What wages are subject to Medicare tax?

Dec 10, 2021 · Key Takeaways. Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee’s wages. Employers also pay 1.45%. The Medicare tax for self-employed individuals is 2.9% to cover both the employee’s and employer’s portions.

What is Medicare tax withheld for maximum salary?

Mar 15, 2022 · Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual's wages paid in excess of $200,000 in a calendar year, without regard to filing status. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee and continue to withhold it each pay period …

Is there wage cap on Medicare taxes?

No Annual Wage Limit for Medicare Tax Unlike the Social Security tax, the Medicare tax does not have an annual wage limit. Therefore, every dollar of the employees' gross pay is subject to the Medicare tax of 1.45% and must be matched by the employer. However, the Additional Medicare Tax for higher income individuals is not matched by the employer.

What is the maximum income taxed for Medicare?

Nov 11, 2021 · In 2021, IRMAA surcharges apply to individual Medicare beneficiaries who earn more than $88,000, and to couples who earn more than $176,000. For 2022, these limits are projected to increase to $91,000 and $182,000, respectively.

What is the Medicare wage limit for 2020?

The Medicare wage base will not have a dollar limit for 2020. The employer and employee tax rates will remain the same in 2020. The Social Security (full FICA) rate remains at 7.65% (6.20% Social Security plus 1.45% Medicare) for wages up to $137,700. All wages over $137,700 are subject only to the 1.45% Medicare rate.

What is the wage base limit for Medicare?

Social security and Medicare tax for 2022. The Medicare tax rate is 1.45% each for the employee and employer, unchanged from 2021. There is no wage base limit for Medicare tax. Social security and Medicare taxes apply to the wages of household workers you pay $2,400 or more in cash wages in 2022.

Do you pay Medicare tax on all income?

The Medicare tax is a payroll tax that applies to all earned income and supports your health coverage when you become eligible for Medicare.Feb 18, 2022

Does the 3.8 Medicare tax apply to wages?

First off, the new Medicare tax increases the existing 2.9% Medicare tax rate on wages and earnings to 3.8% (on wages above $200,000 on a single return, $250,000 on a joint return, or $125,000 if married filing separately), of which the additional amount is borne only by the employee.

What are Medicare wages?

Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax.

What wages are subject to Social Security tax?

Social Security wages include:Hourly wages and salaried wages.Bonuses.Commissions.Tips that exceed $20 per month.Sick time.Paid time off.Payments in-kind (goods, services, etc.), unless the employee is a household or agricultural worker.Elective retirement contributions.

What income is subject to the 3.8 Medicare tax?

Income Tax Calculator: Estimate Your Taxes There is a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000 of AGI.Nov 9, 2021

Is there a Medicare tax limit?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

Can Medicare wages be higher than wages?

There is no maximum wage base for Medicare taxes. The amount shown in Box 5 may be larger than the amount shown in Box 1. Medicare wages include any deferred compensation, retirement contributions, or other fringe benefits that are normally excluded from the regular income tax.

Are qualified dividends subject to Medicare tax?

The maximum federal tax rate on long-term capital gains and qualified dividends will be 23.8% (20% plus 3.8% additional Medicare Contribution Tax on net investment income). The threshold amounts are not indexed for inflation.

What does the 3.8 surtax apply to?

The net investment income tax (NIIT) is a 3.8% tax on investment income such as capital gains, dividends, and rental property income. This tax only applies to high-income taxpayers, such as single filers who make more than $200,000 and married couples who make more than $250,000, as well as certain estates and trusts.

How are Medicare wages calculated?

The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction. Dental – subtract the YTD employee dental insurance deduction.

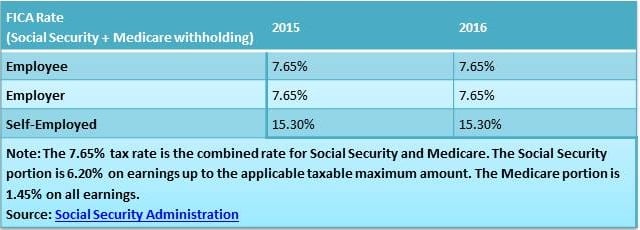

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What are Medicare income limits?

Medicare beneficiaries with incomes above a certain threshold are charged higher premiums for Medicare Part B and Part D. The premium surcharge is...

Why does Medicare impose income limits?

The higher premiums for Part B took effect in 2007, under the Medicare Modernization Act. And for Part D, they took effect in 2011, under the Affor...

Who is affected by the IRMAA surcharges and how does this change over time?

There have been a few recent changes that affect high-income Medicare beneficiaries: In 2019, a new income bracket was added at the high end of the...

Will there be a rate increase in 2022?

We don’t yet have concrete details from CMS. But the Medicare Trustees Report, which was published in late August, projects that the standard Part...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

How much is Medicare tax?

Therefore, every dollar of the employees' gross pay is subject to the Medicare tax of 1.45% and must be matched by the employer.

What is the annual wage limit?

Definition of Annual Wage Limit. Annual wage limit is a term in payroll accounting associated with the Social Security payroll tax. The annual wage limit is also known as the annual wage base, wage ceiling, taxable maximum, and maximum taxable earnings. The annual wage limit applies to only the Social Security payroll tax portion ...

How much is Social Security tax in 2021?

Assume that an employee has gross wages of $150,000 during the year 2021. Only $142,800 of the employee's wages are subject to the Social Security tax of 6.2%. As a result, the amount withheld from the employee's pay for the Social Security tax will be $8,853.60 ($142,800 X 0.062). In addition, the employer must match the amount withheld ...

What is the Social Security wage limit for 2021?

The annual wage limit for the Social Security tax is adjusted each year. In 2021, the annual wage limit is $142,800. This means that in the year 2021, only the first $142,800 of an employee's (or self-employed's) gross wages, salaries, bonuses, etc. will be subject to the Social Security tax of 6.2%. In addition to the amounts withheld ...

Does an employer have to match Social Security taxes?

In addition to the amounts withheld from its employees, the employer must match the amount of the Social Security taxes. (Self-employed individuals must pay both the employee and the employer portions of the payroll tax.)

How much does Medicare pay for Part D?

If you earn more than $88,000 but less than $412,000, you’ll pay $70.70 on top of your plan premium. If you earn $412,000 or more, you’ll pay $77.10 in addition to your plan premium. Medicare will bill you for the additional Part D fee every month.

How much do you have to pay in taxes if you make more than $412,000 a year?

If you earn more than $412,000 per year, you’ll have to pay $504.90 per month in taxes. Part B premiums will be cut off directly from your Social Security or Railroad Retirement Board benefits. Medicare will send you a fee every three months if you do not receive either benefit.

What is SLMB in Medicare?

SLMB, or Specified Low-Income Medicare Beneficiary. If you earn less than $1,296 per month and have less than $7,860 in assets, you may be eligible for SLMB. Married couples must make less than $1,744 per month and have less than $11,800 in debt to qualify. This plan covers your Part B premiums.

What happens if you retire in 2020 and only make $65,000?

Loss of income from another source. If you were employed in 2019 and earned $120,000 but retired in 2020 and now only make $65,000 from benefits, you may want to challenge your IRMAA. To keep track of your income fluctuations, fill out the Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event form.

What is the income limit for QDWI?

You must meet the following income criteria if you want to enroll in your state’s QDWI program: Individuals must have a monthly income of $4,339 or less and a $4,000 resource limit. A married couple’s monthly income must be less than $5,833. A married couple’s resource limit must be less than $6,000.

How much will Part D cost in 2021?

Through the Extra Help program, prescriptions can be obtained at a significantly reduced cost. In 2021, generic drugs will cost no more than $3.70, while brand-name prescriptions will cost no more than $9.20.

How much do you have to pay for Part B?

If this is the case, you must pay the following amounts for Part B: If you earn less than $88,000 per year, you must pay $148.50 per month. If you earn more than $88,000 but less than $412,000 per year, you must pay $475.20 per month.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Understand annual wage base limits

A wage base limit is a per-employee cap on the earnings that are taxable. Once an employee reaches the cap, taxes may stop or increase.

How to update wage base limits

Note: Not sure which payroll service you have? Here's how to find which payroll service you have.

See wage bases and limits (for reference)

Federal Income Tax is based on the employee. See IRS Publication 15 (Circular E) for calculations.

How to see your employee wage base limits

This report shows detailed information about how QuickBooks calculates tax amounts on employee paychecks and the wage base limit for each employee for each tax.