[Table] Top 20 Most Populous Medicare-Eligible Texas Counties & Medicare Advantage Plan Enrollment

| Texas County | Total Number of Medicare Beneficiaries | Medicare Advantage Enrollment (Populatio ... | Medicare Advantage Enrollment (Percentag ... |

| Harris County | 567,107 | 299,573 | 53 percent |

| Dallas County | 328,145 | 150,023 | 46 percent |

| Bexar County | 303,158 | 155,334 | 51 percent |

| Tarrant County | 282,260 | 142,398 | 50 percent |

Full Answer

What are the Medicare Advantage plans in Texas?

Sep 22, 2021 · The plans below are rated 4.5 stars out of 5 by the CMS: Baylor Scott & White Health Plan: BSW SeniorCare Advantage, BSW SeniorCare Advantage Basic, BSW SeniorCare Advantage... Cigna: Cigna Alliance Medicare, Cigna Fundamental Medicare (select counties), Cigna Preferred Medicare (some counties),... ...

How to pick the right Medicare plan?

Jun 01, 2021 · Use the Medicare Plan Finder to compare plans, benefits, and costs. The cheapest premium doesn’t always result in the lowest total cost. Make sure to enter your prescriptions in the plan finder to see how your costs will vary by plan and look closely at copayments and deductibles. The Medicare Plan Finder also includes a helpful rating system ...

What are the best Medicare plans?

Nov 15, 2021 · Aetna offers some of the most popular Medigap plan options in most parts of Texas. Depending on the plan you choose, you may pay as little as $37 a month for coverage. Aetna also offers discounts...

Who has the best Medicare Advantage plan?

In Texas in 2021: Medicare Advantage: • The average monthly Medicare Advantage premium changed from $12.43 in 2020 to $11.42 in 2021. This represents a -8.15 percent change in average premium. • 289 Medicare Advantage plans are available in 2021, compared to 231 plans in 2020. This represents a 25.11 percent change in plan options.

How Much Does Medicare Advantage plan cost in Texas?

In Texas, the average cost of a Medicare Advantage plan is $34 per month, and the average cost of a Medicare Part D plan is $52 per month. Among the companies offering plans for 2022, UnitedHealthcare/AARP stands out as one of the best Medicare Advantage providers for most people in Texas.Feb 25, 2022

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

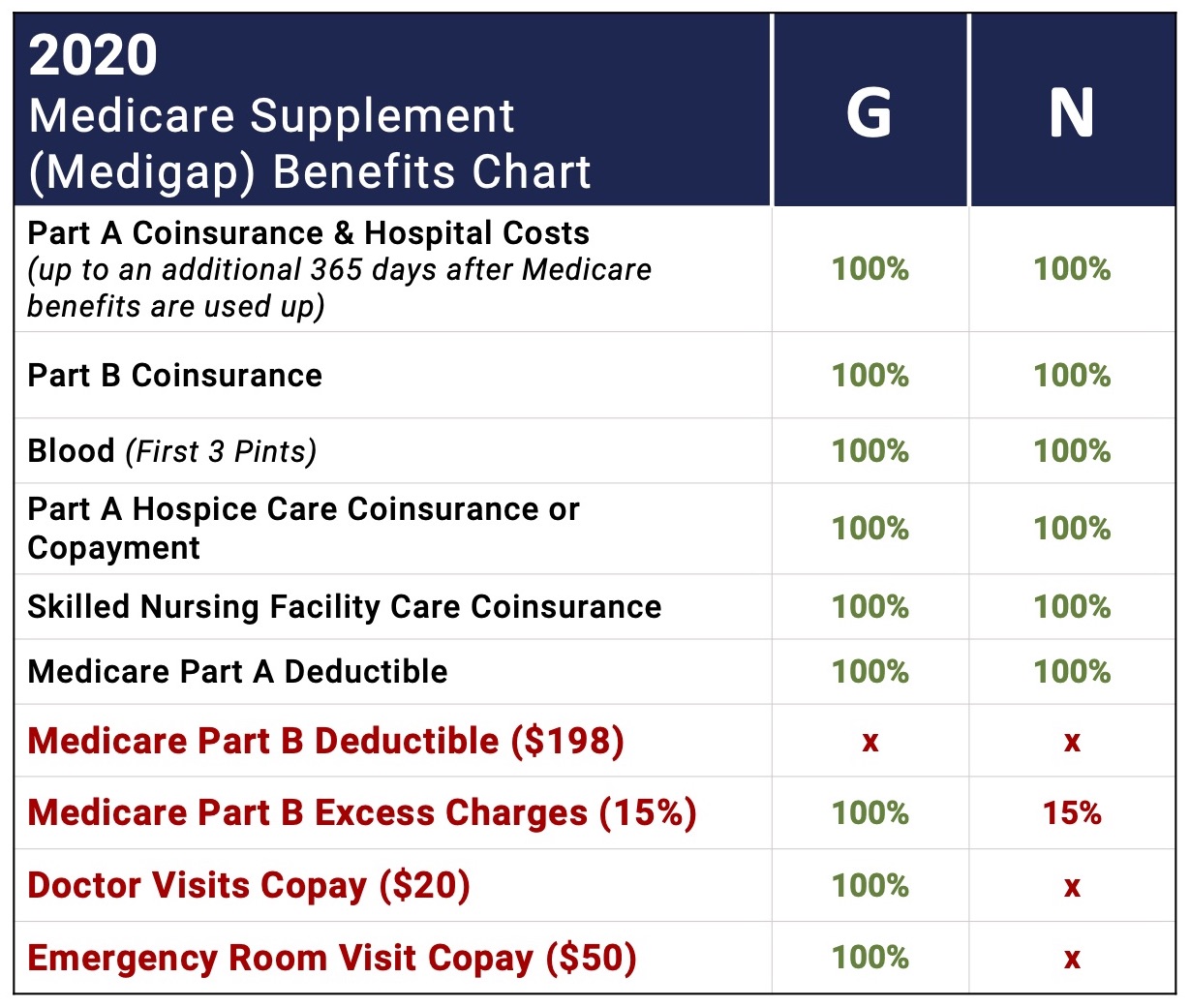

How Much Does Medicare Plan G cost in Texas?

$92-$419How Much Do Medigap Policies Cost?Plan TypePremium RangePlan F$106-$442Plan G$92-$419Plan N$70-$400

What insurance company has the best Medicare plans?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

How do I choose the best Medicare Advantage plan?

Factors to consider when choosing a Medicare Advantage plancosts that fit your budget and needs.a list of in-network providers that includes any doctor(s) that you would like to keep.coverage for services and medications that you know you'll need.Centers for Medicare & Medicaid Services (CMS) star rating.

What is the most expensive Medicare supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

Is Medicare G the best plan?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

What is the average cost of a Medicare Supplement plan?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

Who is the best Medicare provider?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCoverage areaBlue Cross Blue Shield5.0Offers plans in 48 statesCigna4.5Offers plans in 26 states and Washington, D.C.United Healthcare4.0Offers plans in all 50 statesAetna3.5Offers plans in 44 states1 more row•Feb 25, 2022

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What are the top Medicare Advantage plans in Texas?

Medicare Advantage plans vary from County to County in Texas. This is due to the local nature of healthcare provider networks. If you enter your zi...

Do Texas Medicare Advantage plans include prescription coverage?

Most Medicare Advantage plans available in Texas include a Part D plan, but not all. Before joining a plan, be sure to check that all of your most...

Is Medicare Advantage worse than Original Medicare?

To understand the pros and cons of Medicare Advantage, you need to compare it with Original Medicare and factor in your health and financial situat...

How much does Medicare pay for Part B?

Your Part B premium is based on your income. After you meet the Part B deductible, Medicare will pay 80 percent for covered services, and you’ll pay the remaining 20 percent unless you have a Medigap policy. Your costs will be different if you decide to go with a Medicare Advantage plan instead of traditional Medicare.

How long do you have to sign up for Medicare?

For most people, that begins three months before your 65th birthday and runs until three months after your birthday. You may be able to delay enrollment if you have job-based health insurance, but check with your benefits manager to see if your employer plan qualifies. If you don’t enroll when you’re first eligible, you may have to pay higher premiums once you do sign up.

What happens if you don't enroll in Medicare?

If you don’t enroll when you’re first eligible, you may have to pay higher premiums once you do sign up. If you’re already getting Social Security or disability benefits, you will be automatically enrolled in medical services and hospital care through Medicare.

When do you have to enroll in Medicare?

Most people need to enroll in Medicare through Social Security when they turn 65. It can be a confusing process, but knowing some key facts can help you decide on the best plan. You can also change Medicare plans during open enrollment each year. Medicare open enrollment is October 15 to December 7.

Does Medicare Advantage Plan cover prescription drugs?

You may not need a separate Part D plan if you have a Medicare Advantage Plan because most advantage plans include drug coverage. Check the plan’s drug formulary to make sure it covers your prescriptions.

Best Medicare Supplement Plans in Texas

Continue reading to explore the benefits and drawbacks of choosing the following Medicare Supplement Plan providers in Texas to cover your Medigap needs.

What Is a Medicare Supplement Plan?

Medicare Supplement Plans are Medicare insurance add-on plans sold through private insurance companies. These policies are sometimes also referred to as “Medigap coverage.” Medicare Supplement Plans help pay medical costs that are not covered by Original Medicare, such as coinsurance, copayments and deductibles.

When Can I Enroll in Medicare Supplement Plans in Texas?

You can enroll in Medicare Supplement Plans at a few different times. The Medicare Supplement Open Enrollment Period is the best time to enroll and is specific to you. Your Medicare Supplement Open Enrollment Period begins the day that your Part B insurance goes into effect — which only occurs once you reach 65 years of age.

Medicare Supplement Provider Reviews

Now that you understand how Medicare supplemental plans work, let’s take a look at a few of the best Medicare Supplemental policy providers offering options in Texas.

Finding the Best Medicare Supplement Plans in Texas

The most important thing to remember when enrolling in a Medicare Supplement Plan is that you’ll pay less and receive guaranteed approval when you enroll during your unique Open Enrollment period. This fact makes it important to begin comparing coverage options as soon as possible.

How much is Medicare Advantage in Texas in 2021?

In Texas in 2021: Medicare Advantage: •The average monthly Medicare Advantage premium changed from $12.43 in 2020 to $11.42 in 2021. This represents a -8.15 percent change in average premium. •289 Medicare Advantage plans are available in 2021, compared to 231 plans in 2020.

What is the CMS?

The Centers for Medicare & Medicaid Services (CMS), under the Trump Administration’s leadership, has taken several actions to improve the Medicare Advantage and Part D prescription drug programs that have resulted, overall, in an increase in plan choices and benefits, and lower costs in these popular programs.

What percentage of Medicare beneficiaries in Texas choose Advantage?

In fact, over 20 percent of all Medicare beneficiaries in Texas choose Medicare Advantage enrollment over traditional Medicare. What you really need to know is that these plans are not for everyone, and for some Texas seniors they are a disadvantage.

What happens when you become a Medicare Advantage Plan member in Texas?

Specifically, when you become a Medicare Advantage plan member in Texas you are agreeing to accept the plan's managed care health system.

What is the disadvantage of Medicare Advantage Plan?

You see, when you take doctor choice out of the equation, the big difference between Medicare Advantage and Medigap is when you pay for services. It's that same no matter what type of Medicare Advantage plan you're evaluating (e.g., HMO, PPO, PFFS, Cost, or HSA).

What is the difference between Medicare Part A and Medicare Part B?

Medicare Part A is hospital inpatient coverage for people with Original Medicare, whereas Part B is medical coverage for doctor visits, tests, etc.... and Medicare Part B.

What is out of pocket medical?

Out-of-pocket costs (aka, out-of-pocket medical expenses) are costs that a beneficiary must pay because their health insurance does not cover them. Out-of-pocket costs are found in the deductibles, copayments, and coinsurance outlined in each health... .

Do you pay for Medicare supplemental insurance in advance?

However, with Original Medicare and a Medigap plan for supplemental coverage, you pay for most of your costs in advance with a higher premium. You control your costs by choosing a plan that pays the deductible (s) you want to be covered.

Is Medicare Advantage the best option?

If you qualify for both Medicare and Medicaid, regardless of your health condition, Medicare Advantage is your best option. If you have special needs (i.e., a full-time nursing home resident, diabetes, etc.) and an appropriate Medicare Advantage Special Needs Plan (SNP) is available, this is your best option.

What is the deductible for Medicare in Texas in 2021?

People with Medicare benefits in Texas have more Medicare Part D Plan (PDP) choices in 2021. However, the initial deductible is now up to $445, up from $435 last year, a $20 increase over last years' standard deductible. The Initial Coverage Limit has increased to $4,130, a $110 bump over last year.

What is Medicare Part A?

Medicare Part A is hospital inpatient coverage for people with Original Medicare, whereas Part B is medical coverage for doctor visits, tests, etc.... and Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare.

How much is the 2020 TROOP limit?

That's $200 more than the 2020 TrOOP limit of $6,350. TrOOP is the dollar amount you'll spend to get out of the Donut Hole or Coverage Gap and into your Medicare Part D plan's Catastrophic Coverage phase. A premium is an amount that an insurance policyholder must pay for coverage.

What is the ICL for 2021?

The 2021 Initial Coverage Limit (ICL) is $4,130. The Coverage Gap (donut hole) starts when you reach the ICL and ends when you hit the out-of-pocket threshold, which is now $6,550. The Initial Coverage Limit marks the coverage gap entry point. You enter the coverage gap when the total negotiated retail value of your prescription drug purchases exceed your plan’s Initial Coverage Limit.

What is the Donut Hole discount for 2021?

The 2021 Donut Hole Discount is 75% for Generic Drugs. If you reach the 2021 Coverage Gap phase of your Part D coverage, the generic drug discount will be 75%. This means your generic drug costs in the Donut Hole will be 25% of your Part D plan's negotiated retail prices.

Does Medicare Part D have a deductible?

Most Medicare Part D plans have an initial deductible, but many popular Medicare Part D plans exclude Tier 1 and Tier 2 drugs from the deductible, giving immediate coverage on most lower-cost medications.

Is Medicaid a public health insurance?

Medicaid is a public health insurance program that provides health care coverage to low-income families and individuals in the United States.... (aka, dual eligible or Medi-Medi) may be enrolled in a Texas Medicare Prescription Drug Plan automatically, as well as Social Security's Extra Help program.