

Which of the following services are covered by Medicare Part B?

Medicare Part B helps cover medically-necessary services like doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services.Sep 11, 2014

What is the Part A deductible for 2021?

$1,484The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital for 2021 will be $1,484, which is an increase of $76 from $1,408 in 2020.Nov 13, 2020

How much is deducted from Social Security for Medicare?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

What month is Medicare deducted from Social Security?

Hi RCK. The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.Mar 5, 2021

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

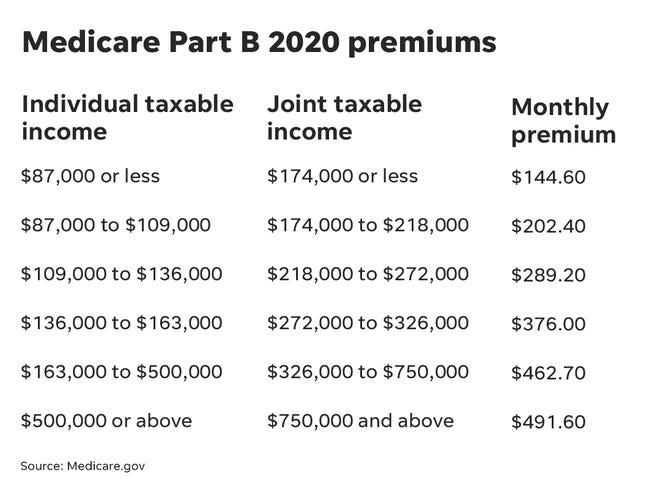

How much is Medicare Part B 2020?

In 2020, the Medicare Part B deductible came in at $198. This is a $13.00 increase from where we were in 2020. That’s a 7% increase year over year and a very similar increase to what we saw (on a percentage basis) with the Medicare Part A deductible. 198 greenbacks including a debut of my 1953 Series A $2 Bill.

When did Medicare Part B deductible start?

A Brief History of the Medicare Part B Deductible. Way back in 1966 when Medicare first showed up on the radar, the Medicare Part B deductible came in at $50. It hung out around there for seven years or so before it saw an increase to $60 in 1973.

What is the average monthly Social Security payment for 2020?

In 2020, the average monthly social security payment for a retiree is $1,503. If a retiree living off social security gets hit with this deductible in January, they just saw 13% of their monthly income leave their pocket. But people with early retirement dreams like Max build entire portfolios to plan for costs like this.

Will Medicare Part B pay outpatients in 2020?

In 2020, once we fill up our Medicare Part B deductible bucket with 198 dollars, Medicare Part B should start paying our outpatient services. Unfortunately, out-of-pocket costs don’t completely stop when we hit this deductible. We are still on the hook for a 20% coinsurance after we fill up our Medicare Part B deductible bucket.

Does Medicare cover outpatient surgery?

It also covers more intensive services provided on an outpatient basis like surgeries, diagnostic imaging, chemotherapy, and radiation therapy. Even if these services are provided in the hospital setting, if it is an outpatient service, Medicare Part B will be responsible for covering it and the Medicare Part B deductible will be applied to it.

Does Medigap cover 100% of Medicare?

Yes = the plan covers 100% of this benefit. Plans C and F will pay the Part B deductible in full. Be careful here though; states like Massachusetts, Michigan, and Wisconsin have some weird rules around these Medigap plans.

Is Medicare Supplement Insurance secondary to Medicare?

These policies are secondary to Medicare and often pick up out-of-pocket costs left to the patient by the traditional Medicare program. Generally, these policies are sold by commercial carriers regulated by federal law and must be clearly identified as “ Medicare Supplement Insurance”.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

How much does it cost to treat a broken arm?

If you refer back to your broken arm example. Say your treatment cost you $80. If you broke your arm before you reached your Part B deductible amount of $198, you’d have to pay the full $80 for your care or whichever amount you had left to hit your $198 cap.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is IRMAA in insurance?

IRMAA is an extra charge added to your premium. If your yearly income in 2019 (for what you pay in 2021) was. You pay each month (in 2021) File individual tax return. File joint tax return. File married & separate tax return. $88,000 or less. $176,000 or less. $88,000 or less.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

Medicare Part B Deductible – What It Is

Medicare Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Some people automatically get Medicare Part B (Medical Insurance), and some people need to sign up for Part B

Find Best Medicare Insurance Plan Coverage

There are countless companies looking to sell you Medicare coverage. Only one resource exclusively lets you find local Medicare insurance agents.

What Does Part B Cover?

Medically necessary services: This includes services or supplies that are needed to diagnose or treat your medical condition. And, they meet accepted standards of medical practice.

How much is Medicare Part B 2020?

The 2020 Medicare Part B deductible is $198 per year. But your Part B costs don’t end just because you’ve met the deductible. In addition to a Part B deductible, you must also pay coinsurance. Part B coinsurance is 20% of the Medicare-approved amount of the services you receive.

What is the 2020 Medicare deductible?

A deductible is the amount you must pay before your Medicare coverage “kicks in.”.

What is a Medigap plan?

These plans — also called Medigap plans — fill the gaps in your Original Medicare coverage. Like Medicare Advantage, these plans are offered by private insurers, so the costs for each plan — like premiums and deductibles — will vary.

What is Medicare approved amount?

The Medicare-approved amount is the amount a doctor has agreed to charge Medicare patients — it is often less than their usual or customary rate. Example: A doctor typically charges $110 for an office visit. However, he has agreed to charge Medicare patients $85. Your coinsurance amount would be $17 (20% of $85).

What happens if you don't know what Medicare does and doesn't cover?

If you don’t know what Medicare does and doesn’t cover, or the full cost of the various Medicare deductibles in 2020, it could spell financial disaster. Keep reading to get the facts on your Medicare coverage, costs and your options to ensure access to the care you need — and your financial peace of mind. While Medicare Parts A and B provide ...

What is Medicare Part D?

Many different Medicare Part D plans are available — the specific plans and costs depend on your location. For all plans, you’ll be responsible for out-of-pocket payments, including a premium and deductible. Before you decide on a Medicare Part D plan, gather a list of any medications you take and the dosage.

What is the deductible for Part A?

Part A is your hospital insurance. It covers: The Part A deductible for 2020 is $1,408 for each benefit period. A benefit period starts on the day you are admitted to a hospital or skilled nursing facility. It ends when you have not received inpatient care for 60 days.