Ohio Medigap Plans by Carrier

| Insurance Carrier | Plan F | Plan G | Plan N |

| AARP | $134.29 | $114.23 | $93.13 |

| Aetna | $124.62 | $104.79 | $77.14 |

| American Republic | $155.05 | N/A | N/A |

| American Retirement Life | $163.87 | $133.05 | $96.12 |

Full Answer

What is the best Medicare plan in Ohio?

Apr 06, 2022 · What Is the Best Medicare Supplement Plan in Ohio? The top Medicare Supplement plan in Ohio is Plan F. However, each beneficiary has different insurance and healthcare needs, making some plans better than others. Before enrolling in a Medigap plan, consider how often you intend to use your insurance and what monthly premium you are willing to pay.

How to choose the best Medicare supplement plans?

Apr 16, 2022 · Learn about Medigap in Ohio so you can determine which plan best meets your needs. In 2019, there were just over 607,000 Medicare Supplement enrollees in Ohio. Plans F and G are the most popular and comprehensive Medigap plan types in Ohio. Plan F is no longer available to people who are eligible for Medicare after December 31, 2019.

What are the top 5 Medicare supplement plans?

Dec 15, 2020 · We’ll find you the absolute highest value with your Medicare Supplement coverage by shopping all of the insurance companies that offer Ohio Medigap coverage. Be an informed buyer and comparison shop your Ohio Medicare Supplement Insurance plans and rates. Just click here to request a quote or call us at (888) 411-1329 for personal service.

Which Medicare supplement plan should I Choose?

What is the average cost of a Medicare Supplement plan in Ohio?

Medicare Supplement Plans have premiums that cost anywhere from around $70/month to around $270/month. Typically, plans with higher monthly premiums will have lower deductibles.

What is the most comprehensive Medicare Supplement plan?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

What are the pros and cons of Medicare Supplement plans?

Medigap Pros and ConsMedigap ProsMedigap ConsPlans are easy to compareDifficult to switch once enrolledGuaranteed 6 month enrollment period when 1st eligibleMay not be able to enroll after initial enrollment periodAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductible3 more rows•Sep 26, 2021

Is Plan G as good as Plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.Feb 18, 2021

What is the least expensive Medicare Supplement plan?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage.Mar 16, 2022

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What's the difference between Medigap and advantage?

Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

What are the disadvantages of a Medigap plan?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans....Some disadvantages of Medicare Advantage include:Having to make sure your preferred provider is in your plan.No coverage while traveling.A likelihood of higher out-of-pocket and emergency costs.

Does Plan G have a deductible?

Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F. Plan N is the least expensive of these three plans but you'll have more out-of-pocket costs with it.

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

How much does G plan cost?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

Overview of The Top Medicare Supplement Plans in Ohio for 2020

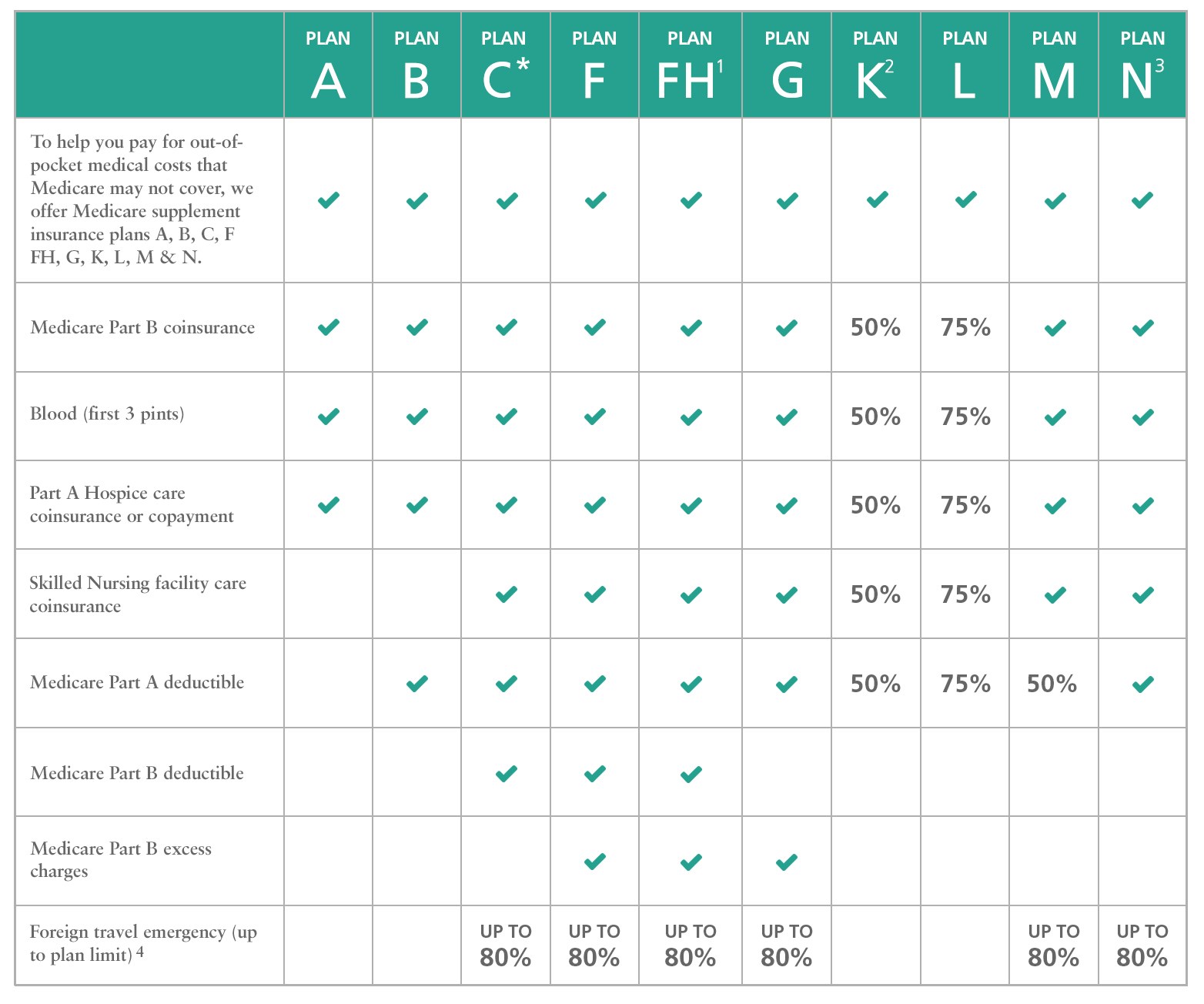

Thirty-eight insurance carriers offer Medicare Supplement plans in Ohio. All of Ohio’s 88 counties have options, but the plans available vary by zip code. The Medigap plan names include Plan A, Plan B, Plan C, Plan D, Plan F, Plan G, Plan K, Plan L, Plan M, and Plan N.

Medicare Supplement Plan Comparison Chart in Ohio for 2020

Choosing from the best Medicare Supplement plans in Ohio can be tricky. You want to pick a plan with a monthly premium that you can afford, but you probably also want to make sure that you have the best coverage that you can afford. When looking at your options, you’ll definitely want to check out the most popular plans.

When Should I Apply for Medicare Supplement Plan in Ohio for 2020?

You should apply for the best Medicare Supplement plan in Ohio during your Medigap Open Enrollment Period. Open enrollment is a six-month period that begins 3 months before the month you meet two conditions:

How Are 2020 Rates Calculated for Medicare Supplement Plans in Ohio?

Although many companies sell Medicare Supplement plans, each company sets its premiums for the best Medicare Supplement plans in Ohio. Factors that influence your premium include gender, whether you use tobacco, zip code and type of coverage. There are three types of coverage:

Can I Use My Ohio Medicare Supplement Plan In Different States?

Since Medicare is a federal program, you can use the best Medicare Supplement plans in Ohio anywhere throughout the country with any doctor that accepts Original Medicare. You do not need preferred provider networks or referrals for doctor’s appointments, hospital visits or skilled nursing care.

How Do I Apply for A Medicare Supplement Plan in Ohio for 2020?

With so many health insurance companies offering the best Medicare Supplement plans in Ohio, it’s a good idea to get assistance from a qualified insurance agent. Our goal is to help you save money on your out-of-pocket health care costs by showing you the options you have.

Related Medicare Supplement Plan Topics in Ohio

Senior Life Insurance Plans is a great resource for Medicare beneficiaries to learn about there options, we also specialize in senior life insurance plans. We help educate Medicare beneficiaries on their Medigap options and help them go through the process of reviewing and comparing plans.