If you’re 65 or older and covered by a group health plan because you or your spouse are still working and entitled to Medicare… typically, the employer insurance pays first, and Medicare would pay second. If your employer has less than 20 employees, Medicare would pay first and the group plan second.

Full Answer

How does Medicare work if you are still employed after 65?

Learn how Medicare works if you are still employed after 65. Your health insurance generally terminates when you leave your job. Apply for Medicare 2 to 3 months before you end employment to avoid a gap in coverage. If you enrolled in Social Security before your 65th birthday, you will be enrolled automatically in Medicare Parts A and B.

Should I enroll in Medicare at 65?

If there are less than 20 employees, you should enroll in Medicare at 65 whether you continue working or not. The same is true if you are covered by your spouse’s insurance plan through your spouse’s employer.

How much does Medicare supplement insurance cost for a 65-year-old?

A 65-year-old male will pay anywhere from $126 to $464 monthly for a Medigap policy, according to the American Association for Medicare Supplement Insurance. For 65-year-old women, the range is $118 to $464.

Can I work after age 65 and still get benefits?

"Talking with your benefits department is one of the most important steps you can take if you are planning to work after age 65," Feinschreiber advises. "You don't want to be in a situation where you have a gap in your primary insurance coverage.

Is it a good idea to get Medicare if you're still working at 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work. Generally, if you have job-based health insurance through your (or your spouse's) current job, you don't have to sign up for Medicare while you (or your spouse) are still working.

What happens if you plan to keep working after age 65?

If you continue to work after reaching age 65, you technically become eligible for Medicare, but you may or may not want to enroll right away. Here's the dilemma: Your employer must continue to cover all eligible workers, regardless of age, under its group health insurance—yet Medicare is telling you to sign up now.

Can you have Medicare and employer insurance at the same time?

Yes, you can have both Medicare and employer-provided health insurance. In most cases, you will become eligible for Medicare coverage when you turn 65, even if you are still working and enrolled in your employer's health plan.

Do you get Medicare if you are still working?

You can get Medicare if you're still working and meet the Medicare eligibility requirements. You become eligible for Medicare once you turn 65 years old if you're a U.S. citizen or have been a permanent resident for the past 5 years. You can also enroll in Medicare even if you're covered by an employer medical plan.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

Can you collect Social Security at 65 and still work full time?

When you reach your full retirement age, you can work and earn as much as you want and still get your full Social Security benefit payment. If you're younger than full retirement age and if your earnings exceed certain dollar amounts, some of your benefit payments during the year will be withheld.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Do I automatically get Medicare when I turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What happens if you don't enroll in Medicare Part A at 65?

If you don't have to pay a Part A premium, you generally don't have to pay a Part A late enrollment penalty. The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled.

Can I delay Medicare if still working?

As long as you have group health insurance from an employer for which you or your spouse actively works after you turn 65, you can delay enrolling in Medicare until the employment ends or the coverage stops (whichever happens first), without incurring any late penalties if you enroll later.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How much is Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

What age do you have to be to get Medicare?

You'll need to know what your coverage options will be at age 65 and adjust your Medicare enrollment to meet your needs. One other situation that can cause confusion occurs if you leave your job with a "retiree" health care plan or coverage under COBRA (the Consolidated Omnibus Budget Reconciliation Act of 1985).

When do you have to enroll in Medicare?

If you work for an employer with fewer than 20 employees, you need to enroll in Medicare at age 65, during your IEP. Medicare becomes the primary payer and your employer's insurance becomes secondary.

How long can you enroll in Medicare if you don't have insurance?

If you don't enroll during your IEP because you have employer group health insurance coverage, you can enroll at any time you still have employer group coverage or within 8 months after the month your employment or group coverage ends. You'll need to know what your coverage options will be at age 65 and adjust your Medicare enrollment ...

What are the pitfalls of working past 65?

5 pitfalls to avoid when working past age 65. 1. Not doing your homework: If you plan to work past age 65, or if your spouse or partner continues to work and covers you, you've got some research to do to make sure you know your options, the costs, and any restrictions. Your employer is required to offer you coverage, but is that your best option? ...

When does Medicare become the primary payer?

Medicare becomes the primary payer for your health care expenses once you reach age 65 and lose your employer group coverage (assuming you work for an employer with more than 20 employees). If you continue to work, your employer's insurance pays first.

What to do if you are 65 and still working?

If you’ll hit age 65 soon and are still working, here’s what to do about Medicare 1 The share of people age 65 to 74 in the workforce is projected to reach 30.2% in 2026, up from 26.8% in 2016 and 17.5% in 1996. 2 If you work at a company with more than 20 employees, you generally have the choice of sticking with your group health insurance or dropping the company option to go with Medicare. 3 If you delay picking up Medicare, be aware of various deadlines you’ll face when you lose your coverage at work (i.e., you retire).

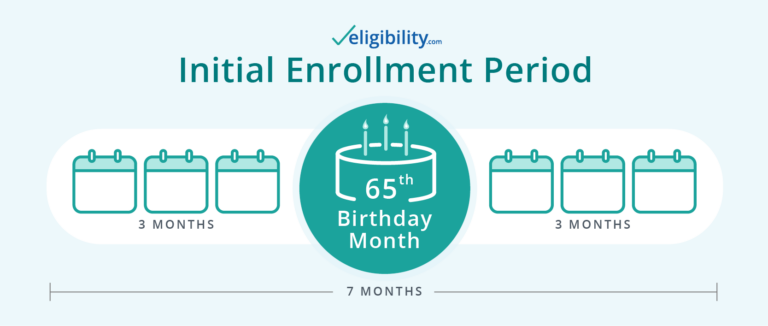

How long does Medicare last?

Original, or basic, Medicare consists of Part A (hospital coverage) and Part B (outpatient and medicare equipment coverage). You get a seven-month window to sign up that starts three months before your 65th birthday month and ends three months after it.

What happens if you delay picking up Medicare?

It’s becoming a common scenario: You’re creeping closer to your 65th birthday, which means you’ll be eligible for Medicare, yet you already have health insurance through work.

How many employees can you delay signing up for Medicare?

If you work at a large company. The general rule for workers at companies with at least 20 employees is that you can delay signing up for Medicare until you lose your group insurance (i.e., you retire). At that point, you’d be subject to various deadlines to sign up or else face late-enrollment penalties.

How old do you have to be to sign up for Medicare?

While workers at businesses with fewer than 20 employees generally must sign up for Medicare at age 65 , people working for larger companies typically have a choice: They can stick with their group plan and delay signing up for Medicare without facing penalties down the road, or drop the company option and go with Medicare.

Can you continue taking a specialty drug under Medicare?

On the other hand, if you take a specialty drug that is covered by your group plan, it might be wise to continue with it if that drug would be more expensive under Medicare. Some 65-year-olds with younger spouses also might want to keep their group plan.

How long do you have to work to get Medicare Part A?

If by the time you reach 65 you’ve worked a total of approximately 10 years over your career, you’re entitled to premium-free Medicare Part A, which pays for in-patient hospital charges and more.

How many employees do you have to have to have Medicare Part B?

If the employer has fewer than 20 employees: If your or your spouse's employer has fewer than 20 employees and the health coverage is not part of a multiemployer group plan, at age 65 you must enroll in Medicare Part B, which will be your primary insurance. If you have an HSA and want to keep contributing: If you have an HSA ...

What is Medicare Part A?

If the employer has fewer than 20 employees: If your or your spouse's employer has fewer than 20 employees and the health coverage is not part of a multiemployer group plan, at age 65 you must enroll in Medicare Part A, which will be your primary insurance. “Primary” means that Medicare pays first, and then the employer insurance kicks in ...

What happens if you overlook Medicare enrollment rules?

Medicare processes and rules are complex and rife with exceptions; if you overlook something in the enrollment rules, you may pay a high price in terms of both penalties and gaps in coverage. So you should consult with Medicare and with the benefits administrator for your employer coverage — before you enroll or decide to delay enrollment.

How long do you have to keep HSA contributions?

Stop making contributions to your HSA at least six months before you sign up for Part B. And you’ll want to sign up for Medicare at least a month before you stop work ...

What percentage of Americans will be working in 2026?

Millions find themselves in this situation. The proportion of Americans ages 65 to 74 who are working is projected to reach 30.2% in 2026, according to the Bureau of Labor Statistics. But Medicare is complicated, and there are a lot of caveats and some surprise expenses to be avoided.

Does Medicare Part A cover my employer?

Because in some cases, Medicare Part A may cover what your employer plan does not. But as with so many aspects of Medicare, there are caveats, exceptions and potential pitfalls. If the employer has 20 or more employees: If your or your spouse's employer has 20 or more employees and a group health plan, you don't have to sign up for Medicare ...

Should you delay Part B enrollment?

If you’re working past 65, you may be able to delay getting Medicare Part B, but there are situations that make it necessary for you to enroll. Make sure you understand the requirements.

Shop for a Plan

You have options when it comes to choosing Medicare coverage. Find the plan that best fits your health and lifestyle needs.

WHAT IS MEDICARE SUPPLEMENTAL INSURANCE?

Medicare supplemental insurance is a separate insurance policy from Original Medicare. It fills in some of the gaps that Original Medicare leaves in terms of expense coverage.

HOW MANY EMPLOYEES DOES YOUR EMPLOYER HAVE?

If you work for an company with 20 or more employers, you’re not required to sign up for Original Medicare or Medicare supplemental insurance. You can continue to use your employer group coverage until you retire.

DO YOU QUALIFY FOR PREMIUM-FREE PART A?

Most people don’t have to pay a premium for Original Medicare Part A, which covers inpatient hospital visits. If you qualify for premium-free Part A, you can enroll up to three months before you turn 65 and for up to three months after.

DO YOU HAVE POST-RETIREMENT GROUP COVERAGE?

You might still have group coverage through your employer even after you’ve retired. For instance, some corporate benefits packages continue to pay part or all of your health insurance premiums for a period after you retire.

HOW SHOULD YOU DECIDE WHAT HEALTHCARE PLAN YOU NEED?

If you’re not sure what type of healthcare coverage you need after turning 65, visit your employer’s human resources department. A benefits coordinator or similar professional can guide you through your options and let you know what your healthcare costs will be.

CONCLUSION

Many people like their jobs or want to save more money, so they continue working after age 65. There’s nothing wrong with that.

How long does Medicare enrollment last?

If you enroll in Medicare after this period, you may be eligible for a Special Enrollment Period (SEP) that starts three months before you need your coverage to start and lasts for eight months after your last day of work.

What is the Medicare premium for a hospital?

This is the standard Medicare premium most individuals will pay unless they make more than $88,000 per year.

What can a Medicare agent do?

A qualified Medicare insurance agent can walk you through the other costs associated with all the Medicare plans, such as copays, deductibles, etc., to help you determine what the insurance will really cost you. The size of the company you work for also factors into whether Medicare is a better choice for coverage.

How much is the penalty for delayed Medicare?

Unless you’re covered by group insurance, you can incur a 10% penalty for each year you delayed your Medicare after you’re eligible. Not only that, but you will have to wait for the General Enrollment Period (GEP), which takes place January 1 though March 31 each year, but coverage will not start until July.

Should I get health insurance at 65?

Having health insurance from your employer after 65 might not always be the best solution. When you turn 65, It is important to take the time to explore all your options. I’ve talked with many individuals who never took the time to compare their employer group coverage with what Medicare could provide them and later regretted it.

Is Medicare Supplement a stand alone plan?

Those wanting to keep Medicare as their primary insurance can also consider a Medicare Supplement, also referred to as a Medigap Supplement plan, along with a stand-alone prescription Part D plan.

Does turning 65 mean you have to retire?

For Medicare-specific information, working with an insurance agent who is well versed in the confusing aspects of Medicare can be a big plus. Turning 65 does not mean you have to retire. It also does not mean you have to settle for one specific type of health insurance.