5 Best Medicare Supplemental Insurance Companies

- Cigna. One of the most well-known specialty insurance providers in the United States, Cigna’s Medicare supplement policies are top-notch and widely available.

- Humana. Humana is a rock-solid supplemental insurance provider that offers plans throughout the country. ...

- Blue Cross Blue Shield. ...

- Aetna. ...

- United Medicare Advisors. ...

Full Answer

How to deal with Medicare as a secondary insurance?

Feb 22, 2022 · Best Medicare Supplement Insurance Companies of 2022 Best Overall: Mutual of Omaha; Best User Experience: Humana; Best Set Pricing: AARP; Best Medigap Coverage Information: Aetna

Will my secondary insurance be compatible with Medicare?

Mar 24, 2022 · How Does Medicare Supplement Insurance Work? Medicare Supplement Insurance helps you pay for the gaps in Medicare coverage. Once Medicare pays its share of the services you are receiving, Medigap will help you pay the rest. If your Part B policy says it covers 80% of a doctor’s visit, Medicare will pay that. Medigap kicks in for the other 20%.

What is the best supplemental insurance to have with Medicare?

Jul 01, 2021 · What's the best secondary insurance for seniors? Our 2021 pick for the best Medicare supplement plan for new enrollees is Plan G. However, this comprehensive plan has a high monthly premium. The full list of the best Medicare supplement plans also recommends Plan K for seniors on a budget. However, some seniors with this plan could end up with high …

Is Medicare ever used as a secondary insurance carrier?

Oct 16, 2018 · My research showed that buying a supplemental insurance was cheaper than the deductible and co-pays with Medicare alone. My dad pays about 200.00 monthly for his supplemental (which pays everything Medicare does not) and his prescription coverage. There is a 185.00 (roughly) deductible that everyone pays on Medicare, so once he has paid that ...

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is the most comprehensive Medicare Supplement plan?

Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

What is the cost of supplemental insurance for Medicare?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization. Several factors impact Medigap costs, including your age and where you live.

Is AARP a good secondary insurance?

Is AARP supplemental insurance good? A supplemental insurance plan from AARP/UnitedHealthcare is a good value. It can help you reduce your out-of-pocket costs for medical care, and it includes discounts on vision, dental, hearing, gym membership and more.Jan 24, 2022

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Does Plan G cover Medicare deductible?

Get online quotes for affordable health insurance Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

Is there a Medicare Supplement that covers everything?

Plan G will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible — $233 for 2022 — before insurance benefits will begin to pay for your health care. Plan G is the most popular Medicare Supplement for new enrollees.Mar 16, 2022

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

What is the difference between a Medicare Supplement and a Medicare Advantage Plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Did UnitedHealthcare buy AARP?

UnitedHealthcare Insurance Company (UnitedHealthcare) is the exclusive insurer of AARP Medicare Supplement insurance plans.

What is the most popular Medigap insurance company?

What's notable: Around one out of every three Medigap beneficiaries are enrolled in a plan from UnitedHealthcare and AARP. UnitedHealthcare is one of the top two largest insurance companies in the world....Top 10 Best Medicare Supplement Insurance Companies.AARP/UnitedHealthcare ProsAARP/UnitedHealthcare ConsGenerous plan selectionMust be an AARP member to enroll1 more row

Why does AARP recommend UnitedHealthcare?

From our long-standing relationship with AARP to our strength, stability, and decades of service, UnitedHealthcare helps make it easier for Medicare beneficiaries to live a happier, healthier life.

What is secondary coverage for health insurance?

Secondary health insurance policies can fill in any coverage gaps, such as vision coverage, and available policies can also reduce the cost of heal...

Can you have two health insurance plans at the same time?

Yes, it's common to have multiple health insurance policies, and dual coverage can help cover more of your medical costs so that you pay less out o...

Which insurance companies offer secondary health insurance?

Plans are available from Blue Cross Blue Shield, USAA, AARP, UnitedHealthcare, Aetna, Aflac, Alliance, Humana, Cigna and more.

Is secondary health insurance worth it?

Secondary health insurance can give you financial protection if your main insurance policy has limitations. Most people have some form of secondary...

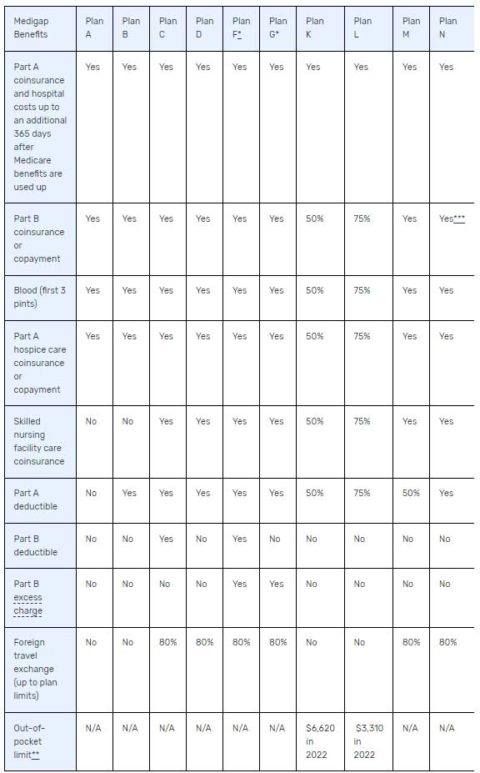

What does Medicare Part B cover?

Both plans also cover Medicare Part B coinsurances and copays, the first three pints of blood, Part A hospice care coinsurances or copays, skilled nursing facility care coinsurances, and the Part A deductible, but not at 100% like other plans. Plan K covers these benefits at 50% and Plan L covers them at 75%.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

How long do you have to be on Medicare if you have a disability?

If you have a disability and you’re receiving disability benefits from the Social Security Administration, you’ll automatically be enrolled in Parts A and B of Medicare once you’ve been receiving benefits for 24 months.

Does Medicare pay for prescription drugs?

Medicare Part D helps you pay for prescription drugs. Depending on your plan, you may have to shop at preferred pharmacies to get the best price. You may also have to pay an out-of-pocket deductible before the insurance begins paying. Part D drug plans carry a premium which you must pay in addition to the Plan B premium.

What is Plan F?

Plan F. Plan F is the most extensive Medicare Supplement Insurance plan available. It covers everything the other plans cover, in addition to 100% of Medicare Part B excess charges. Plan F also covers 80% of medical emergency expenses when you travel outside of the country.

What is secondary health insurance?

A secondary insurance policy is a plan that you get on top of your main health insurance.

How does secondary insurance work?

If you have multiple insurance policies, there is a clear order in which the plans will pay for health care services.

What types of coverage can you get?

The category of secondary health insurance includes multiple types of insurance plans. Some plans help with the costs of your primary insurance policy by addressing things such as high deductibles or the cost of a hospital stay.

What's the cost of secondary health insurance?

Secondary health insurance can cost anywhere from $5 per month to hundreds of dollars per month, depending on the type of coverage and the level of support the plan provides.

How do you choose the best secondary insurance plan?

Just as there are multiple considerations when choosing the best health insurance company, asking yourself the following questions can help you choose the best secondary health insurance policy.

Frequently asked questions

Secondary health insurance policies can fill in any coverage gaps, such as vision coverage, and available policies can also reduce the cost of health care services, such as hospital indemnity to help you cover the cost of hospital care.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What happens if a group health plan doesn't pay?

If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment. Medicare may pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. or a. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.

What is a dual eligible Medicare Advantage plan?

There are certain types of Medicare Advantage plans known as Dual-eligible Special Needs Plans (D-SNP) that are custom built to accommodate the specific needs of those on both Medicare and Medicaid.

What is third party liability?

Third party liability. Under federal law, all other sources of health care coverage must pay claims first before Medicaid will pick up any share of the cost of care. This is referred to as “third party liability” (TPL), which means the primary payment for care is the responsibility of any available third-party resources and not that of Medicaid.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio.

Can you be on Medicare and Medicaid at the same time?

Some people are eligible for both Medicare and Medicaid and can be enrolled in both programs at the same time. These beneficiaries are described as being “dual eligible.”.

What is the last resort for medicaid?

Medicaid acts as the “payer of last resort” when a beneficiary has an employer-based or other private commercial insurance plan. This means Medicaid will be the last plan to contribute to a medical bill and may pick up copayments and coinsurances in similar fashion to how Medicaid works with Medicare.

Is medicaid a primary or secondary insurance?

Medicaid can work as both a primary or secondary insurer. In this Medicaid review, we explore when and how the program works as secondary, or supplemental, insurance that can coordinate with other types of insurance.

What is secondary health insurance?

Secondary health insurance is coverage you can buy separately from a medical plan. It helps cover you for care and services that your primary medical plan may not. This secondary insurance could be a vision plan, dental plan, or an accidental injury plan, to name a few. These are also called voluntary or supplemental insurance plans.

What is gap insurance?

Gap insurance is a type of secondary insurance. It's sometimes called "limited benefits insurance.". Gap insurance offers cash benefits. This means it can help pay health care costs related to your deductible, copay, coinsurance, and other out-of-pocket medical expenses.

What is short term disability?

Disability: Short- and long-term disability plans are a type of secondary insurance coverage. It gives you benefits if you become injured or ill and can't work for any length of time. Life Insurance: A type of secondary insurance that pays out a lump sum to a beneficiary in the event of your death.

What is accidental injury insurance?

An accidental injury plan is a type of secondary insurance that may give you a cash payout, or lump sum. You can use this money to help pay medical bills or household expenses.

What is a supplement plan?

Supplemental health plans like vision , dental , and cancer insurance can provide coverage for care and services not typically covered under your medical plan. Supplemental plans often have a deductible, copay, and coinsurance. When you meet the deductible then your plan starts sharing part of the costs with you.

What does a vision plan cover?

A vision plan can provide coverage for routine eye exams and prescription glasses or contacts , depending on the plan. Dental: A dental plan can cover you for preventive care such as routine teeth cleanings and some X-rays. It may also help cover you for certain kinds of specialized dental care.

What happens when you meet your deductible?

When you meet the deductible then your plan starts sharing part of the costs with you. When you see a provider you may have to pay a small fee, or copay, at the time of the visit. Lump sum insurance plans pay you a cash amount, should you suffer a covered illness or injury.

What is the best health insurance for retirees?

Most retirees receive health insurance through Medicare, the federal government's health insurance program for people age 65 and older. To maximize the value of the health plan, make sure to sign up at the correct time and take advantage of the free and low-cost services Medicare provides.

What is the Medicare program for retirees?

Your Medicare Coverage. Most retirees receive health insurance through Medicare, the federal government's health insurance program for people age 65 and older. To maximize the value of the health plan, make sure to sign up at the correct time and take advantage of the free and low-cost services Medicare provides.