How to find the best Medicare Part D drug plan?

Jan 24, 2020 · Part D plans are not required to impose an initial coverage limit, but for those that do, the max limit for 2020 is $4,020. Once the costs you and your Part D plan pay have reached this limit, you will pay a fixed 25% of Medicare’s costs for prescription medication until the catastrophic coverage threshold is reached. In 2020, the catastrophic coverage threshold is …

What plans are available for Medicare Part D?

Oct 18, 2021 · The annual deductible for Part D prescription drug coverage in a standalone Part D drug plan or a Medicare Advantage plan is $435. 2020 Part D Monthly Premium Average Part D premiums are expected to fall to $30 in 2020. 3 The average Part D premium has been between $30 and $35 per month for over a decade.

How to compare Medicare Part D plans?

First, plans are allowed by law to charge deductibles of as much as $435 in 2020, up $20 from 2019's levels. However, Part D plans don't have to charge the full amount, or any deductible at all.

How do you add Part D to Medicare?

will increase from $3,820 in 2019 to $4,020 in 2020. will increase from $5,100 in 2019 to $6,350 in 2020. begins once you reach your Medicare Part D plan’s initial coverage limit ($4,020 in 2020) and ends when you spend a total of $6,350 out-of-pocket in 2020.

What is the Medicare premium for Part D in 2020?

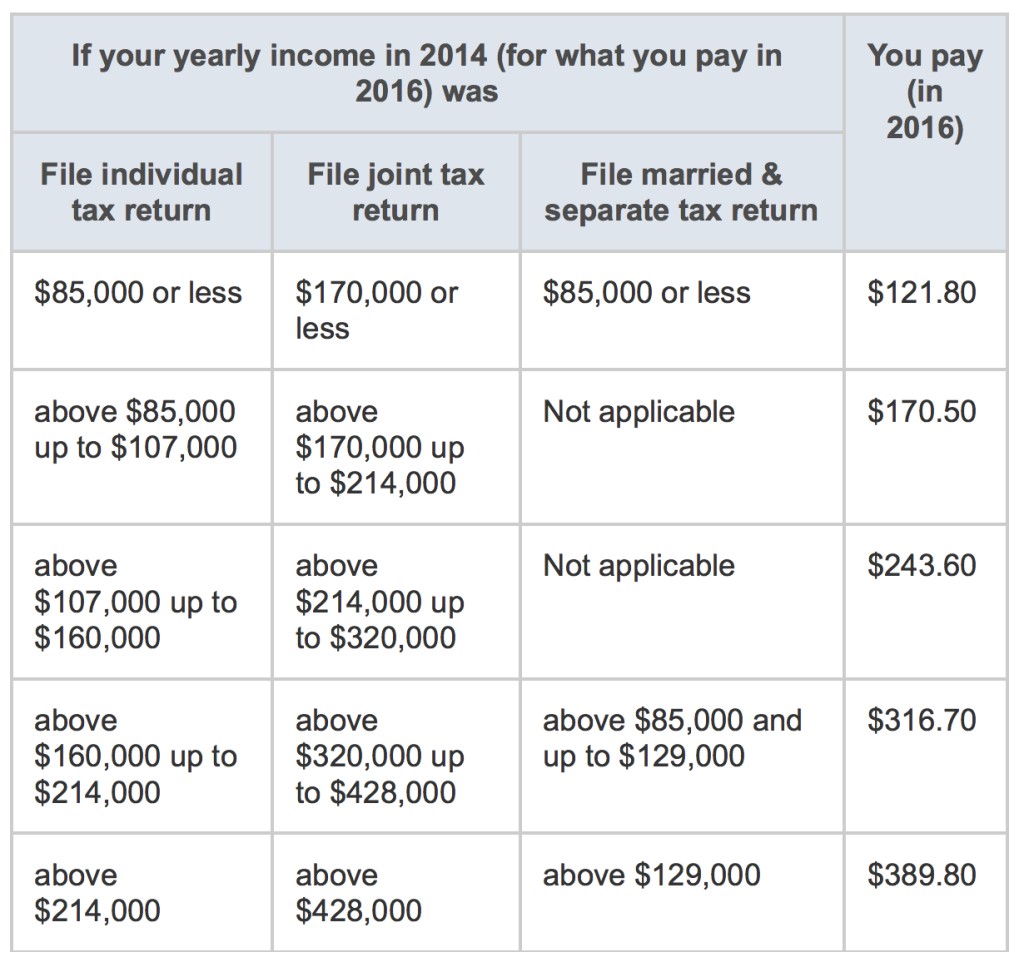

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2020 is $32.74, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.Sep 27, 2019

What does Medicare Part D cost in 2021?

Premiums vary by plan but the base monthly premium for a Part D plan in 2022 is $33.37, up from $33.06 in 2021. If you make more than a certain amount, you will have to pay a higher premium. The extra amount you pay is based on what's known as an income-related monthly adjustment amount (IRMAA).

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What is the cost of Part D for 2022?

The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.Nov 2, 2021

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Why is Medicare Part D so expensive?

If you have a health condition that requires a “specialty-tier” prescription drug, your Medicare Part D costs may be considerably higher. Medicare prescription drug plans place specialty drugs on the highest tier. That means they have the most expensive copayment and coinsurance costs.

What is the cheapest Medicare Part D plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Do you have to pay for Medicare Part D?

How much does Part D cost? Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

What is the Best Medicare Plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).Oct 13, 2021

What is the 2022 Part D initial coverage limit?

$4,430The Initial Coverage Limit (ICL) will go up from $4,130 in 2021 to $4,430 in 2022. This means you can purchase prescriptions worth up to $4,430 before entering what's known as the Medicare Part D Donut Hole, which has historically been a gap in coverage.

Do I Need A Medicare Part D Plan?

If you have Original Medicare (Part A and Part B) and want prescription drug coverage for prescription drugs you take at home, you will likely have...

What Is The Medicare Deductible For A Medicare Part D Plan?

A Medicare deductible is the amount you must pay each year for your prescription drugs before your Medicare Part D Prescription Drug Plan begins to...

How Else Do Stand-Alone Medicare Part D Plans differ?

Unlike Medicare Part D deductibles, Medicare doesn’t set a dollar limit for Medicare Part D premiums. Your plan sets the amount for your monthly pr...

Why is Medicare Part D important?

In its short history, Medicare Part D has become quite popular, and it's important for those retirees struggling to make ends meet. Looking into Part D coverage can be the best move an older American can make to protect their health.

Who is Dan Caplinger?

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.

Do Part D plans have deductibles?

However, Part D plans don't have to charge the full amount, or any deductible at all. Also, Part D plans can set fixed copays or certain coinsurance percentage amounts to require participants to bear some of the costs of each prescription drug they use.

Does Medicare Part D cover prescription drugs?

What does Medicare Part D cover? Medicare Parts A and B come directly from the federal government, but that's not the case for prescription drug plans. Private insurers provide the coverage that Medicare Part D offers, and the specifics differ from plan to plan. Image source: Getty Images.

How much is Medicare Part D 2020?

will increase from $5,100 in 2019 to $6,350 in 2020. begins once you reach your Medicare Part D plan’s initial coverage limit ($4,020 in 2020) and ends when you spend a total of $6,350 out-of-pocket in 2020.

When will Medicare Part D enrollment start in 2022?

If you would like for us to send you an email as additional 2022 Medicare Part D plan information comes online and when enrollment begins (October 15th), please complete the form below. We will NOT share your information with any third-parties.

What is the Medicare Part D benefit?

The CMS "Part D Benefit Parameters for Defined Standard Benefit" is the minimum allowable Medicare Part D plan coverage . However, CMS does allow Medicare Part D plans to offer a variation on the defined standard benefits (for example, a Medicare Part D plan can offer a $0 Initial Deductible). will be increased by $20 to $435 in 2020.

How much does a drug cost in 2020?

will increase to $3.60 for generic or preferred drug that is a multi-source drug and $8.95 for all other drugs in 2020.

How much does Medicare pay for generic drugs?

Medicare Part D beneficiaries who reach the Donut Hole will also pay a maximum of 25% co-pay on generic drugs purchased while in the Coverage Gap (receiving a 75% discount). For example: If you reach the 2020 Donut Hole, and your generic medication has a retail cost of $100, you will pay $25.

What is Medicare Part D?

Medicare Part D plans are private insurance plans. Insurance companies are free to design plan benefits and cost-sharing structures to meet the needs of their members, as long as they follow Medicare’s rules for minimum coverage requirements. Your costs and benefits may be different with each plan available in your area.

What is the maximum deductible for 2020?

The 2020 maximum deductible set by CMS is $435, however, insurers can set their deductible below the limit. According to research by the Kaiser Family Foundation, 86% of stand-alone Part D prescription drug plans have an annual deductible.

When do you enter the coverage gap?

In 2020, you enter the coverage gap once you and your insurance company spend ...

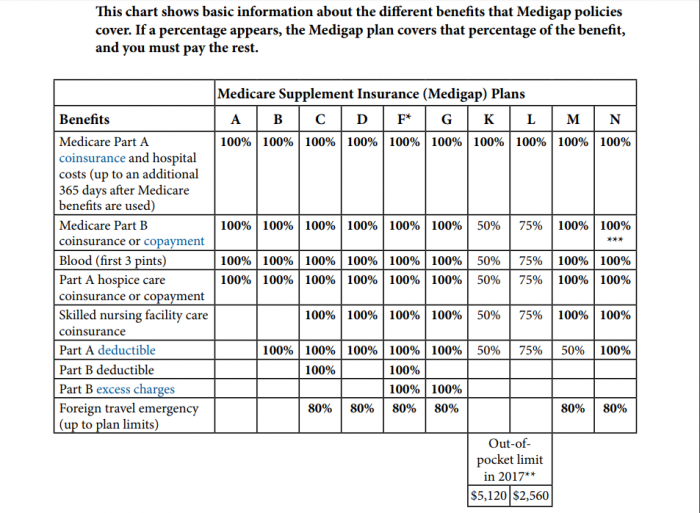

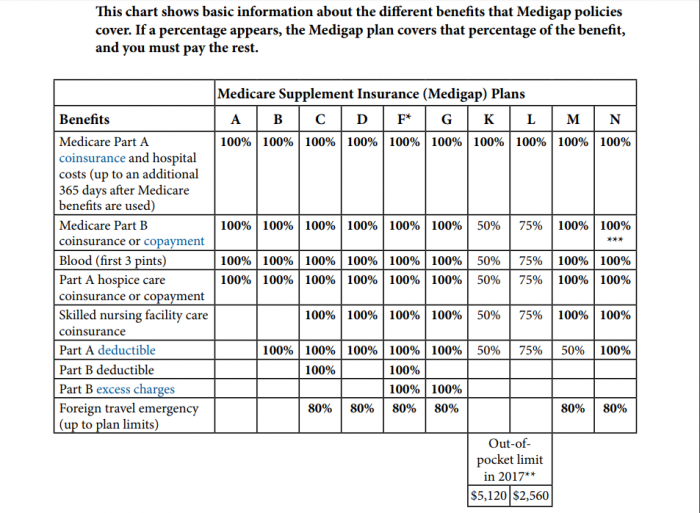

Does Medicare Supplement Insurance cover Part D?

Also remember a Medicare Supplement Insurance Plan doesn’t cover any costs associated with Medicare Part D coverage. Finally, compare pharmacy networks and benefits such as mail-order pharmacies. If you have a preferred pharmacy and it’s not in a plan’s network, you may be happier with a different plan.

Does Medicare cover prescription drugs?

Medicare Part D coverage for prescription drugs is technically optional , but if you enroll in Original Medicare (Part A and Part B), there is very little coverage for prescription medications you take at home. For that reason, most Medicare enrollees choose to buy a Medicare Part D plan to help pay for prescription drugs.