How much do employers pay for Medicare?

Also divided up so that both employer and employee each pay 1.45%. There is no wage base limit for Medicare. However, an extra .9% must be withheld for employees making in excess of $200,000 per year (the employer does not share this extra tax, it is paid only be the employee).

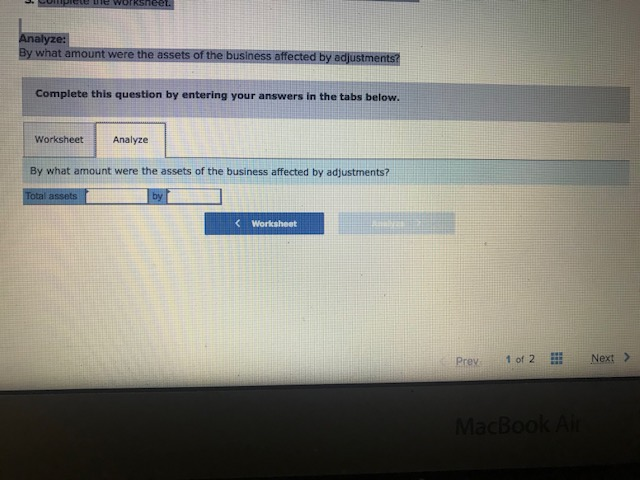

How does the federal government fund unemployment?

Though the federal government collects tax for unemployment, the money gets distributed to each state and participating territory, which is then disbursed to residents in need. Employers fund federal unemployment through a FUTA payroll tax. The amount owed, or liability, depends on the number of employees and their wages.

What taxes do employers pay for Social Security?

Social Security and Medicare taxes (these are called FICA taxes, which stand for “Federal Insurance Contributions Act.” This tax is split 50/50 between employee and employer) Federal Unemployment Tax Act (or “FUTA”. This is paid by the employer) State Unemployment Tax Act (or “SUTA”.

What is the federal income tax percentage for federal employees?

There is no universal federal income tax percentage that is applied to everyone. This is because all employees are required to fill out a W-4 form (“Employee’s Withholding Allowance Certificate”), when hired at a company.

How Much Does employer pay for Social Security and Medicare?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What percentage is federal Medicare and federal Social Security from a check?

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

How much money did the US collect in Social Security and Medicare taxes?

Since its inception, FICA has collected more than $20 trillion for Social Security and Medicare. Congress enacted FICA in 1935.

What payroll is taken out for Medicare and Social Security?

FICA is a U.S. federal payroll tax. It stands for the Federal Insurance Contributions Act and is deducted from each paycheck. Your nine-digit number helps Social Security accurately record your covered wages or self- employment.

How much should my employer be withholding for federal taxes?

Social Security is 6.2% for both employee and employer (for a total of 12.4%). Medicare is 1.45% for both employee and employer, totaling a tax of 2.9%. These two taxes (aka FICA taxes) fund specific federal programs. Federal income tax withholding varies between employees.

How much does an employer pay in taxes for an employee?

Current FICA tax rates The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Combined, the FICA tax rate is 15.3% of the employee's wages.

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

How much money has the government borrowed from the Social Security fund?

The total amount borrowed was $17.5 billion.

How much does the government pay for Social Security?

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

How does an employer pay Social Security and Medicare taxes?

Their employer deducts Social Security taxes from their paycheck, matches that contribution, sends taxes to the Internal Revenue Service (IRS), and reports wages to us. But self-employed people must report their earnings and pay their taxes directly to the IRS.

What is amount of federal withholding?

Your federal withholding is the amount that you've already paid the federal government. So, when you file your return, you'll get a credit for this amount to apply to any tax you'll owe the federal government. Your federal income tax withholding from your pay depends on: The filing status shown on your W-4 form.

What percentage of my paycheck is withheld for federal tax 2021?

For the 2021 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your filing status and taxable income (such as your wages) will determine what bracket you're in.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

How much is Social Security tax?

Social Security tax. 12.4%. This is divided up so that both employer and employee pay 6.2% each. There is a wage base limit on this tax. For the 2019 tax year, the maximum income amount that can be subjected to this tax, is $132,900.

How much is Medicare tax?

Medicare tax. 2.9%. Also divided up so that both employer and employee each pay 1.45%. There is no wage base limit for Medicare. However, an extra .9% must be withheld for employees making in excess of $200,000 per year (the employer does not share this extra tax, it is paid only be the employee).

What is payroll tax?

When a person works for a company full-time, both the worker and the employer are subjected to a variety of taxes. These taxes are known as “Payroll Taxes”. The employer withholds these amounts from the worker’s paychecks, and submits them along with the company’s contributions, to the government. The implementation of these taxes, ...

What is SUTA in insurance?

State Unemployment Tax Act (or “SUTA”. Paid by the employer in most states) State Disability Insurance (paid by employer, employee, or both) Workers’ Compensation (this is a state tax, paid by the employer)

Do self employed people pay federal taxes?

Self-employed individuals must also pay their federal and state taxes, along with social security and Medicare (they don’t pay FUTA or SUTA). The differences are: Self-employed individuals pay the full amount once per year, when filing their personal income tax returns.

Can payroll taxes be deducted?

Certain payroll taxes are deductible to a business paying them on behalf of their employees, but they are not deductible by the employees themselves. A business cannot deduct federal income taxes (because the employee paid them), but can claim tax deductions for Social Security, Medicare and FUTA taxes.

What is the wage base limit for Social Security?

See requirements for depositing. The social security wage base limit is $137,700 for 2020 and $142,800 for 2021. The employee tax rate for social security is 6.2% for both years.

When is Medicare tax withheld?

Beginning January 1, 2013, employers are responsible for withholding the 0.9% Additional Medicare Tax on an employee's wages and compensation that exceeds a threshold amount based on the employee's filing status. You are required to begin withholding Additional Medicare Tax in the pay period in which it pays wages and compensation in excess of the threshold amount to an employee. There is no employer match for the Additional Medicare Tax.

What is self employment tax?

Self-Employment Tax. Self-Employment Tax (SE tax) is a social security and Medicare tax primarily for individuals who work for themselves. It is similar to the social security and Medicare taxes withheld from the pay of most employees.

Do employers have to file W-2?

Employers must deposit and report employment taxes. See the Employment Tax Due Dates page for specific forms and due dates. At the end of the year, you must prepare and file Form W-2, Wage and Tax Statement to report wages, tips and other compensation paid to an employee.

Do you pay federal unemployment tax?

You pay FUTA tax only from your own funds. Employees do not pay this tax or have it withheld from their pay.

How is SSI payment reduced?

Payment reduction. The monthly amount is reduced by subtracting monthly countable income. In the case of an eligible individual with an eligible spouse, the amount payable is further divided equally between the two spouses. Some States supplement SSI benefits.

What is the maximum federal income tax for 2021?

The latest such increase, 1.3 percent, becomes effective January 2021. The monthly maximum Federal amounts for 2021 are $794 for an eligible individual, $1,191 for an eligible individual with an eligible spouse, and $397 for an essential person.

What is the federal unemployment tax?

Federal Unemployment Tax Act (FUTA): this is a payroll tax that goes into a fund used at the federal level to oversee state unemployment insurance programs. If a state is experiencing a period of high unemployment and struggling to pay out benefits, they may borrow money from this federal unemployment fund, for example.

What is the maximum federal tax credit for unemployment?

If you paid wages subject to state unemployment tax, you may receive a credit when you file your Form 940. The credit maximum is 5.4%. If you are entitled to such a credit, your final FUTA tax rate would be the standard FUTA tax rate of 6.0% minus the credit.

What is payroll tax?

What are payroll taxes? Payroll taxes are federal, state and local taxes withheld from an employee's paycheck by the employer. These taxes consist of income taxes, unemployment taxes, and deductions for Social Security and Medicare taxes, the last of which are often referred to as "the payroll tax.". Setting aside income taxes for the moment, we ...

What is the FUTA rate?

The FUTA tax rate is 6.0%. FUTA applies to the first $7,000 you paid to each employee as wages during the year. This first $7,000 is often referred to as the federal or FUTA wage base.

What is the federal law that requires employers to withhold taxes from wages?

These benefits are funded primarily through SUTA, though in some instances FUTA funds may be used. Federal Insurance Contributions Act (FICA): this is a federal law requiring that employers withhold specific taxes from the wages you pay your employee, namely Social Security and Medicare.

Which states have unemployment tax withholding?

Employees in Alaska, New Jersey, and Pennsylvania are subject to state unemployment tax withholding as well. If you employ workers in any of these three states, you will be required to withhold the tax from their wages and remit these funds directly to the state.

What is SUI in unemployment?

State Unemployment Insurance (SUI): this provides benefits in the form of money to people who have lost their jobs (there are additional requirements to collect SUI, including that you have lost the job through no fault of your own and are actively pursuing new employment).