What does Medicare cover in North Carolina?

- The bill must be less than two years old.

- If the bill is more than two years old, the applicant must have made a payment on it within the past two years.

- All medical insurance the petitioner had at the time must have been filed and either paid or denied.

Is there Medicaid in North Carolina?

Starting July 1, nearly 1.6 million Medicaid beneficiaries in North Carolina began receiving the same Medicaid services in a new way through NC Medicaid Managed Care health plans. Most beneficiaries are still getting care from the same doctors they saw previously, but they are now a member of a health plan.

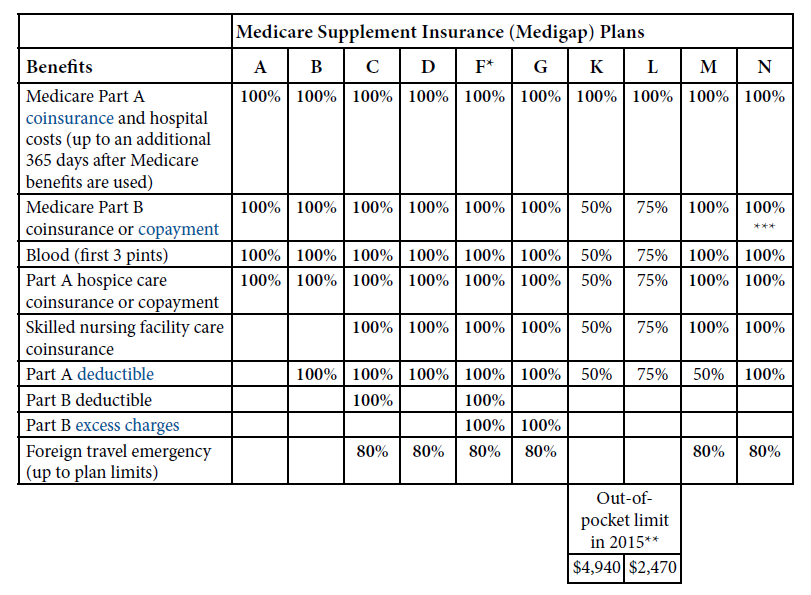

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

What is the state health plan for North Carolina?

The taxpayers of North Carolina invest in teachers and state employees by offering eligible employees full medical and pharmacy benefits through the State Health Plan (Plan). The state pays for the majority of your health plan benefit, with employees subsidizing the coverage for any dependents you choose to add on to the Plan.

What is the best Medicare Supplement plan in North Carolina?

The best-rated Medicare Advantage plans in North Carolina are from HealthTeam Advantage and Blue Cross Blue Shield. These companies have impressive ratings of 4.5 to 5 stars. The cheapest companies in the state are Alignment Health Plan and Experience Health, which only offer $0 plans.

How much is plan G in North Carolina?

$87-$290How Much Do Medigap Policies Cost?Plan TypePremium RangePlan F$108-$308Plan G$87-$290Plan N$68-$274

What is the highest rated Medicare Supplement company?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Plans and Coverage: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Are all Plan G Medicare supplements the same?

Because all Medicare Supplement Plan G policies provide the exact same coverage or benefits. This is what people mean when they say these plans are “standardized.” That said, not all Plan G policies cost the same. Insurance companies are free to charge what they want for them, and so they do.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

What is the best Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What does plan G pay for?

Medicare Supplement Plan G covers your percentage of any medical benefit that Original Medicare covers, except for the outpatient deductible. So, it helps to pay for inpatient hospital costs, such as the first three pints of blood, skilled nursing facility care, and hospice care.

Is AARP UnitedHealthcare good?

Yes, AARP/UnitedHealthcare Medicare Advantage plans provide good coverage and have an average overall rating of 4.2 stars. The company stands out for cheap PPO plans that cost $15 per month on average. The downside is overall customer satisfaction trails behind other companies such as Humana and Anthem.

Why is plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

How many people in North Carolina have Medicare?

Almost 2 million people in North Carolina have Medicare. Your situation will determine if Medigap or Medicare Advantage coverage is more beneficial. Then, there are some people that just have Medicare. The downside to only Medicare is the lack of Maximum Out of Pocket coverage; so, there is no limit to the amount of money you’ll spend on care.

How many Medicare Part D plans are there in North Carolina?

North Carolina Medicare Part D Plans. There are 28 Part D options in the state of North Carolina. You don’t have to be a specific age to enroll in Part D, as long as you’re Medicare-eligible. No matter which state you live in, you’ll want to enroll in Part D as soon as you’re eligible.

What is the most common Medigap policy?

As you may have heard, Plan F, G , and N are the most common Medigap policies. These are the same top plans across the United States. Plan F is the most comprehensive, but eligibility isn’t for everyone; only those that aren’t newly eligible. Next, Plan G is the second most comprehensive policy.

Is Medicare Supplement available in North Carolina?

But, Medigap isn’t the only option in North Carolina. Beneficiaries can opt for a Medicare Advantage plan if that’s their preference. Although, most people will have more peace of mind with Medigap. Below we’ll discuss the different options for those in North Carolina and in the end you can choose the best for you.

When is the best time to enroll in Medigap?

The best time to enroll in Medigap is during your Open Enrollment Period; this is when no matter what your health looks like, your policy is approved. If you miss the Open Enrollment Period, no worries, you can sign up for Medigap at any time.

Is Medigap better than Social Security?

If you want steady coverage that doesn’t change and is predictable, Medigap will be the best option for you. If you can’t afford Medigap or you don’t qualify, some coverage is always better than none. Also, if the Medicare Advantage plan has a premium, you can choose to have that deducted from Social Security.

Does North Carolina have Medicare Advantage?

And, just about 36% of beneficiaries in North Carolina have a Medicare Advantage policy. While none of the options are 5-star plans, there are plenty of 4.5-star plans throughout the state; including plans by top carriers like Aetna and Humana. There are advantages and disadvantages to Part C plans, so before you jump into a policy read ...

What is Medicare Supplement?

What is a Medicare Supplement (or Medigap) Plan? Medicare supplement plans are one health insurance option for people with Original Medicare. There are standardized Medicare supplement insurance plans available that are designed to fill the gaps left by Original Medicare (Parts A and B).

What is the number to call for Medicare Supplement?

Are you considering a Medicare Supplement Plan? For a comparison of Medicare Supplement plans that might be right for you, call one of our trained SHIIP counselors Monday through Friday from 8am to 5pm toll-free at 1-855-408-1212.

How long can you wait to apply for Medicare Supplement?

The insurance company may impose a pre-existing condition waiting period, but it cannot be longer than six months . This would include any health condition diagnosed or treated six months prior to the Medicare supplement application. If a person has prior creditable coverage, the waiting period must be waived.

Does North Carolina have Medicare?

North Carolina is one of the states that legislatively mandates eligibility to individuals eligible for Medicare due to disability. North Carolina G.S. 58-54-45 guarantees that individuals under the age of 65 who qualify for Medicare are eligible to purchase a Medigap policy A, D, and G effective January 1, 2020.

Does Medicare cover disability?

Medicare Supplemental Insurance federal regulations do not guarantee eligibility to individuals under age 65 who are eligible for Medicare due to disability. However, thirty-three states have adopted state legislation extending guarantee issue to that group of individuals. North Carolina is one of the states that legislatively mandates eligibility ...

What is Medicare Supplement in North Carolina?

Medicare Supplement plans in North Carolina help Medicare beneficiaries control the ever-rising cost of health care. Medicare Supplemental Insurance, also called Medigap health plans, pays for out-of-pocket costs such as deductibles and copays that the federal Medicare program doesn’t cover.

What happens if you have a Medicare Advantage policy?

If you have a Medicare Advantage policy and it’s discontinued. If you have a Medicare Advantage policy and you move out of its coverage area. If you have Original Medicare and you’re retiring from group coverage. If your Medigap insurance company decides not to renew your policy.

Is there a deductible for Medicare Part B in 2021?

There is not a deductible on Medicare Plan G, you are simply required to pay the Medicare Part B deductible before outpatient care is covered. For 2021, the Part B deductible is $203.00.

Does Medicare Supplement cover preventive care?

Some Medicare Supplement insurance plans offer preventive care. These differences in health care coverage are why it’s essential that you closely compare the Medigap policies offered in your area before you enroll. Medigap policies supplement the Medicare benefits you receive through Original Medicare. Here are some of the benefits Medigap ...

Is Plan G the most popular health insurance in North Carolina?

Since Plan F is no longer sold to new Medicare beneficiaries, Plan G is becoming the most popular Medicare Supplemental health insurance plan in North Carolina and nationwide. Over the past five years, its enrollment has grown tremendously, jumping 39% from 2017 to 2018. Several things make Plan G popular:

Does Medicare Supplement cover prescriptions in North Carolina?

Medicare Supplement insurance plans in North Carolina do not include prescription drug coverage. Medicare beneficiaries must buy separate Medicare Part D drug plans to cover medications. Just like Medigap plans in North Carolina, prescription drug plans differ in monthly premiums and the drugs covered. When you compare policies, make sure that the ...

Find affordable Medicare Supplement plans

What are the best North Carolina Medicare Supplement plans? Which plan offers you the best value? In this guide, we’ll walk you through how to compare plans and find the most savings when shopping for North Carolina Medigap plans.

Compare North Carolina Medicare Supplements

It is important to know that even though the coverage for North Carolina Medicare Supplement Plans are the same, the rates are not. You need to compare the plan letters from company to company. For example, compare Medicare Supplement Plan G from multiple companies.

REMEDIGAP can answer your questions

Our service is free. We help North Carolina Medicare Insurance beneficiaries who are new to Medicare or already using Medicare.

North Carolina Medigap Locations

Are you wondering if I can help you lower your Medicare Supplement costs? I can! Below are the cities in North Carolina that I serve. Click here if you’re looking for other Medicare Supplement states.

When is the best time to buy Medicare Supplement in NC?

The best time to buy one of the best Medicare Supplement plans in North Carolina is during the six-month open enrollment period that starts surrounding your 65th birthday month or your enrollment in Medicare Part B. During the Medigap Open Enrollment Period; you can purchase any of the 10 Medicare Supplement plans in North Carolina.

When will Medicare plan F be available in NC?

Please note: Medigap Plan F in North Carolina will no longer be available to Medicare beneficiaries that turn age 65 after 01/01/2020. Plan F will still available to Medicare Beneficiaries who are already on Medicare Part A and Medicare Part B prior to 01/01/2020.

What percentage of North Carolina is over 65?

Approximately 15 percent of the population of North Carolina is over 65. This figure has increased roughly 2 percent each year since 2011. Projections suggest that more than 20 percent of the people in North Carolina will be over 65 by the year 2035. The average retirement age in NC in 2016 was 62.

Can I use Medicare Supplement in North Carolina?

You can use the best Medicare Supplement plans in North Carolina anywhere in the U.S. There are no provider networks . You can see a specialist without a referral as long as the provider accepts Medicare. This flexibility is one of the main reasons people choose Medigap coverage.

Does NC have community rated Medicare?

Community-rated. Charge the same premium for all policyholders regardless of age. Premiums will not increase as you age. Medicare Supplement plans in North Carolina are attained-age policies most of the time. However, community-rated and issue-age policies are available for most plans in NC.

Does Medicare Supplement cover foreign travel?

Some Medicare Supplement plans do not include coinsurance for stays in skilled nursing homes, and some do not include foreign travel emergency care. It is essential to review the benefits provided under each plan and confirm that you select the one most appropriate for your situation.

Does Medicare Supplement Plan increase based on age?

Issue-Age. Base the premium on your age when you enroll. The Medicare Supplement plan rates do not increase based on your age. Issue-age policies are often more expensive than attained-age policies to start with, but they may become more cost-effective over time.