The Best Medicare Advantage Companies

| Medicare Advantage Company | Best For | |

| 1 | Aetna | Great Benefits |

| 2 | SelectQuote Senior | Great Convenient Quotes |

| 3 | Humana | Great Variety |

| 4 | The Medicare Helpline | Great Plan Comparison |

Full Answer

How do I choose the best Medicare Advantage plan?

Aug 27, 2021 · Best of the Blues: Highmark. Best for size of network: UnitedHealthcare. Average Medicare star rating: 4.2 out of 5. Service area: Available in 50 states and Washington, D.C. Best for extra perks: Aetna. Best for member satisfaction: Kaiser Permanente. Best for low-cost plan availability: Humana. ...

What companies offer Medicare Advantage plans?

Oct 14, 2021 · A Best Insurance Company for Medicare Advantage Plans is defined as a company whose plans were all rated as at least three out of five stars by CMS and whose plans have an average rating of 4.5 or ...

How to choose the best Medicare Advantage plan?

Dec 21, 2021 · The Best Medicare Advantage Plans of 2022 Best User Quality: Cigna; Best User Experience: Humana; Best in Educational Content: Aetna ; Best for Bonuses: AARP

Who has the best Medicare Advantage plan?

Feb 11, 2022 · According to MoneyGeek’s scoring system, the top-rated Medicare Advantage plans are Blue Cross Blue Shield for preferred provider organizations and UnitedHealthcare for health maintenance organizations.

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

How do I choose the best Medicare Advantage plan?

Factors to consider when choosing a Medicare Advantage plancosts that fit your budget and needs.a list of in-network providers that includes any doctor(s) that you would like to keep.coverage for services and medications that you know you'll need.Centers for Medicare & Medicaid Services (CMS) star rating.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Is AARP Medicare Complete the same as Medicare Advantage?

AARP MedicareComplete is a Medicare Advantage health insurance plan that gives you both Medicare Part A and Part B along with additional benefits for drug coverage, hearing exams and wellness programs.

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What is the least expensive Medicare Advantage plan?

Aetna Medicare advantage as one of the cheapest Medicare advantage plans. Aetna Medicare advantage plans are one of the cheapest Medicare advantage plans because it has some of the widest-ranging coverages available. They offer both HMO and PPO plans.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Which is better a Medigap policy or Medicare Advantage plan?

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

Which two Medicare plans Cannot be enrolled together?

You generally cannot enroll in both a Medicare Advantage plan and a Medigap plan at the same time.Jun 2, 2021

What is the benefit of choosing Medicare Advantage rather than the original Medicare plan?

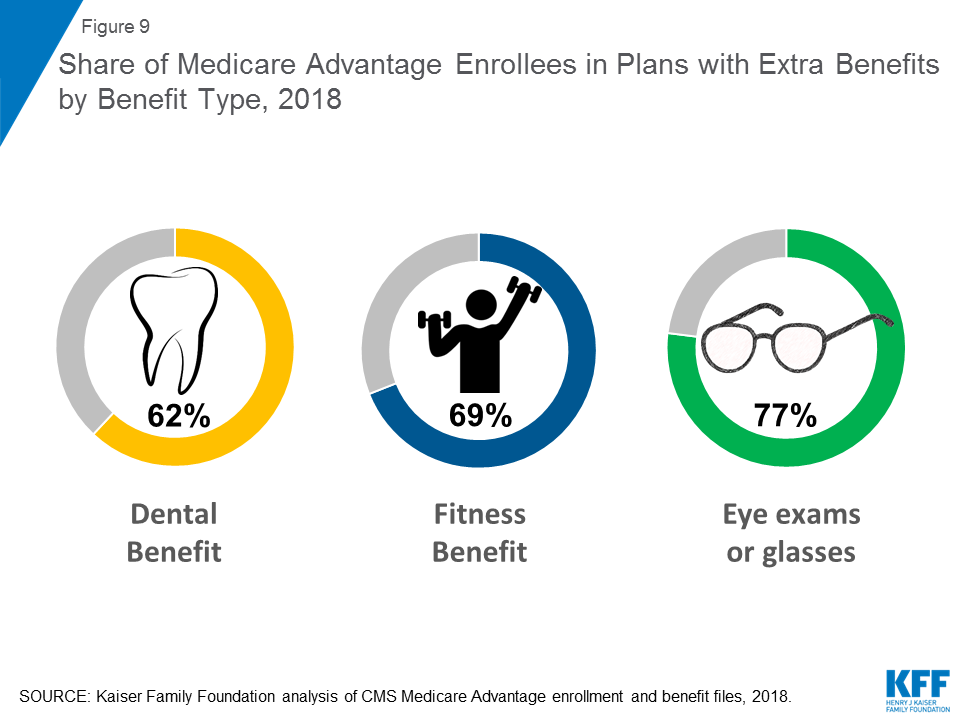

Under Medicare Advantage, you will get all the services you are eligible for under original Medicare. In addition, some MA plans offer care not covered by the original option. These include some dental, vision and hearing care. Some MA plans also provide coverage for gym memberships.Oct 12, 2021

What is UnitedHealthcare complete?

A UnitedHealthcare Dual Complete plan is a DSNP that provides health benefits for people who are “dually-eligible,” meaning they qualify for both Medicare and Medicaid. Who qualifies? Anyone who meets the eligibility criteria for both Medicare and Medicaid is qualified to enroll in a DSNP.Oct 14, 2019

How much does Medicare Advantage cost?

Costs vary depending on coverage, and choosing a Medicare Advantage plan requires careful consideration. The average monthly cost of a Medicare Advantage plan is $21, much lower than the cost of $144 with Original Medicare. 2. And when it comes to Medicare Advantage plans, the number of choices keeps growing, so it can be overwhelming.

What is the benefit of Medicare Advantage?

You get Part A and Part B, as well as in most cases Part D, which is coverage for prescription drugs. Some plans also allow for further coverage, such as dental or vision.

What is Cigna HealthSpring?

Cigna, sometimes called Cigna HealthSpring for its Medicare Advantage plans, earns higher average Star Ratings from the Centers for Medicare and Medicaid Services (CMS), the agency that oversees Medicare.

What is AARP Advantage?

AARP Medicare Advantage plans are full of extra benefits, from dental, vision, and hearing to over-the-counter benefits, fitness programs, and wellness programs. AARP offers lots of additional support to help members stay healthy or manage health conditions.

How many stars does Cigna have in 2021?

Cigna Medicare Advantage plans earned an average of 3.88 out of 5.0 Stars from CMS in 2021. 3 On this standard measure of Medicare Advantage quality, Cigna scores better than other large national insurers.

What is the age limit for Medicare?

Original Medicare is the basic Medicare offered to everyone 65 or older, or people who qualify on a basis other than age (e.g., you have a disability ). You may be enrolled in Original Medicare automatically, or you may have to sign up if you’re 65, or almost 65, and do not get Social Security.

When can I switch from Medicare Advantage to Original?

Whether you’re switching from one Medicare Advantage plan to another Medicare Advantage plan, or switching from Medicare Advantage to Original Medicare, you may do so within the two Medicare enrollment periods each year: October 15–December 7 and January 1–March 31 .

The Best Overall Medicare Advantage Provider

MoneyGeek’s top pick for the best overall Medicare Advantage option is Blue Cross Blue Shield's preferred provider organization plans.

The Best Medicare Advantage Provider for HMO Plans

Among Medicare Advantage HMOs available in at least 25 states, MoneyGeek’s pick for the best carrier overall is UnitedHealthcare based on Medicare Star Ratings and the availability of robust extra benefits.

The Best Medicare Advantage Provider for Plans Without Drug Coverage

Prescription drug coverage is optional for Medicare members and is not included in Original Medicare. Though many Medicare Advantage plans include prescription drug coverage, you can choose a Medicare Advantage plan without drug benefits.

Best Medicare Advantage Provider for Low Out-of-Pocket Cost Plans

Medicare Advantage plans can be relatively low-cost, many with zero premiums. But the trade-off can come in the form of higher out-of-pocket costs. When evaluating the price of a plan, consider all the costs, not just the premiums.

What to Know About the Best Medicare Advantage Plans

It can be hard to determine which Medicare Advantage plan is right for you. Though there are standard quality ratings, the best plan for you will depend on your specific needs.

How to Get The Best Medicare Advantage Plan for You

More than 26 million people — 42% of all Medicare beneficiaries — enrolled in a Medicare Advantage plan in 2021, more than double the number enrolled a decade ago. There are only more Medicare Advantage options for people in 2022.

What is Medicare Advantage?

Medicare Advantage is a convenient way to bundle Medicare coverage plans. Generally, all Americans age 65 and older are eligible for federally-subsidized Medicare health insurance. Original Medicare is divided into Part A to cover hospitalization and optional Part B medical insurance.

How much is Medicare Advantage 2019?

The average Medicare Advantage premium for 2019 is $28 per month but can vary from $0 to $300. Other out-of-pocket costs might include annual or other deductibles or copayments for visits or services. Many plans have in-network and out-of-network providers, so you may pay more if you use a provider who is not part of the network.

What insurance companies are part of Medicare Helpline?

Medicare Helpline finds plans from top insurance companies, including Aetna, Mutual of Omaha, Cigna and Humana. Enter your information using the online portal to compare Medicare Advantage plans and narrow your choices.

What is SelectQuote Senior?

SelectQuote Senior is an online insurance brokerage service. It is free to use. You provide your contact information, and a representative calls you on the phone to give a quote for a Medicare Advantage or other Medicare Supplement insurance plan from a partner company.

What is the number for Medicare Helpline?

Enter your information using the online portal to compare Medicare Advantage plans and narrow your choices. (855) 944-1220 Learn More.

How often do you pay Medicare premiums?

Part A may be free if you or your spouse worked and paid Medicare taxes for at least 10 years. However, most people pay premiums for Parts B and D. Medicare bills every three months if you enroll in Parts B and D, or premiums get deducted from your Social Security, Civil Service Retirement or Railroad Retirement check.

What is Taptap Medicare?

Organize your benefits and insurance in one place. TapTap Medicare is an online marketplace where shoppers can find gap insurance that works for their situation. TapTap Medicare works with more than 21 Medicare supplement and Medicare advantage providers. Read Review.

Which company offers the best Medicare Advantage Plan?

Cigna. These long-standing companies offer the best Medicare Advantage plans year after year. But, since Medicare isn’t free, it’s a good idea to have other options for coverage. One option is a Medicare Advantage plan. These plans will take the place of Medicare. When you go to the doctor, your Medicare Advantage Plan ID card is your main card ...

What is Medicare Advantage Plan ID?

When you go to the doctor, your Medicare Advantage Plan ID card is your main card for Medicare. These plans have Part D, which can make keeping track of your healthcare easier. Some plans even include things like routine dental, routine eye care, and silver-sneakers fitness programs.

What is the lowest out of pocket cost for Humana?

For example, some maximum out-of-pockets are as low as $2,200. If this plan is in your service area, that would mean the most you can spend on copayments and coinsurances for the year is $2,200.

What are the benefits of Humana Part C?

Most Advantage plans are including fitness programs and access to more than 13,000 fitness centers, convenient mail-order pharmacy services, and a 24/7 nurse advice line.

Do some states have more Medicare Advantage plans than others?

Choosing a reliable company to handle your Medicare Advantage benefits is essential. Some states have more Medicare Advantage plan enrollees than other states. For example, fewer beneficiaries in Louisiana have Medicare Advantage than the percentage of enrollees in Florida.

Does Cigna have special needs plans?

That is why Cigna offers many plan options, including Special Needs Plans. Cigna has special needs plans for people in nursing homes or skilled nursing care, or people with diabetes, cardiovascular issues, and options for people with Medicare and Medicaid. Cigna has over 86 million members worldwide.

Can you join Medicare Advantage at any time?

Things to Know About Medicare Advantage Plans. You can only join at certain times during the year unless you qualify for a Special Election Period. In most cases, you enroll in a plan for a year. The Medicare Advantage Open Enrollment Period allows beneficiaries to switch to another plan.

What is the Medicare program for retirees?

Your Medicare Coverage. Most retirees receive health insurance through Medicare, the federal government's health insurance program for people age 65 and older. To maximize the value of the health plan, make sure to sign up at the correct time and take advantage of the free and low-cost services Medicare provides.

Can Medicare beneficiaries enroll in Medicare Advantage?

MEDICARE-ELIGIBLE beneficiaries can enroll in a Medicare Advantage plan or a Part D Prescription Drug plan from a private insurance company. U.S. News provides a tool for Medicare-elig ible beneficiaries to find the right Medicare plans for their needs. U.S. News analyzed insurance companies’ offerings in each state based on their 2021 CMS star ...

Why do you keep your Medicare card?

Keep your red, white, and blue Medicare card in a safe place because you’ll need it if you ever switch back to Original Medicare. Below are the most common types of Medicare Advantage Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

What is a special needs plan?

Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

What is a TAB plan?

#TAB#Medical Savings Account (MSA) plans—These plans combine a high-deductible health plan with a bank account. Medicare deposits money into the account (usually less than the deductible). You can use the money to pay for your health care services during the year. MSA plans don’t offer Medicare drug coverage. If you want drug coverage, you have to join a Medicare Prescription Drug Plan. For more information about MSAs, visit Medicare.gov/publications to view the booklet “Your Guide to Medicare Medical Savings Account Plans.”

Can I go to a doctor for a HMO?

#TAB#Health Maintenance Organization (HMO) plans—In most HMOs, you can only go to doctors, other health care providers, or hospitals in the plan’s network, except in an urgent or emergency situation. You may also need to get a referral from your primary care doctor for tests or to see other doctors or specialists.

Can you sell a Medigap policy if you already have a Medicare Advantage Plan?

If you already have a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re disenrolling from your Medicare Advantage Plan to go back to Original Medicare.