Who has the best Medicare plans in Pennsylvania?

Best Overall in PA: easyMedicare Just like its name, easyMedicare believes finding your Medicare plan should be easy. Its licensed sales agents will provide personalized, 1-on-1 help so you can sort through available plan options, discuss your healthcare insurance needs and confidently choose a plan that fits you.

What is the most popular Medicare supplement plan?

What's the most popular Medicare Supplement plan? Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of its comprehensive benefits, about 49% of Medicare Supplement enrollees have chosen this plan.

Do you have a Medicare supplement plan in Pennsylvania?

According to healthinsurance.org, over 660,000 beneficiaries in Pennsylvania have a Medicare Supplement plan. We help beneficiaries make informed decisions on their healthcare coverage. You don't have to do it alone. When you're a client of ours, you get unlimited support from our Client Care Team.

What are the best Medicare supplement plans for low-income seniors?

Policyholders can expect to pay about $77 per month, making it the best Medicare Supplement plan for low-income seniors. Plan N is a good option for individuals who want coverage that's nearly as good as Plan G but at a cheaper price. The only difference between the two plans is that Plan N doesn't have coverage for Medicare Part B excess charges.

What is the highest rated Medicare Supplement company?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Plans and Coverage: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

What Medigap plans are available in Pennsylvania?

Medigap Policies F, G, or N are the most popular plans in Pennsylvania. They provide coverage for most of your Medicare out-of-pocket costs.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

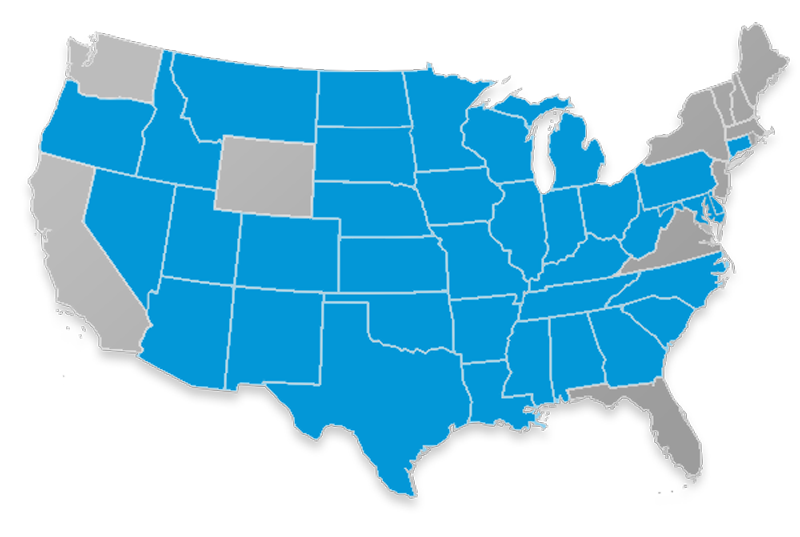

Are Medicare Supplement plans the same in every state?

Medigap plans are standardized across most states, meaning they offer the same benefits. The exceptions are Wisconsin, Minnesota and Massachusetts. Plans in those states may have options that differ from Medigap plans in other states.

How do I choose a Medicare supplement plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

How much does Medicare Part B cost in Pennsylvania?

Part B costs $170.10 per month but can be more if you have higher income. There are 160 Medicare Advantage Plans in the state that are an alternative to Original Medicare. Learn more about your Medicare options in Pennsylvania.

Is AARP UnitedHealthcare good?

Yes, AARP/UnitedHealthcare Medicare Advantage plans provide good coverage and have an average overall rating of 4.2 stars. The company stands out for cheap PPO plans that cost $15 per month on average. The downside is overall customer satisfaction trails behind other companies such as Humana and Anthem.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

What is the most comprehensive Medicare supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

Can you change your Medicare supplement anytime during the year?

As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period. An application may be “medically underwritten”.

What is the difference between Plan G and Plan N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

How to contact Medicare Supplement Insurance in Pennsylvania?

Just click here to request a quote or call us at (888) 411-1329 for personal service.

What is Medigap insurance?

Medigap plans are standardized insurance plans that are regulated by the government.

What is a Medigap letter?

The Medigap lettered plans (Plan G for example) are standardized. This is a safety net put in place by CMS(Centers for Medicare and MedicaidServices) to protect you. Insurance companies, by law, can’t make any changes to standardized Medigap benefits.

Why buy the least expensive premium gas?

You probably buy the least expensive premiumgas because it’s the sameregardless of which station you buy it from.

Can Medigap be reviewed?

If you have a Medigap plan, we can review your coverage and find lower rates to save you money on the same exact plan.

Is Medicare Supplement Insurance standardized in Pennsylvania?

Medicare Supplement Insurance Plan premium prices are different when comparing Pennsylvania Medicare Supplement Insurance Companies. The Medigap lettered plans (Plan G for example) are standardized. This is a safety net put in place by CMS (Centers for Medicare and Medicaid Services) to protect you. Insurance companies, by law, can’t make any ...

Is Medicare Advantage an HMO?

Medicare Advantage plans are usually an HMO or PPO. Advantage Plans have provider and pharmacy networks. Not all doctors, pharmacies or other providers are in every network. Costs are also specific to each MAPD plan and vary widely.

How many Medicare beneficiaries are there in Pennsylvania?

Medicare Supplement Plans in Pennsylvania. There are over 2.6 million Medicare beneficiaries in Pennsylvania. Of them all, over 660,000 are enrolled in a Medigap plan. It’s important to know the difference between all of your Medicare options. If you make the wrong choice now, it could negatively impact you for the rest of your life.

How much does Medigap cost in Pennsylvania?

Medigap premiums in Pennsylvania average between $145-$220. The benefits are the same across all carriers. The only difference is carriers use different rating methods to determine the premium they want to charge.

What is Pennsylvania Medicare 2021?

Pennsylvania Medicare Plans in 2021. Pennsylvania Medicare includes supplements that help lower out of pocket expenses. These include Medigap, Medicare Advantage, and Part D prescription plans. New beneficiaries may not realize they’re still responsible for cost-sharing. The deductibles are enough to break the bank for some.

Why is Medicare changing?

However, Medicare is changing because of MACRA. Any new beneficiaries won’t be eligible for Plan F.

How much does a Silverscript insurance plan cost?

Or you could go with Silverscript. They offer a plan that has a lower deductible with a low-income subsidy option, but the premium will be over $30 a month . As you can see, there are many options to compare.

How much is a Part D plan in Pennsylvania?

Part D in Pennsylvania. In Pennsylvania, stand-alone Part D plans range from $13-$40 a month. Some do cost more, but the same coverage is usually available with another carrier with a lower premium. Don’t be afraid to ask your agent to compare rates with other lesser well-known carriers.

Does Pennsylvania charge Medicare premiums?

Pennsylvania is one of the few states that don’ t charge significantly higher Medigap premiums when you’re under 65. Most premiums triple for those with Medicare due to disability. For Pennsylvania Medicare beneficiaries under 65 on Medicare due to a disability, you’ll pay about the same as those aging into Medicare.

What is Medicare Supplement Insurance?

Medicare supplement insurance is private insurance that fills in the gaps left by Medicare. For instance, when you have a hospital or doctor bill, Medicare pays its approved amount first, then the supplemental insurance pays other costs, such as deductibles and copays.

Who runs Medicare approved health plans?

These Medicare-approved health plans are run by private insurance companies and provide benefits for hospital, doctor, and other health care provider services covered under Original Medicare Parts A and B as well as supplemental benefits that vary by plan. The insurer receives money from Medicare and may also charge you a premium in some cases, ...

What is the age limit for Medicare Supplement?

Medicare Supplement Coverage. If you are 65 , you are eligible for Medicare. As you approach your 65 th birthday, you should consider applying for Medicare. Opens In A New Window. . There are two types of Medicare: original Medicare and Medicare Advantage.

Does Medicare Advantage require you to use a doctor?

Medicare Advantage might require you to use certain doctors and hospitals. Prescription drug coverage is available under Medicare Part D. Prescription drug benefits are included in some Medicare Advantage plans but otherwise must be purchased separately.

Does Medicare Supplement Plan A include dental coverage?

However, the premium you pay for that plan may differ from one company to another. It is important to note that most Medicare supplement plans do not include dental or vision coverage.

Does Medicare cover my spouse?

Your policy will not cover your spouse. Choosing the right Medicare supplement plan can be complicated. There are a number of questions to ask.

Does Medicare Supplement Plan A have the same benefits?

All insurance companies must offer the same benefits under a given plan. In other words, Medicare Supplement Plan A will have the same benefits regardless of which company sells it. However, the premium you pay for that plan may differ from one company to another.

Why should I enroll in a Medicare Supplemental Plan?

Medicare Part A and Part B, also known as Traditional Medicare or Original Medicare, do not provide all of the coverage you’ll need to protect yourself from major medical expenses during your retirement.

Can I change my Medicare Supplement Plan after I’m enrolled?

You may decide to switch Medicare Supplement Plans at some point. For example, you may find that another credible insurer is charging less for the same coverage, or you may want to upgrade to better coverage.

What is the best Medicare Supplement?

As mentioned above, your best Medicare Supplement plan will be the plan that balances costs and coverage. In general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

What is the most popular Medicare plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of its comprehensive benefits, about 49% of Medicare Supplement enrollees have chosen this plan. Plan G has 22% of the market, making it the most popular choice for those who are newly eligible for Medicare.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

What is the best Medigap plan?

If you qualified for Medicare before Jan. 1, 2020, Plan F is the best Medigap plan. Plans will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

How much does Medigap Plan G cost?

For most people, we recommend Medigap Plan G from AARP/UnitedHealthcare, which costs about $159 per month for a 65-year-old. This plan will give you comprehensive medical coverage from a well-rated company. However, all Supplement plans have standardized benefits that will help protect you from out-of-pocket medical expenses you'd have with Original Medicare (Part A and Part B).

How to get Medicare quote over the phone?

To get a Medicare quote over the phone, call 855-915-0881 TTY 711 to speak with a licensed agent today !