How much is Medicare every year?

2022If your yearly income in 2020 (for what you pay in 2022) wasYou pay each month (in 2022)File individual tax returnFile joint tax return$91,000 or less$182,000 or less$170.10above $91,000 up to $114,000above $182,000 up to $228,000$238.10above $114,000 up to $142,000above $228,000 up to $284,000$340.203 more rows

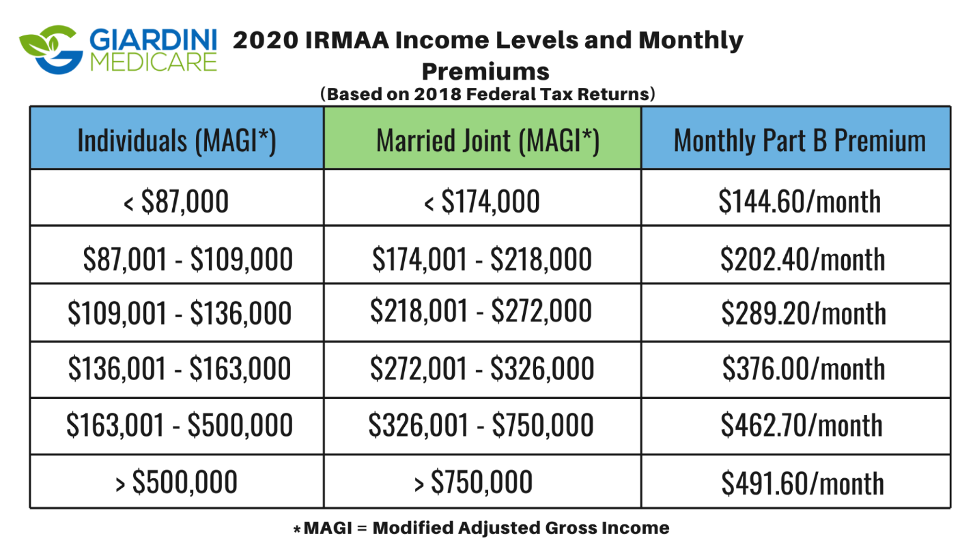

What is the 2020 Medicare cost?

$144.60The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

What is the premium for Medicare Part B for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

How much is taken out of Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Is Medicare free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Does Social Security count as income for Medicare premiums?

(Most enrollees don't pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How can I lower my Medicare Part B premium?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

What is the cost of Medicare Part B in 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Why do I have a Medicare premium bill?

What is it? An extra amount you pay in addition to your Part D plan premium, if your income is above a certain amount. . Most people don't get a bill from Medicare because they get these premiums deducted automatically from their Social Security (or Railroad Retirement Board) benefit.)

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How much is Medicare each month?

$170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

What is the current Medicare premium?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

How much does Medigap cost?

The average Medigap premiums can be anywhere from $20 to over $500. Essentially, you are paying an extra monthly cost to have more coverage later on if Original Medicare falls short. Deductibles range from $203 (the deductible you pay for Medicare Part B) to $6,220, if you opt for a high-deductible Medigap plan.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is the late enrollment penalty for Medicare?

The penalties are added to your monthly premium. Part A late enrollment penalty : 10% higher premium for twice the number of years you didn’t sign up. Part B late enrollment penalty : 10% higher premium for every 12 months you don’t sign up after becoming eligible, for as long as you have the plan.

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

Which states have the lowest Medicare premiums?

States with the lowest average premiums: Wisconsin, Hawaii, Iowa, New Mexico, North Carolina. Medicare Supplement Insurance provides coverage for deductibles, copayments and other out-of-pocket expenses brought on by Part A and Part B. Learn more about Medicare Supplement Insurance plans in your state.

Is Christian Worstell a medicare supplement?

It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums. Christian Worstell is a health care and policy writer for MedicareSupplement.com. He has written hundreds of articles helping people better understand their Medicare coverage options.

Is Medicare Advantage available in Alaska?

These plans provide the same benefits offered by Original Medicare, and many Medicare Advantage plans offer additional benefits such as prescription drug coverage and routine hearing and dental care. *Medicare Advantage is not sold in Alaska, and data was not made available for Wyoming or Washington, D.C. State. Monthly Cost.

What are the costs of Medicare Advantage?

What Other Costs Do Medicare Advantage Plans Have in 2020? 1 A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in. Some Medicare Advantage plans may offer a $0 deductible. 2 Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

How much does Medicare Advantage cost?

The average premium for a Medicare Part C plan (also known as Medicare Advantage) was $35.55 per month in 2018. 1. Medicare Advantage plans are sold by private insurance companies. Part C plan costs can vary depending on several factors, including what plan you have and where you live.

What is Part C insurance?

Part C plans may also include costs such as deductibles and coinsurance (or copayments). A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in.

Does Medicare Advantage cover hospital insurance?

Medicare Advantage plans must offer at least the same benefits that are covered by Medicare Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plan carriers are able to also offer extra benefits that Original Medicare (Part A and Part B) don’t cover. In addition to prescription drug coverage that is offered by many ...

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans may offer a $0 deductible. Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.