Best Detailed Plan Descriptions: Cigna Best for Easy Application: Mutual of Omaha The most popular Supplemental Plan was Plan F, but as of Jan. 1, 2020, Plan F is closed to new enrollees. However, if you were eligible to sign up for Medicare before Jan. 1, 2020, you still may be able to enroll in a Supplement Plan F. 3

Full Answer

Is plan F the best health insurance plan for You?

Feb 22, 2022 · Aetna stands out because it offers several Medicare Supplement plans, including Parts A, B, C, D, F, G, and N, with each plan’s information and coverage clearly laid out on the company website....

What are the best Medicare Advantage plan companies for You?

Oct 14, 2021 · companies best medicare advantage company; alabama: viva medicare: arizona: cigna: arkansas: cigna: california: essence healthcare: kaiser permanente: scan health plan: sharp health plan: wellcare...

How much is the deductible on a Medicare Plan F?

May 06, 2022 · In business for over 100 years, Mutual of Omaha offers coast-to-coast coverage to U.S. adults exploring their Medicare Supplement plan …

Which is the best Medicare Supplement Insurance Company?

Nov 07, 2019 · As mentioned, Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings (Plans A-N; Plans E, H, I, and J are no longer sold). Medigap Plan F may cover: Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers. Part A hospice care copayment or coinsurance costs.

Is United Healthcare Plan F good?

What is the average cost of Medicare Part F?

Does AARP offer high-deductible Plan F?

AARP also offers a high-deductible Plan F option. This plan will require you to pay a plan deductible of $2,340 before beginning to assist with your costs. Once you've met your deductible, the plan will pay 100% of covered costs for the remainder of the year.Jan 4, 2022

Can you still purchase a Medicare Plan F?

Why is Plan F being discontinued?

Does Medicare Part F cover prescriptions?

Are all Medigap Plan F policies the same?

Does AARP Medicare Supplement Plan F cover dental?

Can I switch from Plan F to Plan G without underwriting?

What is the difference between AARP Plan F and Plan G?

What is Medicare Plan F being replaced with?

Who can get Plan F?

What is a Medicare Supplement Plan?

A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that are not paid for by Original Medicare. These can include prescriptions, doctor visits, vision and dental care, and more.

Does Aetna offer Medicare Supplement?

Aetna stands out because it offers several Medicare Supplement plans, including Parts A, B, C, D, F, G, and N, with each plan’s information and coverage clearly laid out on the company website. Consumers are supplied with ample details to really understand the options before making a decision.

Does Medicare Supplement cover out of pocket costs?

As the cost of healthcare continues to increase, so do the out-of-pocket costs for services that are not covered by Original Medicare. Because it can be difficult to predict your exact health care needs and costs, Medicare Supplement plans are used to cover many of the services you may need.

Do all Medicare Supplement plans have the same benefits?

No matter which insurance company offers a particular Medicare Supplement plan, all plans with the same letter cover the same basic benefits. For instance, all Plan C policies have the same basic benefits no matter which company sells the plan.

Is Medicare Advantage the same as Medigap?

Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan. Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

Does Cigna cover Part B?

Warning. As of Jan. 1, 2020, Medicare Supplement plans sold to new Medicare recipients aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on Jan. 1, 2020. Medicare Supplement plans don't cover the costs ...

Does Mutual of Omaha offer a discount?

Mutual of Omaha also offers a 7% discount if your spouse or domestic partner has applied for, or is applying for, coverage with Mutual of Omaha or an affiliate company. However, the company only offers three plans (F, G, and N).

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

How to Choose the Right Medicare Supplement Plan for You

What are my health care needs now and possibly in the future? Consider your current health status as well as your family history.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best.

How to Sign Up for Medigap Plans

Signing up for a Medigap plan is easy. “Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time.

What is Medicare Supplement Plan F?

Medicare Supplement (Medigap) plans may help with certain out-of-pocket health-care costs that Original Medicare doesn’t pay for, such as deductibles, copayments, and coinsurance. Of the 10 standardized plans that may be available in most states, Medicare Supplement Plan F offers the most comprehensive coverage.

Is Medicare Supplement Plan F the most comprehensive?

Because Medicare Supplement Plan F offers the most comprehensive coverage of the standardized lettered plans offered in most states, premium costs tend to be higher than other plans. Costs may vary by plan, company, and location, so check with the specific insurance company if you’re interested in this plan.

Which states have standardized Medicare Supplement Plans?

Please note that Massachusetts, Minnesota, and Wisconsin have their own standardized Medicare Supplement plans. Medicare Supplement Plan F isn’t available in those states. Here’s an overview of what Medicare ...

Does Medicare Supplement Plan F have a high deductible?

Costs may vary by plan, company, and location, so check with the specific insurance company if you’re interested in this plan. Medicare Supplement Plan F also has a high-deductible version.

How much is Medicare deductible for 2017?

In 2017, the deductible is $2,200 (note that this amount may change from year to year).

When will Medicare stop covering Part B?

If you qualify for Medicare before January 1, 2020: You may be able to buy Medicare Supplement Plan F (or Plan C). You can typically keep your existing Plan F or Plan C. You can talk to your insurance company about how ...

What is a Medigap Plan F?

Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage.

What does Medicare Supplement Insurance Plan F cover?

Medicare Supplement Plan F covers costs that Medicare doesn’t cover, says Laura Decker, co-founder and president of the Employee Benefits Division at SSGI, a Maryland-based employee benefits insurance agency.

What doesn't Medicare Supplement Plan F cover?

Medicare Plan F won't cover any services not covered under Original Medicare.

How much does Medicare Part F cost?

The cost of Medicare Plan F depends on a few factors, including your age.

Medicare supplement plans comparison

Medicare Plan F is no longer available for purchase. However, several other Medigap supplement plans can help cover the out-of-pocket costs associated with Original Medicare.

Frequently Asked Questions

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium.

Does Medicare cover Plan F?

Plan F covers everything covered by Plan C and also covers any excess charge by a doctor or hospital that Medicare does not cover. Due to the changes regarding the Part B deductible, newly eligible consumers can no longer enroll in Plan F.

How much is the deductible for a 2021 plan F?

This version of Plan F has the same coverage as the standard Plan F, but individuals must pay a high deductible — $2,370 in 2021 — before the policy pays anything.

Does Mutual of Omaha have Medicare Supplemental?

Mutual of Omaha. Availability of Medicare supplemental insurance plans from Mutual of Omaha may vary slightly depending on your location, though it services customers throughout the U.S. It cites Plan F, Plan G and Plan N as the company’s most popular plans. Plan G and Plan N both had a deductible of $198 in 2020, ...

Does Medicare Supplemental Insurance cover dental care?

Medicare supplemental insurance (Medigap) covers health care costs not included with your Medicare plan. There are up to 10 plans to choose from, and some plans feature coverage for skilled nursing care or Medicare Part B "excess charges.". Medigap plans have the same standardized benefits and do not cover: Dental care.

When do you have to have Medicare Part A and Part B?

You must have Medicare Part A and Part B. You must purchase during your open enrollment period, which starts the first day of the month when you turn 65 and are enrolled in Part B. If you try to purchase Medigap coverage outside this enrollment period, your options may be limited, and there may be extra costs.

What is Medicare Supplement Insurance?

Medicare supplement insurance is also known as “Medigap” because it covers gaps in Original Medicare coverage. This supplemental insurance, offered by private companies, covers costs including deductibles, copayments and coinsurance. You pay a monthly premium for this added coverage.

Is Plan C still available for new Medicare recipients?

As of Jan. 1, 2020, Plan C is no longer available for new Medicare recipients.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

Is Plan F a good plan?

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor. The monthly premium for Plan F will be $221. Unfortunately, Plan F will not be available to new Medicare enrollees who become eligible after Jan. 1, 2020.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Does Cigna offer a discount on Medicare?

Cigna Medicare supplement has some added benefits when compared to other companies, such as a household premium discount. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

What is the best alternative to Plan G?

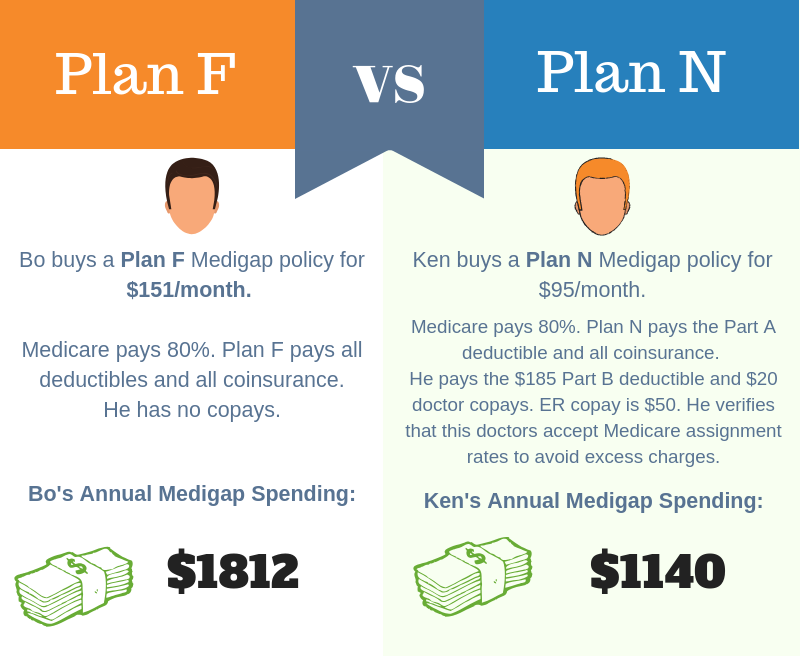

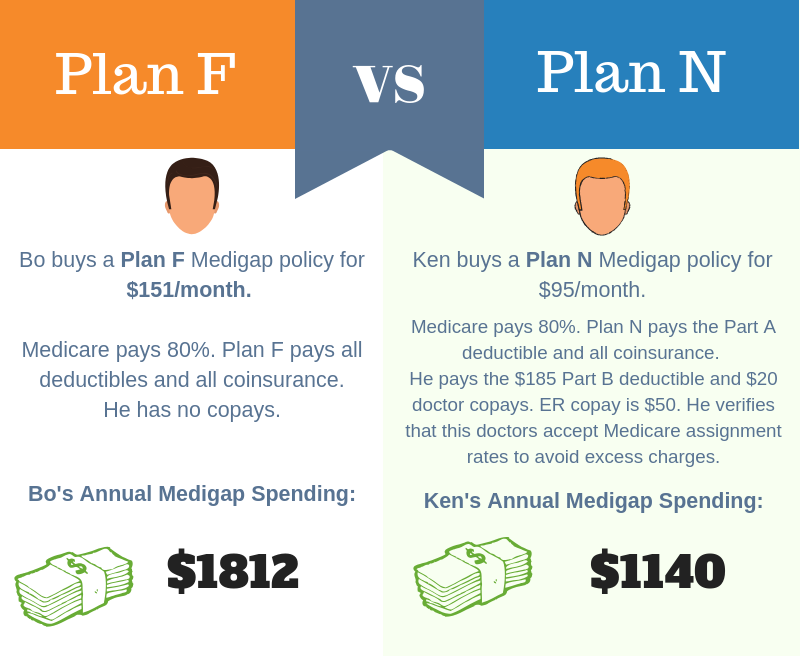

Best alternative to Plan G Medicare supplement: Plan N. Plan N is a good option for individuals who do not want to purchase Plan G but still want comprehensive Medicare insurance coverage at a cheaper price.

What is the best Medicare plan for 2021?

SilverScript. Humana. Cigna. Mutual of Omaha. UnitedHealthcare. The highest rating a plan can have is 5-star. Just because a policy is 5-star in your area doesn’t mean it’s the top-rated plan in the country. There is no nationwide plan that has a 5-star rating.

Is a suitable insurance policy the most affordable?

A suitable policy is the most affordable one for YOU. Spending time making sure your plan is the best value is a serious recommendation. With the rising cost of prescriptions, it’s more important now than ever before to make sure that you find the best policy.

Will Medicare change to Part D in 2021?

Medicare prescription drug plan changes in 2021 are noteworthy. Also, by knowing what to expect, you can stay ahead of the game. Drugs can be costly, and new brand-name drugs can be the most expensive. With age, you’re more likely to require medications. Medicare’s standalone Part D plan can cover you.

Does Medicare cover Part D?

Medicare’s standalone Part D plan can cover you. Part D plans have a monthly premium that insurance companies determine. There may be several plans as well as companies to choose from in your state. Policies vary by county, so moving may warrant a plan change.

What are the preferred pharmacies for Choice Plan?

For those with the Choice plan, there are fewer options. For example, the Choice plan preferred pharmacies are CVS, Walmart, and thousands of community-based independent drug stores. Then, the Plus plan includes CVS, Walmart, Publix, Kroger, Albertsons, as well as many grocery stores and retailers.

Is SilverScript a Part D insurance?

SilverScript is one of the largest Part D insurers. They have 24/7 customer service, online tools, and medication programs to keep you on track. The only downside I can think of, they only offer two plans. Many of the other top companies have at least three options.

Does Humana Part D have a deductible?

Humana Part D Reviews. Many generics with Humana have a $0 deductible. Further, they have a variety of plan options, something for everyone. The high deductible on brand name medications isn’t that great, and you have to go to Walmart to get the best savings.

Does Mutual of Omaha offer Medicare Supplement Plan G?

Mutual of Omaha offers Medicare Supplement Plan G in all 47 states where traditional Medicare Supplement Plans are available, and High-Deductible Plan G in all of those states except New York.

Does Aetna give a discount on Medicare Supplement Plan G?

Aetna’s Medicare Supplement Plan G has a premium discount of 7% if someone in your home is also on one of its plans. This includes a spouse, someone with whom you have a civil union partnership, or anyone who has lived with you for 12 months or more.

How much did Medicare spend in 2016?

In 2016, the average Medicare beneficiary spent more than $5,400 out of pocket for health care and more than $7,400 when they did not have supplemental insurance. Thankfully, Medicare Supplement Plans, also known as Medigap, help fill in the gaps. Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries. Medicare Supplement Plan G, like other Medigap plans (A through N), is standardized by the federal government.

When did Medicare stop allowing Part B deductible?

When Congress passed the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015, it changed which Medicare Supplement Plans could be made available to new Medicare beneficiaries. The law required discontinued plans that paid the Part B deductible. This is why, starting on January 1, 2020, Medicare Plans C and F were no longer available to people who were newly eligible for Medicare. There are no current plans to discontinue Plan G, and high-deductible plans were made available for the first time in 2020. 5

Does Medicare cover acupuncture?

Instead, they cover the left-over costs for Medicare-approved services that Part A or Part B did not pay in full. Original Medicare does cover acupuncture for chronic low back pain. If you meet the specific criteria for acupuncture services, Part G will cover the remaining costs.

Is Humana a high deductible plan?

It offers Medicare Supplement Plan G in all 47 states where traditional Medicare Supplement Plans are available. High-Deductible Plan G is available in all of those states except Missouri.