What is the best Medicare Supplement?

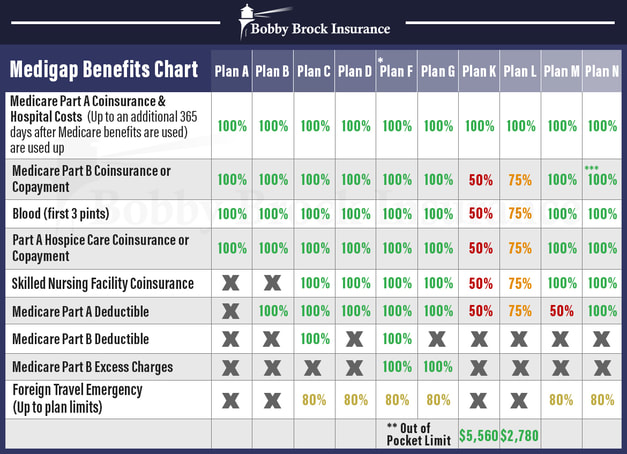

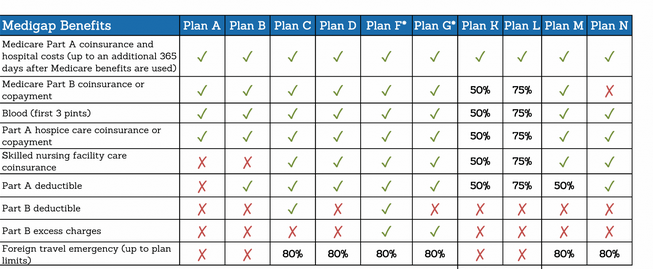

| Plan K | Plan L | |

| Medicare Part A coinsurance | 100% | 100% |

| Medicare Part B coinsurance | 50% | 75% |

| Blood (3 pints) | 50% | 75% |

| Part A hospice care coinsurance | 50% | 75% |

Full Answer

What are the top 5 Medicare supplement plans?

Medigap Plan G – 2022. With Plan F not open to people not on Medicare, Medigap Plan G will be the most mainstream of all Medicare supplement plans for 2022, just as a legitimate explanation. Plan G gives inclusion that is fabulous to those on Part A and B Medicare, with only one minimal yearly permissible to cover.

What is the best and cheapest Medicare supplement insurance?

Jan 04, 2022 · In 2022, the deductible for high-deductible Plan F and high-deductible Plan G is $2,490. This means that in exchange for a much lower monthly premium, you agree to pay up to $2,490 in 2022 for your covered services before your Medigap plan will cover most the rest of your out-of-pocket Medicare costs for the rest of the year.

What is the most comprehensive Medicare supplement plan?

Best overall Medicare Supplement pre-2020: Medigap Plan F. For Medicare beneficiaries who became eligible for the program before Jan. 1, 2020, Plan F offers the broadest coverage. Plans F and C are the only plans that cover the Part B deductible, which is $203 in 2021 and is projected to be $217 in 2022.

What is the best Medicare supplement?

Feb 22, 2022 · A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that ...

Who has the best Medicare plan for 2022?

For 2022, Kaiser Permanente ranks as the best-rated provider of Medicare Advantage plans, scoring an average of 5 out of 5 stars.Feb 16, 2022

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Which Medicare Supplement plan is the most comprehensive?

Medicare Plan FMedicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

What is the Medicare Advantage premium for 2022?

In 2022, the average monthly premium for Medicare Advantage plans is $62.66 per month. Depending on your location, $0 premium plans may be available in your area.Feb 15, 2022

What is the out-of-pocket maximum for Medigap Plan G?

Similarly, Plan G has no out-of-pocket limit to protect you from spending too much on covered health care in a year.Dec 12, 2019

How much does the G plan cost?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

Should I switch from plan F to plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What is difference between plan G and N?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

Why does AARP endorse UnitedHealthcare?

What is AARP Medicare Supplement insurance? AARP Medicare Supplement plans are insured and sold by private insurance companies like UnitedHealthcare to help limit the out-of-pocket costs associated with Medicare Parts A and B.

What is the premium for Medicare Part B in 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What changes are coming to Medicare in 2022?

Also in 2022, Medicare will pay for mental health visits outside of the rules governing the pandemic. This means that mental health telehealth visits provided by rural health clinics and federally qualified health centers will be covered. Dena Bunis covers Medicare, health care, health policy and Congress.Jan 3, 2022

How much will Part B go up in 2022?

$170.10Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Which Medicare Supplement plan is the best?

For most people, we recommend Medigap Plan G from AARP/UnitedHealthcare, which costs about $159 per month for a 65-year-old. This plan will give yo...

How much do Medicare Supplement plans usually cost?

A Medicare Supplement plan costs about $163 per month for 2022. However, the range of costs is especially wide because of the variety of plans avai...

What's the most popular Medicare Supplement plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of...

What's the least expensive Medicare Supplement plan?

Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves aga...

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

What is SelectQuote Senior?

SelectQuote Senior is one of several brokers that refers prospective clients to various insurance companies for Medicare Supplement Plans. You'll get quotes for 20+ different providers through this service, depending on which companies are issuing policies where you live. Those companies may include Aetna, Cigna, Anthem and Humana; all insurers with whom they partner are at least A- rated. The business itself has an "A+" rating and accreditation from the BBB, which means that in the company's 36 years in operation, they've done a good job of treating their clients fairly and honestly.

How many states does United Medicare Advisors work in?

While this is fairly common in today's internet age, it's still something to note. Another fact is that United Medicare Advisors is active in 44 states, leaving out Alaska, California, Hawaii, Massachusetts, New York and Rhode Island. If you live in one of those states, you should keep reading further in our reviews.

Who are United Medicare Advisors?

United Medicare Advisors specializes in Medicare and related supplemental plans, giving you unbiased information and access to many different insurance companies. In business since 2009, they have enrolled hundreds of thousands of Medicare Supplement policies across the country. They work with over 20 carriers, including some of the major names in the industry (such as Aetna, Mutual of Omaha, and Humana).

How long has Aetna been around?

Aetna. Aetna has been around for a LONG time: over 160 years, as a matter of fact. And, as the insurer most often quoted during our process of finding Medicare Supplement Plans, Aetna is an obvious company to consider for your coverage needs.

Does United Medicare Advisors offer online quotes?

So, while United Medicare Advisors does not show you an online quote, they absolutely deliver the goods with the lowest priced Medicare Supplement Plans we found. This is because of their vast access to both the bigger names in the industry as well as smaller, reputable companies you might not have heard of before.

Compare Medicare Supplement Plans in 2022

Though the plan letters are not changing in coverage for 2022, many people are in fact changing their Medicare supplement plan to opt for different coverage.

Medigap Plans 2022 – The 3 Most Popular

There might be 12 different Medigap plans available for 2022, but in reality, most people will enroll in one of the three below. More people will enroll in Plan G, however, we highly suggest that you let us show you why Medigap Plan N is likely your best choice going into 2022 and beyond.

Medicare Plan G – 2022

With Plan F not available to people new to Medicare, Medigap Plan G has now become the most popular of all the Medicare supplement plans for 2022, and for good reason.

Medicare Plan N – 2022

A close second in popularity of all the Medigap Plans for 2022 is Medicare Plan N. This plan offers great coverage but does have the possibility of some additional out-of-pocket expenses.

High-deductible Medicare Plan G

Yes, there are two Plan G’s! One is standard Plan G as explained above, and the other is a high-deductible version of this.

What is the best Medicare Supplement Plan?

Plan B: Best Medicare Supplement Plan for Basic Benefits. Some beneficiaries just want a basic Medigap plan with no thrills. Medigap Plan B checks that box, with coverage for three types of out-of-pocket Medicare costs that Medicare beneficiaries may be more likely to face that can add up quickly:

What is the deductible for Medicare 2021?

In 2021, the deductible for high-deductible Plan F and high-deductible Plan G is $2,370. This means that in exchange for a much lower monthly premium, you agree to pay up to $2,370 in 2021 for your covered services before your Medigap plan will cover most the rest of your out-of-pocket Medicare costs for the rest of the year.

What is a plan F?

Plan F is the only Medigap plan to offer coverage in each of the nine benefit areas offered by this type of insurance. Members of Plan F enjoy little to no out-of-pocket expenses because their Medigap plan picks up nearly all health care costs not paid for by Original Medicare (Medicare Part A and Part B).

How much is the Part B deductible for 2021?

The Part B deductible is $203 per year in 2021, so it’s a relatively small cost requirement when compared to some other types of Medicare out-of-pocket copays and deductibles. And the monthly premiums for Plan G are typically lower than those of Plan F, which can more or less cancel out the Part B deductible cost.

Does Medicare cover foreign travel?

One of the health care costs that can be covered by some Medicare Supplement Insurance plans is foreign travel emergency care, or emergency care received outside of the U.S. or U.S. territories. There are 6 Medigap plans that will pay for 80% of your foreign travel emergency care costs. Two of those plans are Plan M and Plan N, ...

What is Medicare Part B coinsurance?

Medicare Part B coinsurance. Having those three areas covered means you will likely avoid some of the biggest potential Medicare charges you could face. This can help many beneficiaries enjoy some peace of mind with a simple plan that has everything they need and nothing they don’t. Compare Medicare Supplement Plans.

Does Medigap Plan K have out of pocket limits?

Surprise or unexpected medical bills can ruin anyone’s budget. But Medigap Plan K and Plan L have annual out-of-pocket limits built into them to give beneficiaries an extra layer of protection.

What is a Medicare Supplement Plan?

A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that are not paid for by Original Medicare. These can include prescriptions, doctor visits, vision and dental care, and more.

Who is Stephanie Trovato?

Stephanie Trovato is a writer who specializes in researching consumer topics, and creating easy-to-understand articles to help consumers make informed decisions. Her experience in healthcare includes e-commerce, insurance advisements, mental health wellness and vitamin and supplement information.

What is a SHIP program?

13 Also known as SHIP, they provide free local health coverage counseling to people with Medicare.

Does Aetna offer Medicare Supplement?

Aetna stands out because it offers several Medicare Supplement plans, including Parts A, B, C, D, F, G, and N, with each plan’s information and coverage clearly laid out on the company website. Consumers are supplied with ample details to really understand the options before making a decision.

Do all Medicare Supplement plans have the same benefits?

No matter which insurance company offers a particular Medicare Supplement plan, all plans with the same letter cover the same basic benefits. For instance, all Plan C policies have the same basic benefits no matter which company sells the plan.

Is Medicare Advantage the same as Medigap?

Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan. Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

Does Mutual of Omaha offer a discount?

Mutual of Omaha also offers a 7% discount if your spouse or domestic partner has applied for, or is applying for, coverage with Mutual of Omaha or an affiliate company. However, the company only offers three plans (F, G, and N).