What is the 80 20 rule for Medicare?

Medicare’s 80–20 Rule. One thing that confuses many patients… | by Joe Leandri | Medium One thing that confuses many patients is the 80–20 rule of Medicare’s, which supposedly means that Medicare will pay for 80% of a medical bill, and the patient is responsible for the other 20%.

What is 80/20 health insurance and how does it work?

Health insurance is a necessity for anyone looking to control his out-of-pocket medical expenses and safeguard against unexpected health costs. The hallmark of the health insurance system is cost sharing between the insured and the insurer. A traditional way this is done is through an 80/20 split.

What does 20% of Medicare not cover?

Here’s How To Pay The 20% Medicare DOES NOT Cover… Medicare Part B pays only 80% of covered expense for doctors, outpatient services and durable medical equipment; beneficiaries are responsible for the other 20%. Medigap plans pay that 20%, and can also step in and cover lots of other things.

What is a 80/20 plan with a deductible?

Deductible. A deductible is the amount of money you pay out of pocket before any insurance kicks in. With an 80/20 plan with a deductible, you pay the deductible first. Once you pay the deductible amount, insurance begins to pay, and you pay the 20 percent of the bill up to your out-of-pocket maximum.

What is a 80/20 copay?

Firstly, 80/20 health insurance is a particular type of health plan based around the co-insurance or “co-pay” a patient is required to pay. The idea in an 80/20 plan is that your healthcare provider will cover 80 percent of your medical costs, while you are responsible for the other 20 percent.

What does 80 no deductible mean?

Coinsurance Percentage Breakdown Coinsurance is the amount of money you are going to pay for covered services assuming you have no deductible. When you go in for a medical procedure, you pay 20 percent of the total cost of the bill, and your health insurance pays 80 percent of the total cost of the bill.

Does Medicare cover all costs for seniors?

En español | Medicare covers some but not all of your health care costs. Depending on which plan you choose, you may have to share in the cost of your care by paying premiums, deductibles, copayments and coinsurance. The amount of some of these payments can change from year to year.

What percentage of the population accounts for 80% of health care costs?

That brings us to our ruling. Bates said that 20 percent of the population accounts for 80 percent of the health care dollars spent.

How does 80/20 health insurance work?

The 80/20 Rule generally requires insurance companies to spend at least 80% of the money they take in from premiums on health care costs and quality improvement activities. The other 20% can go to administrative, overhead, and marketing costs. The 80/20 rule is sometimes known as Medical Loss Ratio, or MLR.

How does 80/20 insurance work with deductible?

You have an “80/20” plan. That means your insurance company pays for 80 percent of your costs after you've met your deductible. You pay for 20 percent. Coinsurance is different and separate from any copayment.

Does Medicare pay 100 percent of hospital bills?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

What procedures are not covered by Medicare?

Some of the items and services Medicare doesn't cover include:Long-Term Care. ... Most dental care.Eye exams related to prescribing glasses.Dentures.Cosmetic surgery.Acupuncture.Hearing aids and exams for fitting them.Routine foot care.

What percentage of medical bills Does Medicare pay?

80%In most instances, Medicare pays 80% of the approved amount of doctor bills; you or your medigap plan pay the remaining 20%, if your doctor accepts assignment of that amount as the full amount of your bill.

Does Medicare only pay 80?

Original Medicare only covers 80% of Part B services, which can include everything from preventive care to clinical research, ambulance services, durable medical equipment, surgical second opinions, mental health services and limited outpatient prescription drugs.

How much does the average American pay out of pocket for healthcare?

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans.

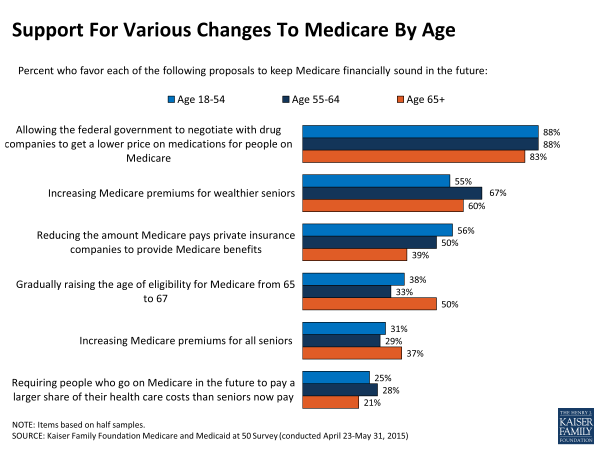

What age group spends the most money on healthcare?

People age 55 and over account for over half of the total health spending. While there are people with high spending at all ages, overall, people 55 and over accounted for 56% of total health spending in 2019, despite making up only 30% of the population.

What is 80/20 co-insurance?

If you have an 80/20 medical plan, then after you meet your annual deductible, your insurance company pays for 80 percent of health costs while you pay 20 percent. This arrangement is known as co-insurance and is in addition to your regular monthly insurance premium.

What happens when you enroll in an 80/20 plan?

When you enroll in an 80/20 plan, you'll have other costs on top of your 20 percent share of medical bills. To purchase medical insurance, you need to pay a monthly premium to your insurance company . This money only keeps your insurance active and does not go toward paying your medical expenses.

What is a deductible for health insurance?

A deductible is the amount you need to pay completely on your own for health care before your insurance kicks in. If your plan has a $2,000 deductible, you'll need to pay all of your first $2,000 in expenses before the 80/20 split comes into play.

What happens if you go over the 80/20 limit?

If your bills go over the coinsurance maximum limit for the year, your insurance company will start paying 100 percent of your costs for the rest of the year.

How does 80/20 work?

How Payment Works. An 80/20 plan splits up your bill immediately after treatment. When a doctor or hospital administrator sees your card, he will know to send 80 percent of the costs to your insurance company and leave you with the remaining bill.

Can insurance companies deny essential care?

Your insurer can place limits on how much they pay for non-essential health care , but they cannot deny payment for essential care. Any limits appear in your insurance policy documentation.

What is the 80/20 rule in 2012?

In 2012, insurance companies that meet or exceed the standard in the 2011 coverage year will send a notice to consumers explaining the purpose of the 80/20 rule and notifying consumers that they met or exceeded the standard. Insurance companies will provide consumers with unprecedented information about the value consumers get for every dollar ...

How many consumers are insured by insurance companies?

Approximately 66.7 million consumers are insured by an insurance company that provides the required value for their premium dollars. This means that a large majority of consumers are insured by companies that meet or exceed the MLR standard: 62% of consumers in the individual market; 83% in the small group market; and 89% in the large group market.

What is the new law that holds insurance companies accountable to consumers?

The new health reform law, the Affordable Care Act, holds health insurance companies accountable to consumers and ensures that American families are reimbursed if health insurance companies don’t meet a fair standard of value. Because of the Affordable Care Act, insurance companies now must reveal how much of premium dollars they actually spend on ...

Why do insurance companies have to disclose how much they spend on health care?

Because of the Affordable Care Act, insurance companies now must reveal how much of premium dollars they actually spend on health care and how much they spend on administration, such as salaries and marketing. This information was not shared with consumers in the past. Not only is this information made available to consumers for the first time, ...

How much are insurance premiums increased?

Insurance companies are now required to subject insurance premium rate increases of 10% or more to a new review process and justify these increases. Most states now have the authority to determine whether these increases are excessive, while HHS reviews rates in states that do not operate effective rate review programs.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Is my test, item, or service covered?

Find out if your test, item or service is covered. Medicare coverage for many tests, items, and services depends on where you live. This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

What is 80/20 in insurance?

The other 20% can go to administrative, overhead, and marketing costs. The 80/20 rule is sometimes known as Medical Loss Ratio, or MLR. If an insurance company uses 80 cents out of every premium dollar to pay for your medical claims and activities that improve the quality of care, the company has a Medical Loss Ratio of 80%.

What happens if my insurance company doesn't meet its 80/20 target?

If your insurance company doesn’t meet its 80/20 targets for the year, you’ll get back some of the premium that you paid. You may see the rebate in a number of ways: A lump-sum deposit into the same account that was used to pay the premium, if you paid by credit card or debit card.

How much of your insurance premiums must be spent on care and quality improvement?

Insurance companies selling to large groups (usually more than 50 employees) must spend at least 85% of premiums on care and quality improvement. If your insurance company doesn’t meet these requirements, you’ll get a rebate on part of the premium that you paid.

Who pays the rebate for a small group plan?

For small group and large group plans, the rebate is usually paid to the employer. It may use one of the above rebate methods, or apply the rebate in a way that benefits employees.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.

What is the 80/20 plan?

The 80/20 plan is a common healthcare plan , but you may save money on premiums by changing the numbers to 70/30 or even 50/50. Just remember, you'll pay more in the case of an accident or unexpected medical necessity.

How much does insurance pay out of pocket?

Once you pay the deductible amount, insurance begins to pay, and you pay the 20 percent of the bill up to your out-of-pocket maximum. Choosing a higher deductible plan often lowers your personal monthly premium or the amount of money you pay out of pocket for your health plan.

How much does coinsurance pay?

Most coinsurance plans do cap the total amount you pay with out-of-pocket limits. You would pay 20 percent of your total healthcare costs until you reach your out-of-pocket limit. Then the insurance pays 100 percent of your medical expenses.

Does 80/20 coinsurance cover medical bills?

Coinsurance Covered Services. The 80/20 coinsurance coverage only works on covered services. Make sure the healthcare service you are going to need is covered by your health plan. When it is not covered, you pay the entire cost of the procedure or medical bill. When you sign up for your health insurance, the company sends you a packet listing ...

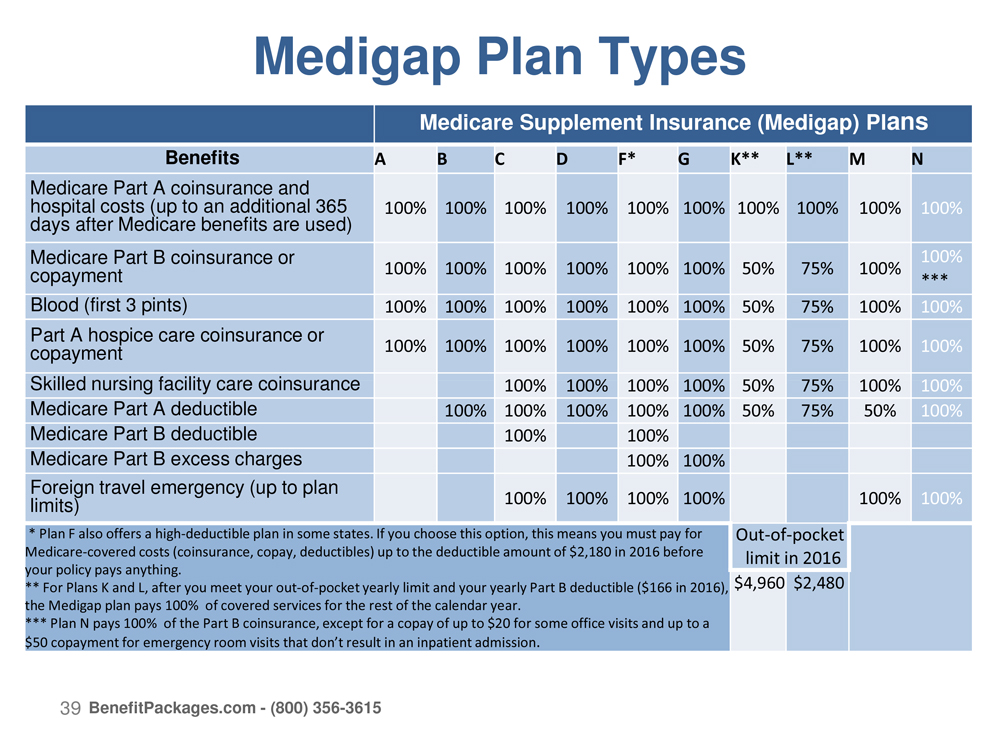

How many different letter plans are there for Medigap?

There are 10 different “letter” plans for Medigap. Under federal rules, all insurers selling a particular plan (A, B, C, etc.) must cover the same things. Coverage requirements of the plans are explained on page 11 of Medicare’s guide to Medigap policies.

What is Medicare Part B?

Medicare Part B pays only 80% of covered expense for doctors, outpatient services and durable medical equipment; beneficiaries are responsible for the other 20%. Medigap plans pay that 20%, and can also step in and cover lots of other things. The details depend on which plan you buy.

How is Medigap regulated?

Medigap plans are regulated by state insurance departments. Once you’ve narrowed your policy search, you should touch base with your state insurance department to see if it has assembled any consumer-complaint data that would help you make an informed decision.

Can you have a Medicare Advantage plan and a Medigap policy?

They also provide annual ceilings on out-of-pocket expenses and work somewhat like Medigap policies. In fact, you can’t have a Medicare Advantage plan and a Medigap policy.

What services does Medicare cover?

Medicare-covered services include, but aren't limited to: Semi-private room (a room you share with other patients) Meals. Skilled nursing care. Physical therapy (if needed to meet your health goal) Occupational therapy (if needed to meet your health goal)

What is SNF in Medicare?

Skilled nursing facility (SNF) care. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Care like intravenous injections that can only be given by a registered nurse or doctor. The way that Original Medicare measures your use of hospital and skilled nursing facility (SNF) services.

How many days do you have to stay in a hospital to qualify for SNF?

Time that you spend in a hospital as an outpatient before you're admitted doesn't count toward the 3 inpatient days you need to have a qualifying hospital stay for SNF benefit purposes. Observation services aren't covered as part of the inpatient stay.

When does the SNF benefit period end?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period.

Who certifies SNF?

You get these skilled services in a SNF that’s certified by Medicare.

How long do you have to be in the hospital to get SNF?

You must enter the SNF within a short time (generally 30 days) of leaving the hospital and require skilled services related to your hospital stay. After you leave the SNF, if you re-enter the same or another SNF within 30 days, you don't need another 3-day qualifying hospital stay to get additional SNF benefits.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. , and the Part B.

What percentage of Medicare payment does a supplier pay for assignment?

If your supplier accepts Assignment you pay 20% of the Medicare-approved amount, and the Part B Deductible applies. Medicare pays for different kinds of DME in different ways. Depending on the type of equipment:

What is Medicare assignment?

assignment. An agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance. you pay 20% of the. Medicare-Approved Amount.

Does Medicare cover DME equipment?

You may be able to choose whether to rent or buy the equipment. Medicare will only cover your DME if your doctors and DME suppliers are enrolled in Medicare. Doctors and suppliers have to meet strict standards to enroll and stay enrolled in Medicare.

Rate Review

80/20 Rule

- The 80/20 Rule generally requires insurance companies to spend at least 80% of the money they take in from premiums on health care costs and quality improvement activities. The other 20% can go to administrative, overhead, and marketing costs. The 80/20 rule is sometimes known as Medical Loss Ratio, or MLR. If an insurance company uses 80 cents out...

Will I Get A Rebate Check from My Insurance Company?

- If your insurance company doesn’t meet its 80/20 targets for the year, you’ll get back some of the premium that you paid. You may see the rebate in a number of ways: 1. A rebate check in the mail 2. A lump-sum deposit into the same account that was used to pay the premium, if you paid by credit card or debit card 3. A direct reduction in your future premium 4. Your employer may also …

Does This Apply to My Plan?

- It depends. For Rate Review: These requirements don’t apply to grandfathered plans. Check your plan’s materials or ask your employer or your benefits administrator to find out if your health plan is grandfathered. For the 80/20 Rule:These rights apply to all individual, small group, and large group health plans, whether your plan is grandfathered or not.