2016 Social Security and Medicare Tax Withholding Rates and Limits

| Tax | 2015 Limit | 2016 Limit |

| Social Security Gross | $118,500.00 | $118,500.00 |

| Social Security Liability | $7,347.00 | $7,347.00 |

| Medicare Gross | No Limit | No Limit |

| Medicare Liability | No Limit | No Limit |

...

2016 Social Security and Medicare Tax Withholding Rates and Limits.

Will Medicare premiums and deductibles increase in 2016?

Nov 10, 2015 · The daily coinsurance amounts will be $322 for the 61 st through 90 th day of hospitalization in a benefit period and $644 for lifetime reserve days. For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 in a benefit period will be $161.00 in 2016 ($157.50 in 2015).

What is the income threshold for additional Medicare tax?

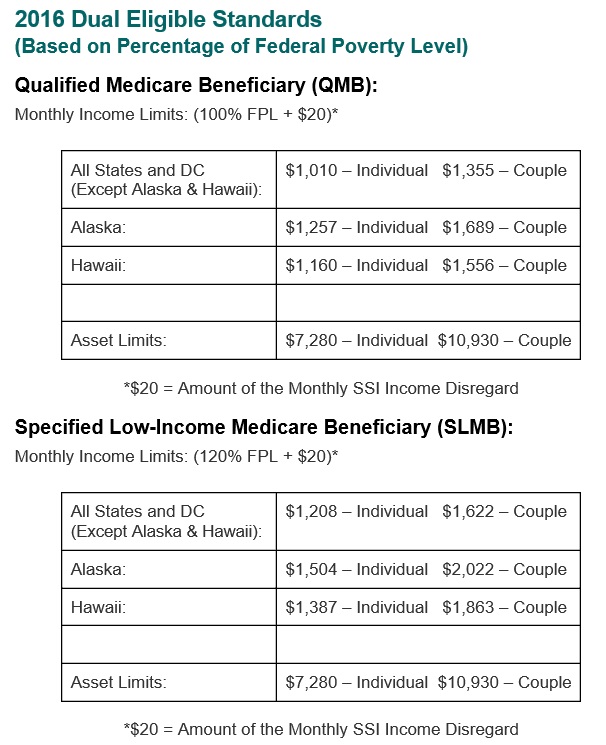

ask you to pay a part of your Medicare Part A premium. In 2016, the resource limits for the QMB, SLMB, and QI programs are $7,280 for a single person and $10,930 (doesn’t include $1,500 burial fund disregard) for a married person living with a spouse and no other dependents. These resource limits are adjusted on January 1 of each year,

What is the income limit to receive Medicare?

Feb 18, 2022 · Topic No. 560 Additional Medicare Tax. A 0.9% Additional Medicare Tax applies to Medicare wages, self-employment income, and railroad retirement (RRTA) compensation that exceed the following threshold amounts based on filing status: $250,000 for married filing jointly; $125,000 for married filing separately; and. $200,000 for all other taxpayers.

How many Americans are enrolled in Medicare Part B in 2016?

The threshold amounts are based on your filing status: Single, head of household, or qualifying widow (er) — $200,000. Married filing jointly — $250,000. Married filing separately — $125,000. For purposes of the additional Medicare tax, earned income includes: Wages. Bonuses. Tips.

Is there a cap on additional Medicare tax?

What is the Social Security cap for 2016?

| Year | Amount |

|---|---|

| 2016 | $118,500 |

| 2017 | $127,200 |

| 2018 | $128,400 |

| 2019 | $132,900 |

What is the 2016 Medicare Tax Rate This rate is applied to what maximum level of salary and wages?

What is the 3.8 Medicare surtax?

How much can I make on SSDI in 2016?

What is the Social Security tax limit for 2021?

How do you calculate additional Medicare tax 2021?

What is the 2016 Medicare tax rate?

What is the additional Medicare tax for 2021?

2.35% Medicare tax (regular 1.45% Medicare tax + 0.9% additional Medicare tax) on all wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return). (Code Sec. 3101(b)(2))Oct 15, 2020

Who pays additional Medicare tax 2021?

How is additional Medicare tax calculated?

...

What is the additional Medicare tax?

Who pays the 3.8 Obamacare tax?

What is the maximum Social Security tax for 2016?

The Social Security Tax Rate remains at 6.2 percent. The resulting maximum Social Security Tax for 2016 is $7,347.00. There is no limit on the amount of earnings subject to Medicare (Hospital Insurance) Tax.

What is the FICA tax rate for 2016?

The FICA Tax Rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2016 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

When did Medicare withholding change?

Note: The Patient Protection and Affordable Care Act signed into law March 23, 2010, created the “additional Medicare Tax” that changed Medicare withholding computations effective January 1, 2013. All wages, self-employment income, and other compensation that are subject to regular Medicare Tax and are paid in excess of ...

Is Medicare taxed on self employment?

All wages, self-employment income, and other compensation that are subject to regular Medicare Tax and are paid in excess of the applicable threshold are subject to the additional Medicare Tax.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

How much tax do you pay on Medicare?

For example, if you’re a single tax filer with an employment income of $250,000, you’d pay the standard 1.45 percent on $200,000 of your income, and then 2.35 percent on the remaining $50,000. So, in this example, you’d pay $4,075 in Medicare taxes for the year.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

What happens when you file Medicare taxes?

In some cases, you might owe more, and in other cases, you might have paid too much. Any payment owed or refund adjustment needed will be added to your overall required payment or refund amount.

How much Medicare do self employed people pay in 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

Do you have to pay taxes on Medicare?

While everyone pays some taxes toward Medicare, you’ll only pay the additional tax if you’re at or above the income limits. If you earn less than those limits, you won’t be required to pay any additional tax. If your income is right around the limit, you might be able to avoid the tax by using allowed pre-tax deductions, such as:

How to calculate Medicare taxes?

If you receive both Medicare wages and self-employment income, calculate the Additional Medicare Tax by: 1 Calculating the Additional Medicare Tax on any Medicare wages in excess of the applicable threshold for the taxpayer's filing status, without regard to whether any tax was withheld; 2 Reducing the applicable threshold for the filing status by the total amount of Medicare wages received (but not below zero); and 3 Calculating the Additional Medicare Tax on any self-employment income in excess of the reduced threshold.

What form do you need to request an additional amount of income tax withholding?

Some taxpayers may need to request that their employer withhold an additional amount of income tax withholding on Form W-4, Employee’s Withholding Certificate, or make estimated tax payments to account for their Additional Medicare Tax liability.

Can non-resident aliens file Medicare?

There are no special rules for nonresident aliens or U.S. citizens and resident aliens living abroad for purposes of this provision. Medicare wages, railroad retirement (RRTA) compensation, and self-employment income earned by such individuals will also be subject to Additional Medicare Tax, if in excess of the applicable threshold for their filing status.

Is railroad retirement subject to Medicare?

All Medicare wages, railroad retirement (RRTA) compensation, and self-employment income subject to Medicare Tax are subject to Additional Medicare Tax, if paid in excess of the applicable threshold for the taxpayer's filing status. For more information on ...

What is the threshold for Medicare tax?

What is the Income Threshold for Additional Medicare Tax? If you are a high earner, you are subject to the 0.9% additional Medica re tax on earned income in excess of the threshold amount . The threshold amounts are based on your filing status: Single, head of household, or qualifying widow (er) — $200,000.

What is the extra tax on Medicare?

Under the Affordable Care Act, taxpayers who earn above a set income level (depending on filing status) pay 0.9% more into Medicare on top of the regular contribution. This extra tax is called the Additional Medicare Tax.

How much does my spouse pay in Medicare?

Your spouse earns $10,000. Since your joint earned income ($235,000) isn’t more than $250,000, you won’t owe Additional Medicare Tax. However, your employer will still withhold the tax from your paycheck on wages over $200,000.

When does Medicare start withholding?

Your filing status isn’t important for this. Withholding starts when your wages and other compensation are more than $200,000 for the year.

Why don't people pay for Medicare?

Most people don’t pay for Medicare Part A (hospital insurance) because its funded by taxpayer contributions to the Social Security Administration. Employees pay 1.45% of their earnings, employers pay another 1.45%, and self-employed individuals pay the full 2.9% on their own.

Does Medicare tax withheld from paycheck?

Any tax withheld from your paycheck that you’re not liable for will be applied against your taxes on your income tax return. If you earn $200,000 or less, your employer will not withhold any of the additional Medicare tax. This could happen even if you’re liable for the tax.

What is the personal exemption for 2016?

The personal exemption for tax year 2016 is $4,050. The adjusted gross incomes phase-out range begins and ends as follows:

What is the tax rate for Medicare and Social Security?

Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount. The Medicare portion is 1.45% on all earnings. Source: Social Security Administration.

What is the Medicare payroll tax rate?

For employees, the Medicare payroll tax rate is 1.45 percent on all earnings, bringing the combined Social Security and Medicare payroll tax for employees to 7.65 percent—with only the Social Security portion limited to the $118,500 earned-income threshold.

How much is Social Security financed?

Social Security is financed by a 12.4 percent tax on wages up to the annual threshold, with half (6.2 percent) paid by workers and the other half paid by employers. This taxable wage base usually goes up each year—it rose from $117,000 in 2014 to $118,500 in 2015.

How much is the earned income credit?

For example, the maximum earned income credit amount is $6,269 for taxpayers filing jointly who have 3 or more qualifying children, phasing out completely when adjusted gross income (or, if greater, earned income) reaches $53,505.

Does Medicare withholding apply to employees?

Additional Medicare Tax withholding applies only to employee compensation in excess of these thresholds in a calendar year. These thresholds are not inflation-adjusted, and thus they apply to more employees each year.

Is there a COLA for Social Security?

He added, “Since there is no COLA, the statute also prohibits a change in the maximum amount of earnings subject to the Social Security tax, as well as the retirement earnings test exempt amounts.”

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What age does QDWI pay Medicare?

The QDWI program helps pay the Medicare Part A premium for certain individuals under age 65 who don’t qualify for premium-free Part A.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.