What you spend out of pocket may be totally different than what a family member or friend with Medicare pays. But, on average, people spend more than $5,000 out of pocket annually — or more than $400 per month — on their Medicare costs, according to the Kaiser Family Foundation (KFF).

How much are healthcare out of pocket costs?

Feb 15, 2022 · In 2022, the average monthly premium for a Medicare Advantage plan is $62.66 per month. 1 Part D (prescription drug coverage) Medicare Part D plans are also sold by private insurance companies, so plan premiums may vary across the board. The average monthly Part D premium in 2022 is $47.59. 1

How much is health insurance out of pocket cost?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a …

How much did you pay out of pocket?

If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274. Part A hospital inpatient deductible and coinsurance: You pay: $1,556 deductible for each benefit period

How much does Medicare take out of your paycheck?

Jan 03, 2022 · 2 Plan K has an out-of-pocket yearly limit of $6,620 in 2022. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year. 3 Plan L has an out-of-pocket yearly limit of $3,310 in 2022. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the …

How much do Medicare patients pay out-of-pocket?

How much does Medicare cost the average person?

| Medicare plan | Typical monthly cost |

|---|---|

| Part B (medical) | $170.10 |

| Part C (bundle) | $33 |

| Part D (prescriptions) | $42 |

| Medicare Supplement | $163 |

Does Medicare have a maximum out-of-pocket expense?

What are Medicare premiums for 2021?

How much does Medicare take out of Social Security?

Is Medicare Part A free at age 65?

What counts towards out-of-pocket maximum?

What is the out-of-pocket threshold for 2021?

What is the out-of-pocket maximum for Medicare Advantage plans for 2021?

Is Medicare Part B going up 2022?

Why do doctors not like Medicare Advantage plans?

What is the standard Medicare Part B premium for 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

How long do you have to pay late enrollment penalty?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What are the out-of-pocket costs of Medicare?

Some of the out-of-pocket costs you can expect to pay with Original Medicare include deductibles, copayments and coinsurance.

What is Medicare out of pocket?

Original Medicare (Part A and Part B) is the federal health insurance program for people age 65 and older and individuals with certain disabilities. Although Original Medicare provides comprehensive coverage, it still leaves some out-of-pocket costs to recipients.

What is coinsurance in Medicare?

Coinsurance is the percentage of costs you pay for health care expenses after your deductible is met. In most cases, your Medicare Part B coinsurance is 20 percent of the cost of Medicare-approved services. In 2021, your Medicare Part A coinsurance for inpatient hospital care is as follows:

How much is Medicare Part A coinsurance for 2021?

In 2021, your Medicare Part A coinsurance for inpatient hospital care is as follows: Days 1-60: $0 coinsurance for each benefit period. Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each lifetime reserve day after day 90 for each benefit period ...

How many Medigap plans are there?

Medicare Supplement Insurance provides full or partial coverage for some of the out-of-pocket expenses listed above. There are currently 10 standardized Medigap plans available in most states, and each includes a unique blend of basic benefits.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

How much does Plan N pay for Part B?

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission .

What is Medicare out of pocket?

Here's what you can expect to pay for Medicare out of pocket: Premiums. Deductibles and coinsurance.

How much does Medicare cost for a hospital stay?

Medicare Hospital Stays Costs. If you are hospitalized, Medicare Part A has a $1,408 deductible. If you end up spending more than 60 days in the hospital, it will cost you $352 per day for days 61 through 90 and $704 for up to 60 lifetime reserve days after that.

How often does Medicare cover preventive care?

There are some services Medicare beneficiaries are eligible for that aren't subject to these cost-sharing requirements, such as a wellness visit once every 12 months and a variety of preventive care services, including flu shots and cardiovascular disease screenings. "Some preventive screening tests like colonoscopies and mammograms are free under Part B, but only if certain conditions are met," Feke says. However, if a problem is discovered during a preventive visit, it could lead to other medical services that do have an additional cost.

Why do Medicare beneficiaries pay lower premiums?

Medicare Part B payments are prevented by law from reducing Social Security payments, so some Social Security beneficiaries pay lower premiums because their Social Security payments have not increased enough to cover the current standard Medicare premiums.

How much is Medicare Part B deductible?

Medicare Deductibles and Coinsurance. Medicare Part B has a $198 deductible in 2020. After that, Medicare beneficiaries typically need to pay 20% of the cost of most doctor's services.

What is Medicare Advantage Plan?

Another option is to sign up for a Medicare Advantage plan, which means you will receive your Medicare Parts A and B benefits via a private insurance plan instead of original Medicare . Medicare Advantage plans have different cost-sharing requirements for medical services and sometimes more coverage restrictions than traditional Medicare.

How many days can you go without prescriptions?

Premiums are higher for people who go 63 or more days without prescription drug coverage after becoming eligible for Medicare and for high-income Medicare beneficiaries. To get the best value for your money, you will need to continue to compare plans each year because the prices and covered medications change annually.

How much does Medicare typically cost?

Medicare protects people aged 65 and older and younger people with disabilities from financial hardship by providing health insurance. But it comes with out-of-pocket costs. How much Medicare costs depends on how each individual uses it and the choices they make about coverage.

How much does the average Medicare beneficiary spend out of pocket?

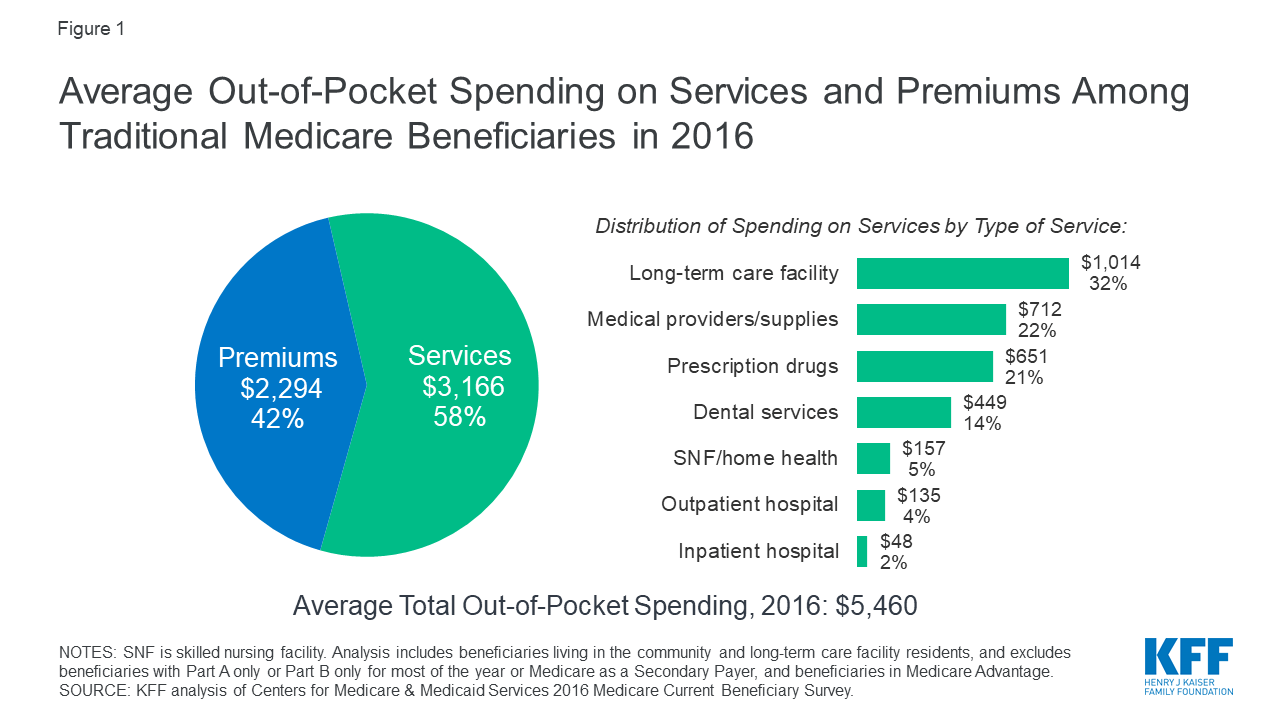

What you spend out of pocket may be totally different than what a family member or friend with Medicare pays. But, on average, people spend more than $5,000 out of pocket annually — or more than $400 per month — on their Medicare costs, according to the Kaiser Family Foundation (KFF).

What do you pay with Medicare Part A?

If you go to the hospital, after paying your Part A deductible, inpatient hospital care is covered under the following conditions:

What do you pay with Medicare Part B?

Unlike Part A, qualified Medicare enrollees must pay a monthly premium for Part B.

What is observation status, and how does it affect your Medicare costs?

A confusing and potentially costly scenario that some hospitalized patients encounter is what’s called observation status. Even though you’re at the hospital, you may sometimes still be considered an outpatient for the first day or two (or longer in extraordinary cases).

What do you pay for Medicare drug coverage (Part D)?

You’ll want to consider additional coverage for medications if you don’t already have coverage of equal value. You do this to avoid the Part D late enrollment penalty. You can buy a Medicare Part D plan — while keeping Parts A and B — or a Medicare Advantage plan instead.

Medigap: Covering your out-of-pocket costs

With original Medicare, there’s no annual out-of-pocket maximum. So if you need a lot of care, your out-of-pocket costs can add up. For that reason, about half of Medicare enrollees have supplemental coverage. Some get it through their employer, others have Medicaid, and many use Medicare supplement insurance known as Medigap.

What factors affect how much you pay out of pocket?

Other factors that could affect how much you pay out of pocket are: Whether you go out of network to get care. Whether you need extra benefits. Whether your doctor accepts Medicare assignment if you do go out of network. Whether you have Medicaid or other financial help. What the plan’s yearly out of pocket limit is.

What is a deductible for Medicare?

A deductible is the amount you must pay out of pocket for health care before your plan begins to pay. For example, if your deductible is $1,000, you could pay $1,000 out of pocket before you plan begins to cover your health care costs. Some Medicare Advantage plans have $0 annual deductibles.

What is Medicare premium?

A premium is the amount you pay monthly or annually to have the plan, whether or not you receive services. Some Medicare Advantage plans have premiums as low as $0 but you must continue to pay your Medicare Part B premium.

What is Medicare Advantage?

Medicare Advantage plans are another way to get your Medicare Part A and Part B benefits from a private insurance company contracted with Medicare. Medicare Advantage plans must cover everything that Original Medicare (Part A and Part B) cover with the exception of hospice care, which is still covered by Part A.

What is coinsurance and copayment?

Coinsurance and copayment is the amount you pay every time you see a doctor or use a service. Coinsurance is usually a percentage and a copayment is a set dollar amount. For example, you could pay a $15 copayment every time you visit the doctor.

Does Medicare Advantage have out of pocket limits?

Unlike Original Medicare, Medicare Advantage plans have out of pocket limits, capping what you spend yearly on covered medical services. Medicare Advantage plans may save you money overall but they also generally come with some out of pocket costs. Medicare Advantage plans out of pocket costs include: premiums, deductibles. coinsurance/copayments.

How much does Medicare pay for a hospital stay?

Part A: No fee for hospital stays of 60 days or less. For 61 to 90 days, $341 per day. For 91 days or more, $682 per day or full cost of stay. Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once.

How much does Medicare pay for 91 days?

For 91 days or more, $682 per day or full cost of stay. Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once. Part B: Typically, 20 percent of the Medicare-approved cost of the service for most services.

What is QMB in Medicare?

The Qualified Medicare Beneficiary (QMB) program helps pay for Part A and Part B premiums as well as deductibles, coinsurance and copays. If you qualify for this program, you automatically qualify for the Extra Help prescription drug program to help you with the out-of-pocket costs of your medicines. This program has the lowest income threshold of the four.

How much will Medicare Advantage cost in 2021?

If you sign up for a Medicare Advantage plan that includes prescription drugs with a mid-priced premium, CMS predicts you’ll pay $4,339 in 2021. These are just estimates, of course, but they can help you choose the policy that’s best for your health care needs and financial situation.

How often does the Medicare tab swing?

And the tab can swing wildly each year, depending on the state of a beneficiary’s health, where he or she lives, and whether the government and insurers have instituted any price increases — or decreases. Individual plans can also tinker with the services and drugs they cover.

How much is Part B for Social Security in 2021?

Part B: $148.50 monthly for 2021 (automatically deducted from Social Security benefit payments). Individuals with an annual income of more than $88,000 pay a higher premium.

Does Medicare cover out of pocket expenses?

Medicare covers the majority of your health care expenses each year. But you still may have to pay thousands of dollars in out-of-pocket costs:

How much did Medicare pay out of pocket in 2016?

A: According to a Kaiser Family Foundation (KFF) analysis of Medicare Current Beneficiary Survey (MCBS), the average Medicare beneficiary paid $5,460 out-of-pocket for their care in 2016, including premiums as well as out-of-pocket costs when health care was needed.

How much did Medicare cost in 2016?

In 2016, Medicare enrollees who reported being in poor health spent $6,384 in premiums and out-of-pocket health costs, while those who reported being in excellent or good health had average costs of $4,715.

How much does a female Medicare beneficiary spend on health insurance?

Female Medicare beneficiaries spent a slightly higher average portion of self-reported income on health coverage and out-of-pocket costs than their male counterparts (spending $5,748 versus $5,104 spent by men), although this was not the case for those under age 65 who are enrolled in Medicare because of disability.

Is the Medicare Part D donut hole closed?

For prescription drugs, total out-of-pocket spending for seniors who end up in the Medicare Part D donut hole has decreased, as the Affordable Care Act has gradually closed the Part D donut hole, eliminating it as of 2020. But average prices for prescription drugs – and thus, the total amount that people pay in coinsurance, which is a percentage of the cost – have increased since 2010, so people who don’t end up in the donut hole may be paying more for their Part D prescriptions than they were several years ago.

Does Medicare cover long term care?

In addition to cost sharing (deductibles, co-pays and coinsurance), beneficiaries have to pay out-of-pocket for expenses Medicare doesn’t cover, such as long-term care and dental services. According to the KFF analysis, the amount Medicare beneficiaries paid for covered and non-covered care decreased slightly from 2013 and 2016, ...

Is there a deductible for Medicare Part A 2020?

The Part A deductible and coinsurance also increased slightly in 2020, as did the premium for Part A that applies to people who don’t have enough work history (or a spouse with enough work history) to qualify for premium-free Medicare Part A.