New York Medigap Plans by Carrier

| Insurance Carrier | Plan F | Plan G | Plan N |

| AARP | $234.75 | $210.75 | $148.50 |

| Bankers Life and Casualty Company | $469.06 | $432.41 | $245.03 |

| BlueCross BlueShield of Western New York | $368.92 | N/A | N/A |

| CDPHP | $336.45 | N/A | $185.94 |

Full Answer

Where can I find the best Medicare supplement plans?

9 rows · Jan 08, 2022 · Who's got the best Medicare Supplement in New York? Here are your top choices in New York: ...

Is GoHealth a good Medicare supplement company?

Apr 08, 2022 · In New York, the average cost for a Medicare supplements plan will vary according to the plan letter: Plan F is about $378; Plan G is around $359; Plan N averages $240; What’s the most popular Medigap plan in New York? Plan N is the most popular Medicare Supplement in New York. How to Get Help Signing Up for Medigap in New York

Does Medicare supplement work with Medicare Advantage?

What is the best Medicare Supplement plan in New York for 2022? Here’s how the top five Medigap plans in New York compare: Best for full coverage: Medicare Plan F. Plan F provides the most comprehensive coverage. It includes the following benefits: All copayments; Medicare Part A deductible; Medicare Part B deductible; All coinsurance

What are the different types of Medicare supplement plans?

What are the best Medicare Supplement plans in New York for 2022? Medigap policies pay for out-of-pocket costs left from Original Medicare, but how much and what each plan pays is different. Here’s a quick rundown on the top five plans for 2022. 1. Best for full coverage: Plan F Plan F covers everything, including Part B deductible

How long does it take to enroll in Medicare Supplement in New York?

Many states limit enrollment in the best Medicare Supplement plans in New York to this six-month time frame. However, New York state law requires insurance carriers offering Medigap plans ...

What is the average age to retire in New York?

The average retirement age is 64. The five largest counties are Kings, Queens, New York, Suffolk, and the Bronx. Top health insurance companies like UnitedHealthcare, AARP, Blue Cross Blue Shield and more offer Medigap policy options for New Yorkers who want to enhance their benefits through the federal Medicare program.

What is senior life insurance?

Senior Life Insurance Plans is a great resource for Medicare beneficiaries to learn about there options, we also specialize in senior life insurance plans. We help educate Medicare beneficiaries on their Medigap options and help them go through the process of reviewing and comparing plans. We work with most of the nations top-rated Medigap carriers such as Aetna , Cigna , Mutual of Omaha and Florida Blue Medicare plans. Give us a call today, or request a quote online to learn more about Aetna Medicare Supplement plan G and Mutual of Omaha Medicare Supplement plan G in your state. We educate you on the best Medicare Plans for your situation, then let you decide.

Can you get Medicare Supplement in New York?

Companies cannot deny your request for a Medicare Supplement plan in New York, nor can they charge you a higher premium based on your health history, pre-existing conditions claims history or whether you are receiving treatment from a health care provider.

Is Medigap Plan F deductible?

Either high-deductible or standard Medigap Plan F is worth your consideration, though, since this is the most robust option. It is even one of only two plans to cover the Medicare Part B deductible. Although there are plans available in all 62 New York counties, not every Medigap plan is available in each county.

Does New York have a Medicare Supplement Plan?

Best Medicare Supplement Plans in New York for 2020. Medicare Supplement plans in New York only work with Original Medicare. If you have coverage under a Medicare Advantage plan, you cannot have Medigap insurance at the same time. In New York, as in 46 other states, you can choose the best Medicare Supplement plan from one ...

Is Plan F still available?

Plan F will still available to Medicare Beneficiaries who are already on Medicare Part A and Medicare Part B prior to 01/01/2020. Medicare Plans E, H, I and J are not available to new beneficiaries in 2010, but if you have one of these Medicare Supplement plans, it is still in effect. NY also offers a high-deductible option for Plan F.

Medicare Supplement Insurance in New York

Medicare Supplement insurance is extra health care insurance that picks up all or some of the 20% left after Original Medicare pays on a claim. Supplement insurance is also called Medigap insurance because it bridges the gap between what Medicare pays and what you’re responsible for.

What are the best Medicare Supplement plans in New York for 2022?

Medigap policies pay for out-of-pocket costs left from Original Medicare, but how much and what each plan pays is different. Here’s a quick rundown on the top five plans for 2022.

How much does a Medicare Supplement plan cost?

Monthly premiums for a Medicare Supplement insurance plan in New York fluctuate based on a variety of factors:

When can I apply for a Medicare Supplement Plan?

Under New York law, the private insurance companies selling Medicare Supplement insurance plans in New York must offer beneficiaries a chance to enroll without worrying about whether they’ll be accepted. This is known as your Medigap Open Enrollment Period. Here’s how open enrollment works:

How many Medicare Supplement Plans are there in New York?

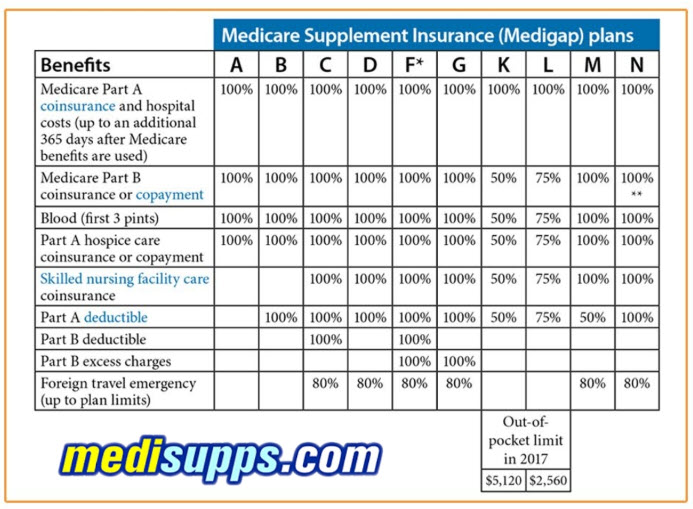

What do Medicare Supplement plans in New York cover? In 47 states, including New York, there are up to 10 standardized Medicare Supplement plans, each named with a letter: A, B, C, D, F, G, K, L, M and N. “Standardized” means that plans of the same letter cover the same basic benefits. All of Medicare Supplement plans in New York cover Medicare ...

How long is the Medicare Supplement open enrollment period?

If you are 65 or older, you may be protected from medical underwriting during your Medicare Supplement Open Enrollment Period. This is a 6-month period that begins when you’re both 65 or older and enrolled in Medicare Part B. During that time period, you can buy any Medicare Supplement policy sold in your state, regardless of your health problems. ...

Does Medicare come with a monthly premium?

Medicare Supplement plans in New York typically come with a monthly premium. The private insurance companies that offer Medicare Supplement plans in New York set their own premiums, so the cost will vary from company to company. Insurance companies can choose to price their Medicare Supplement plans in New York (or other states) ...

Does Medicare Supplement work with Medicare Advantage?

Medicare Supplement works together with Original Medicare (Part A and Part B) but does not work with Medicare Advantage. You can also get prescription drug coverage (Medicare Part D) to go alongside Original Medicare and Medicare Supplement.

Is Medicare free in New York?

Although Original Medicare in New York is provided by the federal government, it is not free. You may have to pay various out-of-pocket costs, including copayments, coinsurance, and deductibles.

Does New York have a Medicare Supplement?

Medicare Supplement (Medigap) plans in New York can help pay these costs. If you develop an illness that requires extensive doctor visits or hospitalization, you may be glad for a Medicare Supplement plan to limit your out-of-pocket spending on medical care.

What is Medicare Advantage?

Medicare Advantage (MA), also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare (Medicare Part A and Medicare Part B).... sold in New York protect you with an annual maximum out-of-pocket (MOOP) limit. Once you reach this spending limit ...

What is MA plan in New York?

Specifically, the MA plans (aka, Part C of Medicare) available in New York can include minor healthcare benefits such as prescription drug coverage, vision, hearing, dental, fitness, telehealth, and more. In contrast, Original Medicare only covers major medical healthcare services. To join a plan you must first be enrolled in both Medicare Part A.

What is the difference between Medicare Part A and Medicare Part B?

Medicare Part A is hospital inpatient coverage for people with Original Medicare, whereas Part B is medical coverage for doctor visits, tests, etc.... and Medicare Part B.

Do you pay for Medicare supplemental insurance in advance?

However, with Original Medicare and a Medigap plan for supplemental coverage, you pay for most of your costs in advance with a higher premium. You control your costs by choosing a plan that pays the deductible (s) you want to be covered.

Is Medicare Advantage the best option?

If you qualify for both Medicare and Medicaid, regardless of your health condition, Medicare Advantage is your best option. If you have special needs (i.e., a full-time nursing home resident, diabetes, etc.) and an appropriate Medicare Advantage Special Needs Plan (SNP) is available, this is your best option.

Does Medicare have an out-of-pocket maximum?

Original Medicare does not have an out-of-pocket maximum. Most Medicare Advantage plans come bundled with a New York Medicare Part D. Medicare Part D is Medicare's prescription drug plan program. Plans are offered by private insurance companies and cover outpatient prescriptions.... plan for prescription coverage.

Can you travel to New York with Medicare Advantage?

With Medicare Advantage you must use New York healthcare providers within the plan's network. With Original Medicare, you can use the Medicare-approved provider of your choice . If you travel and have a medical emergency, Medicare Advantage covers you.

Medicare Supplement Insurance Carrier and Rate Look-Up

Visit our DFS Portal and enter your zip code for a list of Medicare supplement insurance carriers and their current monthly rates.

Medicare Advantage Plans

Medicare Advantage Plans are approved and regulated by the federal government's Centers for Medicare and Medicaid Services (CMS). For information about what plans are available, plan benefits and premium rates, contact CMS directly or visit CMS Medicare website.

What is the best Medicare Advantage plan in New York?

What are the Best Medicare Advantage Plans in New York? The top Medicare Advantage plans in New York are the Humana Choice PPO, Aetna Medicare Elite Plan, and the Aetna Medicare Premier Plan. Now, these plans can change each year. So, while they may be popular, they might not be the best option for you. For example, if your doctor isn’t in the ...

Who is Lindsay Malzone?

Lindsay Malzone. Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

How long does a pre-existing condition last?

While plans may include a pre-existing condition waiting period, it generally only applies if you didn’t have creditable coverage in the last 63 days. But, if you did have creditable coverage, chances are the waiting period could be waived.

Is Medicare Advantage more expensive in New York?

Because Medigap in New York is more expensive than in other states, Medicare Advantage enrollment is slightly higher than in other states. 40% of enrollees chose a Medicare Advantage plan. Private insurance companies offer Medicare Advantage plans. They’ve been approved by Medicare and are usually an HMO or PPO plan.

Does Medigap have a difference in cost?

All Medigap plans have a difference in costs depending on which carrier you chose. Be smart and compare all Medicare Supplements available in your area. MedicareFAQ can help guide you to find the best supplemental plan suitable for you.

Is Medicare open in New York in 2021?

Your Guide to Medicare in New York for 2021. Medicare Supplement plans in New York give beneficiaries year-round open enrollment. While the plans are the same as other areas across the country, New Yorkers have quite a few extra perks. In this guide, we’ll discuss Medigap, Medicare Advantage, Part D, and more.

Does Medigap cover prescriptions?

Medigap, Part A, and Part B don’t cover any prescription costs. It’s your responsibility to select a policy to avoid a late enrollment penalty for going without Part D if you don’t enroll when you’re first eligible. But, if you have a form of creditable coverage, you won’t be penalized.