What is Medicare Part B payment?

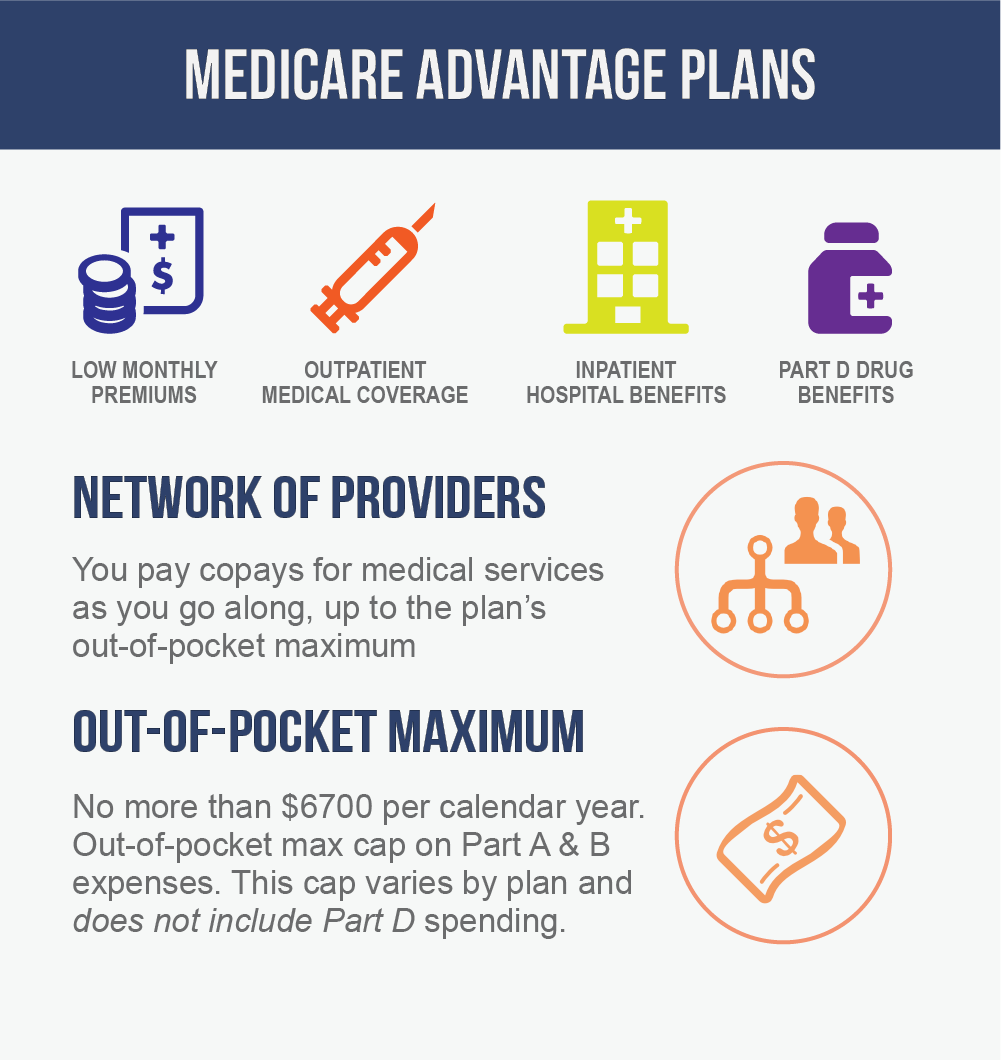

The Part B premium you are paying from your Social Security benefit is why your Medicare Advantage plan premium is as low as it is. Many people like the cost efficiency and extra coverage provided by Medicare Advantage plans and are comfortable with the restriction to use “in-network” providers.

When does Medicare cover doctor visits?

hese days it is now possible for people to receive treatment from the comfort of their own home, rather than having to stay in hospital or a nursing facility, but Medicare will only cover this if your situation is named on their list of requirements.

Will Medicare cover the costs of my doctor visits?

Medicare may cover doctor visits if certain conditions are met, but in some cases, you’ll have out-of-pocket costs, like deductibles and coinsurance amounts. No matter what kind of Medicare coverage you may have, it’s important to understand that your doctor must accept Medicare assignment.

Does Medicare cover copay?

Original Medicare is a federal health insurance program for seniors and people with certain disabilities. When a Medicare recipient requires emergency care, Medicare does cover emergency room visits for the most part, and the recipient pays a copayment.

Is there a copay with Medicare Part B?

Medicare Part B does not usually have a copayment. A copayment is a fixed cost that a person pays toward eligible healthcare claims once they have paid their deductible in full.

Does Medicare Part B cover doctor visits?

Medicare Part B pays for outpatient medical care, such as doctor visits, some home health services, some laboratory tests, some medications, and some medical equipment. (Hospital and skilled nursing facility stays are covered under Medicare Part A, as are some home health services.)

What is the Part B copay?

Part B deductible & coinsurance The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid.

Do Medicare patients pay a copay?

Medicare beneficiaries are responsible for out-of-pocket costs such as copayments, or copays for certain services and prescription drugs. There are financial assistance programs available for Medicare enrollees that can help pay for your copays, among other costs.

Does Medicare Part B cover 100 percent?

Generally speaking, Medicare reimbursement under Part B is 80% of allowable charges for a covered service after you meet your Part B deductible. Unlike Part A, you pay your Part B deductible just once each calendar year. After that, you generally pay 20% of the Medicare-approved amount for your care.

What is Medicare approved amount for doctor visit?

Medicare's approved amount for the service is $100. A doctor who accepts assignment agrees to the $100 as full payment for that service. The doctor bills Medicare who pays him or her 80% or $80, and you are responsible for the 20% coinsurance (after you have paid the Part B annual deductible).

Is there a copay for office visits with Medicare?

Copayments and Coinsurance by Medicare Part You will have no copay for outpatient services that Medicare covers. But you will have to pay coinsurance of 20 percent of the Medicare-approved costs for services after you meet your yearly deductible – $233 in 2022.

What is the deductible for Medicare Part B?

$233Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the Medicare deductible for 2021 Part B?

$203 inMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What is the maximum out-of-pocket for Medicare?

$7,550Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

What is the Medicare Part B deductible for 2020?

$198 in 2020The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs.

What will Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

Doctor Visits: A General Rule

No matter what kind of Medicare coverage you may have, its important to understand that your doctor must accept Medicare assignment. Thats an agreement the doctor has with Medicare that the doctor will accept the Medicare-approved amount as payment in full for a given service, and wont charge you more than a coinsurance payment and deductible.

Blue Medicare Advantage Plus 2022

Medicare Advantage plans help fill in the gaps Medicare doesn’t cover. You get all of the health and medical benefits of Original Medicare plus additional benefits, like Silver & Fit ® and services Medicare doesn’t cover like lower cost-sharing for health care services and coverage for prescription drugs all in one convenient, easy-to-use plan.

Keep Costs Down Stay In Network With Provider Finder

Before you go for care, make sure you go to a doctor or hospital in your health plan network. These providers have agreed to work with your health plan to keep your costs down. If you visit a doctor outside of your network, you may have to pay more for your care. In some cases, you may have to pay the full cost.

What To Bring To Doctor Visits

Some useful information to bring to doctor visits especially if its your first visit with this doctor includes:

Costs You May Pay With Medicare

Medicare Part B and most Medicare Part C, Part D and Medigap plans charge monthly premiums. In some cases, you may also have to pay a premium for Part A. A premium is a fixed amount you pay for coverage to either Medicare or a private insurance company, or both.

Which Medical Visits Are Not Covered

There are instances when Medicare doesnt cover doctors visits. This includes dentist visits, naturopathic medicine and most optometrist and chiropractic services. However, some services that arent covered by Original Medicare may be covered under the additional benefits in a Medicare Advantage Plan.

Late Enrollment Penalties For Medicare Part A And Part B

Both Medicare Part A and Part B can have late enrollment premium penalties.

What is a copay in Medicare?

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met. A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin ...

How much is Medicare Part B deductible for 2021?

The Medicare Part B deductible in 2021 is $203 per year. You must meet this deductible before Medicare pays for any Part B services. Unlike the Part A deductible, Part B only requires you to pay one deductible per year, no matter how often you see the doctor. After your Part B deductible is met, you typically pay 20 percent ...

What percentage of Medicare deductible is paid?

After your Part B deductible is met, you typically pay 20 percent of the Medicare-approved amount for most doctor services. This 20 percent is known as your Medicare Part B coinsurance (mentioned in the section above).

How much is Medicare coinsurance for days 91?

For hospital and mental health facility stays, the first 60 days require no Medicare coinsurance. Days 91 and beyond come with a $742 per day coinsurance for a total of 60 “lifetime reserve" days.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is Medicare approved amount?

The Medicare-approved amount is the maximum amount that a doctor or other health care provider can be paid by Medicare. Some screenings and other preventive services covered by Part B do not require any Medicare copays or coinsurance.

How long does Medicare Part A last?

A benefit period begins the day you are admitted to a hospital or skilled nursing facility for an inpatient stay, and it ends once you have been out of the facility for 60 consecutive days.

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

Copays With Medicare Advantage

When it comes to copays, Medicare Advantage is a whole other story. Medicare Advantage, or Part C, refers to a way of receiving your Medicare coverage through a private health insurance company. If you have a Medicare Advantage plan, many of the associated fees will be set by that insurance company, rather than Medicare.

What Is A Medicare Copayment

A Medicare copayment is a fixed, out-of-pocket expense that you have to pay for each medical service or item such as a prescription you receive if you have a Medicare Advantage plan or a Medicare prescription drug plan. Your Medicare plan pays the rest of the cost for the service.

When Does Medicare Not Cover Medical Visits

Medicare doesnt cover certain medical services that you may consider preventive or medically necessary. However, there are sometimes exceptions to this rule.

What Do I Do If My Doctor Does Not Accept Medicare

You can choose to stay and cover the costs out-of-pocket, but this is not an affordable option for most Americans. Instead, you can ask your doctor for a referral to another healthcare provider that does accept Medicare, do your own research, or visit an urgent care facility. Most urgent care offices accept Medicare.

Doctor Visits: A General Rule

No matter what kind of Medicare coverage you may have, its important to understand that your doctor must accept Medicare assignment. Thats an agreement the doctor has with Medicare that the doctor will accept the Medicare-approved amount as payment in full for a given service, and wont charge you more than a coinsurance payment and deductible.

Will Medicare Pay For A Yearly Physical Examination

En español | Medicare does not pay for the type of comprehensive exam that most people think of as a physical. But it does cover a one-time Welcome to Medicare checkup during your first year after enrolling in Part B and, later on, an annual wellness visit that is intended to keep track of your health.

What is Medicare Part B?

Medicare Part B pays for outpatient medical care, such as doctor visits, some home health services, some laboratory tests, some medications, and some medical equipment. (Hospital and skilled nursing facility stays are covered under Medicare Part A, as are some home health services.) If you qualify to get Medicare Part A, ...

Why do people opt out of Medicare Part B?

Some people opt out of Medicare Part B because they still have coverage through union or employer health insurance. As long as your coverage is considered “creditable” you will not pay a penalty for signing up late.

How much does Medicare pay after paying $203?

After you pay $203 yourself, your benefits kick in. After that, Medicare will pay 80% of the cost of most Part B services, and you (or your Medigap policy) pay the other 20%. Finally, it’s important to know that there's a penalty for signing up late for Part B.

What happens if a doctor doesn't accept assignment?

If your doctor is willing to accept what Medicare pays and won't charge you any more, they are said to "accept assignment.". But if your health care provider does not accept assignment and charges more than Medicare pays, you will have to pay the difference. For more information about Medicare Part B, see the Medicare web site at www.medicare.gov ...

What happens if you accept assignment from Medicare?

If you have traditional Medicare, make sure your doctor "accepts assignment" before you make an appointment. Medicare decides what it will pay for any particular medical service. This is called the Medicare-approved amount. If your doctor is willing to accept what Medicare pays and won't charge you any more, they are said to "accept assignment." But if your health care provider does not accept assignment and charges more than Medicare pays, you will have to pay the difference.

What happens if you don't sign up for Medicare Part B?

If you don't sign up for Medicare Part B when you first become eligible (and you don’t have comparable coverage from an employer), your monthly fee may be higher than $148.50. You’ll pay a lifetime 10% penalty for every 12 months you delay your enrollment. Medical and other services.

How much is Medicare Part B 2021?

For Part B, you have to pay a monthly fee (called a premium ), which is usually taken out of your Social Security payment. For 2021, this fee is $148.50 per month. But if you have a higher than average personal income (over $85,000) or household income (over $176,000), you will have to pay a higher monthly premium for Medicare Part B.

What are the out-of-pocket costs of Medicare?

Medicare Advantage out-of-pocket costs can include: 1 Medicare Part B premium#N#Even under Medicare Advantage, you must still pay your Part B premium (unless your plan helps pay for it). The standard Part B premium in 2021 is $148.50 per month. 2 Deductibles#N#Some plans require you to meet a deductible when seeing doctors, visiting hospitals, or getting your drugs filled. 3 Medicare copay#N#Many Medicare Advantage plans require that you pay a copay when you see a doctor. This is a fixed cost — and an alternative to Original Medicare’s 20 percent coinsurance. 4 Premiums#N#As noted above, the average monthly premium for Medicare Advantage plans with drug coverage is $33.57 per month in 2021.

Does Medicare Advantage have a limit?

Medicare Advantage, unlike Original Medicare, comes with an out-of-pocket limit, which means your out-of-pocket spending will be capped.

What is a copay in Medicare?

A copayment, or copay, is a fixed amount of money that you pay out-of-pocket for a specific service. Copays generally apply to doctor visits, specialist visits, and prescription drug refills. Most copayment amounts are in ...

How much does Medicare copay cost?

Copays generally apply to doctor visits, specialist visits, and prescription drug refills. Most copayment amounts are in the $10 to $45+ range , but the cost depends entirely on your plan. Certain parts of Medicare, such as Part C and Part D, charge copays for covered services and medications.

What percentage of Medicare coinsurance is paid?

coinsurance for services, which is 20 percent of the Medicare-approved amount for your services. Like Part A, these are the only costs associated with Medicare Part B, meaning that you will not owe a copay for Part B services.

How much is Medicare Part A monthly premium?

monthly premium, which varies from $0 up to $471. per benefits period deductible, which is $1,484. coinsurance for inpatient visits, which starts at $0 and increases with the length of the stay. These are the only costs associated with Medicare Part A, meaning that you will not owe a copay for Part A services.

What is Medicare for 65?

Cost. Eligibility. Enrollment. Takeaway. Medicare is a government-funded health insurance option for Americans age 65 and older and individuals with certain qualifying disabilities or health conditions. Medicare beneficiaries are responsible for out-of-pocket costs such as copayments, or copays for certain services and prescription drugs.

What is covered by Medicare Part C?

Under Medicare Part C, you are covered for all Medicare parts A and B services. Most Medicare Advantage plans also cover you for prescription drugs, dental, vision, hearing services, and more.

How long does it take to get Medicare if you have a disability?

Most individuals will need to enroll into Medicare on their own, but people with qualifying disabilities will be automatically enrolled after 24 months of disability payments.