What are the best Medicare supplement plans in Florida?

Feb 08, 2022 · Best for Straightforward Plan Management: Aetna. Aetna is a Medicare Supplement plan provider that offers straightforward plan management and portal options. Get signed up for coverage after ...

What are the top 5 Medicare supplement plans?

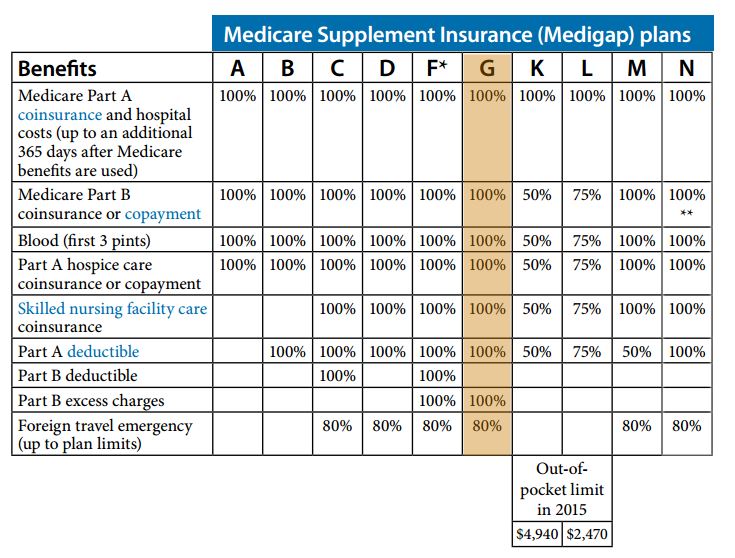

Must have a Medicare start date before Jan. 1, 2020. 2. Best comprehensive coverage: Plan G. Plan G offers the most coverage for those new to Medicare after Jan. 1, 2020. Covers everything except Part B deductible. Considerable premium savings compared to Plan F in return for paying the Part B deductible. 3.

Who has the best Medicare supplement plans?

Here are some of the benefits Medigap Supplement plans in Florida cover: Skilled nursing facility coinsurance. Medicare Part A coinsurance and additional days in the hospital. Home health care. Medicare Part A and Part B deductibles. Hospice care coinsurance. Part B excess charges. Foreign travel emergency.

What is the best Medicare Advantage plan in Florida?

Best Medicare Supplement Insurance in Florida AARP (UnitedHealthcare) Aetna Capital Life Insurance Cigna Great Southern Life Humana Lumico National Guardian Life Insurance Union Security Insurance Company United of Omaha Life Insurance Medigap Plans …

What are the top 3 most popular Medicare supplement plans in 2021?

What is the highest rated Medicare Advantage plan in Florida?

Which Medicare supplement plan has the highest level of coverage?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

Are Medicare supplements more expensive in Florida?

What are the 5 Star Medicare Advantage plans in Florida?

The plans below are rated 5 stars out of 5 by the CMS: BayCare Health Plans: BayCarePlus Complete, BayCarePlus Premier, BayCarePlus Rewards. Capital Health Plan: Capital Health Plan Advantage Plus, Capital Health Plan Preferred Advantage, Capital Health Plan Silver Advantage.Jan 19, 2022

Which company has the best Medicare Advantage plan?

| Category | Company | Rating |

|---|---|---|

| Best overall | Kaiser Permanente | 5.0 |

| Most popular | AARP/UnitedHealthcare | 4.2 |

| Largest network | Blue Cross Blue Shield | 4.1 |

| Hassle-free prescriptions | Humana | 4.0 |

What is the least expensive Medicare supplement plan?

What is the difference between Plan G and high deductible plan G?

Does Plan N cover Medicare Part B deductible?

How much does Medicare Part G cost in Florida?

Is Medicare Plan F available in Florida?

How much is Medicare G?

What is the best Medicare Supplement plan in Florida?

While there are 10 Medicare Supplement plans in Florida you can choose from, the best one is the one that gives you the best health care coverage . For many Florida Medicare beneficiaries, the best Medicare Supplement insurance plan is Medicare Plan G, in terms of the fullest coverage.

What is Medicare Supplemental Insurance in Florida?

Medicare Supplemental Insurance, also called Medigap health plans, pays for out-of-pocket costs such as deductibles and copays that the federal Medicare program doesn’t cover.

Does Medicare Supplement cover preventive care?

Some Medicare Supplement insurance plans offer preventive care. These differences in health care coverage are why it’s essential that you closely compare the Medigap policies offered in your area before you enroll. Medigap policies supplement the Medicare benefits you receive through Original Medicare. Here are some of the benefits Medigap ...

Is there a deductible for Medicare Part B in 2021?

There is not a deductible on Medicare Plan G, you are simply required to pay the Medicare Part B deductible before outpatient care is covered. For 2021, the Part B deductible is $203.00.

Do Medicare Part D plans cover prescriptions?

Medicare beneficiaries must buy separate Medicare Part D drug plans to cover medications. Just like Medigap plans in Florida, prescription drug plans differ in monthly premiums and the drugs covered. When you compare policies, make sure that the policy includes the prescriptions you take.

Is there an open enrollment period for Medicare Supplement?

Under federal law, there is no annual open enrollment period for Medicare Supplement plans like there is for prescription drug plans and Medicare Advantage plans. There are, however, a few times other than your Medigap Open Enrollment Period that you can join a Medicare Supplement plan without penalty:

What happens if you have a Medicare Advantage policy?

If you have a Medicare Advantage policy and it’s discontinued. If you have a Medicare Advantage policy and you move out of its coverage area. If you have Original Medicare and you’re retiring from group coverage. If your Medigap insurance company decides not to renew your policy.

Which Medicare plan is the highest enrollment rate in Florida?

Medicare Plan F is generally the Medicare Supplement Insurance plan in Florida with the highest enrollment rate. However, based on new Medigap policies purchased, popularity is quickly shifting to Plan G.

Which is the most comprehensive Medicare plan?

Of all the Medigap policies, Plan F is the most comprehensive, but it is only available to people who were newly eligible prior to January 1, 2020. For Medicare recipients who became eligible on or after that date, Plan G is the most comprehensive.

When did Medicare discontinue F?

When F was discontinued as of January 1, 2020, Medigap Plan G became the most comprehensive coverage for Medicare recipients. If you have F, you may consider switching to Plan G to take advantage of a reduced premium.

What is the deductible for a 2021 F plan?

However, the high-deductible plan premium as compared to the original Plan F is substantially lower. In 2021, the deductible is $2,370. Once you satisfy this deductible, the plan will cover 100% of the costs.

Is Plan N a good plan?

Plan N is great for individuals who want comprehensive coverage. However, there is a trade-off between monthly premium savings and reduced benefits. Plan N pays the Medicare Part B coinsurance in full, but you are responsible for Medicare Part B copayments as follows:

What is Medicare Supplement Insurance in Florida?

Florida Medicare Insurance Regulations (re: Medigap Plans Florida) The following comes from the Florida Department of Financial Services. Every Medicare Supplement policy must meet State and Federal laws designed to protect consumers and the policy must be clearly identified as “Medicare Supplement Insurance.”.

Does Medicare Supplement cover prescriptions?

Since January 1, 2006, Medicare Supplement policies do not include prescription drug coverage. If you have a Medicare Supplement policy without prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D) during the Medicare Advantage Annual Enrollment Period (AEP).

How long is the preexisting period on Medicare Supplement?

The maximum pre-existing time period is 6 months minus credit for prior coverage. A 30-day free look period is provided on all Medicare Supplement policies according to s. 627.674, Florida Statutes. This means the policy can be returned to the company for a full refund of all premiums.

Does free look coverage apply to Medicare?

(The free-look provision does not apply to Medicare Advantage Plans.)

What are the benefits of Medicare Supplement in Florida?

These are some of the benefits that are included in some Medicare Supplement plans in Florida: Skilled Nursing Facility. Home Health Care. Medicare Part A and Part B deductibles. Original Medicare’s coinsurances and copayments. Part B Excess Charges. Foreign Travel.

Is Medicare Advantage a supplement in Florida?

Medicare Advantage Plans vs. Medicare Supplement Plans in Florida: Medicare Supplement plans in Florida work with the two parts of original Medicare to enhance it. Medicare Advantage replaces original Medicare with another policy. Both MA and Medigap plan members are still beneficiaries and are protected by strict federal and state laws.

Does Medicare Supplement work in Florida?

Medicare Supplement plans in Florida work with Original Medicare to provide you with additional benefits. If you choose to sign up for one of the Medigap plans in Florida, you’ll still be covered by the standard Medicare benefits. Then, you’ll have supplemental coverage from your Medigap company and plan.

Do you have to compare Medigap plans in Florida?

You don’t have to compare Medigap plan F from insurance company to insurance company. This is because every insurance company has to offer the same benefits for each plan. However, you should compare rates for these Medigap plans in Florida to ensure you’re paying the best price. You can save on out-of-pocket costs with Florida Medigap plan F in ...

Is Florida Blue a Medicare Supplement?

Florida Blue is one of the top rated insurers in the state, and they provide both MA and Medicare Supplement Insurance plans in Florida. This company uses to be called Blue Cross and Blue Shield of Florida, and they are part of the national Blue Cross and Blue Shield system.

Is Medicare Part D included in Medicare Advantage?

Just know that unlike with Medicare Advantage, Medicare Part D Drug Plans are not included. Instead, you should sign up for a Prescription Drug Plan separately. Also, since Supplements are designed to help with healthcare costs, life insurance is not included in any of these plans.

Is life insurance included in a prescription drug plan?

Instead, you should sign up for a Prescription Drug Plan separately. Also, since Supplements are designed to help with healthcare costs, life insurance is not included in any of these plans. If you’d like to have life insurance coverage, though, you can shop around for your best options.

What is Medicare Supplement Plan in Florida?

A Medicare Supplement plan in Florida for 2021 can help you cover the out-of-pocket expenses left after Original Medicare Part A and Medicare Part B pays their portion. These out-of-pocket expenses include coinsurance, copayments, and deductibles. Plans can differ depending on where you live, so to find the Medicare Supplement plan in Florida ...

When will Medicare plan F be available in Florida?

Please note: Medigap Plan F in Florida will no longer be available to Medicare beneficiaries that turn age 65 after 01/01/2020. Plan F will still available to Medicare Beneficiaries who are already on Medicare Part A and Medicare Part B prior to 01/01/2020.

What are the out-of-pocket expenses for Medicare in Florida?

These out-of-pocket expenses include coinsurance, copayments, and deductibles. Plans can differ depending on where you live, so to find the Medicare Supplement plan in Florida that best fits your needs and budget, you need to understand how Medicare Supplement insurance works and the outline of coverage for each plan.

Does everyone have the same Florida Medicare?

Everyone who has the same Florida Medicare Supplement through the same health insurance company pays the same rate, regardless of age. Issue-age. Also, know as entry age rated. Your age when you buy the plan determines the premium.

Does Florida Blue Medicare have an age rated plan?

Also, know as entry age rated. Your age when you buy the plan determines the premium. Premiums may increase as you age due to inflation or higher costs, but not because of your age. Florida Blue Medicare Supplement Plans offer “Forever 65”. This is essentially their version of entry age-rated coverage.

How much does Medicare pay in Florida?

In Florida’s Alachua County, Medicare spends $9,592 per enrollee; in Palm Beach County, Medicare pays $11,417. That means that if you live in Jacksonville, you might pay more or less than someone living in Miami, even though you both have the same Medicare Supplement insurance plan.

How many Medigap plans are there?

There are 10 Medigap plans available to choose from: A, B, C, D, F, G, K, L, M, and N. Medicare Supplement Plan F, Medicare Supplement Plan G and Medicare Supplement Plan N are the most popular and are considered by many to be the best. Each Medigap plan offers the same basic benefits in addition to Medicare Part A and Part B; however, ...

What Are Medigap Plans?

Medigap plans are Medicare Supplement Insurance offered by Medicare-approved private insurance companies to help cover cost sharing requirements of Original Medicare Parts A and B.

What Medicare Supplement Plans Cover

Medigap policies serve as your secondary source of insurance after Medicare pays. Medigap fills in the “gaps” between what Medicare pays for covered services and what you are charged. Some plans offer extended coverage for Part B excess charges and foreign travel emergency costs.

What Medigap Plans Cost in Florida

Expect to pay about $46 to $201 each month for a Medigap plan A, G, or N in Florida if you enroll during your open enrollment period. Premiums will vary depending on your insurer and how your premium is rated.

Medigap vs. Medicare Advantage Plans

Medigap and Medicare Advantage Plans are very different. You are eligible for either type of plan when you are enrolled in Medicare Part A and B, but you cannot have both at the same time. Both Medigap and Medicare Advantage Plans are offered by Medicare-approved private insurance companies.

Types of Medigap Plans in Florida

Every standardized type of Medigap plan is offered in Florida, but Plans F and G offer the most comprehensive coverage and are the most popular. Plans F and G also come in a high-deductible version. Here are some highlights and difference among some of the plans:

When to Sign Up for Medicare Supplement Plans in Florida

In general, you will get the best price for Medicare Supplement Insurance if you purchase a plan as soon as you are eligible for Medicare and enrolled in Parts A and B.

How to Choose a Medigap Plan in Florida

Consider these factors as you compare Medicare Supplement Insurance plans available in your area:

Does Florida have Medicare Advantage?

Over 40% of Medicare enrollees in Florida chose a Medicare Advantage plan to administer their benefits. There are many $0 premium plans available throughout the state. Not all counties have the same plans; some areas, like Miami-Dade, have a lot of Advantage plan enrollees. But, Key West has fewer Medicare Advantage enrollees.

What is the best Medigap plan?

The best Medigap plans are Plan F, G , and N. But, these are the top Medigap plans in the nation too. Plan F covers the most benefits, leaving you with no out of pocket costs. Those with Plan G will cover the Part B deductible themselves. Further, those with Plan N will also pay the Part B deductible and have a few co-payments.

How long is the Medigap Open Enrollment Period?

Each beneficiary gets a 6-month Medigap Open Enrollment Period to select a plan and avoid underwriting. Delaying enrollment could result in the inability to enroll in a Medigap plan in the future. You can still enroll in a plan outside your OEP, but your health could impact your premiums.

How much does Plan N cost in Orlando?

The premium for Plan N for a female under 65 in Orlando would cost over $400 a month. Those with Medicare and disability opt for a Medicare Advantage plan until they turn 65.

Does Key West have Medicare?

But, Key West has fewer Medicare Advantage enrollees. While these plans are notorious for being “ all-in-one ” coverage options, they have rules and restrictions you must follow. Rules can include using in-network doctors and obtaining referrals. Many HMO plans don’t cover you unless you stay in-network.

Can you change your Medicare Supplement plan?

One of the best parts about Medicare Supplement plans is that you can change policies at any time. But, depending on your situation, you may need to go through underwriting. Many people pass through underwriting without any hassles. But each company is different.

Does Medicare cover home health?

Yes, Medicare will cover the cost of home healthcare. But, you must be under the care of a doctor, be homebound, need speech therapy, or skilled nursing care. Also, please note that “home” can be assisted living, a house, an apartment, or adult family care housing.

What is Florida Medicare Supplement Plan F?

Florida Medicare Supplement Plan F. Medicare Plan F is popular because it covers all the gaps. Some people refer to it as the Cadillac plan. When you have Plan F or any other Medigap plan, you can see any doctor who accepts Medicare, no matter the carrier you have it through.

Does Florida have Medicare Advantage?

Florida has more Medicare Advantage plans available than many other states. That’s because the state attracts more retirees than other states. Medicare Advantage plans are private insurance policies which deliver your Medicare benefits instead of Medicare.

Is Florida a Medigap state?

However, you still have the option to enroll in one if you can afford the premium. Also, Florida is one of the most expensive Medigap states. Because of the higher percentage of seniors in the state, insurance carriers have to charge higher premiums to be able to afford to pay for your coverage.

Is there a Medigap plan in Florida?

Fortunately, there are a ton of Medigap plans in Florida, so you have plenty of options to compare to find the most cost-effective plan.

How many Medicare plans are there in Florida?

Also called Medicare supplement plans, Medigap plans are standardized in Florida. There are 10 plans available. This makes it easy to compare prices. You must be enrolled in Parts A and B to enroll in a Florida Medigap plan. Everyone has a 6-month open enrollment window that begins with their Part B effective date.

How long does it take to enroll in Medigap in Florida?

You must be enrolled in Parts A and B to enroll in a Florida Medigap plan. Everyone has a 6-month open enrollment window that begins with their Part B effective date. You can join any Medigap plan during this period without any health questions. Many major well-known carriers offer Medigap plans in Florida.

Is Medicare Advantage a one size fits all plan in Florida?

When deciding between a Medicare Supplement and Medicare Advantage plan in Florida, it’s important to know there is not a one-size-fits-all plan. A Medicare Supplement may be most cost-effective for one Florida beneficiary, while a Medicare Advantage plan is for another.

What is the best Medicare plan for 2021?

SilverScript. Humana. Cigna. Mutual of Omaha. UnitedHealthcare. The highest rating a plan can have is 5-star. Just because a policy is 5-star in your area doesn’t mean it’s the top-rated plan in the country. There is no nationwide plan that has a 5-star rating.

Is a suitable insurance policy the most affordable?

A suitable policy is the most affordable one for YOU. Spending time making sure your plan is the best value is a serious recommendation. With the rising cost of prescriptions, it’s more important now than ever before to make sure that you find the best policy.

Will Medicare change to Part D in 2021?

Medicare prescription drug plan changes in 2021 are noteworthy. Also, by knowing what to expect, you can stay ahead of the game. Drugs can be costly, and new brand-name drugs can be the most expensive. With age, you’re more likely to require medications. Medicare’s standalone Part D plan can cover you.

Does Medicare cover Part D?

Medicare’s standalone Part D plan can cover you. Part D plans have a monthly premium that insurance companies determine. There may be several plans as well as companies to choose from in your state. Policies vary by county, so moving may warrant a plan change.

What is the SilverScript plan?

SilverScript Medicare Prescription Drug Plans. There are three different plans available with SilverScript. The Choice, the Plus plan, and the SmartRx plan. All policies are a great option, depending on the medications you take, one could be more beneficial to you than the other.

What are the preferred pharmacies for Choice Plan?

For those with the Choice plan, there are fewer options. For example, the Choice plan preferred pharmacies are CVS, Walmart, and thousands of community-based independent drug stores. Then, the Plus plan includes CVS, Walmart, Publix, Kroger, Albertsons, as well as many grocery stores and retailers.

Does Humana Part D have a deductible?

Humana Part D Reviews. Many generics with Humana have a $0 deductible. Further, they have a variety of plan options, something for everyone. The high deductible on brand name medications isn’t that great, and you have to go to Walmart to get the best savings.