Aetna Medicare Advantage (2019) Example Pricing And Coverage

| Medicare Select HMO | Medicare Prime HMO | Medicare Choice PPO | |

| Monthly premium | $0 | $0 | $73 |

| Copay (primary) | $0 | $0 | $5 in network 40% out of network |

| Deductibles | $0 for medical $0 for drug | $0 for medical $0 for drug | $0 for medical in network ($750 out of n ... |

Full Answer

What is the best Medicare Advantage plan for You?

12 rows · With this plan, the monthly premium is about $94, and there’s a $200 medical deductible whether ...

What are the best Medicare Advantage plans&carriers for 2021?

· What are the Best Medicare Advantage Plans 2019? One of the most common questions we get here at Boomer Benefits is: What are the best Medicare Advantage plans for 2019? We wish it could be so simple as to give you a list and let you peruse the top three plans. However, every person’s needs are different, so the best Medicare Advantage plan ...

Do Medicare Advantage plans include drug coverage?

· Answer: The Plan Finder tool at Medicare.gov is the best way to compare all of the Medicare Advantage plans in your area. These plans provide medical and drug coverage from a private insurer, and ...

What are Medicare Advantage plans (MA plans)?

Below are the most common types of Medicare Advantage Plans. Health Maintenance Organization (HMO) Plans Preferred Provider Organization (PPO) Plans; Private Fee-for-Service (PFFS) Plans; Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include Hmo Point Of Service (Hmopos) Plans and a

Which Medicare Advantage plan has the highest rating?

What Does a Five Star Medicare Advantage Plan Mean? Medicare Advantage plans are rated from 1 to 5 stars, with five stars being an “excellent” rating. This means a five-star plan has the highest overall score for how well it offers members access to healthcare and a positive customer service experience.

What is the average maximum out of pocket cost for a Medicare Advantage plan?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.

What percent of seniors choose Medicare Advantage?

Recently, 42 percent of Medicare beneficiaries were enrolled in Advantage plans, up from 31 percent in 2016, according to data from the Kaiser Family Foundation.

What are the top 3 most popular Medicare supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Do you still pay Medicare Part B with an Advantage plan?

Medicare Advantage Plans cover almost all Part A and Part B services. However, if you're in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies.

Does Medicare Advantage pay 100 percent?

Medicare Advantage plans must limit how much their members pay out-of-pocket for covered Medicare expenses. Medicare set the maximum but some plans voluntarily establish lower limits. After reaching the limit, Medicare Advantage plans pay 100% of eligible expenses.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Who Has the Best Medicare Advantage plan for 2022?

For 2022, Kaiser Permanente ranks as the best-rated provider of Medicare Advantage plans, scoring an average of 5 out of 5 stars. Plans are only available in seven states and the District of Columbia.

What is the deductible for Plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses.

Is it better to have Medicare Advantage or Medigap?

Is Medicare Advantage or Medigap Coverage Your Best Choice? Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

What is the most comprehensive Medicare supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

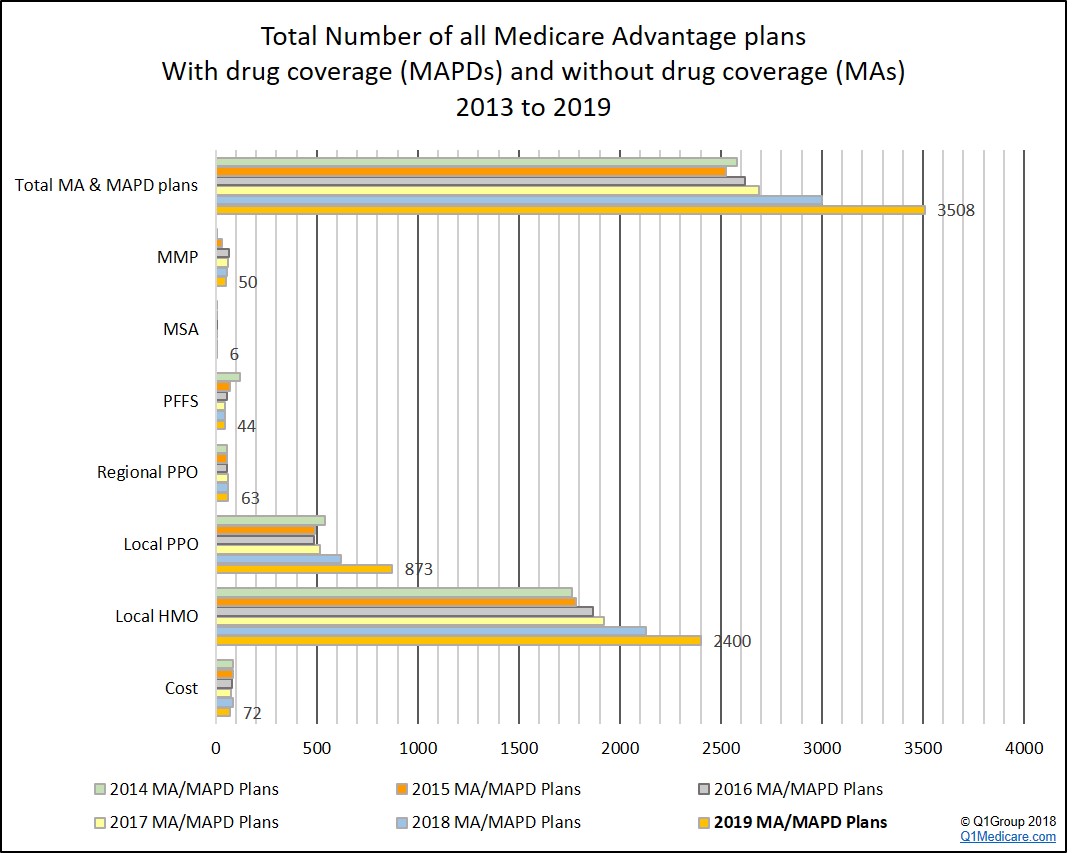

How many Medicare Advantage plans are there in 2019?

How do they stack up? What should you be looking for? What can you expect as you start shopping for health insurance in retirement? Well, we can’t give you a detailed analysis that crunches all the numbers — after all, there are about 3,700 total Medicare Advantage plans available in 2019 — but we can take a look at a handful to give you a better idea of what you need to consider as you shop for Medicare Advantage for next year.

Who is Medicare.net?

Medicare.net is powered by Health Network Group, LLC, which is related to Health Compare Insurance Services, Inc., who is a licensed, authorized agent of: Anthem Blue Cross of California, Anthem Blue Cross of Colorado, Anthem Blue Cross of Connecticut, Anthem Blue Cross of Georgia, Anthem Blue Cross of Indiana, Anthem Blue Cross of Kentucky, Anthem Blue Cross of Maine, Anthem Blue Cross of Missouri, Anthem Blue Cross of New Hampshire, Anthem Blue Cross of Nevada, Anthem Blue Cross of New York, Anthem Blue Cross of Ohio, Anthem Blue Cross of Texas, Anthem Blue Cross of Virginia, Anthem Blue Cross of Wisconsin, Blue Cross Blue Shield of Illinois, Blue Cross Blue Shield of Montana, Blue Cross Blue Shield of New Mexico, Blue Cross Blue Shield of Oklahoma, Capital Blue Cross of Pennsylvania, Highmark of West Virginia, Premera in Washington, Premera in Alaska, and Vibra in Pennsylvania.

How much does Aetna pay for medical?

Under the Aetna Medicare Choice Plan, if you are between the ages of 65 and 69 in fair health, the monthly premium is $73, and you can expect to pay approximately $3,738 per year for medical costs, including premiums. There is no deductible if you remain in the network, but if you go outside the network you’ll have to meet a $750 deductible before benefits start. There’s an annual cap on your out-of-pocket costs with this plan of $6,700 (for in-network services). In-network primary care physician copays are $5 and 40 percent outside the network. Specialists are $40 in-network and 40 percent outside the network. Inpatient hospital stays cost $220 per day for the first four days. After that, you won’t have to pay a copay for inpatient stays.

What is Humana Gold Choice?

Humana Gold Choice PFFS covers many of the same benefits as all Humana Medicare Advantage plans in 2019, including everything that original Medicare covers along with added features and services. With this plan, the monthly premium is about $94, and there’s a $200 medical deductible whether you get care from an in-network or out-of-network provider (for services not covered under original Medicare). Primary doctors require a $20 copay while specialists will cost $50 per visit. This plan and the other two outlined above require a $25 copay for visits to an urgent care center and a $90 copay for emergency room visits. There’s also an out-of-pocket cap in place for covered services of $6,700.

How much is deductible for prescription drugs?

Prescription drugs have a $250 deductible for Tiers 2, 3, 4 and 5. Out-of-network pharmacy costs are only covered if you are unable to use an in-network pharmacy, such as if you’re traveling, you need emergency or urgent care, or an in-network pharmacy does not carry the drug you need.

What does tier 1 prescription cost?

Generic tier 1 drugs, for example, cost nothing if you fill them at a preferred pharmacy (30-day supply). Nonpreferred drugs at tier 4 might cost $100 at the same pharmacy type.

Does Humana Gold Plus have a copay?

You can also use any doctor approved by Medicare that accepts Humana without the need for a referral to see specialists. As an HMO plan, there is no coverage for out-of-network providers and services except in cases of urgent or emergency needs. But the plan also doesn’t charge a monthly premium or medical deductible. Primary care physician visits have no copay (specialists cost $45 per visit). There’s no deductible for hospital visits. Your maximum annual out-of-pocket expense is $4,500 for covered benefits.

What is the best way to compare Medicare Advantage plans?

Answer: The Plan Finder tool at Medicare.gov is the best way to compare all of the Medicare Advantage plans in your area. These plans provide medical and drug coverage from a private insurer, and are an alternative to signing up for traditional Medicare along with a medigap and a Part D prescription-drug policy.

When is open enrollment for Medicare?

Starting around October 1, it will have information about the 2019 plans, which you can sign up for during the annual open-enrollment period, which runs from October 15 to December 7, 2018. Start at the Plan Finder main page, where you can personalize your search by entering your Medicare number.

Can you change your insurance provider from year to year?

In-network providers can change from year to year, so it's important to find out if your doctors will still be included – even if you've been happy with your current plan.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

Why do you keep your Medicare card?

Keep your red, white, and blue Medicare card in a safe place because you’ll need it if you ever switch back to Original Medicare. Below are the most common types of Medicare Advantage Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost.

What is a special needs plan?

Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

How much is Medicare Advantage 2020?

You must continue to pay your Part B premium, which is $144.60 per month for most beneficiaries in 2020. Medicare Advantage plans are similar to individual health insurance policies you may have received through your employer or signed up for on your own through the individual insurance market, in that they have different monthly premiums, provider networks, copays, coinsurance and out-of-pocket limits. The trade-off for a lower premium (or $0 premium) could be higher copays or coinsurance.

What age do you have to be to get Medicare?

People usually qualify for Medicare at age 65 and may be automatically signed up if they're receiving Social Security payments, unless they take steps to opt out. Original Medicare comes in two parts: Part A and Part B. Part A covers a portion of hospitalization expenses, and Part B applies to doctor bills and other medical expenses, such as lab tests and some preventive screenings.

When is Medicare open enrollment?

Between Oct. 15 and Dec. 7, Medicare's Annual Open Enrollment Period, millions of Medicare beneficiaries have a chance to make changes to their coverage for the upcoming year.

Is Medicare Advantage a private insurance?

But some individuals may find better value in Medicare Advantage plans. Such plans are run by private insurance companies regulated by the government, and they must offer coverage that's comparable to Original Medicare parts A and B. Most Medicare Advantage plans also include prescription drug coverage, which is an optional add-on called Part D for beneficiaries who keep Original Medicare.

Which company offers the best Medicare Advantage Plan?

Cigna. These long-standing companies offer the best Medicare Advantage plans year after year. But, since Medicare isn’t free, it’s a good idea to have other options for coverage. One option is a Medicare Advantage plan. These plans will take the place of Medicare. When you go to the doctor, your Medicare Advantage Plan ID card is your main card ...

Why are Medicare Advantage plans free?

Some Medicare Advantage plans are free because Medicare pays them monthly to take on your risk. Once you start using the benefits, you’ll start spending money out of pocket. That’s how the carriers make money, between Medicare paying them directly and cost-sharing.

What is Medicare Advantage Open Enrollment Period?

The Medicare Advantage Open Enrollment Period allows beneficiaries to switch to another plan. They can even return to Medicare and enroll in a Medicare Supplement plan if they’re unhappy with their current Advantage plan.

What is the lowest out of pocket cost for Humana?

For example, some maximum out-of-pockets are as low as $2,200. If this plan is in your service area, that would mean the most you can spend on copayments and coinsurances for the year is $2,200.

What does "best" mean in Medicare?

The answer to this question depends on what you define as best. Does best mean the lowest monthly premium, or does best mean lowest cost-sharing. Maybe best to you means the highest overall customer satisfaction rating or the plan with the most benefits. Below, we listed the best Medicare Advantage carriers based on company ratings, coverage options, and benefits.

What are the benefits of Humana Part C?

Most Advantage plans are including fitness programs and access to more than 13,000 fitness centers, convenient mail-order pharmacy services, and a 24/7 nurse advice line.

What is a special needs plan?

Special Needs Plans provide specialized health care for specific groups of people, like those with Medicare and Medicaid, people living in a nursing home, or those with certain chronic medical conditions.

Which is the best company to go through for Medicare Advantage?

If you want Medicare information broken down clearly and straightforwardly, Blue Cross Blue Shield (BCBS) is the best company to go through for Medicare Advantage. We chose it primarily for features such as its Medicare Advantage Plans document, available for anyone to view on its website without entering any personal information.

When do you sign up for Medicare Advantage?

To enroll in a Medicare Advantage Plan, sign up during your initial enrollment period, which starts three months before the month you turn 65 and ends three months after, or during the annual Open Enrollment for Medicare Advantage, which runs from October 15 through December 7.

How much does Medicare cost in 2021?

Costs vary depending on coverage, and choosing a Medicare Advantage plan requires careful consideration. The average monthly cost of a Medicare Advantage plan in 2021 is $21, much lower than the cost of $144 with Original Medicare (note that you will still be responsible for your Medicare premium even with a Medicare Advantage plan). 2

How many stars does Cigna have in 2021?

Cigna Medicare Advantage plans earned an average of 3.88 out of 5.0 Stars from CMS in 2021. 3 On this standard measure of Medicare Advantage quality, Cigna scores better than other large national insurers.

What are the benefits of Cigna?

Cigna’s extra benefits are extensive. In addition to dental, vision, hearing, and fitness, Cigna offers some members help with transportation, over-the-counter allowances, home-delivered meals, health and wellness discounts, and a program to help people find assistance paying for essential needs like housing, food, and prescriptions.

What is the age limit for Medicare?

Original Medicare is the basic Medicare offered to everyone 65 or older, or people who qualify on a basis other than age (e.g., you have a disability ). You may be enrolled in Original Medicare automatically, or you may have to sign up if you’re 65, or almost 65, and do not get Social Security.

Does Aetna offer special needs?

Aetna also offers Dual-eligible Special Needs Plans for people who qualify for Medicare and Medicaid, which allow for the coverage offered by Original Medicare along with additional special benefits like non-emergency transportation, meal programs, over-the-counter medicine coverage, or help to stop smoking.