If you have Original Medicare and you plan to travel abroad regularly, consider adding a Medigap Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …Medigap

Full Answer

Which travel insurance plan is best for You?

Comprehensive travel insuranceplans offer the most benefits of all plan types and will typically include medical coverage. It can offer you additional coverage for things like trip cancellation, trip delay and cancellation, lost luggage, and more. It’s the best way to cover a host of potential common travel-related problems.

Does Medicare travel insurance cover emergency care when traveling?

Medicare supplement insurance (Medigap) policies may cover emergency care when you travel outside the U.S. Because Medicare has limited travel medical coverage outside the U.S., you may choose to buy a travel insurance policy to get more coverage.

How much does Medicare pay for international travel?

With a Medigap plan that covers foreign travel emergencies, the patient pays a $250 deductible plus 20 percent coinsurance, and there’s a lifetime benefit maximum of $50,000. Some Medicare Advantage plans cover medical emergencies that arise during foreign travel.

What credit cards have travel insurance coverage?

This card is full of benefits, including excellent travel insurance coverage. The Platinum Card® from American Express Earn 100,000 Membership Rewards points. Terms Apply. Learn how we get over $5,350 in valuefrom the Amex Platinum. Ink Business Preferred® Credit Card 100,000 Bonus Points

Does Medicare Advantage cover you while traveling?

With Medicare Advantage plans, you'll have emergency and urgent care coverage when traveling outside of your network, within the United States. That means you don't have to worry about coverage if you get a sudden illness or break a bone while traveling.

Do I need travel insurance if I have Medicare?

Do I need travel insurance if I have Medicare? The short answer: Yes. According to Medicare.gov, health care you get while traveling outside the U.S. isn't covered.

Do Medicare Advantage plans cover you the same all over the country?

In most situations, Medicare won't pay for health care or supplies you get outside the U.S. The term “outside the U.S.” means anywhere other than the 50 states of the U.S., the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, and the Northern Mariana Islands.

Does Medicare cover you out of state?

Can You Use Your Medicare Benefits in Another State? If you have original Medicare (Medicare Part A and Medicare Part B) you are covered anywhere in the United States. You must, however, use hospitals and doctors that accept Medicare.

What travel insurance is best for seniors?

Top InsurersTravel Guard Travel Insurance. In addition to offering standard cancellation coverage, this company features plans that cover preexisting conditions and full medical expenses. ... Travelsafe Travel Insurance. ... Allianz Travel Insurance.

Is travel insurance worth the cost?

Though you may pay 5 to 10 percent of your trip cost for travel insurance, travel insurance is often worth the investment for its potential to help reimburse you for hundreds of thousands of dollars of covered travel-related expenses like emergency evacuation, medical bills, and costs related to trip cancellation and ...

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Do any countries accept U.S. Medicare?

Here's what you need to know:Medicare doesn't normally cover healthcare costs outside the U.S. (The official definition of the U.S. includes the 50 states and the District of Columbia, Puerto Rico, Guam, the U.S. Virgin Islands, American Samoa, and the Northern Mariana Islands—you can use your Medicare benefits in ...

What will Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

Can you have Medicare in two states?

You can have Medicare while living in two states, but you'll choose one location as your primary residence. There will be some Medicare plans that benefit you more than others when you have multiple homes. Some retired people choose to reside in two different locations.

Do you lose Medicare if you move out of the country?

Remember, you can have Medicare while you live abroad, but it will usually not cover the care you receive. Most people qualify for premium-free Part A, meaning you will pay nothing for coverage. If you must pay a premium for Part A, be aware of the high monthly cost for maintaining Part A coverage.

What happens if you don't have health insurance and you go to the hospital?

However, if you don't have health insurance, you will be billed for all medical services, which may include doctor fees, hospital and medical costs, and specialists' payments. Without an insurer to absorb some or even most of those costs, the bills can increase exponentially.

Under what circumstances will I be covered by Original Medicare when I'm outside of the United State...

Original Medicare coverage outside the United States and U.S. territories is limited to these circumstances: You’re in the U.S. when you have a med...

Will Medigap cover me when I'm traveling outside the U.S.?

If you’re adding a Medigap plan to supplement your Original Medicare, six of the Medigap plan design options provide coverage for medical emergenci...

Does Medicare Advantage provide coverage while I'm traveling internationally?

Some Medicare Advantage plans cover medical emergencies that arise during foreign travel. If you’re considering Medicare Advantage and are planning...

Other than Medicare, what coverage should I consider when I'm traveling?

For added peace of mind, many Medicare beneficiaries choose to purchase travel medical insurance prior to a trip. Travel medical plans are widely a...

Should I have Medicare coverage if I retire abroad?

For coverage in your new country, you’d need to purchase private health insurance or buy into the country’s public health plan, if that option is a...

How does Medicare cover me if I'm traveling within the U.S.?

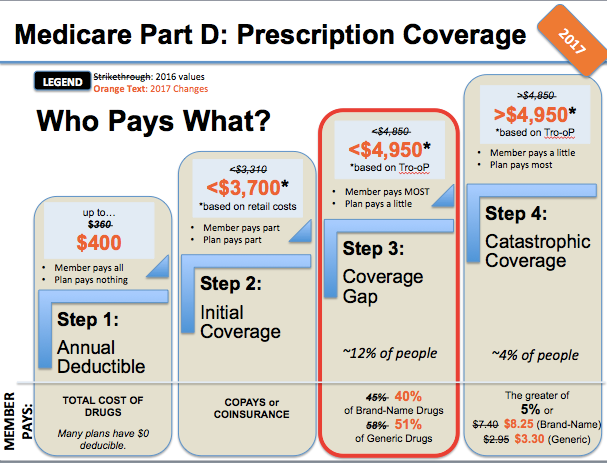

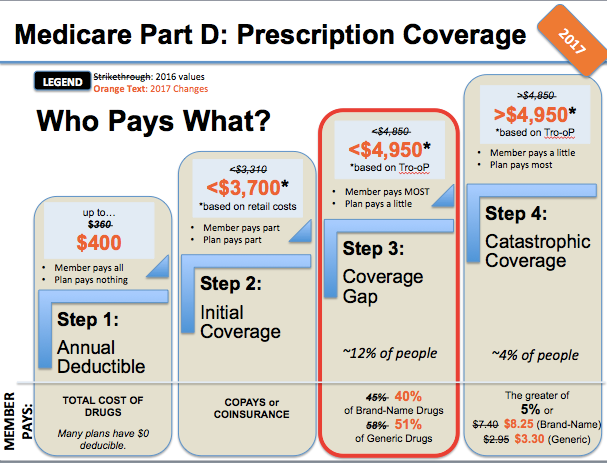

For Medicare beneficiaries who see endless travel opportunities right here in the U.S., Original Medicare plus a Medigap plan (and a Medicare Part...

What is MA from Medicare?

MA differs from Original Medicare in a few important ways. MA plans are sold by private companies, and many offer benefits not included in Original Medicare, like dental, vision and hearing coverage. MA plans also include a network of providers. In Health Maintenance Organization (HMO) plans you generally need to use one ...

How long can you stay in a MA plan?

In fact, the Centers for Medicare & Medicaid Services (CMS) require that members be disenrolled from their MA plan if they live outside their plan’s service area for more than six months.

What is an HMO plan?

In Health Maintenance Organization (HMO) plans you generally need to use one of the health care providers in network to get coverage for a service. Members of Preferred Provider Organization (PPO) plans have coverage when they see providers who are out of their plan’s network, although they usually pay more.

Does Monique C have a travel advantage?

How to make sure your Medicare Advantage HMO plan travels with you. Monique C. has a Medicare Advantage HMO plan from Aetna that includes the Travel Advantage feature. Travel Advantage allows Monique to remain in her plan for an extra six months when out of her plan’s service area. It also offers a multistate provider network.

Does Medicare cover travel?

Medicare can provide excellent health coverage during your travels in the United States . Original Medicare, which is what many people call the combination of Medicare Parts A and B, is widely accepted by health care providers across the country. You just need to confirm that the provider you see accepts Medicare before you receive your care.

Is traveling an essential part of your retirement experience?

Is travel an essential part of your retirement experience? If so, then you’ll need to do some planning. That includes making sure you have the right Medicare coverage. Luckily, there are many different Medicare plans to consider that may offer you coverage during your travels.

Can you pick up prescriptions while on the road?

That’s why certain MA plans come with a national pharmacy network that allows you to pick up your prescription medications across the United States.

How long do you have to live in the US to get Medicare Advantage?

With most Medicare Advantage plans, if you travel outside of your plan’s service area (the area you have to live in to enroll in the plan) for more than six months, you’ll be disenrolled from the Medicare Advantage plan and switched to Original Medicare instead. If you’re in a Medicare Advantage PPO and travel in the United States ...

What percent of doctors are on Medicare?

Ninety-three percent of all U.S. doctors who provide Medicare-covered services are participating providers with Original Medicare. And the number of doctors who have opted out of Medicare declined in 2017, after increasing for several years before that.

How long does it take for a medicaid plan to cover a medical emergency?

Plans C, D, F, G, M, and N cover medical emergencies while traveling, as long as medical care starts within 60 days of leaving the United States.

Can I use travel medical insurance with Medigap?

Travel medical insurance can be used in conjunction with Medigap coverage or other health insurance. Many travel medical insurance plans include separate medevac coverage, but it can also be purchased on a stand-alone basis from private carriers. Medevac return to the United States is not included in the foreign travel emergency coverage provided ...

Can I travel outside the US with Medicare Advantage?

If you’re considering Medicare Advantage and are planning to travel outside the United States, check with the carrier to see if they cover emergency care outside the United States. Medigap plans cannot be used in conjunction with a Medicare Advantage plan. If your Medicare coverage is supplemented by retiree health benefits from your employer, ...

Can I travel with Medicare Advantage PPO?

If you’re in a Medicare Advantage PPO and travel in the United States for less than six months, you’ll have access to out-of-network providers for routine care, but you may have to pay higher out-of-pocket costs. If you’ve got an HMO, you may not have coverage at all for non-emergency care when you’re outside your service area.

Can I get medical underwriting for Medigap?

In most states, Medigap plans are only available with no medical underwriting during your initial enrollment period (and very limited special enrollment periods ), so it’s wise to plan ahead and choose Medigap coverage with international emergency benefits if you think you might travel during retirement. With a Medigap plan that covers foreign ...

What to consider when choosing Medicare for traveling?

Things to consider when choosing the best Medicare Plan for traveling. If you have plans to travel once you’re retired you should give some careful consideration to which Medicare Plan will afford you the best coverage when you’re away from home. Choose the wrong plan and you may find yourself with inadequate coverage or a very limited amount ...

Can I self pay for Medigap?

If your budget will allow it and you can self pay for any of the ancillary benefits available from an Advantage Plan you will have much more freedom and flexibility with a Medigap policy. But keep in mind that you will also need to enroll in a Part D Plan as well since no Medigap policies currently offer prescription drug coverage.

Travel Outside America

During our working years, travel outside the United States can be hard to do because most of us are only allotted so much vacation time by our employers. For this reason, many retirees have saved their international travel for the years when vacation time limitations are no longer a hindrance.

Travel Within America

When it comes to travel within U.S. borders, Medicare coverage gets much easier to understand. Since Medicare involves a national network, your Original Medicare coverage will provide care for you anywhere in the nation as well as within American territories like Samoa and Puerto Rico.

Final Thoughts For Travelers In Retirement

Be aware that foreign emergency care providers may not always agree to submit bills to Medicare for you. When you receive bills, always hang on to them in case you need to submit them to Medicare yourself.

How long do you have to be away from home for health insurance?

It’s pretty common for your health plan to require that you be away from home for a few weeks or months before the benefit kicks in.

Can you get travel insurance if you have a serious illness?

That means you don’t have to worry about coverage if you get a sudden serious illness or break a bone while traveling. If you need non-emergency care while traveling, it may not be covered and you’ll likely have to pay more out of pocket. That’s where a travel benefit can help.

Does Medicare Advantage include travel?

Not all Medicare Advantage plans include a travel benefit. So if you’re like me and plan on traveling south every winter, you should look for a plan that offers one. Some are included in the price of your plan. Others are an option that you pay for only when you need it.

Does Medicare cover snowbirds?

Yes, there are special Medicare Advantage plans just for snowbirds! Make sure you’re covered before you take off. Since I live in the Midwest, where “polar vortex” is actually a thing, I’ve always dreamed of spending the winters somewhere warm. I know a lot of Medicare members are in the same boat.

Do you pay for travel benefits out of state?

With a travel benefit, you’ll pay almost the same for care out-of-state as you would close to home. The benefits and costs are different for every plan, so you’ll need to do your homework to figure out what’s best for you.

Can you get emergency coverage with Medicare Advantage?

If you’re spending part of the year away from home, here are a few things to keep in mind: With the most basic Medicare Advantage plans, you get emergency coverage when traveling outside of your network, if you’re traveling within the United States.

What is the most common type of travel medical insurance?

Length of Trip. You are covered by travel medical insurance based on the type of plan you purchase. These come in 3 types: Single-Trip Coverage. This is the most common type of travel medical insurance. When you leave your home, go on a trip, and then return home, this is considered to be a single trip.

How much does travel medical insurance cover?

Travel medical insurance covers emergency medical costs up to the plan limit. Plan limits vary greatly by plan but typically fall between $50,000 and $2,000,000.

What is the most common medical emergency that is claimed by Allianz?

According to Allianz Travel,the most common overseas medical emergencies that are claimed include: Fractures from falls.

What is comprehensive travel insurance?

Bottom Line: Comprehensive travel insurance is a full-service plan and includes travel medical coverage as well as other coverages that will protect all aspects of your trip. Health Insurance. You might be thinking that already have medical insurance provided by your employer or through Medicare.

How long before a trip can I buy medical insurance?

Most plans allow you to buy insurance up until the day before your trip. However, the best time to buy travel medical insurance is within 15 days of making the first payment on your trip, since buying early can often qualify you for bonus coverages.

What is the difference between Voyager and Choice?

The main difference between the 2 plans is that the Choice plan does not require you to be covered by a primary health plan, but doesn’t cover pre-existing conditions. The Voyager plan will cover all pre-existing conditions, but functions as a secondary coverage after your primary health plan.

Why is travel medical important?

A travel medical policy can be an important addition to your trip since your primary health plan may not cover you fully if you need assistance outside of your home country. An uninsured injury or illness abroad can result in a huge financial burden that can be significantly reduced by having travel medical insurance.