What's the best Medicare Supplement company in Texas?

| Insurer | Popularity | Plan G cost | Plan N cost | Customer satisfaction |

| AARP/UHC | 27% | $126 | $107 | 4.5 |

| BCBS of Texas | 19% | $121 | $99 | 3.0 |

| Mutual of Omaha | 15% | $133 | $100 | 5.0 |

| Aetna | 7% | $126 | $88 | 1.5 |

| Insurance company | Share of Texas Medigap members |

|---|---|

| 1. AARP/UnitedHealthcare | 22.9%. |

| 2. Mutual of Omaha | 18.3%. |

| 3. Blue Cross Blue Shield of Texas | 17.7%. |

| 4. Aetna | 9%. |

What is the best Medicare Advantage plan in Texas?

The options available in Texas include:

- managed care plans, such as health maintenance organizations (HMOs), preferred provider organizations (PPOs), and provider-sponsored organizations (PSOs).

- private fee-for-service plans.

- Medicare special needs plans.

Who has the best Medicare supplement?

Top 10 Supplemental Medicare Insurance Companies in 2021

- Mutual of Omaha – Best Overall

- Aetna – High-Quality Nationwide Options

- Cigna – Superior Customer Care

- United American – Best Enrollment Experience

- GPM – Superior Coverage Options

- UnitedHealthcare – Wide Variety of Plan Options

- Manhattan Life – Best Website Experience

- Bankers Fidelity – Best Senior Expertise

- Blue Cross Blue Shield – Best Mobile App

What companies offer Medicare supplements?

Roundtrip uses its technology platform to coordinate transportation on behalf of healthcare providers, medical transportation companies ... "Every Medicare Advantage plan is thinking about how the social determinants of health fit into their supplemental ...

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

What is the highest rated Medicare Supplement company?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

How Much Does Medicare Plan G cost in Texas?

between $29 to $604 each monthExpect to pay between $29 to $604 each month for a Medigap plan A, G, or N in Texas if you enroll during your open enrollment period. Premiums will vary depending on your insurer and how your premium is rated.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

How do I choose a Medicare Supplement plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

Is AARP UnitedHealthcare good?

Yes, AARP/UnitedHealthcare Medicare Advantage plans provide good coverage and have an average overall rating of 4.2 stars. The company stands out for cheap PPO plans that cost $15 per month on average. The downside is overall customer satisfaction trails behind other companies such as Humana and Anthem.

How much does Plan G cost a month in Texas?

Find a Medigap policy that works for you. Accessed Apr 19, 2022. Medigap Plan G: $96 per month. Medigap Plan N: $74 per month....Medicare Supplement Insurance prices in Texas.Insurance companyPlan G monthly premiumsPlan N monthly premiumsCigna$162.17.$109.21.4 more rows•May 2, 2022

What is the deductible for Plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies.

Are all Plan G Medicare supplements the same?

Because all Medicare Supplement Plan G policies provide the exact same coverage or benefits. This is what people mean when they say these plans are “standardized.” That said, not all Plan G policies cost the same. Insurance companies are free to charge what they want for them, and so they do.

Is there a Medicare plan that covers everything?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What's the difference between plan G and plan N?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

What is Aetna's Medicare?

Aetna has been working with the Medicare system for over 50 years and has been offering Medicare Supplement Insurance for over a decade. In addition to having a wealth of experience, Aetna has also proven to be a company that puts its customers and community first. It has a track record of giving back to the communities it serves after natural disasters and regularly contributes to charitable causes. The company puts a great emphasis on providing outstanding customer service, simplifying the process of getting help when it’s needed, no matter how big or small the question.

Can a company cancel Medicare?

The company’s policies allow customers to see any medical professional who accepts Medicare. Policies are also guaranteed renewable, meaning that the company can not cancel coverage because of health conditions

Is Humana a good insurance company?

With over 13 million customers nationwide, Humana is one of the most respected insurance providers in the industry. The company was founded in 1961 and is now the third-largest health insurance provider in the United States. Humana has received numerous awards and has been recognized by The National Business Group on Health, the American Heart Association, and the Military Times for its high-quality products and customer service. Humana is accredited with the Better Business Bureau and has an A+ rating

Does AARP have competitive rates?

Recently, AARP/UHC restructured their underwriting creating stable and competitive rates for consumers. Clients must be AARP members to enroll in the AARP branded plan.

Does BCBS offer a discount?

BCBS in Texas uses the Attained-Age pricing structure. They do offer a household discount if both spouses are enrolled in a supplement plan. Rate increases are well below most of the other companies averaging about 5% per year.

What Are the Best Rated Medicare Supplement Companies in 2022?

Now that you’re familiar with the top 10 well-known Medicare Supplement companies, we’ll let you know which five are the highest rated. There are several official types of ratings for insurance companies but in this article, we’ll focus on the AM Best and S&P ratings. A high rating with both of these agencies indicates a company’s financial stability and offering of high-quality insurance products.

Why do Medicare premiums vary?

Thus, while comparing options, you may wonder why your premium rate quotes vary between carriers for the same letter plan. In the case of Medicare Supplement plans, many factors affect what you’ll pay each month. Demographic information – such as age, location, and tobacco use – affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board.

Is Mutual of Omaha the same as Medigap?

The above are the top 10 most well-known companies offering Medicare Supplement policies. Every Medigap plan meets government standardization requirements. No matter which company you choose, the benefits are the same when the plan is identical. So, Plan G coverage with Mutual of Omaha is the same as Plan G with Medico.

Is Medicare competitive in 2021?

While every top carrier is competitive, it makes sense to pay more for superior customer service and financial stability. There are many top-rated medicare supplement companies to choose from in 2021, and when you use our agents, you get your cake and eat it too! When you enroll in a policy through us, you get the benefits ...

Does Cigna have the same coverage as Plan G?

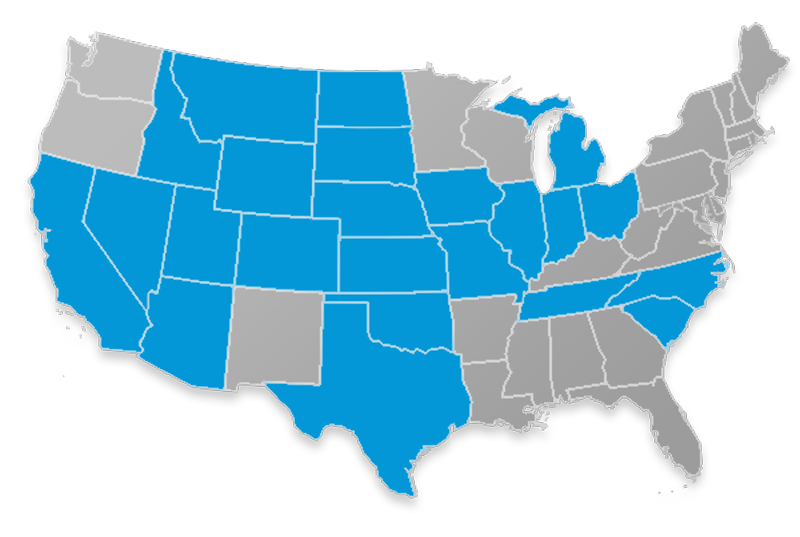

So, Plan G with Mutual of Omaha offers the same coverage as Plan G with Medico. Plan N with Cigna has the same coverage as Plan N with UnitedHealthcare. Additionally, all Medicare Supplement plans allow you to go to any doctor accepting Medicare assignment – which is the majority of doctors, coast-to-coast.

How many insurance companies are there for Medicare Supplements in Texas?

You can choose from over five dozen insurance companies that have been approved to market Medicare supplements in Texas. To help narrow down your search, these reviews provide information about some of the companies with a good reputation for competitive rates, strong finances, and great customer service:

When is the best time to enroll in Medicare Supplements in Texas?

So, the best time to enroll in Texas Medicare supplements is during that Open Enrollment Period when you have turned 65 and qualify for Part A and B. Some people delay enrolling Medicare Part B because they have other health insurance from work, so their Guaranteed Enrollment Period would still begin when they opt into Part B.

How long does it take to get Medicare after 65?

People who qualify for Medicare after turning 65 can enroll in any of the plans without worrying about health underwriting for the first 6 months of enrolling in Medicare Part B. This Guaranteed Enrollment Period begins in the month you qualify and lasts for a total of six months.

Does Texas have Medicare Supplement?

Texas uses the same standardized Medicare supplement plans that most states do, so if you purchase your supplement from United American, Cigna, or one of the other top-rated companies, you can expect the same basic coverage. However, insurers do compete by price, membership perks, and various discounts. For example, you might take advantage of household discounts that are usually about seven percent of the premium. Because supplements offer standardized coverage, they are still somewhat easier to compare than other kinds of health insurance.

Does Texas have Medicare?

According to recent surveys, over 3.6 million Texans rely upon Medicare health insurance for medical benefits. Since Original Medicare won’t pay for everything, many seniors in the Lone Star State also buy Medicare supplements to help keep expenses under control. The Texas Department of Insurance, or TDI, lists over 70 distinct Medicare insurance companies that have been authorized to market Medicare supplement insurance within the state. You can see that finding the best Medicare supplements in Texas can present a challenge, and we are here to help.

Is Cigna a good insurance company?

Cigna: Cigna has a good reputation as a nationwide health insurance provider. Even though Cigna incorporated in its current form in the 1980s, it grew from a merger of two of the oldest U.S. insurance companies. The company currently has an A.M. Best rating of A.

Can you apply for Medicare Supplements in Texas?

You can apply for a Texas Medicare supplement whenever you qualify for Part A and after you enroll in B. Your timing may affect your choices and eligibility.

Why do you need Medicare Supplement Insurance?

Because it helps cover some of the “gaps” in Medicare coverage , Medicare supplement insurance is often called Medigap insurance.

What is Medicare supplement policy?

Medicare basics. Original Medicare has two parts. Part A covers hospital services and Part B covers other types of medical expenses. You may go to any doctor or hospital that accepts Medicare. Medicare supplement policies only work with original Medicare. Medicare Part A (hospital coverage) pays for: care in a hospital.

What is QMB in Medicare?

QMB is a Medicare savings program that helps pay Medicare premiums, deductibles, copayments, and coinsurance.

What is Medicare Part D?

preventive health services, like exams, health screenings, and shots. Medicare Part D (prescription drug coverage ) pays for generic and brand-name prescription drugs. You can get prescription drug coverage by joining a stand-alone prescription drug plan or by buying a Medicare Advantage plan that includes drug coverage.

When is Medicare open enrollment?

Medicare’s open enrollment period for Medicare Advantage and prescription drug plans is October 15 to December 7. Medicare will mail you a Medicare & You handbook each year before open enrollment. The handbook has a list of Medicare Advantage and prescription drug plans.

Who publishes the Medicare and You handbook?

The Centers for Medicare and Medicaid Services (CMS) publishes the Medicare & You handbook that describes Medicare coverages and health plan options. CMS mails the handbook to Medicare beneficiaries each year. You can also get a book by calling 800-MEDICARE (800-633-4227).

When is the best time to buy Medicare?

Buy during open enrollment. The best time to buy a Medicare supplement policy is during your Medicare open enrollment period because companies must sell you any plan they offer without looking at your health history.

What is the best Medicare Supplement?

As mentioned above, your best Medicare Supplement plan will be the plan that balances costs and coverage. In general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

What is the most popular Medicare plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of its comprehensive benefits, about 49% of Medicare Supplement enrollees have chosen this plan. Plan G has 22% of the market, making it the most popular choice for those who are newly eligible for Medicare.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

What is the best Medigap plan?

If you qualified for Medicare before Jan. 1, 2020, Plan F is the best Medigap plan. Plans will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

How much does Medigap Plan G cost?

For most people, we recommend Medigap Plan G from AARP/UnitedHealthcare, which costs about $159 per month for a 65-year-old. This plan will give you comprehensive medical coverage from a well-rated company. However, all Supplement plans have standardized benefits that will help protect you from out-of-pocket medical expenses you'd have with Original Medicare (Part A and Part B).

How to get Medicare quote over the phone?

To get a Medicare quote over the phone, call 855-915-0881 TTY 711 to speak with a licensed agent today !

Which insurance company has the largest number of Medicare Supplement customers?

AARP/United Health Group has the largest number of Medicare Supplement customers in the country, covering 43 million people in all 50 states and most U.S. territories. 3 AARP licenses its name to insurer UnitedHealthCare, which helps make these policies so popular.

Who Are the Established Top Medicare Supplement Insurance Carriers?

In some metropolitan areas, more than 20 insurance companies sell Medicare Supplement insurance. 1 Consider the following companies for coverage, based on market share:

Why Choose a Medicare Supplement Plan?

All of these companies also offer Medicare Advantage plans. Buying Medicare insurance isn’t an easy decision, and understanding the difference between Medigap and Medicare Advantage plans before you choose one or the other is a good idea.

What is United Healthcare?

UnitedHealthcare is the largest Medicare Supplement company by premiums earned, and they cover more than 308,000 people. 11 United Healthcare is known for its easy-to-use online portal, as well as its partnership with AARP. In fact, when you go to AARP to look for Medigap plans, they send you to United Healthcare.

What is Medicare Supplement Insurance?

Medicare Supplement insurance, also known as Medigap, augments your basic Medicare coverage by typically paying the 20% cost that Medicare does not cover.

What to consider when choosing Medicare supplement insurance?

When choosing Medicare supplement insurance, it’s important to consider your personal needs and preferences. While your premium is a big factor, it’s also important to look at other items, including whether you have to worry about copays and coinsurance, and what out-of-pocket costs you’ll have.

How many states does CVS offer Medicare?

CVS/Aetna combined forces in 2018. 10 It offers plans in 49 states, plus Washington, D.C. In all, 52 million people participate in some type of CVS/Aetna Medicare plan.

What is the average Medicare premium in Texas in 2021?

The average monthly premium in 2021 for a Medicare Advantage plan in Texas is $11.42.

What is the star rating for Medicare Advantage?

Each year, the Centers for Medicare & Medicaid Services, or CMS, awards every Medicare Advantage plan a star rating on a scale of 1 to 5, with 5 being a top-rated plan. Below are plans that received top marks in Texas for the 2021 plan year. (Check out more information about Medicare star ratings.)

What is Medicare Advantage?

Medicare Advantage is an all-in-one alternative to Medicare that offers all the same benefits and usually some extras, such as dental and vision coverage.

Is Medicare Advantage cheaper than Medicare Supplement?

Medicare Advantage plans offer more benefits than Original Medicare, and they are often cheaper than paying for Medicare and a Medicare Supplement plan, but they offer less flexibility since you’ll need to get care from within the plan’s network of providers. Weigh your options to determine what plan best suits your needs.