Which insurance company is best for a Medicare supplement?

Feb 22, 2022 · We chose AARP as best for its set pricing for Medicare Supplement coverage because it doesn’t charge more as you grow older. This is especially helpful if …

Which insurance companies sell the most Medicare supplements?

3 rows · Mar 24, 2022 · USAA Life Insurance Company has excellent financial strength ratings: AA+ from A.M. Best and ...

What are the top 5 Medicare supplement plans?

10 rows · Aug 30, 2016 · The average monthly premium cost for Medicare supplemental insurance ranges from $50 to $300. ...

What is the best secondary insurance with Medicare?

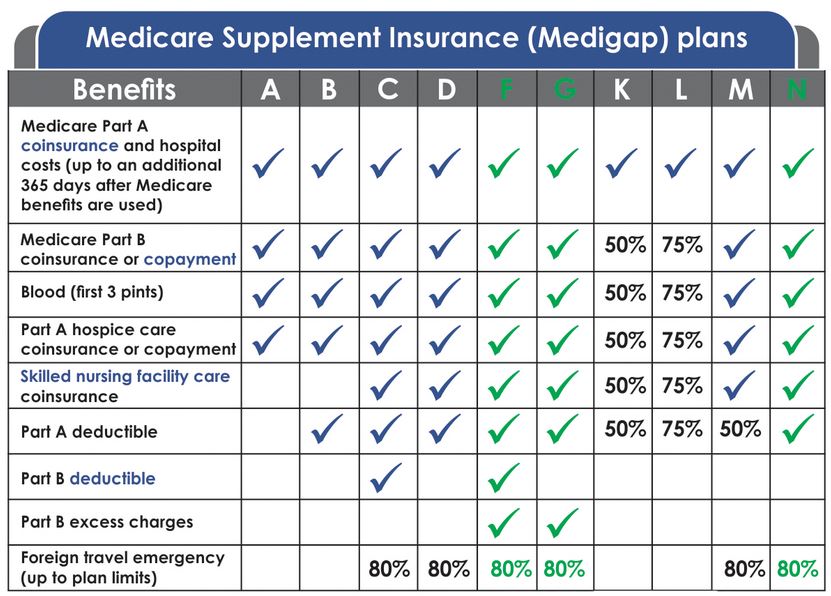

Dec 21, 2021 · Medicare Supplement Insurance Closes the Gaps Medicare Supplement insurance closes or reduces these gaps. That is why it is often called Medigap insurance. Medigap policies come with different levels of coverage. Understanding the details of the Medigap plans can help you know how to choose the best Medigap plan for your specific needs.

What is the most comprehensive Medicare Supplement plan?

Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is the cost of supplemental insurance for Medicare?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization. Several factors impact Medigap costs, including your age and where you live.

What are the pros and cons of Medicare Supplement plans?

Medigap Pros and ConsMedigap ProsMedigap ConsPlans are easy to compareDifficult to switch once enrolledGuaranteed 6 month enrollment period when 1st eligibleMay not be able to enroll after initial enrollment periodAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductible3 more rows•Sep 26, 2021

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

Does Medicare coverage start the month you turn 65?

For most people, Medicare coverage starts the first day of the month you turn 65. Some people delay enrollment and remain on an employer plan. Others may take premium-free Part A and delay Part B. If someone is on Social Security Disability for 24 months, they qualify for Medicare.

What is the difference between a Medicare Supplement and a Medicare Advantage Plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Is Medigap and supplemental insurance the same?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is the difference between AARP Medicare Complete and AARP Medicare Advantage?

AARP MedicareComplete plans are forms of Medicare Advantage health care insurance plans. Medicare Advantage plans are offered through private companies, which develop agreements with Medicare to provide some Medicare benefits to those who sign up with them.

Who regulates Medicare Supplement Insurance?

Medicare Supplement Insurance plans are tightly regulated by the Centers for Medicare and Medicaid Services (CMS), a government agency. CMS determines what each letter plan will cover, and it requires each insurance company to offer the plan as is, without modifications.

How long does a Supplement 1 plan cover?

The Supplement 1 plan covers 120 days of mental health hospitalization and the state-mandated benefits, plus the deductibles for Medicare Part A and Part B, co-insurances for services at a skilled nursing facility under Part A, and emergency medical costs when traveling outside of the U.S.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

What is the name of the insurance company that offers Medicare Supplement Plans?

Blue Cross Blue Shield. BlueCross Blue Shield (known as Anthem in some states, as well as BCBS) is one of the biggest names in insurance. They have a website specifically dedicated to Medicare Supplement Plans, so you don't have to worry about sorting through health insurance information that doesn't apply to you.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

What is SelectQuote Senior?

SelectQuote Senior is one of several brokers that refers prospective clients to various insurance companies for Medicare Supplement Plans. You'll get quotes for 20+ different providers through this service, depending on which companies are issuing policies where you live. Those companies may include Aetna, Cigna, Anthem and Humana; all insurers with whom they partner are at least A- rated. The business itself has an "A+" rating and accreditation from the BBB, which means that in the company's 36 years in operation, they've done a good job of treating their clients fairly and honestly.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

How to find Medicare premiums with United Medicare Advisors?

When it comes to finding plans and premiums with United Medicare Advisors, they provide a simple online form where you enter contact information such as your name, phone number, and email address. This same information is required by almost all Medicare Supplement Plan sites.

How much is the BCBS discount?

There is also a household discount of 5% if more than one household member is enrolled in a BCBS Medicare Supplement Plan. That discount is lower than many other insurers, who typically offer anywhere from 7% to 15% off, and sometimes that applies even if no one else is currently enrolled with you.

What is the Learn About Medicare tab?

Under the Learn About Medicare tab, you can find information on Medicare Supplement, Medicare Advantage, Prescription Drug Plans, and Medicare Parts A and B. They provide access to blogs covering health care news, retirement, and health wellness.

What is Medicare Supplement Insurance?

Medicare supplement insurance is also known as “Medigap” because it covers gaps in Original Medicare coverage. This supplemental insurance, offered by private companies, covers costs including deductibles, copayments and coinsurance. You pay a monthly premium for this added coverage.

How old do you have to be to get Medicare Supplemental?

To purchase Medicare supplemental health insurance coverage, you must be at least 65, have Medicare Part A and B and purchase coverage during your Medigap open enrollment period. Medigap open enrollment starts on the first day of the month you are 65 or older and enrolled in Medicare Part B and lasts six months.

What is Plan K for Medicare?

Plan K covers additional days in the hospital after Medicare benefits are exceeded and 50% of the following (up to a yearly out-of-pocket limit): Part B coinsurance, up to three pints of blood, hospice care coinsurance or copayments, coinsurance for skilled nursing facilities and the deductible for Part A.

What is Medicare Select?

Medicare SELECT is a type of Medigap policy that requires policyholders to use hospitals and doctors within its network to get coverage. The premiums are typically lower than those offered by other Medigap providers, which don’t enforce network restrictions. Medicare SELECT can provide the same Plan A through N coverage as other Medigap policies, just with added network and geographical restrictions.

What is bundle discount?

Bundle discounts: Some companies offer discounts for individuals who have multiple policies with them, so you may want to choose a company that sells several types of policies that interest you. Many companies that sell Medicare Supplement Insurance also offer life insurance policies.

What is the deductible for United American insurance?

1, 2020. High-deductible versions of plan F and G are also available with a deductible of $2,340.

When do you have to have Medicare Part A and Part B?

You must have Medicare Part A and Part B. You must purchase during your open enrollment period, which starts the first day of the month when you turn 65 and are enrolled in Part B. If you try to purchase Medigap coverage outside this enrollment period, your options may be limited, and there may be extra costs.

What are the Basic Benefits of Medicare Supplemental Insurance Plans?

Supplemental insurance plans allow you to receive private health insurance benefits outside of the federally regulated Medicare plans.

Medicare Supplement Insurance Closes the Gaps

Medicare Supplement insurance closes or reduces these gaps. That is why it is often called Medigap insurance. Medigap policies come with different levels of coverage. Understanding the details of the Medigap plans can help you know how to choose the best Medigap plan for your specific needs.

What is the Best Medicare Supplement Plan?

Humana offers a host of extra benefits beyond the standardized benefits. Ranging from vision, hearing, and dental to fitness and nursing line options, Humana’s Medigap plans give you the most options to add a comprehensive wellness package. Humana is financially sound and also ranks in the top 10 list on caring.com.

Medicare Supplement Eligibility

To enroll in Medigap, you must be eligible for, and enrolled in, Original Medicare. You cannot have Medigap without also being enrolled in Medicare Part A and B. For Medicare Supplement insurance, this means that you must be:

Which Medicare Supplement Plan is Best for You?

Now that you know all about Medigap coverage, you can make smart decisions about your coverage.

Who sells Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are sold by dozens of private insurance companies all over the U.S. When shopping for coverage, it’s important to find the right plan for your unique needs and also to find the right insurance company. Different companies may sell Medigap plans that have different prices and terms, ...

What states have Medigap plans?

Their costs and the availability of the types of plans, however, may vary. Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state. Learn more about Medigap plans in your state.

What is Medico insurance?

Medico Insurance Company. Medico sells Medicare Supplement Insurance in 25 states and offers several popular Medigap plans, such as Plan A, Plan F, Plan G and Plan N. Medico offers a number of plan discounts for things like automatic premium withdrawal, being a non-smoker or living with another person over the age of 18.

Is Wellcare the same as Medigap?

It’s important to keep in mind that although each company’s plan selection and pricing may differ, the coverage included in each type of Medigap plan remains the same, no matter where you purchase it.

Does Mutual of Omaha offer Medicare Supplement?

Mutual of O maha Medicare Supplement Insurance plans come with an Additional Benefit Rider that may include services such as discounts on fitness programs, hearing care and vision care. Mutual of Omaha offers several types of Medigap plans. Depending on where you live, you may be able to apply for Mutual of Omaha Medicare Supplement Insurance ...

Is Wellcare a Fortune company?

In 2020, WellCare was named one of Fortune Magazine’s “Most Admired Companies,” and the company boasts a number of community-based programs designed to help members navigate their local social support network and connect to community resources. 4

Does Aetna offer Medigap?

Aetna offers a diverse portfolio of insurance products that includes Medigap plans. Over 1 million people trust Aetna for their Medicare Supplement Insurance. 3. Aetna offers several different types of Medigap plans. Plan availability may vary based on your location.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

What is the best alternative to Plan G?

Best alternative to Plan G Medicare supplement: Plan N. Plan N is a good option for individuals who do not want to purchase Plan G but still want comprehensive Medicare insurance coverage at a cheaper price.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Is Plan F a good plan?

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor. The monthly premium for Plan F will be $221. Unfortunately, Plan F will not be available to new Medicare enrollees who become eligible after Jan. 1, 2020.

Why Choose A Medicare Supplement Plan

All of these companies also offer Medicare Advantage plans. Buying Medicare insurance isnt an easy decision, and understanding the difference between Medigap and Medicare Advantage plans before you choose one or the other is a good idea.

What Is The Best Medicare Supplement

As mentioned above, your best Medicare Supplement plan will be the plan that balances costs and coverage. In general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums.

When Should I Enroll In A Medicare Supplement Plan

The best time to enroll in a Medicare Supplement plan is during your six-month Open Medigap Enrollment Period. This time period begins during the first month that you are eligible for Medicare and enrolled in Part B.

Other Coverage You Have

Although 65 is the traditional retirement age, plenty of people are still employed at that age and continue to work for years.

Best Medicare Supplement Companies

Unlike with traditional health insurance, where policies differ among providers, Medicare Supplement plans are standardized so that the benefits for each plan letter are the same for each company. This means that Medicare Supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna.

How To Choose The Best Medicare Supplement Plan For You In 2021

As you research which Medigap plan is the best fit for you in 2021, here are some points to consider:

Top 10 Best Medicare Supplement Insurance Companies

These top 10 insurance companies offer Medicare Supplement Insurance in most states. Our review explores each company and the plans they offer so that you can compare plans and find the best coverage for your needs.

What is the Medicare program for retirees?

Your Medicare Coverage. Most retirees receive health insurance through Medicare, the federal government's health insurance program for people age 65 and older. To maximize the value of the health plan, make sure to sign up at the correct time and take advantage of the free and low-cost services Medicare provides.

Can Medicare beneficiaries enroll in Medicare Advantage?

MEDICARE-ELIGIBLE beneficiaries can enroll in a Medicare Advantage plan or a Part D Prescription Drug plan from a private insurance company. U.S. News provides a tool for Medicare-elig ible beneficiaries to find the right Medicare plans for their needs. U.S. News analyzed insurance companies’ offerings in each state based on their 2021 CMS star ...