Clients often ask us if this is the case in every state and we say that generally, Plan G is going to be a better buy than Plan F. If the savings are less than $15 from F to G, then you can make a stronger case for Plan F.

Will plan F premiums increase?

· The only benefit Plan F offers that Plan G doesn’t is coverage for the Medicare Part B deductible. Even though Plan G doesn’t cover the Part B deductible, some Plan F options could have high enough premiums that the cost difference between Plan F vs. Plan G would be higher than the Part B deductible itself.

How does high-deductible Medigap plan F work?

· Plan F typically has a higher premium than Plan G. The higher the premium the bigger the agent’s commission. Some insurance carriers don’t sell Plan G, so the best plan they can offer is Plan F. There is only 1 difference between the plans, but it can save you hundreds of dollars now and potentially thousands over time.

What is the best Medicare plan?

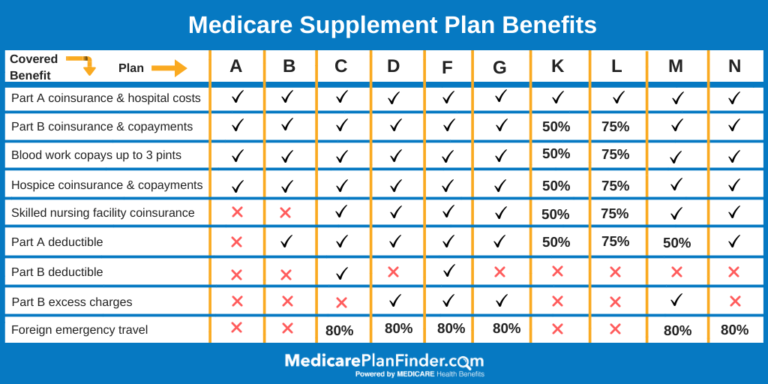

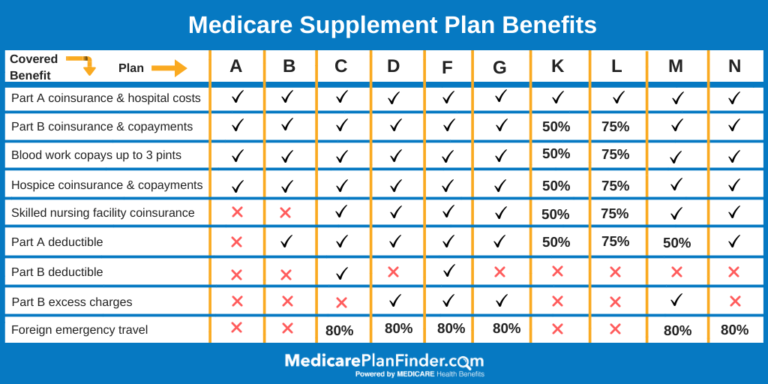

As you can see, there’s actually only one difference in coverage for Medicare Part F vs. G. That is that Medicare Part F covers the Part B deductible, whereas Part G does not. Medicare is phasing out plans that cover the Part B deductible, so anyone newly eligible for Medicare from January 1, 2020 and onward, cannot buy a Part F plan.

What are the top 5 Medicare supplement plans?

Plan G monthly premiums are typically much less expensive than the Plan F premiums – sometimes half the cost. Therefore, even though you will have to pay a deductible, you can save money overall if Plan G has a lower premium than Plan F.

What does Plan F cover that Plan G does not?

The only benefit Plan F offers that Plan G doesn't is coverage for the Medicare Part B deductible. Even though Plan G doesn't cover the Part B deductible, some Plan F options could have high enough premiums that the cost difference between Plan F vs. Plan G would be higher than the Part B deductible itself.

Is Plan G cheaper than Plan F?

Even though it has similar coverage, Medigap Plan G's monthly premiums are typically much less expensive than those for Plan F. In some cases, the difference in premiums between the two plans may be so large that you could save money by choosing Plan G, even after the Part B deductible.

Why is Plan F the best?

The good news: Medicare Plan F is one of the most popular Medicare Supplemental Plans available, with 45% of those enrolled in Medicare also enrolled in Plan F. 1 It offers the most coverage for hospital stays and specialists for the least cost, which explains its popularity.

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

Should I switch from F to G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.

What is the difference between AARP plan F and plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments.

Is Medicare G the best plan?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

What is the cost for Medicare Plan F in 2022?

$172.75 per monthThe average premium for Medicare Supplement Insurance Plan F in 2022 is $172.75 per month, or $2,073 per year.

Does Medicare Plan F cover deductible?

Overview. Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

What is the most popular Medigap plan for 2021?

Medigap Plans F and G are the most popular Medicare Supplement plans in 2021.

Is plan F still available in 2022?

Medicare Plan F has not been discontinued, but it is only available for people who were eligible for Medicare before Jan 1, 2020. If you are currently enrolled in Plan F, your enrollment remains active unless you choose a different plan or fail to pay your premiums.

Does Medicare Part F cover shingles vaccine?

Medicare Supplement (Medigap) plans only cover what Original Medicare covers, so, no, Medigap does not cover the shingles vaccine.

which is better medicare plan f vs plan g?

The better plan will depend on your coverage goals and budget. Plan F makes sense if you want to simply pay a monthly premium and all of your Medic...

should i switch from plan f to plan g?

This will be a personal decision and will depend on your coverage goals. If you want to save some money each year, then a Plan G is a great option....

can i switch from medicare plan f to plan g?

Yes you can switch from Medicare Plan F to Plan G. However, you may be subjected to medical underwriting. This will be determined by the Medicare S...

Why do insurance companies recommend Plan F over Plan G?

There are a couple reasons why an agent or insurance company might recommend Plan F over Plan G . Plan F typically has a higher premium than Plan G. The higher the premium the bigger the agent’s commission. Some insurance carriers don’t sell Plan G, so the best plan they can offer is Plan F. There is only 1 difference between ...

When will Medicare stop selling Plan F?

This includes Medigap Plan F. Insurance companies will no longer be able to sell Plan F to anyone who becomes eligible for Medicare on or after January 1, 2020.

Does Medigap Plan N cover everything?

Plan N is the 3rd most popular plan. Although Medigap Plan N provides great value and excellent coverage, it won’t cover everything. You will be responsible if there are any excess charges. You’ll also have to pay for your Part B deductible as well as some co-payments at the emergency room and your physician’s office.

Is Part B paid at once?

Remember that your Part B is usually paid over several office visits and not all at once. Let’s also consider the long term effect of Plan G vs. Plan F. Market history has shown that Plan G has stable rate increases. Insurance companies like Plan G and some have even reduced Plan G premiums to get your business.

Is Plan F healthier than Plan G?

Because of its popularity and guaranteed acceptance with qualifying individuals, Plan F typically has more unhealthy people than Plan G.

Does Plan F cover Part B?

Although Plan F covers the Part B deductible, you’re still paying for it. It’s just added into your premium.

Why do people get Plan F?

Most people get Plan F because their friend has Plan F. Or, perhaps their agent or insurance carrier didn’t explain the other plans available. Some agents will quickly tell you that everyone gets Plan F because it “pays for everything”. This is true. But you also need to make sure Plan F’s premium suits your budget.

Why would someone choose Plan G?

However, because pricing varies among plans, states, and individuals, this isn’t always true – sometimes there will be minimal difference in the premium cost. Therefore, when you get a quote, compare the premium amount against the deductible to select the more cost-effective option.

How long does Medicare cover hospital costs?

Hospital costs: Part A coinsurance and hospital costs for 365 additional days after Medicare benefits are used up as well as coinsurance or copayments for hospice care.

Is Plan F better than Plan G?

However, if the premium for Plan F is minimal compared to Plan G , it may be the better option . Another thing to consider is that in 2020, Plan F will be going away, however, those who already have Plan F can be grandfathered in to keep it. If you’re looking for another similar option, consider High-Deductible Plan F.

What is the difference between Medicare Plan F and Plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments . Plan G does not.

How much is the deductible for Medicare 2021?

If you’re currently enrolled in the Plan F high-deductible option for 2021, you are required to pay for Medicare-covered costs up to the deductible amount of $2,370 before your Medigap plan begins to cover any expenses.

Does HealthMarkets have Medicare Supplement plans?

HealthMarkets can help you get the right Medicare Supplement plan for your needs. Best of all, this service comes at no cost to you. We can help you quote and compare various Medicare Supplement plans to figure out which one is the right fit for your needs.

Is Medicare Plan F the same as Plan G?

Medicare Plan F and Plan G are similar and offer the same basic coverage benefits, which include:1

Is Medicare Plan F discontinued?

Is Medicare Plan F Being Discontinued? Yes, Medicare Plan F has been discontinued. The last possible day for new enrollment was December 31, 2019. If you currently have Medicare Plan F, you can continue with the plan, if you so decide.

Is Plan F still available?

It’s important to note that as of December 31, 2019, Plan F is no longer available for new Medicare enrollees. However, if you enrolled in Medicare before 2019 or already have Plan F, the decision between Medicare Plan F vs. Plan G is still an important one.

Does Plan G cover Part B?

Although Plan G does not cover the Part B deductible ($198 in 2020), the premium savings could offset the cost of the yearly deductible. For example, the average 2020 premium ranges from $160 to $210 for Plan G and $185 to $250 for Plan F for a 65-year-old Florida woman who does not use tobacco.

Which Medicare Supplement Plan is the most comprehensive?

Of the ten Medicare Supplement plans, Medicare Supplement Plan F offers the most comprehensive coverage, which is why many people prefer it. If you choose Plan F, you’ll essentially only pay your monthly premium, and have no out-of-pocket costs for your covered medical expenses. Because it offers the most benefits, Plan F premiums are generally the most expensive.

Is Medicare Supplement Plan G the same as Plan F?

Medicare Supplement Plan G is almost identical to Plan F, except for the Part B deductible. If you select Plan G, you’ll need to pay your Part B deductible ($203 for 2021), yourself. After you pay your deductible, you have no other out-of-pocket costs, just like the Plan F.

Is Medigap Plan G cheaper than Plan F?

Even though it has similar coverage, Medigap Plan G’s monthly premiums are typically much less expensive than those for Plan F. In some cases, the difference in premiums between the two plans may be so large that you could save money by choosing Plan G, even after the Part B deductible.

Is Plan G the same as Plan F?

Ultimately, Plan G has the same benefits as the Plan F, except for coverage for the Part B deductible ($203 for 2021). Once you pay the Part B deductible, the coverage is the same for both plans.

What is the difference between Medicare Supplements Plan F and Plan G?

The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise they function just the same. There is one important feature that Medicare Supplements Plan F and G have over all the other Medigap plans.

When will Plan F be phased out?

There’s another thing you should know about Plan F. It’s being phased out in 2020. It won’t be offered as a new policy after that time.

Do you pay more for a car insurance premium?

Of course, you’ll pay more in premiums, so be sure to weigh the pros and cons before you make your decision.

Which Medigap plan is the most popular?

Ever wondered which Medigap plan is the most popular? It’s Plan F by a landslide —about 55% of all Medigap plans currently in force are Plan F. Plan C is a distant second at about 9%, according to the most recent Medigap enrollment data.

Does Medigap have to offer all 10 plans?

Medigap is offered by private insurance companies. These companies do not have to offer all 10 plans. However, any company that offers Medigap coverage must offer Plan A. Also, if it wishes to offer more than one plan, it must also offer either Medigap Plan C or Plan F in addition to any other plans it offers.

How many Medigap plans are there?

There are currently 10 different Medigap plans that are standard across most states. (Massachusetts, Minnesota, and Wisconsin have their own plan standards.) What this means for consumers, however, is that Plan A offered by Company X in Anaheim is exactly the same as Plan A offered by Company Y in Boise.

Is Medicare Supplement Plan F the most comprehensive plan?

In 2021, Medicare Supplement Plan F will still be the most comprehensive plan that you can buy. However, you should compare Plans G and N for value.

Which is better, Plan G or Plan F?

Plan F – The plan pays the deductible. Plan G – You pay the deductible. That’s it! Conventional wisdom would suggest that because Plan F is the more comprehensive plan that it would be “better”, but “better” is certainly relative. Let’s take a closer look.

How much would Plan G save?

Plan G would save him $30 a month or $360 a year! Once John accounts for the deductible, he has true savings of $177 a year (or about $15 a month). By enrolling in G, John gets the “best bang for his buck” and doesn’t sacrifice on coverage.

Is Plan F discontinued?

There is no reason not to, and that’s the attitude of most Plan F policyholders. One more reason to buy Plan G: For the reasons cited above, Plan F will be discontinued as of January 1, 2020 as part of the Medicare Access and CHIP Reauthorization.

Which is better, Medigap B or G?

Of the two, Medigap B is a better buy. But for the same premium, Medigap G also covers skilled nursing care, Part B coinsurance and travel emergencies. Based on CDC and KFF figures, Medigap F and G are both better buys than A and B.

Which is the most comprehensive Medicare policy?

Of all Medigap policies, F and G are the most comprehensive. Both cover what Medicare calls "excess charges" -- just about everything Medicare doesn't pay for. As it turns out, both appear to be good deals in the long run.

Does Medigap C cover Part B?

Medigap C and D policies are identical to F and G except that they do not cover Part B coinsurance. Medigap C doesn't cover the medical deductible, but D does. The premium for C was $177 a month in 2010. For D, it was $187.

Does Medigap A cover hospitalization?

Medigap A and B cover coinsurance for hospitalization, but only B covers the hospitalization deductible. The average premiums were $140 a month for A and $169 for B in 2010. With Medigap B, if you're hospitalized once every three years, you're paying $936 more than you would for A to cover a $1,200 deductible.

How much is the deductible for a health insurance policy in 2010?

The deductibles are slightly different. Deductibles at the time of publication are $100 higher for Part A (hospital services) and $8 less for Part B (out-of-hospital, called medical services). The average F policy premium in 2010 was $181. For G, it was $169.

Can you know your healthcare future?

But as an individual, you can't know your healthcare future. To guard against financial surprises, one in four Americans held Medigap policies in 2010, according to an April 2013 Kaiser Family Foundation study. Plan F was the single most popular choice.

Does Medigap F cover coinsurance?

Every year, 32.8 percent are hospitalized and released, staying for an average of 5.5 days. But as an individual, you can't know your healthcare future.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries. Medicare Supplement Plan G, like other Medigap plans (A through N), is standardized by the federal government.

Which company provides Medicare Supplement Plan G?

When it comes to price transparency, Aetna is the clear winner. It uses attained-age pricing and is the only company on the list to provide rates for Medicare Supplement Plan G right on its website. From the homepage, select your state in the dropdown box to view Medicare Supplement State Insurance Plans, and with a few more clicks you can easily generate an Outline of Coverage PDF file with rate information for the plan based on age, gender, and ZIP code. Rates vary by location.

Does Cigna offer Medicare Supplement Plan G?

It offers Medicare Supplement Plan G in 46 states—Massachusetts, Minnesota, New York, and Wisconsin are excluded— but has limited options for High-Deductible Plan G, which is only available in North Carolina.

Does Cigna have a 24/7 nursing line?

Cigna stands out for its customer service and user-friendly website that explains how Medicare Supplement plans work. Its customer support is rounded out by access to a 24/7 nursing line for your healthcare questions. It also offers two mobile apps, the myCigna Mobile app used to track your benefits, and the Cigna Wellbeing App that provides information about chronic conditions like diabetes, wellness tips, healthy recipes, telehealth consultations with a medical professional, and tools to track your weight, blood pressure, cholesterol, and blood sugar.

What states does BCBS offer Medicare Supplement?

Altogether, BCBS offers Medicare Supplement Plan G in 44 states, excluding Alabama, Hawaii, Massachusetts, Minnesota, Utah, and Wisconsin. High-Deductible Plan G is available in 16 states, including Alaska, Arkansas, Illinois, Iowa, Maryland, Michigan, Montana, New Mexico, North Carolina, Oklahoma, South Carolina, South Dakota, Texas, Virginia, Washington, and Wyoming.

Does Blue Cross offer a discount on Medicare?

Blue Cross Blue Shield (BCBS) companies offer a number of discount programs for Medicare Supplement Plan G. Blue of California, for example, offers a New to Medicare discount for your first year ($25 per month), discounts for using automatic bank payments ($3 per month), discounts for enrolling in a dental plan at the same time ($3 per month), and a 7% discount if you and someone else in your household sign up for BCBS Medigap plans.

What states have high deductible plan G?

High-Deductible Plan G is available in 13 states, including Alabama, Arizona, Delaware, Georgia, Illinois, Iowa, Kansas, Louisiana, Maryland, North Carolina, Ohio, Pennsylvania, and South Carolina. Aetna’s Medicare Supplement Plan G has a premium discount of 7% if someone in your home is also on one of its plans.