Premiums for Medicare Advantage Plans With Prescription Drug Coverage

| Plan Type | Average Monthly Premium Weighted by Enro ... |

| Medicare Advantage HMO (Health Maintenan ... | $18 |

| Medicare Advantage Regional PPO (Preferr ... | $48 |

| Medicare Advantage Local PPO | $25 |

Full Answer

How much does Medicare pay Advantage plans?

Medicare Advantage Average Monthly Premiums, 2007-2021. AveragePremiumbyState,2007-2021 IncludesA/B,non-employerMAplans Plan data asofSeptember1,2020 Projected enrollment for 2021, July enrollment for prior years

How much cheaper is Medicare Advantage compared to Medicare?

Feb 15, 2022 · In 2022, the average monthly premium for Medicare Advantage plans is $62.66 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies. Medicare Advantage offer the same benefits that are covered by Original Medicare, and most Medicare …

Which Medicare Advantage plan is the best?

3 rows · Nov 08, 2021 · What Is the Premium for Medicare Advantage? The average monthly premium for 2022 ...

Is Medigap better than Advantage plans?

Oct 10, 2021 · A zero-premium plan is a Medicare Advantage plan that has no monthly premium. In other words, you dont pay anything to the insurance company each month for your coverage. Thats in comparison with the average Medicare Advantage premium of $23/month in 2020. . If you have a zero-premium plan, you pay $0/month instead.

What is the average cost of a Medicare Advantage plan?

The average premium for a Medicare Advantage plan in 2021 was $21.22 per month. For 2022 it will be $19 per month. Although this is the average, some premiums cost $0, and others cost well over $100. For more resources to help guide you through the complex world of medical insurance, visit our Medicare hub.

Do Medicare Advantage plans have high premiums?

. Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium (and the Part A premium if you don't have premium-free Part A). Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

What is the Medicare Advantage premium for 2022?

In 2022, the average monthly premium for Medicare Advantage plans is $62.66 per month. Depending on your location, $0 premium plans may be available in your area.Feb 15, 2022

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

Do you still pay Medicare Part B with an Advantage plan?

Who Pays the Premium for Medicare Advantage Plans? You continue to pay premiums for your Medicare Part B (medical insurance) benefits when you enroll in a Medicare Advantage plan (Medicare Part C). Medicare decides the Part B premium rate.Nov 8, 2021

How much is deducted from Social Security for Medicare?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

What income is used to determine Medicare premiums 2021?

modified adjusted gross incomeMedicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How many Medicare Advantage plans are there in 2022?

3,834 Medicare Advantage plansTotal Number of Plans. In total, 3,834 Medicare Advantage plans are available nationwide for individual enrollment in 2022 – an 8 percent increase (284 more plans) from 2021 and the largest number of plans available in more than a decade (Figure 2; Appendix Table 1).Nov 2, 2021

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

How do I choose the best Medicare Advantage plan?

Factors to consider when choosing a Medicare Advantage plancosts that fit your budget and needs.a list of in-network providers that includes any doctor(s) that you would like to keep.coverage for services and medications that you know you'll need.Centers for Medicare & Medicaid Services (CMS) star rating.

How Medicare Advantage Premiums Work

Medicare Advantage, known as Medicare Part C, includes both Medicare Parts A and B (Original Medicare) coverage. When you enroll in a Medicare Adva...

Medicare Part C Cost: How Much Is The Premium?

Medicare Advantage premiums vary depending on the type of plan and the state you live in. Monthly premiums range from $0 to the high $300s. But ove...

How Does Obamacare Affect Medicare Advantage Costs?

Obamacare (Affordable Care Act) made several changes to Medicare Advantage plans. Most of these changes had to do with the health insurance industr...

Can I Get Help Paying For Medicare Advantage?

You can get help with paying for your Medicare Part C plan through Medicare Savings Programs (MSPs) made available by the Centers for Medicare and...

How Do I Choose A Medicare Advantage Plan?

The first step in choosing a Medicare Advantage plan is to compare quotes from different insurance companies. HealthMarkets provides access to Medi...

What is an Advantage Plan?

Advantage plans are also known as Part C and are commonly called replacement plans because they stand in for Original Medicare. With an Advantage plan, you’ll still be responsible for applicable premiums for Parts A and B. Thus, an Advantage plan with a zero-dollar premium doesn’t mean your Medicare is free.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How much is Medicare Part A deductible for 2021?

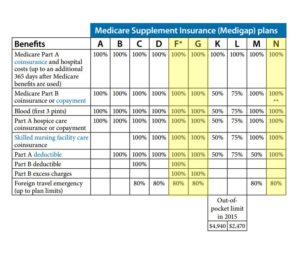

The Part A deductible is $1,484 per benefit period in 2021.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

Does Medicare Part A require coinsurance?

Part A also requires coinsurance for hospice care and skilled nursing facility care. Part A hospice care coinsurance or copayment. Medicare Part A requires a copayment for prescription drugs used during hospice care. You might also be charged a 5 percent coinsurance for inpatient respite care costs.

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How much is coinsurance for skilled nursing in 2021?

Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay. Skilled nursing care is based on benefit periods like inpatient hospital stays.

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

What is Medicare Advantage?

A Medicare Advantage plan is health insurance offered by Medicare-approved private insurance companies. It’s a single plan that includes all Original Medicare (Part A and Part B) ...

What is the Medicare Advantage premium for 2020?

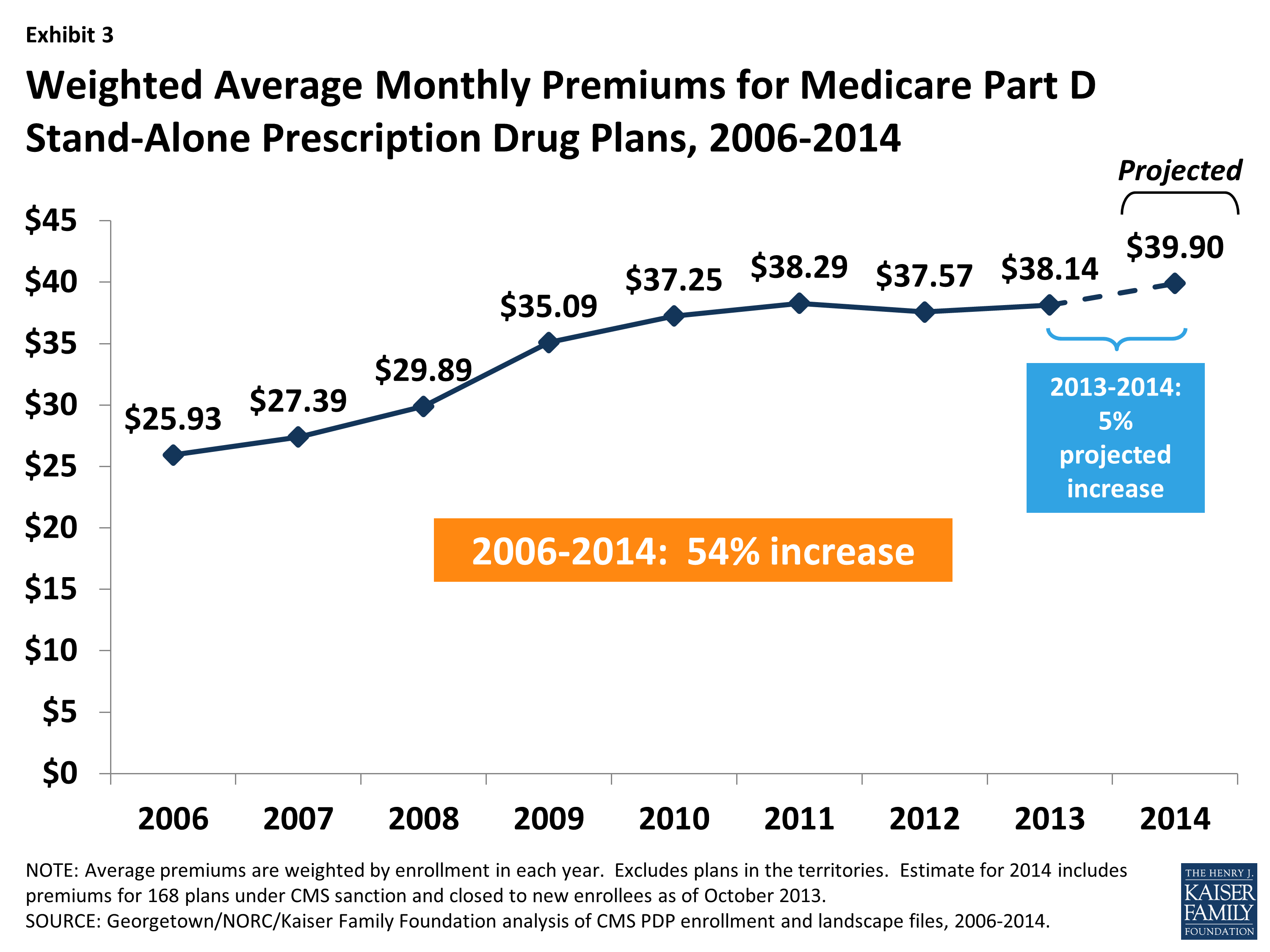

What Is the Premium for Medicare Advantage? In 2020, the average monthly premium for plans that include Medicare Part D prescription drug (MA-PD) benefits is $25, according to the Kaiser Family Foundation. (The average monthly premium is weighted by enrollment.)

How much is Medicare Part B 2021?

Medicare decides the Part B premium rate. The standard 2021 Part B premium is $148.50, but it can be higher depending on your income. On average, those who received Social Security benefits will pay a lesser premium rate. Usually, you pay a separate monthly premium for a Medicare Part C plan. But not all Part C plans have monthly premiums.

When are Medicare premiums due?

Premiums are due the 25th of every month and coverage will end in the fourth month if past due payments are not made. Contact your Medicare Part C provider if you think you will miss a payment. Private insurance companies have their own rules on plan cancellation for nonpayment.

What is a Part C plan?

In addition to covering medically necessary procedures, Part C plans typically provide prescription drug coverage (Medicare Part D) and other types of benefits such as dental and vision. The premium you may pay is used to cover the wider range of services available with Medicare Part C. The Medicare-approved private insurance companies ...

How does Medicare work?

This is how the process works: Medicare approves a private insurance company to provide members with Original Medicare. The insurance company becomes responsible for paying members’ claims. Medicare pays the insurance company a flat fee for the cost of paying claims. The insurance company uses this payment to provide members with healthcare ...

What happens if you don't receive Medicare?

If you don’t receive these benefits, you will receive a bill called ‘Notice of Medicare Premium Payment Due’. You can then pay by mailing a check, use your bank’s online billing to make payments every month, or sign-up for Medicare’s bill pay to have the premium come out of your bank account automatically.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium. Whether the plan pays any of your monthly.

What is Medicare assignment?

assignment. An agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance. if: You're in a PPO, PFFS, or MSA plan. You go.

What is out of network Medicare?

out-of-network. A benefit that may be provided by your Medicare Advantage plan. Generally, this benefit gives you the choice to get plan services from outside of the plan's network of health care providers. In some cases, your out-of-pocket costs may be higher for an out-of-network benefit. .

What is a medicaid?

Whether you have. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid.

What is copayment in medical terms?

copayment. An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).

What is Medicare Advantage?

The amount you are required to pay for each health care visit or service. Medicare Advantage plans typically include cost-sharing measures such as copayments and coinsurance, and the amounts of these costs can correlate with that of the premium. The type of plan.

How does Medicare Advantage plan work?

Aside from the benefits offered and where you live, there are several additional factors that can influence the cost of a Medicare Advantage plan, such as: 1 Whether or not the plan pays any of your Medicare Part B premium#N#When enrolled in a Medicare Advantage plan, you must also continue to pay your premium for Medicare Part B. Some Medicare Advantage plans can cover a portion of the Part B premium for you and may account for that by charging a higher premium for the plan. 2 The amount (if any) of the yearly deductible#N#Many Medicare Advantage plans include annual deductibles. The amount of the deductible can have an effect on the cost of plan premiums. 3 The amount you are required to pay for each health care visit or service#N#Medicare Advantage plans typically include cost-sharing measures such as copayments and coinsurance, and the amounts of these costs can correlate with that of the premium. 4 The type of plan#N#There are several types of Medicare Advantage plans, such as HMO, PPO and Private Fee-For-Service (PFFS) plans, as well as Medicare Savings Accounts (MSA). The type of Medicare Advantage plan you enroll in can affect which health care providers you can see and at what cost, and it can also affect the amount you might pay in premiums. 5 Whether or not you receive any cost assistance#N#There are a few ways (detailed below) in which you may be able to receive some help paying for a Medicare Advantage plan.

What to look for when shopping for Medicare Advantage?

When you are shopping for a Medicare Advantage plan, you may consider features such as a plan’s range of benefits and possible network rules. But above all else, perhaps the biggest thing you might consider is the cost of a plan. When it comes to Original Medicare (Medicare Part A and Part B), the cost of premiums is standardized across the board.

Which state has the lowest Medicare premium?

A closer look at 2021 data also reveals: Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug (MAPD) plans at $11.58 per month. The highest average MAPD monthly premium is in North Dakota, at $76.33 per month.

Is Medicare Advantage privatized?

But because Medicare Advantage is privatized, costs can vary from one plan or coverage area to another.

Does Alaska have Medicare Advantage?

All states except for Alaska offer at least one $0 monthly premium Medicare Advantage plan. $0 premium plans may not be available in all locations within each state. In addition to premiums, many Medicare Advantage plans typically include some out-of-pocket expenses.

Do you have to pay Medicare Part B premium?

When enrolled in a Medicare Advantage plan, you must also continue to pay your premium for Medicare Part B. Some Medicare Advantage plans can cover a portion of the Part B premium for you and may account for that by charging a higher premium for the plan. Many Medicare Advantage plans include annual deductibles.

How much is Medicare Part B in 2021?

Part B monthly premiums in 2021 are $148.50, although this amount may vary with income.

What are the factors that affect Medicare?

Other factors that affect costs are the following: the scope and frequency of healthcare services that a person needs.

What are the different types of MSPs?

The four kinds of MSPs include: 1 Qualified Medicare Beneficiary Program: The monthly income limit to enroll is $1,084 for an individual and $1,457 for a married couple. This program helps pay for premiums for Part A and B, along with copayments, coinsurance, and deductibles. 2 Specified Low-Income Medicare Beneficiary Program: The monthly income limit to enroll is $1,296 for an individual and $1,744 for a married couple. This state program helps pay for Part B for people with Part A. 3 Qualifying Individual Program: The monthly income limit is $1,456 for an individual and $1,960 for a married couple. This state program also helps pay for Part B for people with Part A. 4 Qualified Disabled and Working Individuals Program: The monthly income limit is $4,339 for an individual and $5,833 for a married couple. This program helps a working person with a disability pay for Part A premiums.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

Does Medicare Advantage have a cap?

Medicare Advantage plans also put a yearly cap on costs, which is a benefit that Medicare Part A and B do not offer. The costs and benefits of different Medicare plans can vary depending on an individual’s situation, so it is best to consider the pros and cons of each.

What are the costs of Medicare Advantage?

What Other Costs Do Medicare Advantage Plans Have in 2020? 1 A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in. Some Medicare Advantage plans may offer a $0 deductible. 2 Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

Who sells Medicare Advantage plans?

Medicare Advantage plans are sold by private insurance companies. Part C plan costs can vary depending on several factors, including what plan you have and where you live. This guide shows the average cost of Medicare Part C plans in each state.

What is Part C insurance?

Part C plans may also include costs such as deductibles and coinsurance (or copayments). A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in.

Does Medicare Advantage cover hospital insurance?

Medicare Advantage plans must offer at least the same benefits that are covered by Medicare Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plan carriers are able to also offer extra benefits that Original Medicare (Part A and Part B) don’t cover. In addition to prescription drug coverage that is offered by many ...

What does Part C cover?

In addition to prescription drug coverage that is offered by many plans, some Part C plans may also cover some or all of the following: Routine dental care. Vision exams and coverage for eyeglasses. Routine hearing care and coverage for hearing aids. Fitness memberships.

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans may offer a $0 deductible. Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.