Which Medicare Supplement plan has the highest level of coverage?

Medicare Supplement Plan G is the best overall plan that provides the most coverage for seniors and Medicare enrollees. Plan G will cover almost everything except the Part B deductible.Mar 16, 2022

What are the pros and cons of Medicare Supplement plans?

Medigap Pros and ConsMedigap ProsMedigap ConsPlans are easy to compareDifficult to switch once enrolledGuaranteed 6 month enrollment period when 1st eligibleMay not be able to enroll after initial enrollment periodAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductible3 more rows•Sep 26, 2021

Which is the best known supplemental plan?

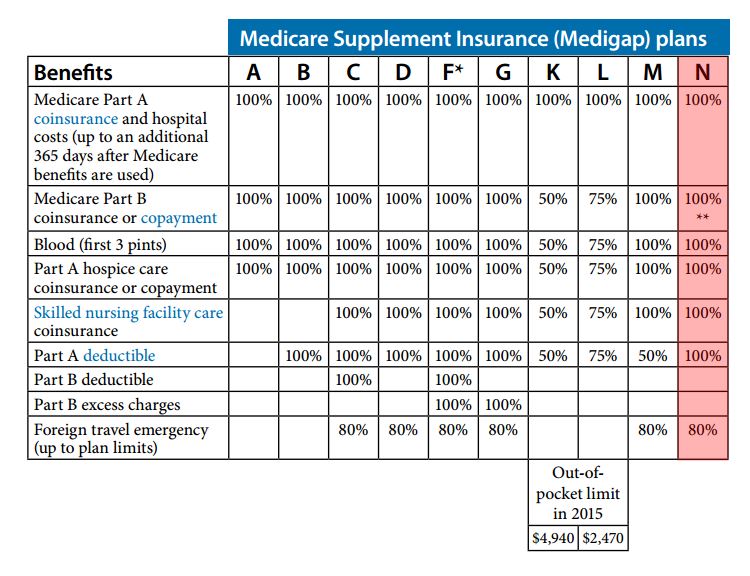

What is the Most Popular Medicare Supplement PlanPlan F is the most comprehensive Medigap plan. It covers the Part B deductible and everything covered by Plan G. ... Plan G is similar to Plan F. ... Plan N is one of the most popular Medicare Supplement plans for all beneficiaries.

Is Plan G as good as Plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.Feb 18, 2021

What's the difference between Medigap and advantage?

Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

Why is Medigap so expensive?

Medigap plans are administered by private insurance companies that Medicare later reimburses. This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage. The more comprehensive the medical coverage is, the higher the premium may be.

Which CMS 1500 block requires entry of either the social security number?

Field 1A of the CMS 1500 form requires a patient's social security number.

Which is a common error that can delay CMS 1500 claims processing?

According to BlueCross BlueShield, the most common fields missing information or using inaccurate information are the patient name, patient sex, insured's name, patient's address, patient's relationship, insured's address, dates of service, and ICD-10 code.

What is a final step in processing CMS 1500 claims?

A final step in processing a CMS-1500 claims is to: Double-check claims for errors and omissions. When unlisted codes are reported on a CMS-1500 claim, what is submitted to the payer with the claim to clarify the services rendered? claim attachment.

Does Plan G have a deductible?

Plan G also covers some of the expenses related to your Medicare policy. For example, Medicare Part A has a deductible of $1,408. If you don't have Plan G, then you'll pay that deductible out of pocket. But with Plan G coverage, your health insurer would pay for the entire deductible.Jan 24, 2022

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

How much does G plan cost?

How much does Medicare Supplement Plan G cost?Atlanta, GASan Francisco, CAPlan G premium range$107– $2,768 per month$115–$960 per monthPlan G annual deductible$0$0Plan G (high-deductible) premium range$42–$710 per month$34–$157 per monthPlan G (high-deductible) annual deductible$2,370$2,370