Chevron medical pre-65 medical coverage is secondary, which means it generally supplements what Medicare covers. Chevron pre65 medical plans assume enrollment in both - Medicare Part A and Part B and will pay claims as though you are enrolled in both parts.

Full Answer

What benefits does Chevron offer?

Chevron offers medical, dental, and vision benefits to eligible retirees and their survivors. For more information, check out the following Chevron resource pages: To determine if you are eligible, phone the Chevron HR Service Center at 1-888-825-5247.

How do I Find my Chevron retirement benefits?

For further information, check the Summary Plan Descriptions (SPDs), call the Chevron HR Service Center (1-888-825-5247), or visit the Chevron Retiree Benefits website. Chevron offers medical, dental, and vision benefits to eligible retirees and their survivors.

What kind of matching does Chevron offer?

Chevron provides one-to-one matching for your eligible financial contributions up to $3,000 per retiree per year. Grants are also available for qualified volunteer work. Our Chevron Humankind page provides details.

Where can I find more information about Chevron HR services?

For more information, check out the following Chevron resource pages: To determine if you are eligible, phone the Chevron HR Service Center at 1-888-825-5247. Post-65 retirees in doubt about who to contact for support should reference our Post-65 Retiree Support page.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

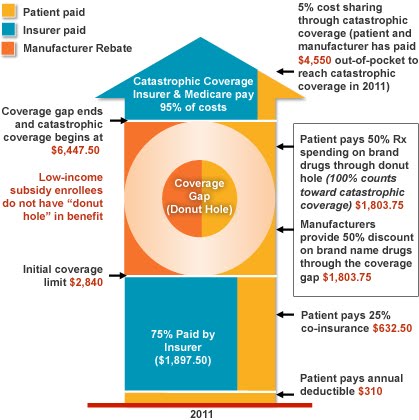

Does Medicare cover prescription drugs?

Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D). If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums.

How to contact Chevron HR?

For further information, check the Summary Plan Descriptions (SPDs), call the Chevron HR Service Center (1-888-825-5247) , or visit the Chevron Retiree Benefits website.

Does Chevron offer vision benefits?

Chevron offers medical, dental, and vision benefits to eligible retirees and their survivors. For more information, check out the following Chevron resource pages: To determine if you are eligible, phone the Chevron HR Service Center at 1-888-825-5247.

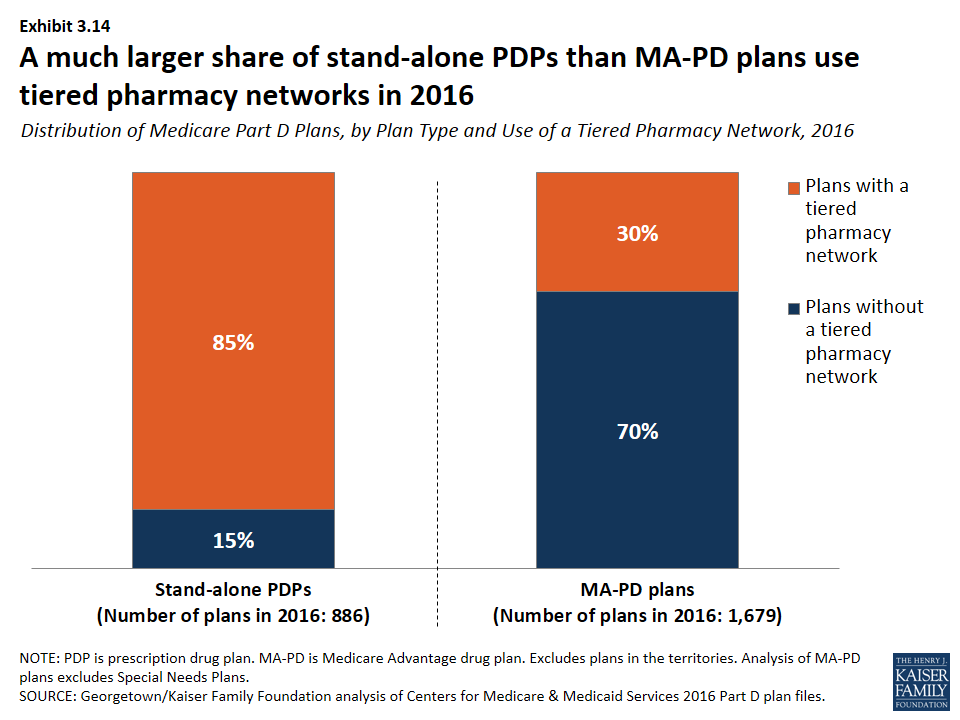

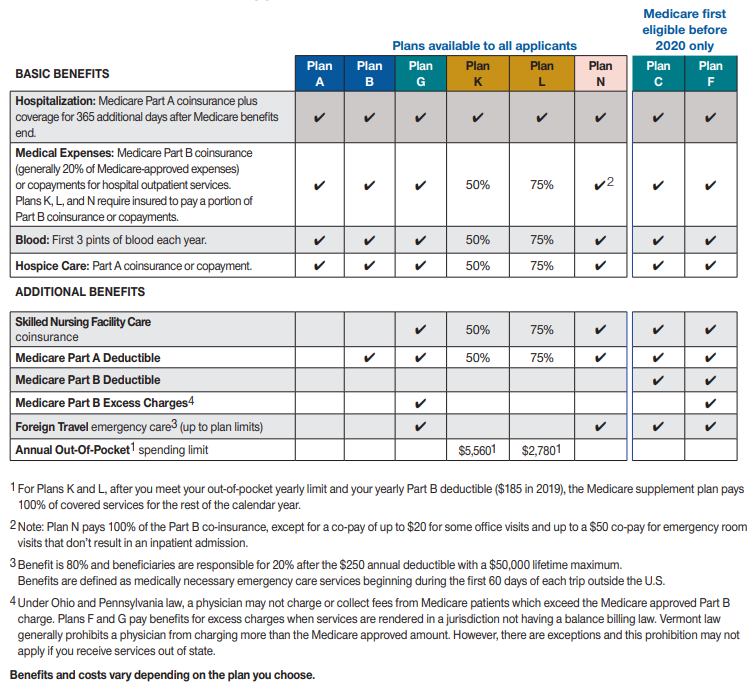

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What Is the Best Medicare Supplement Insurance Plan in 2021-2022?

There isn't one “best” Medigap plan. A specific Medigap plan might work for you if it offers coverage that works for your needs and comes with premiums that fit your budget.

What Is Medigap Insurance?

Medicare Supplement plans (commonly referred to as Medigap) are insurance plans that work alongside your Medicare Part A and Part B benefits and help cover some of your Medicare deductibles, coinsurance, copays and other costs.

What Happened to Plan C and Plan F in 2020?

Medigap Plan F and Plan C are not available to anyone who became eligible for Medicare on or after January 1, 2020.

What Are High Deductible Plans F and G?

Plan F and Plan G both offer high deductible options, which carry a deductible of $2,490 in 2022.

Why MedicareSupplement.com?

A licensed insurance agent can help you compare Medicare Supplement Insurance plans that are available in your area. After you use the comparison chart above, you can ask a licensed agent about the types of Medigap plans that may be offered where you live.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

the basics

You can enroll in the Medical PPO Plan if you're a U.S.-payroll employee and you're eligible for Chevron's health benefits. You can also enroll your eligible dependents, just as you can with Chevron's other health plans.

plan facts at-a-glance

Things change; be sure you're informed. The documents provided below are called a summary of material modification (SMM). An SMM explains recent updates to your plan that are not yet captured or updated in your summary plan description (SPD). Be sure to review the SMM for an understanding of important plan updates.

find a network provider

There are different coinsurance, copayment, deductible, and out-of-pocket maximum amounts depending on if you see a network or an out-of-network provider. Find a network provider here.

second opinion requirement

We request that you seek a second opinion through 2nd.MD — the Health Decision Support Program administrator — prior to receiving any of the four medical procedures (on a non-emergency basis) listed below. If you decline to use the service for these four procedures, that's your choice.

get in the know

Preventive care is an investment in your health. All Chevron medical plans include 100 percent coverage with no copayment, coinsurance or deductible for certain preventive care services when you see a network provider.

contact information

The HR Service Center manages your enrollment in and eligibility for this benefit plan. For all other questions regarding your coverage, contact the claims administrator.

Social Security

The ultimate source of information regarding Social Security is www.ssa.gov, the official Social Security website. We are fortunate to have supplementary articles authored by a Public Affairs Specialist in the Social Security Western Washington office:

Medicare

The "Official U.S. Government Site for Medicare" is www.medicare.gov . Among the useful resources you will find there is Medicare's 2021 Costs at a Glance.

How many standardized Medigap plans are there?

There are 10 standardized Medigap plans with letter names A through N. Plans with the same letter must offer the same basic benefit regardless of the insurance company providing the plan. For example, all Medigap Plan A policies provide the same benefit, but health insurance company premiums vary based on the way they choose to set rates—community-rated, entry age-rated or attained-age-rated.

What are the requirements to be eligible for a Medigap plan?

To be eligible for a Medigap plan, you must be enrolled in Original Medicare Parts A and B, but not a Medicare Advantage plan. You must also be in one of the following categories:

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B ). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

Is Medigap the same as Medicare Advantage?

Medigap plans aren’t the same as Medicare Part C, also known as Medicare Advantage. While a Medicare Advantage plan can serve as an alternative way to get Medicare Part A and Part B coverage, Medigap plans only cover what Part A and Part B do not.

Does Medigap cover prescriptions?

Medigap plans generally don’t cover prescriptions, so you may want to consider enrolling in Medicare Part D, which specifically covers prescription drugs, or a Medicare Advantage plan that includes drug coverage.

Does Medicare cover outpatient care?

Medicare doesn’t cover all of your health care expenses when you turn 65. Medicare Part A covers 80% of inpatient care in hospitals and skilled nursing facilities, and Medicare Part B covers 80% of outpatient care and medically necessary supplies. For the 20% not covered by Medicare, you have the option to purchase Medigap insurance from a private insurance company. Here’s what to know when comparing Medigap plans.

Does Mutual of Omaha offer Medicare Supplement?

In business for over 100 years, Mutual of Omaha offers coast-to-coast coverage to U.S. adults exploring their Medicare Supplement plan options, among other types of insurance. Their website highlights everything you need to know about Medigap plans in a way that’s clear and easy to understand, taking the guesswork and frustration out of enrollment. You can connect with an agent in your area, get a free quote and apply for a Medigap plan all through Mutual of Omaha’s website. Reviews regularly comment on the quality of customer service and overall satisfaction with coverage.