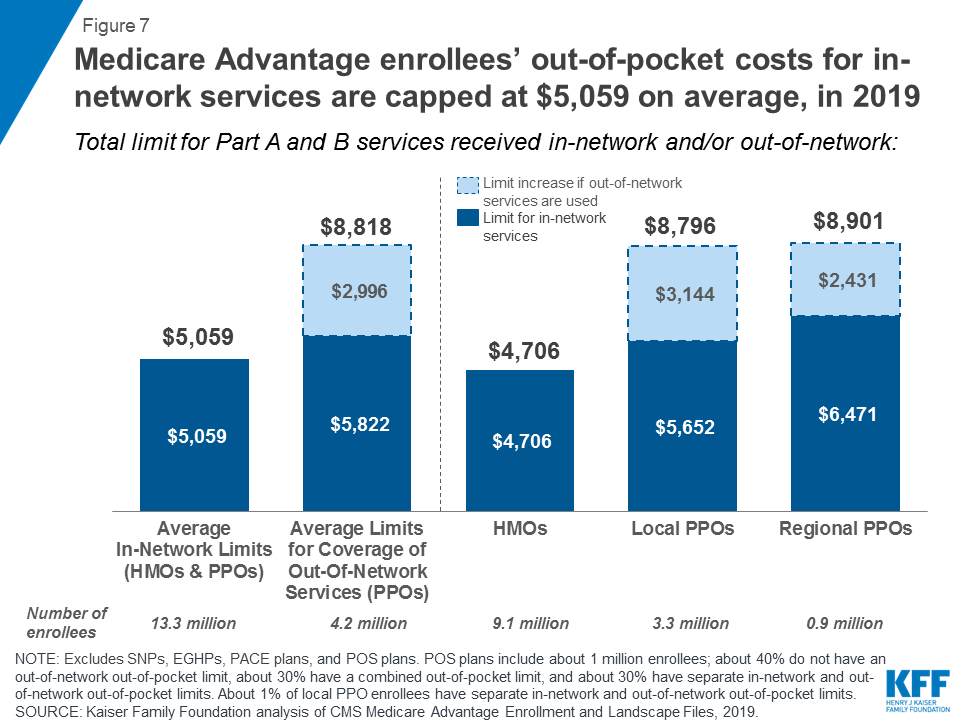

What is the average cost of Medicare Advantage plans?

Dear Rusty: I was told that I can use Medicare Parts A and B as secondary coverage to my Medicare Advantage plan. Is that true? Signed: Puzzled More: Ask Rusty – I Have Medicare Advantage - Why Is a Medicare Premium Deducted from my Social Security?

Is there a monthly premium for Medicare?

What does Medicare cost? Generally, you pay a monthly premium for Medicare coverage and part of the costs each time you get a covered service. There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance (

Does Medicare Advantage cost more?

The Center for Public Integrity data analysis found that Medicare Advantage can cost the government as much as 25 percent more than standard Medicare in some areas. The data analysis also found that seemingly tiny variations in risk scores can boost taxpayer costs enormously — especially in health plans that are growing fast.

How does income affect monthly Medicare premiums?

- Marriage

- Divorce/Annulment

- Death of Your Spouse

- Work Stoppage or Reduction

- Loss of Income-Producing Property

- Loss of Pension Income

- Employer Settlement Payment

How much do Medicare supplement plans usually cost?

Medicare Supplement Plans have premiums that cost anywhere from around $70/month to around $270/month. Typically, plans with higher monthly premiums will have lower deductibles.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan B$242Plan C$288Plan F$256Plan G (our recommendation for best overall plan)$1936 more rows•Jan 24, 2022

What are the top 3 Medicare supplement plans?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is the most basic Medicare supplement plan?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services.

What is the monthly premium for plan G?

How Much Does a Medigap Plan G Cost?StateMonthly premium rangeNumber of Plans availableColorado$110 to $375 $32 to $66 high-deductible57 total *49 (attained age) ^4 (community) ~4 (issue age)California$128 to $246 $37 to $81 high-deductible28 total *26 (attained age) ^2 (issue age)1 more row•Apr 12, 2022

Who is the best Medicare supplement provider?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

What is the deductible for plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses.

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

Are Medicare supplement plans being phased out?

It's been big news this year that as of Jan. 1, 2020, Medigap plans C and F will be discontinued. This change came about as a part of the Medicare Access and CHIP Reauthorization legislation in 2015, which prohibits the sale of Medigap plans that cover Medicare's Part B deductible.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is Plan G Medicare supplement?

Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in both Part A and Part B of Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

What is the difference between Plan N and Plan G?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

How much does Medicare cost in 2021?

There’s no simple answer to this question. Medicare Supplement plans can range from $50-$300+ in monthly premiums.

What is the letter plan on Medigap?

The letter plan itself is a factor that affects your Medigap premium rates. Less popular Medigap plans are priced differently than the top three. This is due to the lesser benefits they offer. Let’s take a look at sample rates for the rest of the Medigap plans, using Florida as the location.

What is Plan N?

Plan N is another popular Medigap plan option. Except for Part B excess charges, it covers everything Plan G covers. This is not a downside if you live in a state that doesn’t allow excess charges to begin with. Plan N Average Monthly Cost in Palm Harbor, FL (34684)*.

Is Plan F deductible?

There’s also a high-deductible version of Plan F. High-Deductible Plan F offers the same benefits as standard Plan F. Premiums for this plan are lower, but there’s a higher deductible the beneficiary must reach before the plan covers all costs.

Is Plan G the same as Plan F?

A high-deductible version of Plan G is also available. It offers the same benefits as standard Plan G. High-Deductible Plan G requires a higher deductible in exchange for lower monthly premiums, like Plan F’s high-deductible option before it.

Is New York a Medigap state?

You might have noticed that New York is not one of those states. You’ll also see it’s best to enroll in a Medigap plan when you become eligible at 65 instead of waiting. Premiums are always subject to increase every year, but you will likely start with higher premiums the older you are when you enroll.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

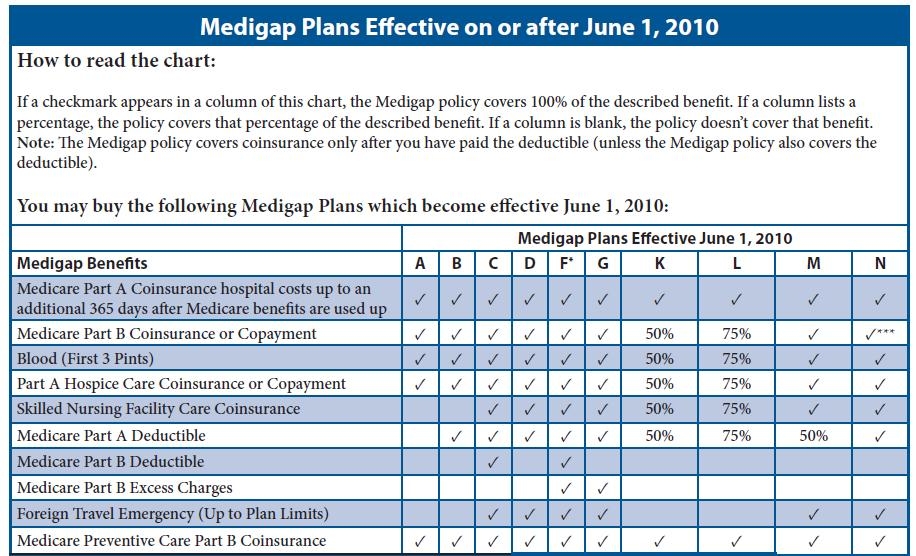

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

What is the average cost of supplemental insurance for Medicare?

On average, you could pay at least $50 a month for Medicare supplemental insurance. But some people pay $300 or more.

What are the best supplemental insurance companies for Medicare?

If you’re unsure where to look for Medigap coverage, start shopping with the best Medicare supplemental insurance companies.

Which factors affect Medicare supplemental insurance policies?

Before you apply for supplemental insurance for Medicare, you’ll need to know what personal characteristics impact your quotes. Let’s examine those factors:

Which Medicare supplement insurance plans are available?

It depends on the company, but Medicare accepts 12 various plans as Medigap coverage. These plans include:

How to Reduce the Average Cost Of Supplemental Insurance For Medicare

Supplemental insurance for Medicare is essential for coverage that standard Medicare doesn’t cover.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is the second most popular Medicare plan?

Medigap Plan G is, in fact, the second-most popular Medigap plan. 17 percent of all Medigap beneficiaries are enrolled in Plan G. 2. The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018. 3.

Which states have the lowest Medicare premiums?

Florida, South Carolina, Nevada, Georgia and Arizona had the lowest weighted average monthly premiums, with all five states having weighted average plan premiums of $17 or less per month. The highest average monthly premiums were for Medicare Advantage plans in Massachusetts, North Dakota and South Dakota. *Medicare Advantage plans are not sold in ...

How to contact Medicare Advantage 2021?

New to Medicare? Compare Medicare plan costs in your area. Compare Plans. Or call. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 to speak with a licensed insurance agent.

What Do Medicare Supplement Plans Cover?

Medigap plans cover all or some of the following costs, with a few exceptions:

What Do Medicare Supplement Plans Cost?

The costs of Medicare Supplement plans vary by state and by insurance company. The main factors that determine cost are your location and age. Keep in mind that a policy that looks less expensive at age 65 could become the most costly at age 85, so ask the insurance company how they set their premium pricing.

How to Apply for a Medicare Supplement Plan

The best time to apply for a Medicare Supplement plan is during your six-month open enrollment period. Open enrollment begins during the first month you’re 65 and enrolled in Medicare Part B. After this one-time open enrollment, you may not be able to purchase a Medigap plan or you might pay a lot more.