For the 2021 tax year, the additional Medicare withholding applies to individuals that earn: All individuals that make above the income thresholds are subject to the additional Medicare withholding. Whether you’re working for an employee or self-employed, the additional Medicare withholding rate is 0.9 percent.

How to calculate additional Medicare tax properly?

For 2021, the FICA tax rate for both employers and employees is 7.65% (6.2% for Social Security and 1.45% for Medicare). For 2021, the Social Security tax rate is 6.2% each for the employer and employee (12.4% total) on the first $142,800 of employee wages. What are the payroll tax rates for 2020? 2020 Income Tax Brackets 2019 Taxable Income.

Do employers match additional Medicare tax?

Feb 18, 2022 · Topic No. 560 Additional Medicare Tax. A 0.9% Additional Medicare Tax applies to Medicare wages, self-employment income, and railroad retirement (RRTA) compensation that exceed the following threshold amounts based on filing status: $250,000 for married filing jointly; $125,000 for married filing separately; and. $200,000 for all other taxpayers.

How to calculate Medicare surtax?

Jul 06, 2021 · The Medicare tax rate in 2021 is 2.9%. That amount is split evenly between employers and employees, with each side paying 1.45% respectively. The Medicare tax rate has gradually increased over the years since debuting at 0.7% (0.35% for both employer and employee) in 1966.

Who pays Medicare surtax?

In 2021, the Medicare tax rate is 2.9%, which is split between an employee and their employer. Self-employed individuals are responsible for both portions of Medicare tax but only on 92.35% of business earnings. There are two additional Medicare surtaxes that apply to certain high earners.

How do you calculate additional Medicare tax 2021?

It is paid in addition to the standard Medicare tax. An employee will pay 1.45% standard Medicare tax, plus the 0.9% additional Medicare tax, for a total of 2.35% of their income....What is the additional Medicare tax?StatusTax thresholdmarried tax filers, filing separately$125,0003 more rows•Sep 24, 2020

What is the Medicare tax surcharge for 2021?

0.9 percentThe extra tax was announced as part of the Affordable Care Act and is known as the Additional Medicare Tax. The tax rate for the Additional Medicare Tax is 0.9 percent. That means you'll pay 2.35 percent if you receive employment wages. Self-employed taxpayers will pay 3.8 percent.

What income is subject to the 3.8 Medicare tax?

There is a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000 of AGI.Nov 9, 2021

How much is additional Medicare tax?

0.9%The additional Medicare tax rate is 0.9%. However, the additional 0.9% only applies to the income above the taxpayer's threshold limit. 9 For example, if you earn $225,000 a year, the first $200,000 is subject to Medicare tax of 1.45%, and the remaining $25,000 is subject to additional Medicare tax of 0.9%.

What is the federal tax rate for 2021?

How We Make MoneyTax rateSingleMarried filing jointly or qualifying widow10%$0 to $9,950$0 to $19,90012%$9,951 to $40,525$19,901 to $81,05022%$40,526 to $86,375$81,051 to $172,75024%$86,376 to $164,925$172,751 to $329,8504 more rows•5 days ago

What is the additional Medicare tax for 2022?

0.9%2022 updates 2.35% Medicare tax (regular 1.45% Medicare tax plus 0.9% additional Medicare tax) on all wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return).Jan 12, 2022

Who pays the 3.8 investment tax?

individual taxpayersEffective Jan. 1, 2013, individual taxpayers are liable for a 3.8 percent Net Investment Income Tax on the lesser of their net investment income, or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

Who is subject to the additional Medicare tax?

An employer must withhold Additional Medicare Tax from wages it pays to an individual in excess of $200,000 in a calendar year, without regard to the individual's filing status or wages paid by another employer.Jan 18, 2022

Does Everyone Pay Medicare Tax?

If your income is reported for tax filing purposes, then you will typically pay the Medicare tax.

Is There a Limit on Medicare Tax?

Unlike Social Security taxes, there is no limit on how much of your income is subject to Medicare taxes. The Medicare tax rate applies to all earned income and taxable wages, and there is no minimum income required to be subject to Medicare taxes.

How Is Medicare Tax Calculated?

The Medicare tax rate is determined by the IRS and is subject to change. To calculate the Medicare tax, multiply your earnings by 0.0145. So if your biweekly pay is $2,000, your Medicare tax will be $29 (2,000 x 0.0145 = 29).

What if I Have Additional Medicare Tax Questions?

You may call 1-800-MEDICARE (1-800-633-4227) with any additional questions about Medicare.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

What is the Medicare tax rate?

The standard Medicare tax is 1.45 percent, or 2.9 percent if you’re self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What are the benefits of the Affordable Care Act?

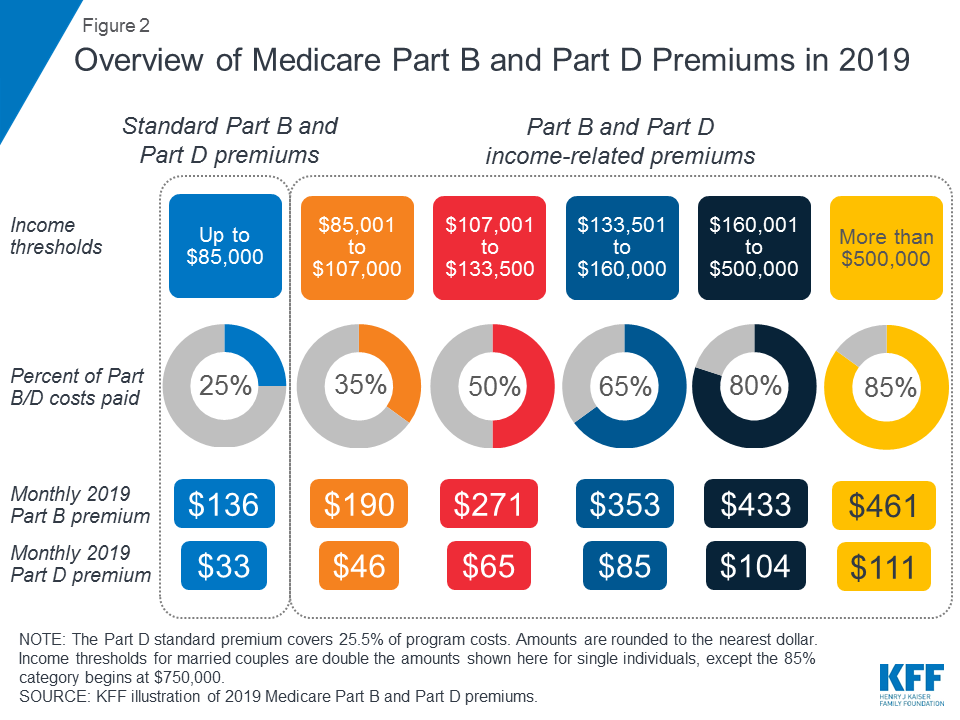

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA tax?

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

How to fill out 8959?

Working through Form 8959 1 Fill out Part I if you received W-2 income. 2 Fill out Part II if you received self-employment income. 3 Fill out Part III if you received RRTA

Does the above article give tax advice?

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

What is the Medicare tax rate?

The Medicare tax rate is 2.9% of the employee's taxable wages, with 1.45% paid by the employee and 1.45% paid by the employer. The Additional Medicare Tax rate is 0.9% for the employee only. The employer doesn't have to pay this additional tax. 1.

Who is Jean Murray?

Jean Murray, MBA, Ph.D., is an experienced business writer and teacher. She has written for The Balance on U.S. business law and taxes since 2008. The Additional Medicare Tax is owed by higher-income employees, and employers are responsible for withholding this tax and paying it to the Internal Revenue Service (IRS).

Is fringe benefit taxable?

Some wages and fringe benefits are taxable to the employee for income tax purposes , but some wages may not be taxable to the employee for Social Security and Medicare taxes, including the Additional Medicare Tax. You must exclude the wages not subject to Social Security and Medicare taxes when you calculate the wages subject to ...

Does Medicare tax self employed?

The new Medicare tax also affects self-employed individuals who earn over a specific amount. If you are both an employee and self-employed, all sources of earned income (as opposed to investment income) are combined to reach the levels where the Additional Medicare Tax is applicable.