MoneyGeek’s top pick overall for Medicare Advantage PPO plans is Blue Cross Blue Shield. For HMOs, UnitedHealthcare took the top spot. The best plan for you will depend on the options available in your area and how they meet your specific needs and preferences.

Full Answer

What are top rated Medicare Advantage plans?

Apr 07, 2022 · According to MoneyGeek’s scoring system, the top-rated Medicare Advantage plans are Blue Cross Blue Shield for preferred provider organizations and UnitedHealthcare for health maintenance organizations.

How do I choose the best Medicare Advantage plan?

Aug 27, 2021 · Aetna Medicare Advantage plans get an average Medicare star rating of 3.8 out of 5 stars. (The national average for all providers in 2022 is 4.37.) Out of nine Medicare Advantage providers ranked,...

What companies offer Medicare Advantage plans?

66 rows · Oct 14, 2021 · A Best Insurance Company for Medicare Advantage Plans is defined as a company whose plans ...

How to choose the best Medicare Advantage plan for You?

Dec 21, 2021 · Cigna Medicare Advantage plans earned an average of 3.88 out of 5.0 stars from CMS in 2021. 4 On this standard measure of Medicare Advantage quality, Cigna scores better than other large national...

How do I choose the best Medicare Advantage plan?

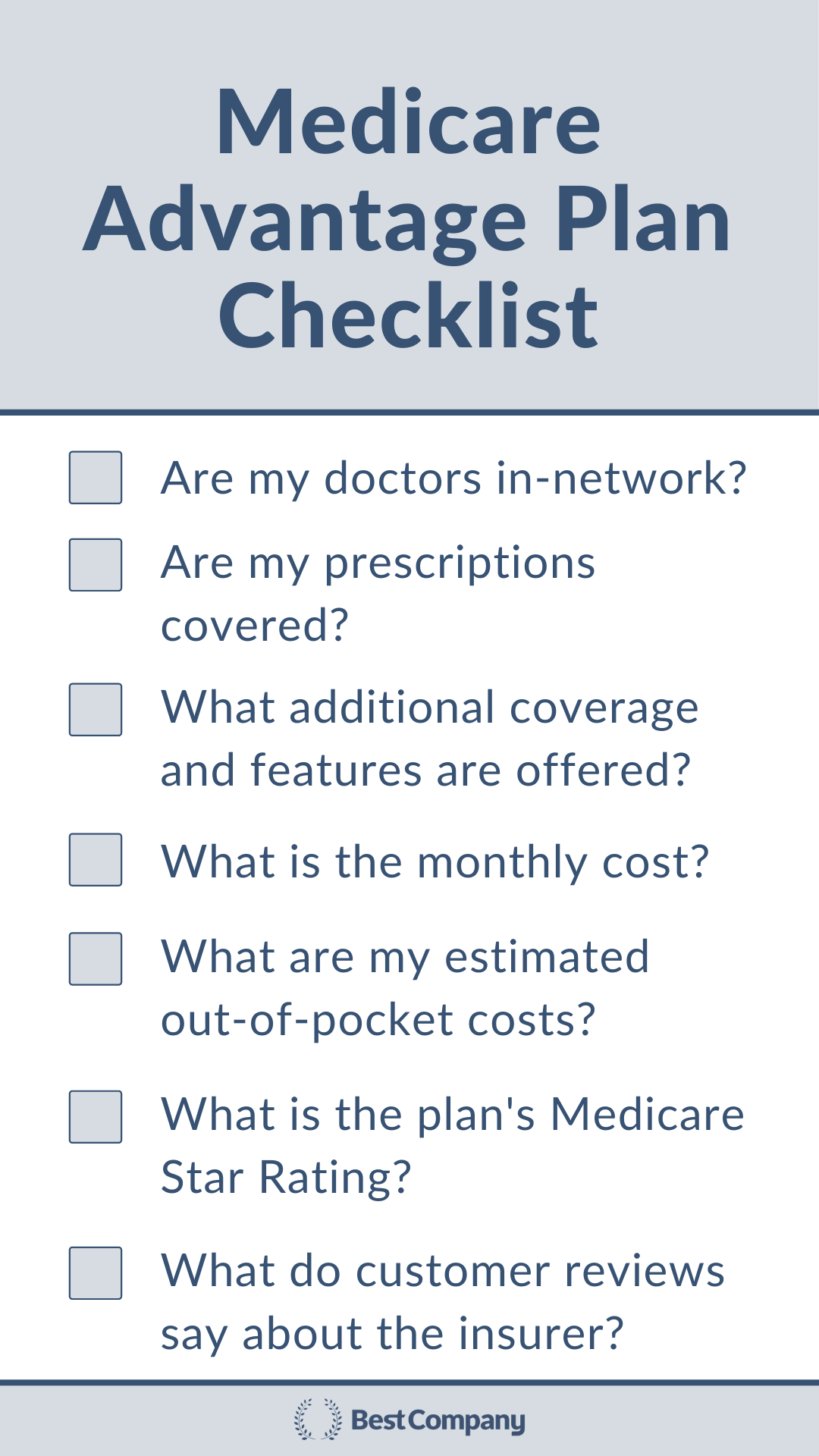

Factors to consider when choosing a Medicare Advantage plancosts that fit your budget and needs.a list of in-network providers that includes any doctor(s) that you would like to keep.coverage for services and medications that you know you'll need.Centers for Medicare & Medicaid Services (CMS) star rating.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

Is Medicare Advantage too good to be true?

Medicare Advantage plans have serious disadvantages over original Medicare, according to a new report by the Medicare Rights Center, Too Good To Be True: The Fine Print in Medicare Private Health Care Benefits.May 10, 2007

Can I switch from original Medicare to Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

Why does zip code affect Medicare?

Because Medicare Advantage networks of care are dependent upon the private insurer supplying each individual plan, the availability of Medicare Advantage Plans will vary according to region. This is where your zip code matters in terms of Medicare eligibility.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.Sep 19, 2017

What is the difference between MA and MAPD?

MA plans can include extra services such as fitness plans, hospital coverage, medical coverage, hearing aids, vision care, and dental care. In addition to all these benefits, MAPD plans offer prescription drug coverage.

Best of the Blues: Highmark

Service area: Available in Delaware, New York, Pennsylvania and West Virginia.

How to shop for Medicare Advantage plans

The right Medicare Advantage plan for you will depend on your health history, prescription medications and where you live, among other things. Here are some strategies for selecting the best plan:

How much does Medicare Advantage cost?

Costs vary depending on coverage, and choosing a Medicare Advantage plan requires careful consideration. The average monthly cost of a Medicare Advantage plan is $21, much lower than the cost of $144 with Original Medicare. 2. And when it comes to Medicare Advantage plans, the number of choices keeps growing, so it can be overwhelming.

What is the benefit of Medicare Advantage?

You get Part A and Part B, as well as in most cases Part D, which is coverage for prescription drugs. Some plans also allow for further coverage, such as dental or vision.

What is AARP Advantage?

AARP Medicare Advantage plans are full of extra benefits, from dental, vision, and hearing to over-the-counter benefits, fitness programs, and wellness programs. AARP offers lots of additional support to help members stay healthy or manage health conditions.

How many stars does Cigna have in 2021?

Cigna Medicare Advantage plans earned an average of 3.88 out of 5.0 Stars from CMS in 2021. 3 On this standard measure of Medicare Advantage quality, Cigna scores better than other large national insurers.

What is the age limit for Medicare?

Original Medicare is the basic Medicare offered to everyone 65 or older, or people who qualify on a basis other than age (e.g., you have a disability ). You may be enrolled in Original Medicare automatically, or you may have to sign up if you’re 65, or almost 65, and do not get Social Security.

When can I switch from Medicare Advantage to Original?

Whether you’re switching from one Medicare Advantage plan to another Medicare Advantage plan, or switching from Medicare Advantage to Original Medicare, you may do so within the two Medicare enrollment periods each year: October 15–December 7 and January 1–March 31 .

When does Medicare open enrollment end?

To enroll in a Medicare Advantage Plan, sign up during your initial enrollment period, which starts three months before the month you turn 65 and ends three months after, or during the annual Open Enrollment for Medicare Advantage, which runs from October 15 through December 7.

What Is Medicare Advantage?

Medicare Advantage is an all-in-one plan choice alternative for receiving Medicare benefits. You may also hear it referred to as Medicare Part C. This plan is bundled with Medicare Part A and Part B and usually includes Part D, which provides prescription drug coverage.

The Average Cost of a Medicare Advantage Plan

Some Medicare Advantage plans may have lower out-of-pocket costs than Original Medicare, and some have a $0 monthly premium. Here are a few questions to consider before purchasing a plan.

Types of Medicare Advantage Plans

There are four common types of Medicare Advantage plans to compare when making your selection.

Medicare Advantage vs. Original Medicare

Consider the following details when deciding whether a Medicare Advantage plan or Original Medicare is best for you.

Methodology

To determine the best Medicare Advantage providers of 2021, the Forbes Health editorial team evaluated all insurance companies that offer plans nationwide in terms of:

When do you have to review Medicare Advantage plans?

Review other Medicare Advantage plans during Open Enrollment. If you are enrolled in a Medicare Advantage plan and you wish try a different plan, you will have several weeks to review additional plans and enroll in a new plan during the Open Enrollment Period, also called the Annual Election Period.

What to consider when shopping for Medicare Advantage?

There are several things you may want to consider when shopping for a Medicare Advantage plan (Medicare Part C), such as plan cost, coverage and availability. You can get some help as you compare Medicare Advantage plans by using plan ratings and insurance company reviews.

What happens if a Medicare plan receives fewer than three stars?

If a plan receives fewer than three stars for three consecutive years, Medicare determines it to be a low-performing plan and reserves the right to remove it from its coverage. Current members of the plan will be notified and given a Special Enrollment Period to enroll in another Medicare plan.

What can an agent do for Medicare?

An agent can help you review which plans are available in your area and help you compare the costs, benefits, network providers and other important details of each plan. Call today to speak with a licensed insurance agent who can help you review Medicare Advantage plans and to find the best coverage for your needs.

Does Medicare Advantage have coinsurance?

Medicare Advantage plans may offer a variety of benefits that are not covered by Original Medicare , and these additional benefits can differ from one plan to the next.

How much is Medicare Advantage 2021?

Even as a Medicare Advantage user, you’ll still be responsible for paying your Medicare Part B premium, which is at least $148.50 in 2021.

How many points did UnitedHealthcare score in 2020?

Power measured member satisfaction with Medicare Advantage plans based on six factors: coverage and benefits, provider choice, cost, customer service, information and communication, and billing and payment. On these measures, UnitedHealthcare scored 800 points out ...

What is an HMO plan?

Other plan offerings include the following types: HMO plans. A health maintenance organization, or HMO, generally requires that you use a specific network of doctors and hospitals. You may need a referral from your primary doctor in order to see a specialist, and out-of-network benefits are usually very limited.

How to buy Medicare Advantage Plan?

There are two main approaches to buying a Medicare Advantage Plan: go directly to an insurance company or work with a broker. Buying your policy right from an insurer can feel more reliable, choosing a company you already know and trust, maybe even one that has been your healthcare insurance provider in the past.

Is Aetna a good Medicare provider?

Their premiums are reasonable, and the company has a solid reputation with the BBB and with agents alike. Aetna is a trustworthy provider of Medicare Advantage policies. See Plans.